Key Events This Week:

- OPEC Monthly Report (Tentative – Monday)

- China: GDP, Industrial Production, Retail Sales (Wednesday)

- US–China Trade War Developments

- US–Venezuela–Iran Oil Sanction Updates

Oil Rebounds from $55 Low

After falling to a four-year low at $55, oil prices rebounded as markets responded to the 90-day tariff delay and improved sentiment. This bounce, which coincided with oversold momentum and equity market recovery, sets a bullish tone for a volatile week ahead driven by geopolitical developments, OPEC decisions, and Chinese data releases.

OPEC+ Moves to Secure Market Share

Markets were jolted by OPEC's recent decision to unwind 411,000 bpd of production cuts starting May 2025. Despite tariff-driven price pressures, oil climbed back near $60 following the tariff delay announcement. OPEC appears committed to preserving market share amid rising global demand, production growth, and population expansion—even if it means weathering short-term price turbulence.

Sanctions on Venezuela and Iran may offset near-term oversupply risks, helping rebalance the market until broader trade agreements stabilize global flows.

China’s Economic Data and Tariff Tensions

China remains in focus as its economic indicators—GDP, Industrial Production, and Retail Sales—are due Wednesday. These data points will be key in assessing oil demand prospects as the tariff standoff with the U.S. continues. Recent tariff escalations (125% from China, 145% from the U.S.) underline the urgency for a potential deal, as both sides signal willingness to negotiate.

Sanctions and Geopolitical Shifts

Beyond the tariff war and OPEC production shifts, sanctions on Iranian and Venezuelan oil could provide upward speculation for prices. Any tariff deal progress may further shift global flows in favor of oil exporters like OPEC and the U.S.

Choeib Boutamine, CEO of Ranadrill Consulting, notes that sanctions—alongside a pending mineral deal with Ukraine and ties with Russia—aim to curb China’s access to discounted oil, which has supported its global cost competitiveness, particularly against the U.S.

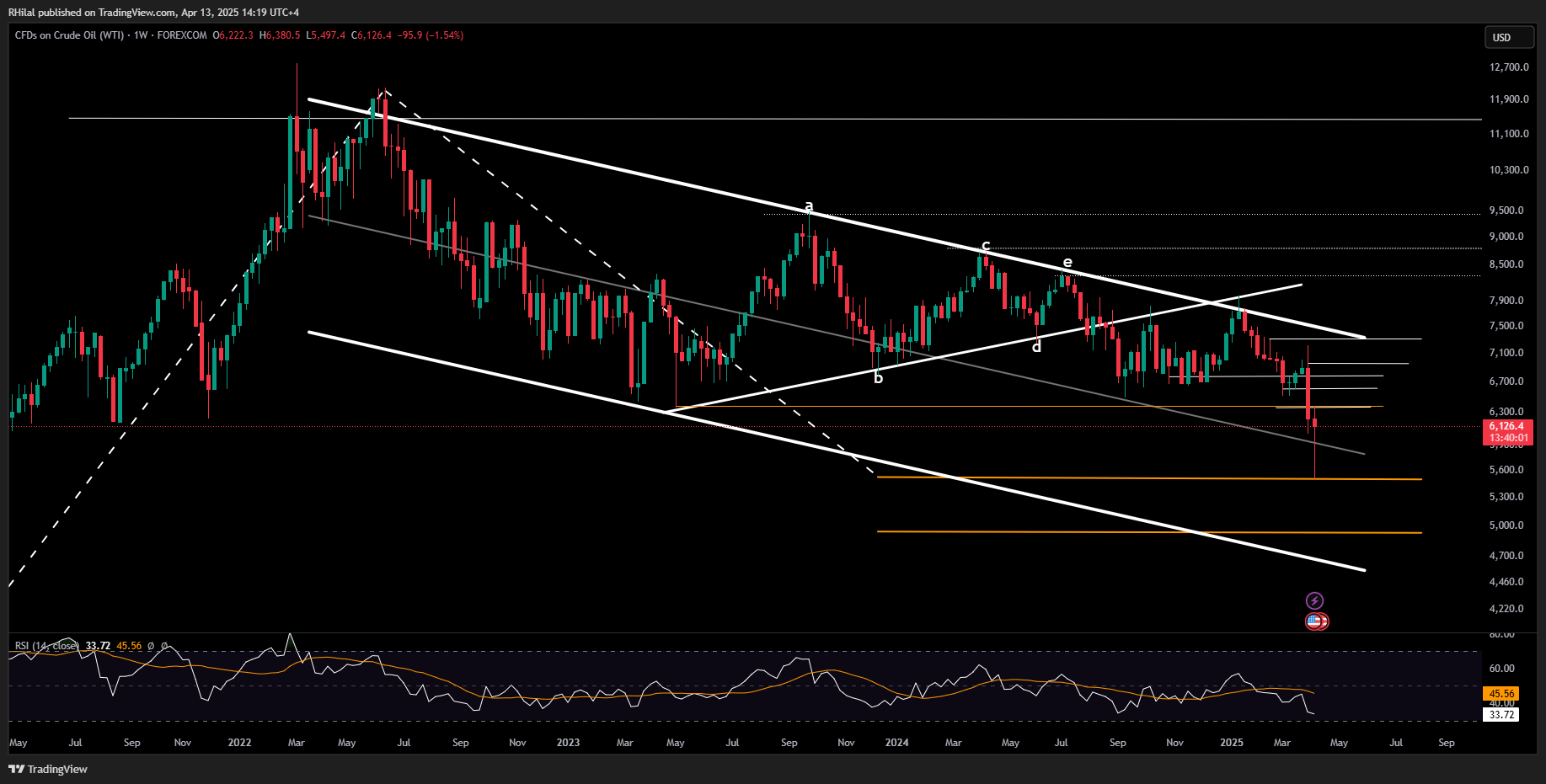

Technical Analysis: Quantifying Uncertainties

Crude Oil Week Ahead: Weekly Time Frame – Log Scale

Source: Tradingview

Crude oil's sharp rebound from the $55 support—aligned with the 0.618 Fibonacci retracement of the 2020–2022 uptrend—faced immediate resistance at the long-standing support-turned-resistance zone around $63.80, established in 2021. A decisive move above $63.80 may clear the way for further gains toward $66, $68, $69.60, and ultimately $73.

On the downside, a drop below $58 would bring $55 back into focus. A clean break below that level could trigger further downside toward $49 per barrel, which aligns with the lower boundary of crude oil's long-term uptrend, as outlined in my Q2 Outlook.

Written by Razan Hilal, CMT

Follow on X: Rh_waves