Canadian Dollar, USD/CAD, FOMC Talking Points:

- This Wednesday brings the FOMC rate decision for the month of June and this is a quarterly rate decision, meaning the bank will also supply updated guidance and projections.

- I’ve maintained that USD/CAD is one of the more attractive majors for USD-weakness and if the Fed does begin to lay the groundwork for cuts in the second-half of this year, the USD/CAD breakdown scenario remains attractive.

- I’ll be looking at USD/CAD along with several other USD pairs ahead of the Wednesday Fed meeting at tomorrow’s webinar. You’re welcome to join: Click here to register.

USD weakness has continued through last week’s inflation data, and now the big question is whether the Fed will begin to lay the groundwork for rate cuts in the second-half of this year.

I covered this in the Friday video but we’re nearing a point where the bank will need to start talking more earnestly about cutting rates if they are in fact planning to start cutting. At this point, the market is expecting 50 basis points of cuts by the end of the year. The Fed, however, hasn’t sounded optimistic given the potential for inflation produced by tariffs. Tariffs remain an opaque topic in general but a couple of key members of the Fed, such as Chair Jerome Powell, Chicago Fed President Austan Goolsbee and New York Fed President John Williams have all sounded like they expect tariffs to produce inflation.

On the other side of that coin, at the bank’s last quarterly meeting in March, the central expectation via the dot plot matrix was for 50 bps of softening this year. Wednesday’s meeting is the next quarterly outing for the bank so we’ll get updated guidance and projections, and the big question is whether they retain that expectation for 50 bps of cuts or whether that nudges up on the basis of tariff potential.

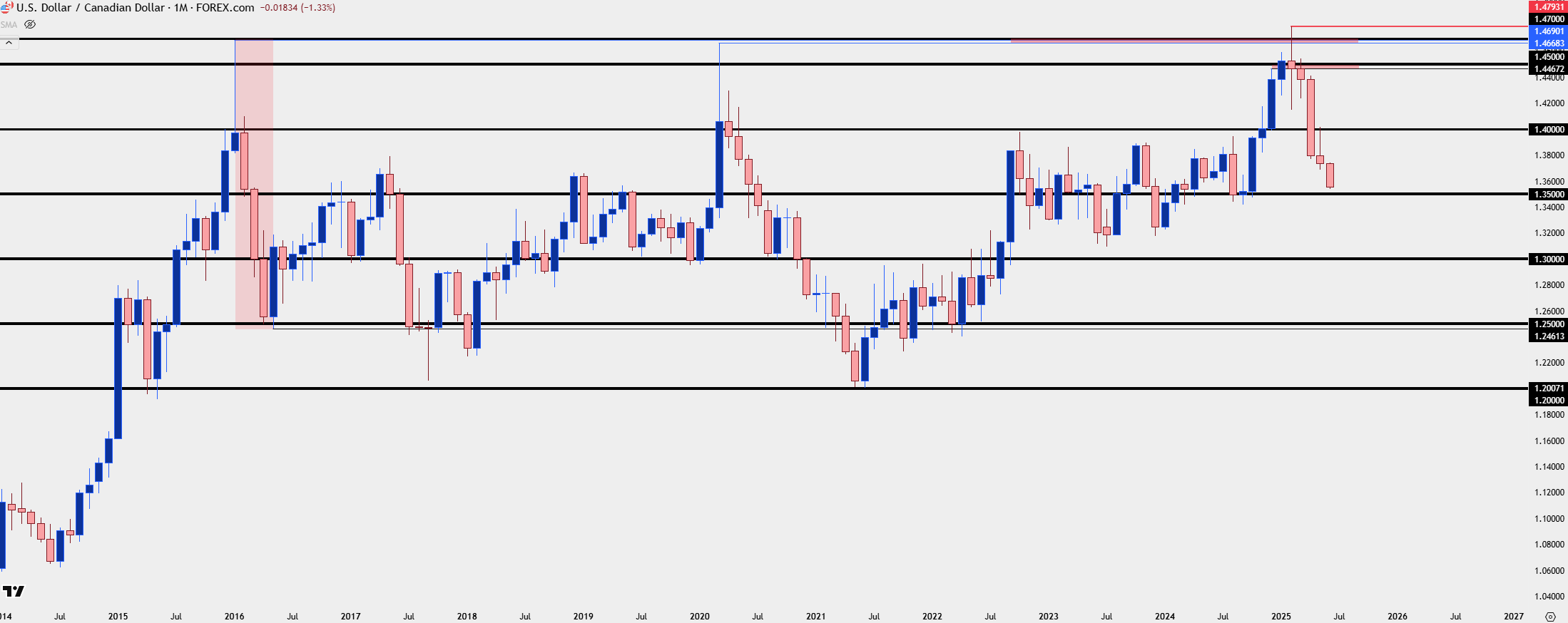

This is key as rate cuts in the U.S. remain a big driver behind the USD, and as I’ve been saying since back in February, if we do have a continued sell-off in the U.S. Dollar, USD/CAD remains attractive for that theme under the premise of the longer-term range that’s continued to hold in the pair.

USD/CAD Monthly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

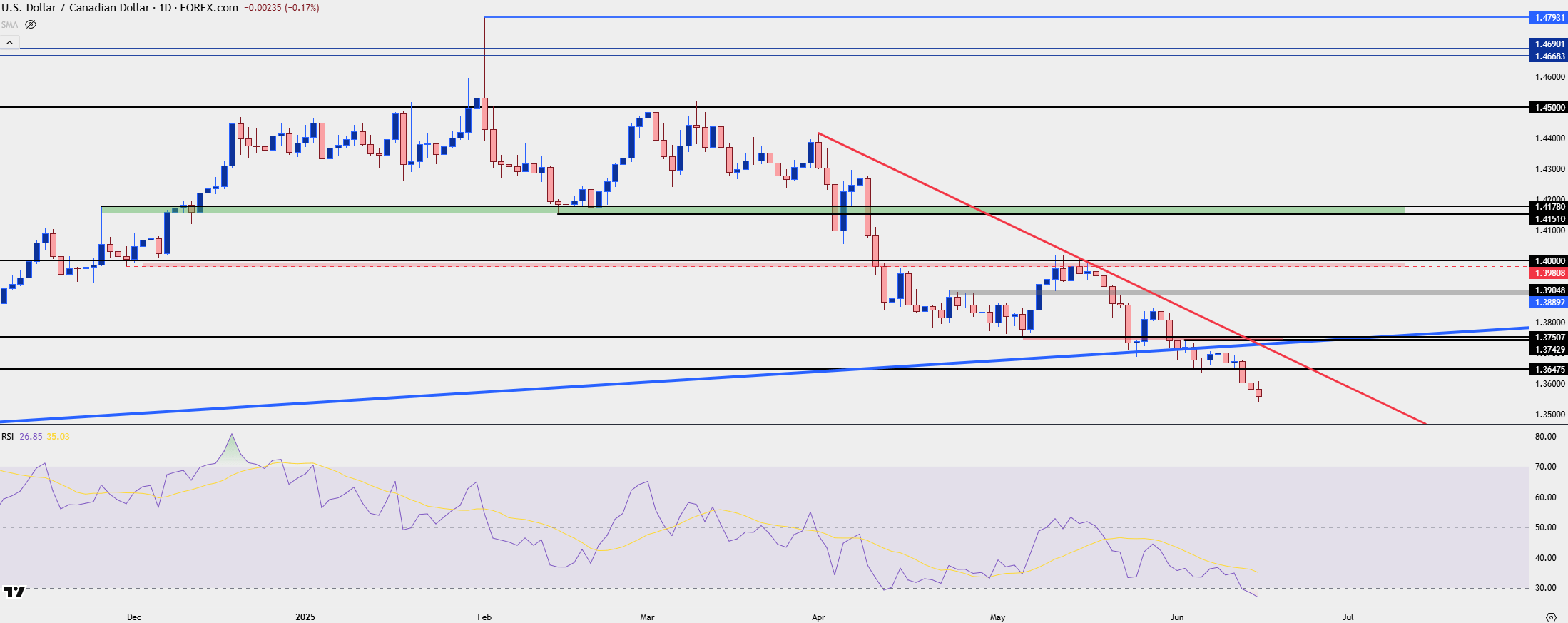

USD/CAD Intermediate-Term

At this stage it seems as though the market has priced-in that 50 bps of cuts from the Fed but there’s still the uncertainty as to whether or not they’ll start to show more commitment, and the tariff topic is a large reason as to why.

I’m not expecting Powell to outright say that the Fed will be cutting in September so I think the drive will come from the projections, themselves, and if the bank’s rate expectations do retain the central expectation for 50 bps of cuts into the end of 2025, that can be read as the Fed readying the market for such a move.

The more-hawkish route would be nudging up 2025 expectations to one cut for this year while pushing another for 2026, in the effort of balancing the move. I think this could cause some quick short-covering in USD and in that case, that could present pullback potential in USD/CAD.

The challenge at this point with USD/CAD is how oversold the move has become, with RSI on the daily going all the way down to a current read of below 27. This is the lowest reading since last August, around the time that sellers started to run into support which was then followed by a case of RSI divergence that led to a reversal.

Oversold RSI doesn’t necessarily denote reversal potential but it does highlight caution if chasing the move lower, as a one-sided market could be prone to a short squeeze scenario if we do see a pullback scenario develop in the USD around FOMC.

But with that said, sellers so far have shown no signs of relenting, as each spot of possible resistance has ushered in fresh sellers to continue driving the trend. At this point, there’s resistance structure at prior support around 1.3650 and 1.3750. If bulls can force a break above that, we’ll also have a breach of the recent trendline, and that will point to a larger pullback towards 1.3900 and 1.4000 zones.

For breakdown scenarios, the next operative area of support potential is the 1.3500 psychological level, which as you can see from the above monthly chart, has previously shown a penchant for support as it helped to set the swing-low last September, just as price was forming a morning star pattern before those fresh 20+ year highs.

USD/CAD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist