Key Events

- Trump–Saudi–NVIDIA deals lift investor sentiment toward tech sector

- Nasdaq breaks above key neckline and the 21,000 level on AI and trade optimism

- Crude oil rebounds toward $63 on stronger growth forecasts

- OPEC Monthly Report is due today, with expectations largely priced in around growth optimism and a gradual unwinding of supply cuts into 2025

Trump’s Middle East Visit and Market Reaction

Trump’s recent visit to the Middle East opened the door to improved geopolitical and economic ties. The easing of sanctions on Damascus, Syria, coupled with AI and tech investment deals in Saudi Arabia — notably involving 18,000 AI chips with NVIDIA — helped shift risk appetite away from safe havens and back toward equities, particularly tech stocks. As a result, the Nasdaq surged past its 21,000-neckline.

Meanwhile, U.S.–China trade discussions had already laid the groundwork for bullish expectations. Trump’s continued engagement with the region, especially with Saudi, UAE, and Qatar, is seen as supporting this broader momentum, aligned with his investment-focused, resolution-driven agenda.

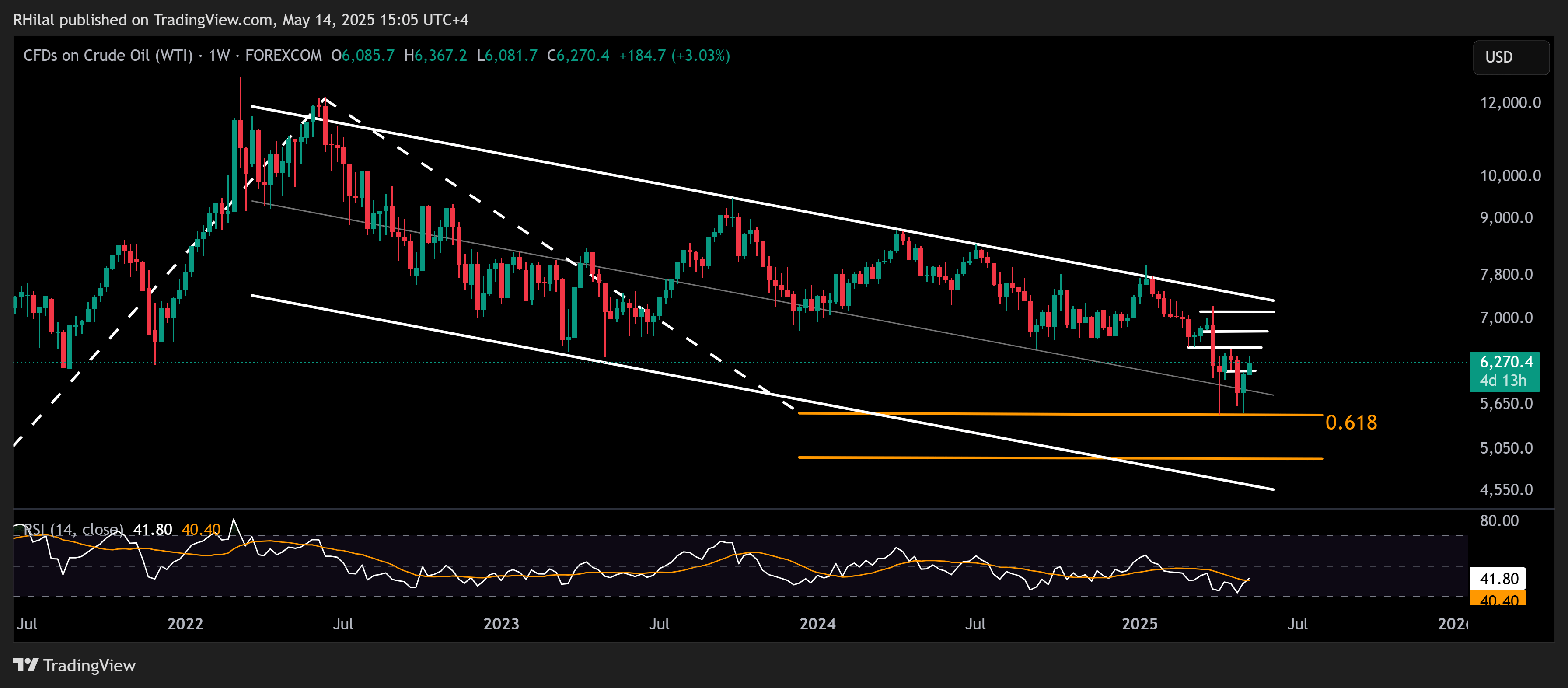

Crude Oil Rises on Growth Hopes

Crude oil prices have also gained traction, supported by rising demand expectations tied to regional economic developments. Oil is now trading back above the $60 level and testing a long-term bullish structure, correlating (though fundamentally different) with the upward movement in the tech and AI sectors.

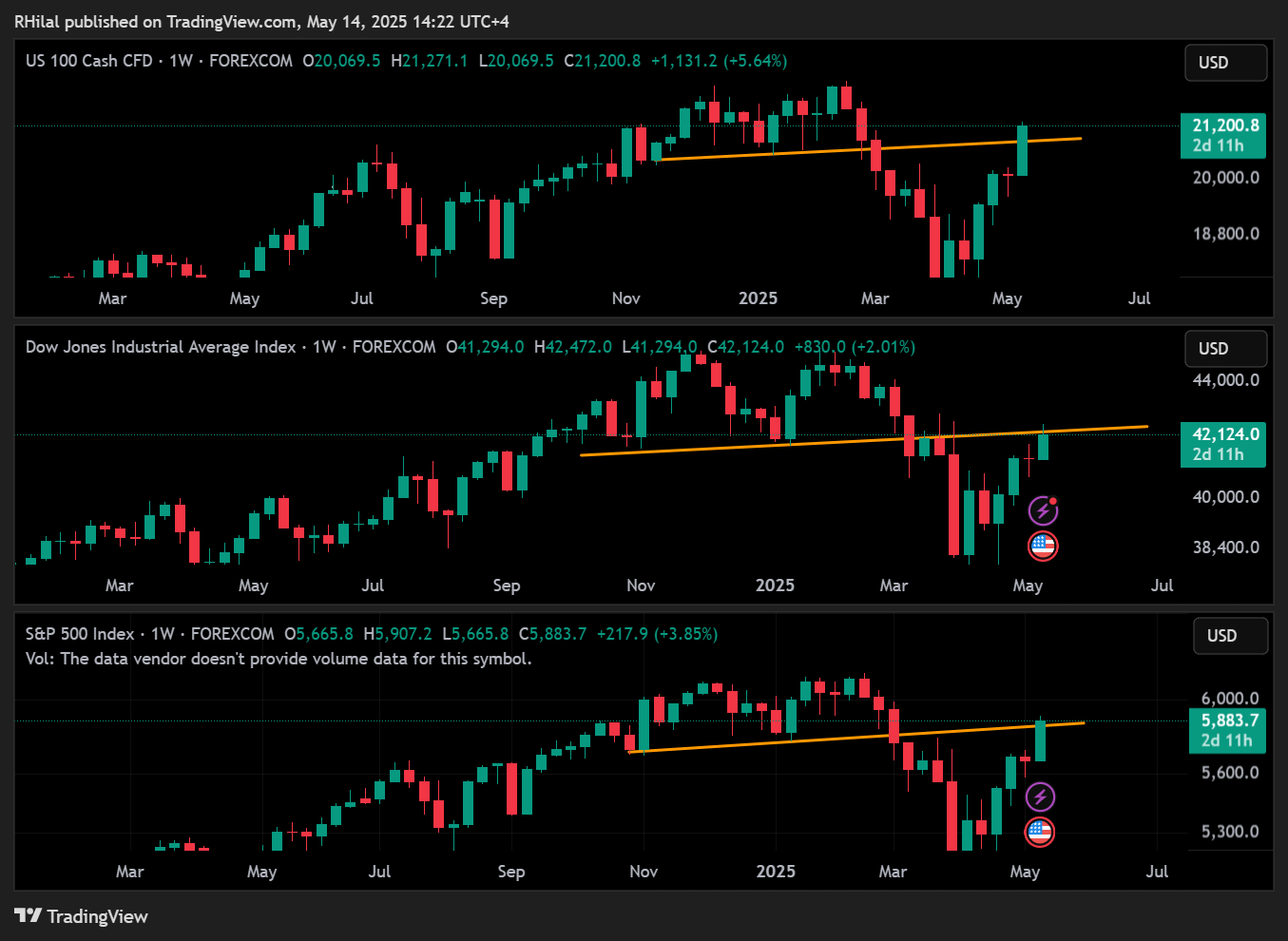

SPX500 and Dow Lag Behind Nasdaq

While the Nasdaq leads the way, the S&P 500 and Dow Jones still have room to catch up. Both remain just below the necklines of their respective double top formations. Their relative underperformance is likely tied to ongoing soft economic data — particularly inflation and growth readings that echo conditions from 2020. However, markets are pricing in a potential breakout as deal momentum builds.

Nasdaq, Dow, SPX500 – Weekly Time Frame

Source: TradingView

In a market that feels like a high-stakes race, the Nasdaq is clearly in the lead — reinforcing longer-term appetite for tech as a "buy-and-hold" sector, especially if trade deals materialize.

Crude Oil – 3-Day Time Frame (Log Scale)

Source: TradingView

Zooming out from short-term volatility, crude oil is holding firmly above key support at $55–58, now trading around $63. Momentum indicators show continued recovery from oversold territory — levels last seen in 2020 — reinforcing the case for a longer-term bullish setup. A sustained move above $65.20 may open the way toward $67.90, $71.30, and $73.00.

On the downside, a break below $61.40 could bring $58.00, $55.00, and $49.00 back into focus as support zones.

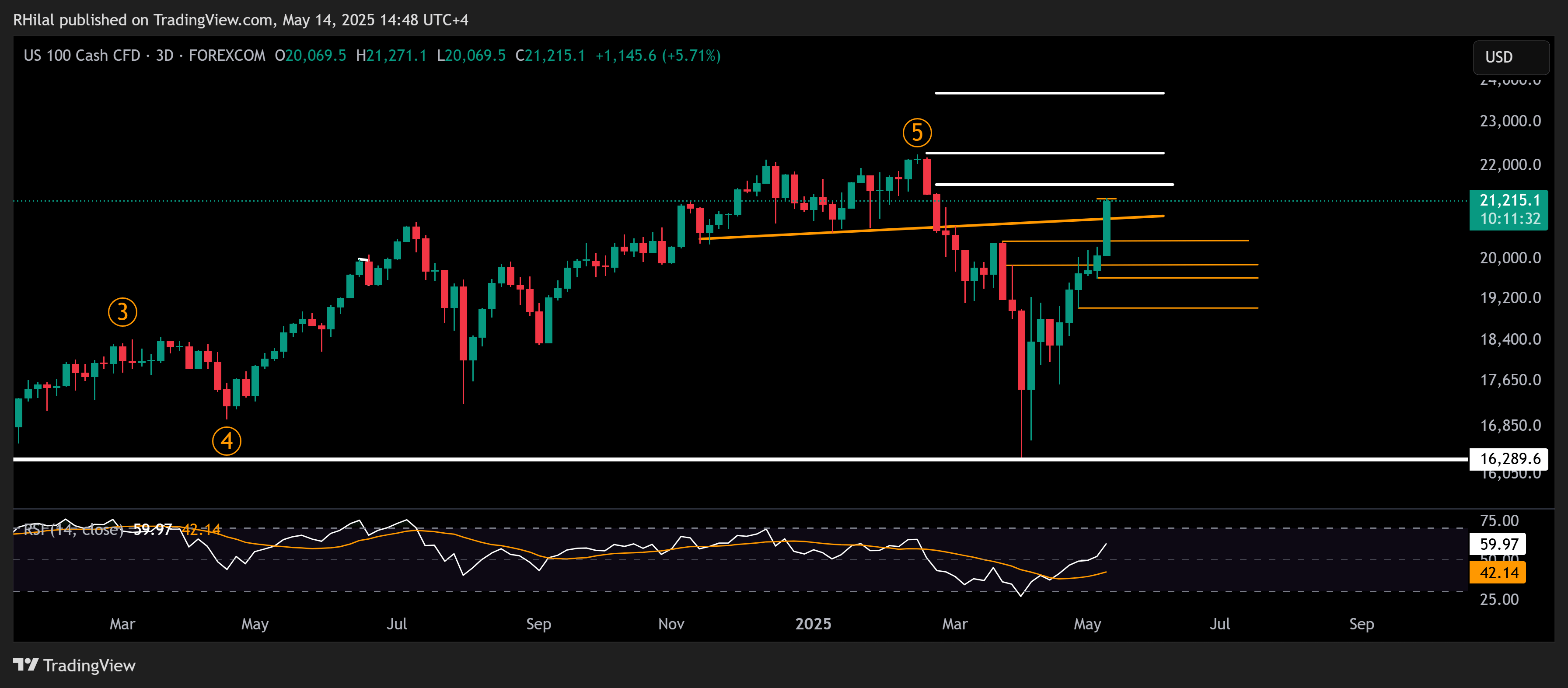

Nasdaq Outlook – 3-Day Time Frame (Log Scale)

Source: TradingView

Nasdaq is trading back in the 21,000 zone, supported by positive momentum from tech headlines and trade optimism. The index is now targeting the 22,200 record high, with initial resistance at 21,500, and a longer-term target above 22,200 at 23,700, as suggested by RSI strength.

However, if Nasdaq fails to hold above 21,200 and slips below 20,900, potential support levels include 20,300, 19,900, and 19,600.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves