Key Events to Watch

- Strait of Hormuz Risks vs. Nuclear Deal Hopes

- FOMC Meeting Amid a Weak Dollar and Geopolitical Tensions

- Headlines Hinting at $90 and $100 per Barrel—Far-Fetched?

$100 per Barrel: Far-Fetched?

Crude oil failed to maintain bullish momentum on Monday, despite heightened geopolitical tensions between Israel and Iran over the weekend. Markets seem to be pricing in a swift resolution—or, at the very least, the lack of any confirmed supply disruption from either country. However, elevated call option volumes indicate that hedging for upside risk remains active, suggesting that investors are still positioning for potential price spikes this month as tensions persist.

Forecasts projecting $100 per barrel can be assessed from two distinct angles. On one hand, a decisive breakout above key resistance levels at $80, $83.50, and $95 would require a combination of strong global demand or a critical supply shock, such as the closure of the Strait of Hormuz. On the other hand, absent these factors, oil prices are likely to remain moderate, aligning more closely with current inflation targets, monetary policy paths, and economic growth agendas.

Consequences of Higher Oil Prices

While recent price increases support OPEC’s gradual unwinding strategies, offering the bloc favorable revenues after prolonged price suppression, a sharp and sustained spike in oil prices may have adverse effects on global economies. If inflationary pressures intensify, the probability of crude holding below the $80–$90 range increases, as central banks would be forced to respond more aggressively.

Powell and the U.S. Economic Landscape

The U.S. Dollar Index continues to hover near three-year lows, facing a trendline that connects higher highs from the 2008 bottom. This trendline faces pressure from economic fragility from tariffs and political uncertainty from the Trump agenda. With the upcoming FOMC meeting, all eyes will be on any updates to the rate path and economic projections. Fresh data may be crucial to reverse the current bearish sentiment heading into the summer months.

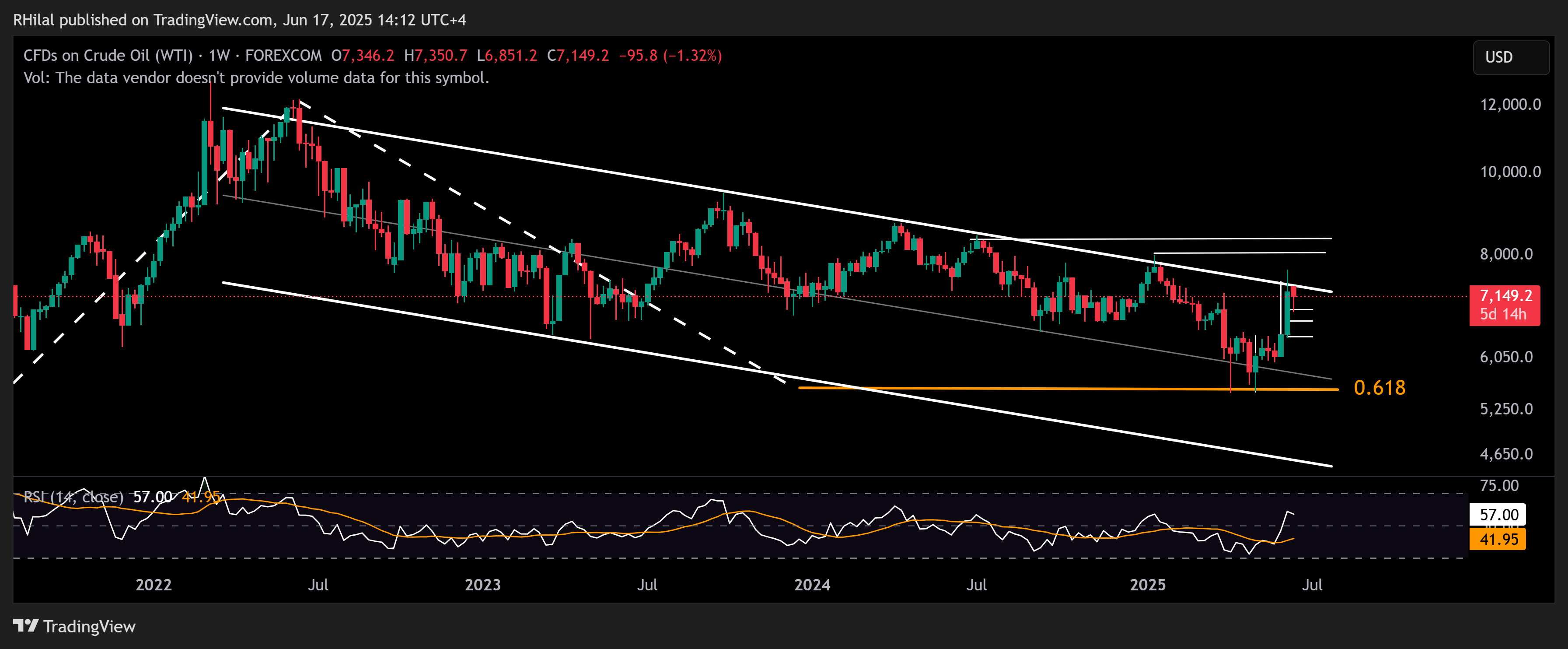

Crude Oil Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

Crude oil remains technically constrained within the three-year descending channel formed since the 2022 highs, currently capped just below the $78 resistance. A clean breakout and hold above $78 could trigger a bullish shift, with upward targets at $80 and $83.50, followed by psychological levels at $90 and $100, should major supply disruptions materialize. Conversely, a failure to break higher leaves the outlook neutral to bearish, with the pullback continuing within the downtrend. Key support zones to monitor include $69, $66, and $64, where potential rebound opportunities could emerge.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves