Canadian Dollar Technical Outlook: USD/CAD Short-term Trade Levels

- USD/CAD rebound off support extends nearly 2% off yearly low- bulls threatens larger recovery

- USD/CAD weekly range contracting just below resistance at 200DMA

- Resistance 1.3881-1.39, 1.3978-1.4010 (key), 1.41- Support 1.3778/98 (key), 1.3714, 1.3614

The US Dollar is poised to mark a second consecutive weekly advance with USD/CAD ripping into resistance early in the week. A near-term range is preserved just below, and the focus is on a potential breakout in the days ahead as the bulls eye a test of the yearly downtrend. Battle lines drawn on the USD/CAD short-term technical charts.

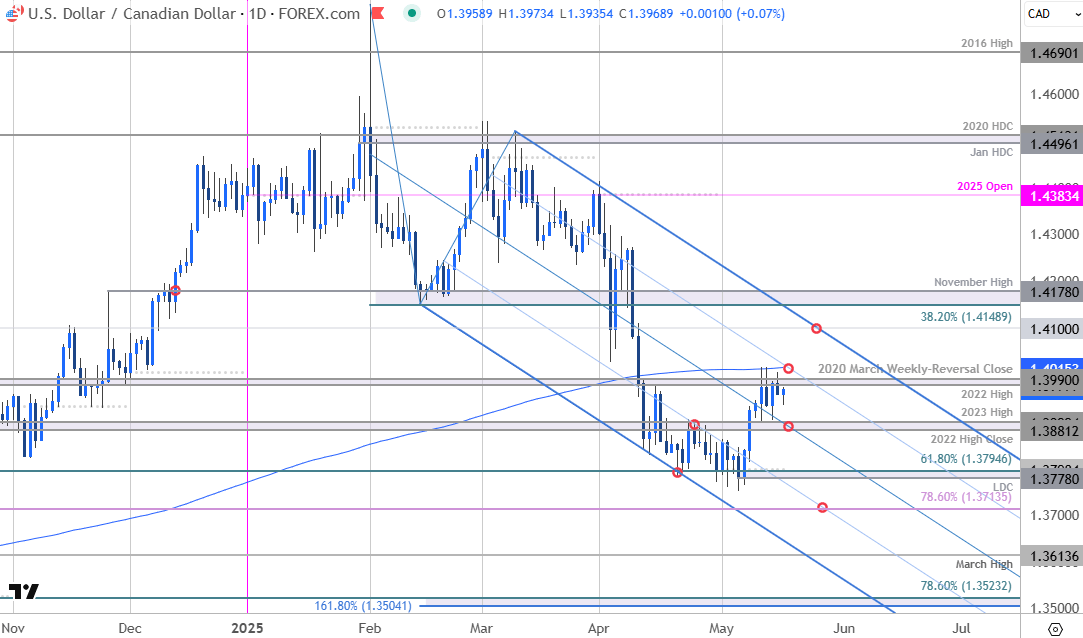

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Loonie setup and more. Join live on Monday’s at 8:30am EST.Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In my last Canadian Dollar Short-term Outlook, we noted that a, “rebound off downtrend support takes USD/CAD into the topside of a multi-week range – risk of a larger recovery while above the weekly open. From a trading standpoint, losses should be limited to 1.3778 IF price is heading higher on this stretch – look for a larger reaction on test of the 200-day moving average.” USD/CAD has now rallied more than 1.9% off the yearly low with the advance failing at the 200-day moving average this week. A breach & retest of the median-line threatens a larger recovery here and the focus now shifts to a breakout of this week’s range for guidance.

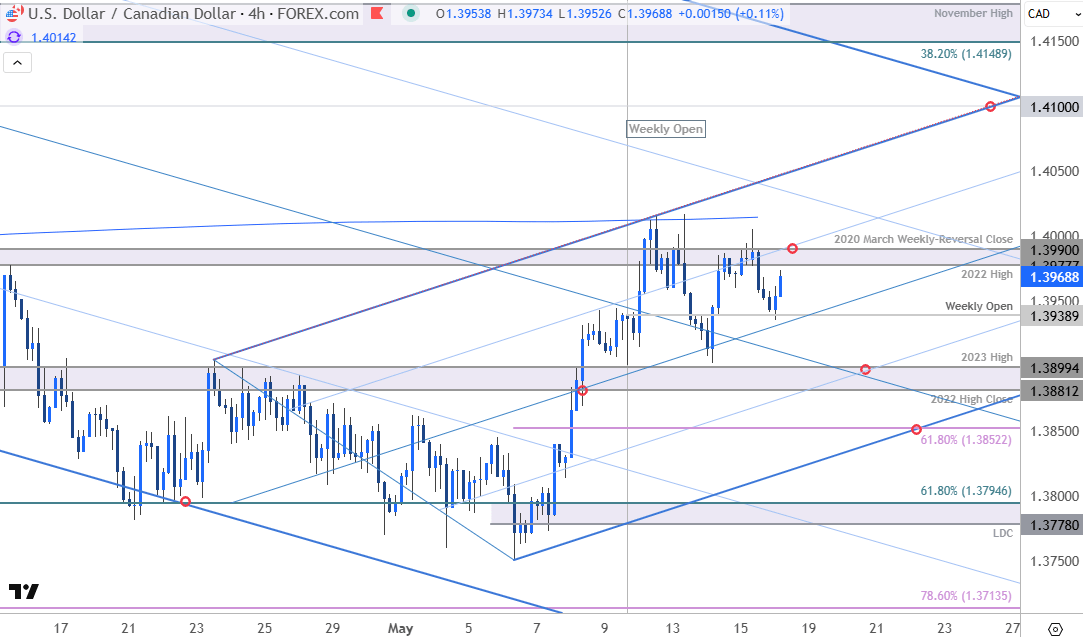

Canadian Dollar Price Chart – USD/CAD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Notes: A closer look at Canadian Dollar price action shows USD/CAD trading within the confines of an ascending pitchfork extending off the May low with the median-line offering support this week. Key resistance stands at 1.3977-1.4014- a region defined by the 2022 high, the 2020 March weekly reversal close and the 200-day moving average. A topside breach / close above this threshold is needed to suggest a more significant low was registered last week / a larger reversal is underway. Subsequent objectives eyed at the 1.41-handle and the 38.2% retracement of the January decline / November High at 1.4149/78- both areas of interest for possible exhaustion / price inflection IF reached.

Weekly open support rests at 1.3939 and is backed by the 2022 high-close / 2023 high at 1.3881/99. Near-term bullish invalidation now raised to the 61.8% retracement at 1.3852. Ultimately, a break / close below the 1.3778/95 would be needed to mark resumption of the February downtrend.

Bottom line: USD/CAD is testing confluent resistance near the 200-day moving average and the focus is on a reaction off this mark. From a trading standpoint, losses should be limited to 1.3881 IF price is heading higher on this stretch with a close above the 200-day moving average needed to fuel the next leg of the advance.

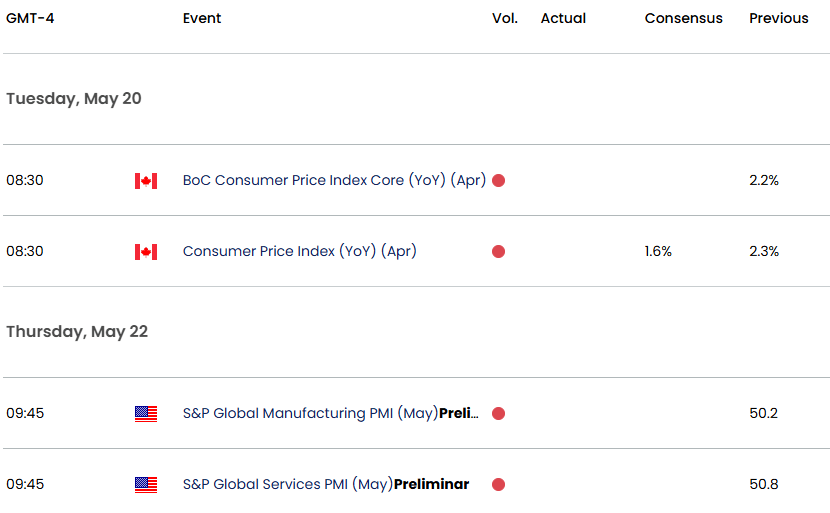

Keep in mind we get the release of key Canadian inflation data next week- watch the weekly closes here for guidance. Review my latest Canadian Dollar Weekly Forecast for a closer look at the longer-term USD/CAD technical trade levels.

Key USD/CAD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Euro Short-term Outlook: EUR/USD Recovery Stalls at Trend Resistance

- Swiss Franc Short-term Outlook: USD/CHF Bulls Tested at Resistance

- Japanese Yen Short-term Outlook: USD/JPY Rejected at Trend Resistance

- Gold Short-term Outlook: XAU/USD Drops to Multi-month Trend Support

- US Dollar Short-term Outlook: USD Bulls Steady After Fed Decision

- British Pound Short-term Outlook: GBP/USD Bulls Eye 2024 High

- Australian Dollar Short-term Outlook: AUD/USD Halted at Resistance

Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex