Key Events

- The PBOC cut rates by 10 bps amid ongoing U.S.-China trade negotiations.

- Gulf AI deals fuel market optimism on one side and Democratic concerns on the other.

- Soft economic data lingers in the background as Nasdaq holds above 21,000 and crude oil stabilizes above $60.

- Flash Manufacturing & Services PMIs on Thursday are expected to further clarify economic resilience amid trade negotiations

AI and Oil: A New Market Dynamic?

Recent AI agreements between the U.S. and Gulf nations—centered around semiconductor and chip technology—are part of long-term strategic development plans in the region. These plans probably align with OPEC’s recent decision to unwind supply cuts, despite persistently low oil prices.

This convergence has fueled a tech-led rally in U.S. indices and supported a rebound in crude oil prices above the $60 psychological level—hinting at a potential emerging correlation between the energy and AI sectors. This could gain traction as global trade deals evolve alongside advancing tech and economic agendas.

In the UAE and Saudi Arabia, Vision 2030 AI initiatives aim to drive economic diversification and growth. The recent chip deals with the U.S. bolster these strategies, potentially benefiting both the AI sector—where these countries aim to lead—and the oil market, which stands to gain from increased economic activity.

However, Democratic leaders in the U.S. have raised concerns about these AI partnerships, citing geopolitical risks tied to Gulf relations with Russia and China. They argue that the spread of advanced U.S. technology to these regions could conflict with national interests.

Implications for Crude Oil

If positive trade developments continue and growth forecasts are revised upward, demand for crude oil—driven by industrial, transportation, and tech-related activity—could rise. This outlook supports OPEC’s gradual market re-entry, not only to penalize non-compliance but also to reclaim revenue from higher demand.

The latest hold above the $55 level may also be seasonally supported by the upcoming summer period, typically associated with increased oil consumption from travel and transport sectors.

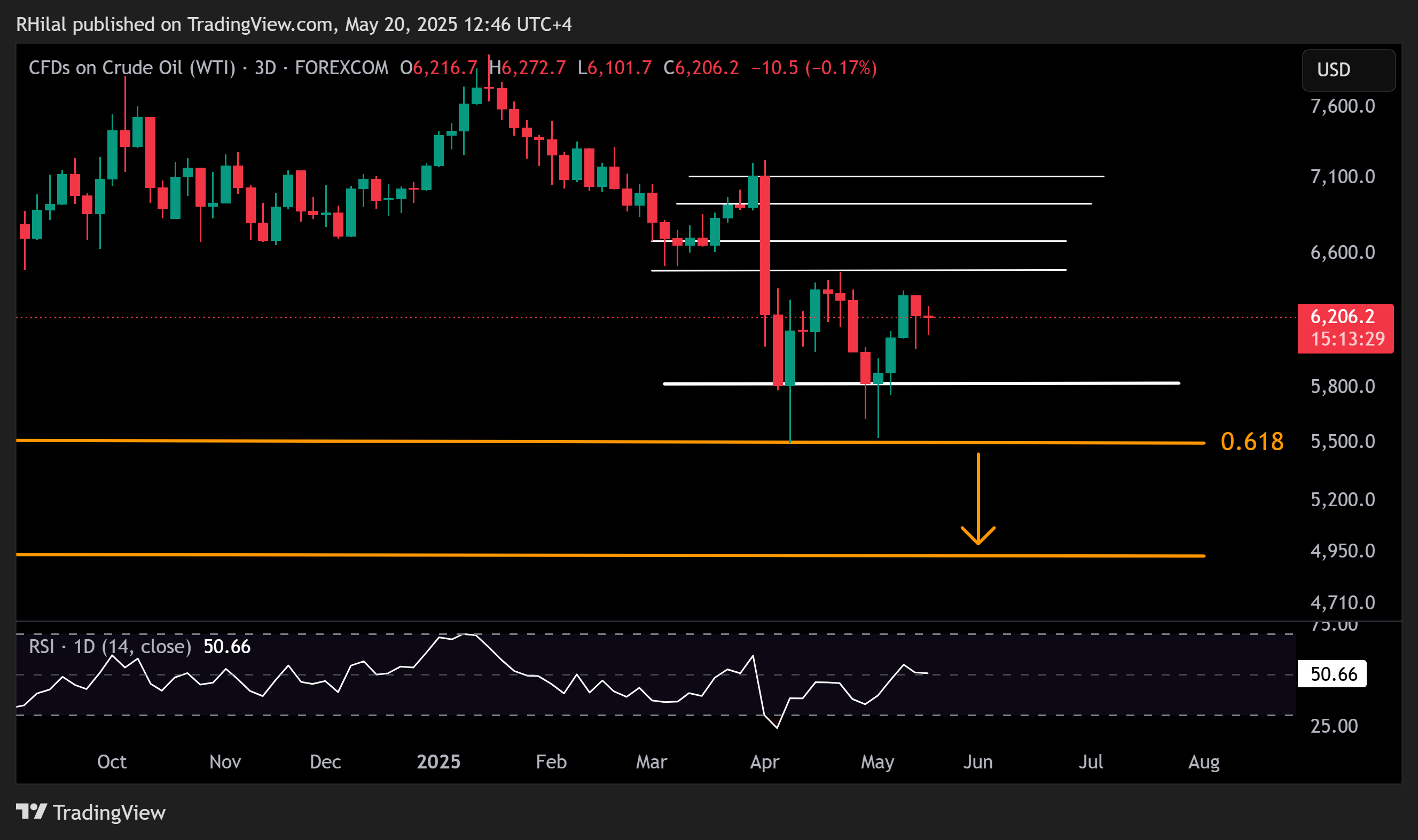

Crude Oil Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

Price action on the 3-day chart and momentum on the daily RSI indicate a bullish-to-neutral stance. Crude oil is currently challenging the $64.80 resistance level, with potential upside targets at $66.70, $69.20, and $71.

On the downside, if oil drops back below the $60 level, key support lies at $58 and $55. A break below these levels could expose the next significant support near $49.

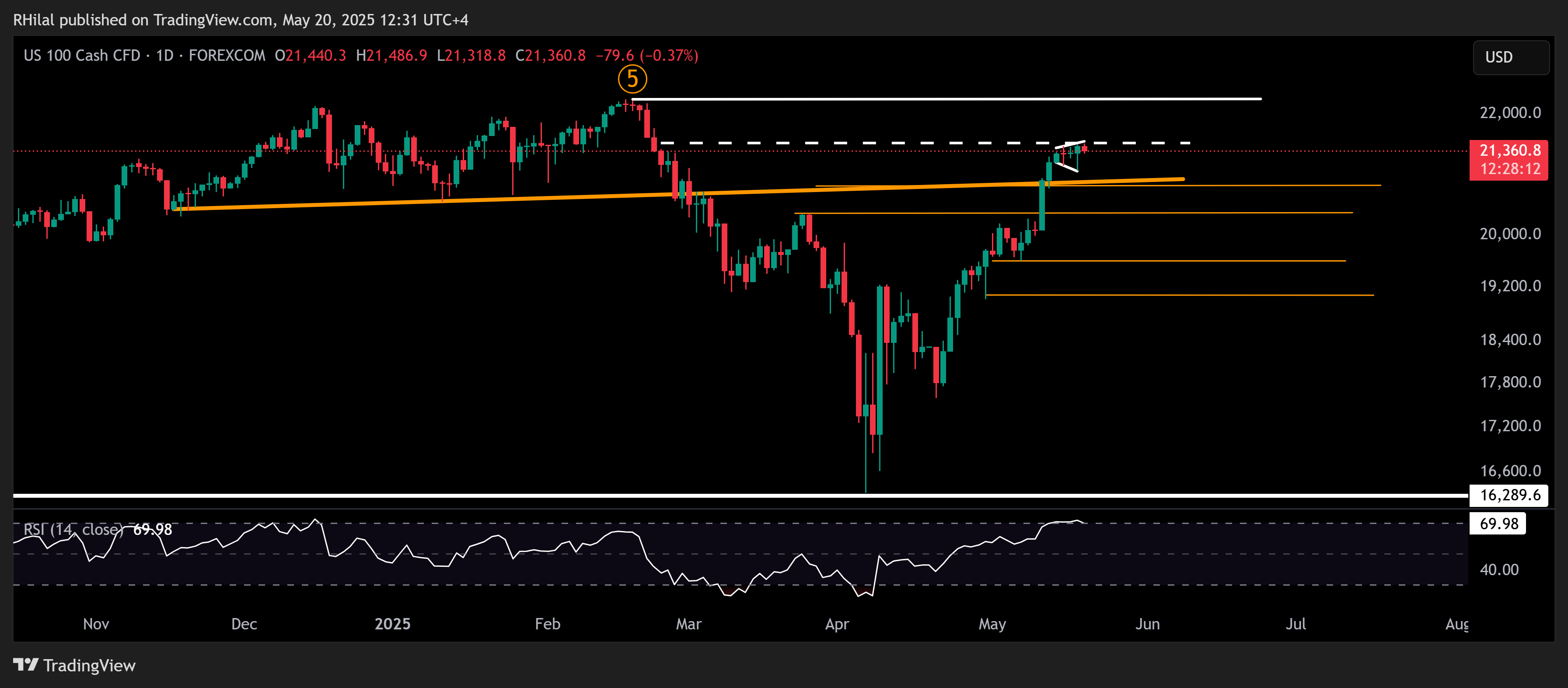

Nasdaq Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

Riding the AI wave and market confidence around a possible Trump administration comeback, the Nasdaq is testing resistance near 21,500. Price is currently consolidating just below this level in what appears to be an expanding pattern.

Downside: A break and hold below 21,000 could trigger further downside toward 20,800—the neckline of the Dec 2024–Feb 2025 double top pattern. A clean break below that level may invite further declines toward 20,300, 19,600, and 19,200.

Upside: A decisive close above 21,500 could resume bullish momentum, targeting the previous record high at 22,200, with the next potential resistance near 23,700.

Written by Razan Hilal, CMT

Follow on X: Rh_waves