CPI, USD, USD/JPY, EUR/USD Talking Points:

- This morning’s CPI report saw the data print below expectations, with YoY headline CPI showing at 2.4% v/s 2.5% expected and Core at 2.8% v/s 2.9% expected.

- This opens the door for USD bears to take their shot at fresh lows but so far they haven’t been able to take out last week’s lows.

- In a related matter, EUR/USD is close to a 1.1500 test and USD/JPY showed another failed breakout ahead of CPI this morning as prices has snapped back below the 145.00 level.

This morning’s CPI data saw both MoM and YoY readings come in below expected for both headline and Core inflation, which seemingly opens the door for Dollar bears to make a press on the lows. The initial reaction was violent, at least, but since then, sellers have displayed a bit of trepidation.

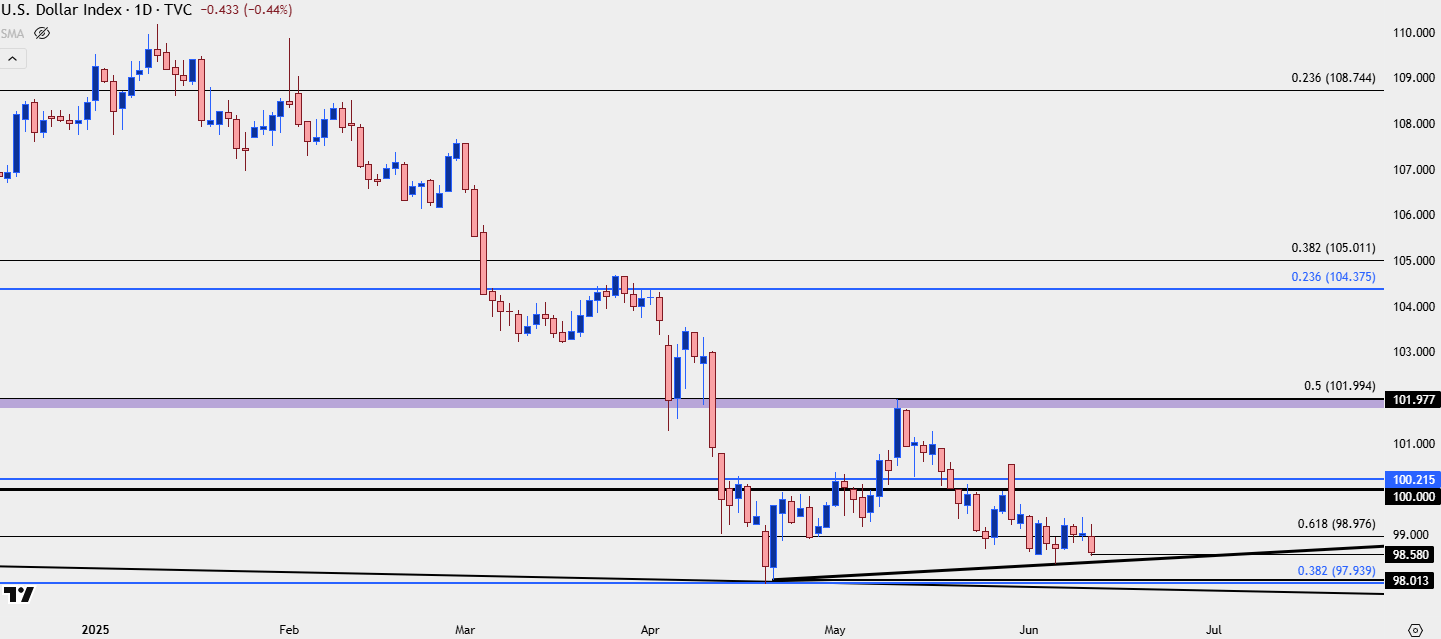

This highlights a deduction that illustrates that beleaguered look that sellers have been showing over the past couple of weeks, following the aggressive sell-off that found support on Easter Monday, and then rallied until the 102 handle held the highs in the USD last month.

The first step towards a bullish reversal is often a slowing of bearish pressure, similar to what’s shown here and in the video, I highlighted the mirror image of that in the Dollar from back in January and February as sellers started to take over. And then going back to last Q3 and into Q4, we have another example of sellers running out of steam which led to the massive reversal in the USD for Q4.

We’re not quite there yet as USD bulls haven’t been able to show much for upside run, but we do have a degree of that bearish stall from USD sellers and that’s of interest as we move deeper into the week and the month of June.

In the USD, current support structure is of interest, as the April low at 97.97 led into a higher-low last week. Those are prices that bears need to test and take-out to exhibit greater control of the trend and in order to open the door for breakouts.

U.S. Dollar Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

The Euro is a whopping 57.6% of the DXY quote and going along with that higher-low context in the US Dollar at the moment we have a similar instance of a lower-high last week in EUR/USD.

The 1.1500 level is of interest as bulls stalled five pips shy of that figure last week. And so far this week, with some push after CPI, there’s another open door for bulls to force a break above that level.

As I said in the video, I can’t justify this as bearish at the moment given that rush up to a fresh short-term high and that bullish breakout potential, but a failure to run trends above the big figure could start to open the possibility of another failure from buyers.

Also shown in the video, GBP/USD and USD/CAD can carry more attractive arguments for USD-weakness scenarios, in my opinion.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

USD/JPY

I remain of the mind that USD/JPY is a large push point behind USD trends at the moment and interestingly, the pair remains near recent highs despite the CPI data this morning that pushed up rate cut expectations for later in the year.

Again, this wouldn’t quite qualify the pair as bullish and there was another failed breakout attempt today, but it would highlight the fact that USD bulls aren’t completely out of the matter yet, especially if we can see a sustained trend in USD/JPY above the 145.00 handle.

USD/JPY Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist