Geopolitical tensions between Israel and Iran have escalated rapidly, with President Trump now considering direct US involvement. Yet despite the heated headlines, WTI crude oil has stalled after a 30% rally. With no fresh highs this week and volatility easing, traders are weighing whether the rally has run its course. If the US steps back from conflict, a risk-on rebound could follow — pressuring oil prices and reviving bets on Fed rate cuts.

View related analysis:

- Australian Dollar Outlook: Will AUD/USD Follow NZD/USD Lower?

- WTI Crude Oil Surges, AUD/JPY Slides After Israel’s “Pre-Emptive Strike” on Iran

- AUD/JPY Eyes Breakout as Bulls Defend Support Ahead of Jobs Data

- Gold Price Outlook: Can Bearish Technical Setup and June Weakness Align?

WTI Crude Oil at a Crossroads: Rally Exhaustion or More to Come Amid Geopolitical Risks?

Headlines from the Isreal-Iran conflict have gone from hopes of a ceasefire at the beginning of the week, to President Trump considering whether the US wade into it by the end of the week. All while Isreal targets Iran’s nuclear facilities and Iran targets civilian hospitals, making a complete mockery of Mondays ceasefire hopes.

Yet while Middle East headlines have continued to heat up, oil prices have not. Yes, they the price of crude remains highly elevated by recent standards. And they’re likely to remain so until a resolution has been found. But with Trump supposedly mulling over US involvement over the next two weeks, it warns Iran of how things may turn out while also providing time to cut a deal. Only this time, Trump does not have eye-watering tariffs on hand as leverage, so from that angle his ‘2 weeks’ could be seen as soft, and his latest TACO trade.

My best guess is that the US won’t get involved, and this will spark a bout of risk-on — with Wall Street indices rallying and oil prices falling. It might also allow traders to refocus their attention on a slowing US economy and short the US dollar on the prospects of Fed rate cuts. Of course, Trump and Powell do appear to be at odds with one another, and I can’t help but feel that Powell wants to keep rates higher to spite the man who’s trying to strongarm him into lowering them. But that’s a different story.

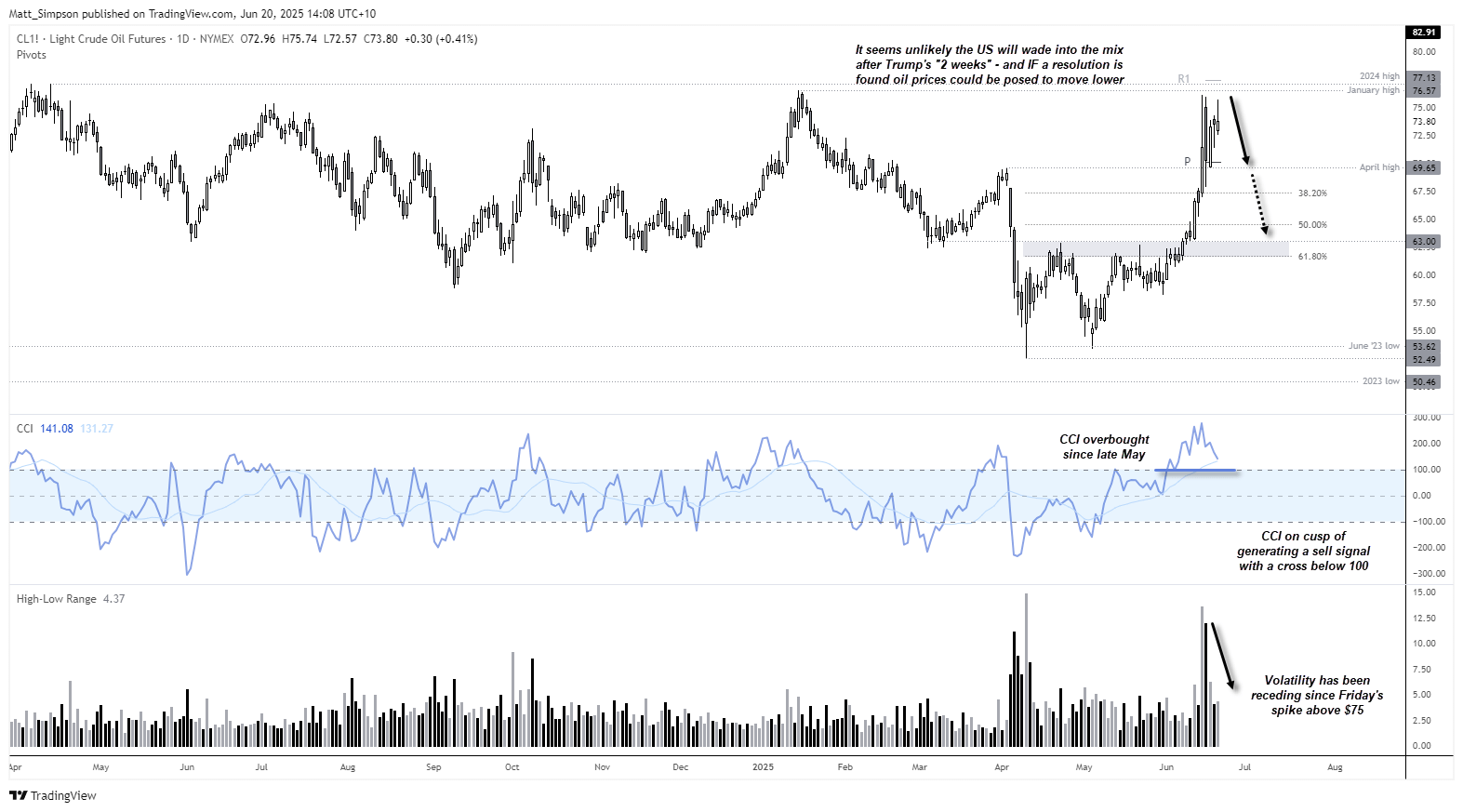

WTI Crude Oil Futures (CL) Technical Analysis

Oil prices rallied 30% over the 10 trading days between May 30 and June 13. The CCI (Commodity Channel Index) reached its highest level since March 2022 by Friday’s close and has remained above 100 (overbought) since the rally began. The CCI is also close to dipping back below 100, which is a classic sell signal by some TA books.

WTI crude oil has also failed to take out last week’s high despite the escalated levels of fighting between Israel and Iran. And while WTI has stayed in the top half of Friday’s candle, price action has been choppy and volatility has receded somewhat.

Put together, I strongly suspect we’ve seen the best part of this rally. Unless Iran decides to wreak havoc on the Bab el-Mandeb Strait, it’s hard to see how oil prices could go significantly higher from here — especially given they’ve struggled to do so already this week. And as I’m feeling optimistic about a resolution before the two weeks are up, I suspect fading into false breaks may be the better approach than chasing an already extended rally.

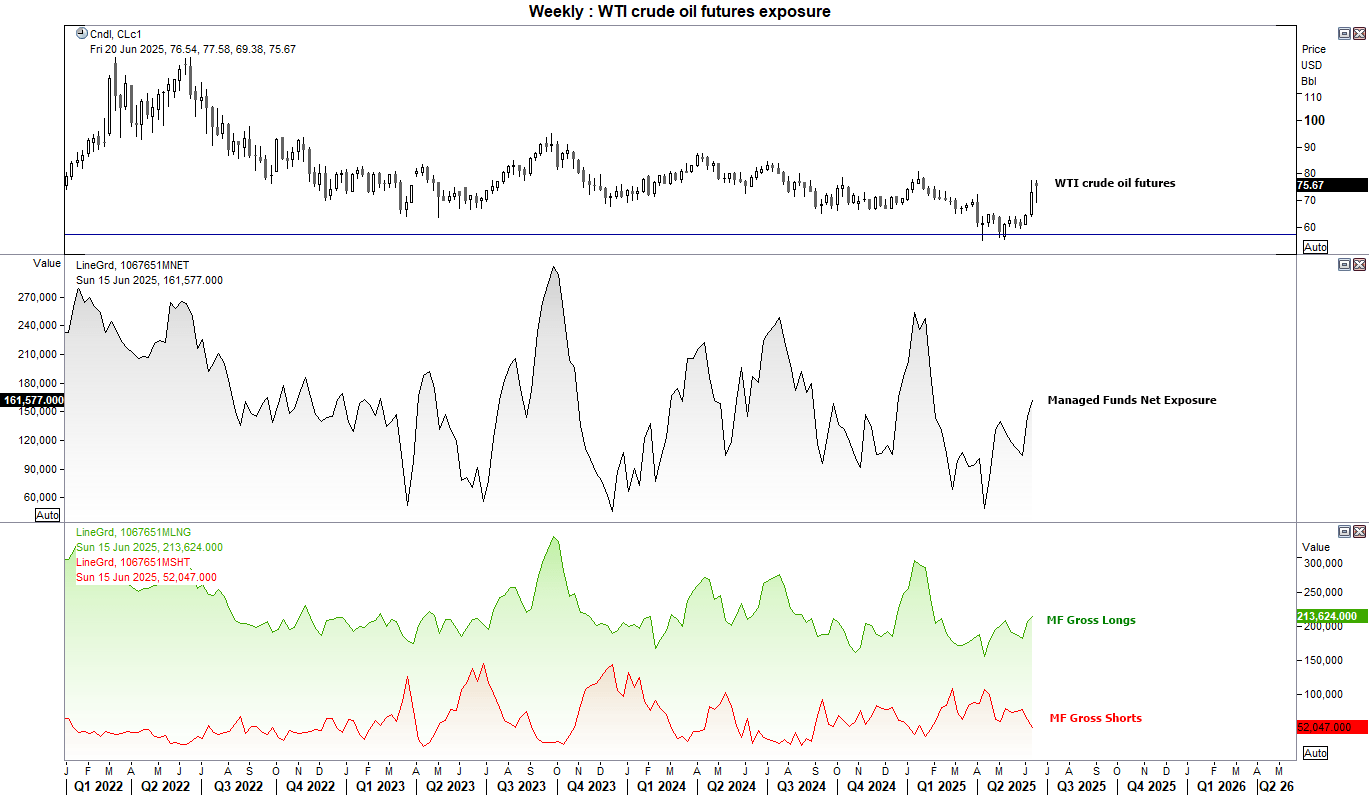

WTI Crude Oil Positioning (CL): Weekly COT Report Analysis

- Managed funds increased their net-long exposure to WTI crude oil to a 19-week high of 16.9k contracts last week

- 6.4k gross longs were added, while 10.6k gross shorts were closed

- Large speculators also increased their net-long exposure by 24k contracts, bringing the combined increase to 40.9k contracts

Traders were clearly bullish on crude oil judging by these figures. And the numbers are likely to show even more bullish positioning when this week’s data is released later today, given the snapshot was taken last Tuesday — before oil prices rallied as much as 20% from Wednesday’s close to Friday’s high.

However, given WTI crude oil’s inability to push higher this week, we can likely look past this lagging dataset and instead focus on incoming headlines and how well prospects for a ceasefire are shaping up.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge