Key Events to Watch

- Eurozone & UK Flash Manufacturing PMIs remain mixed amid ongoing trade war volatility; U.S. PMIs due next

- April tariff adjustments underway: reciprocal measures and additional 20% tariffs on China stabilize gold above $3,000 and pressure oil’s rebound below the $70 mark

- Geopolitical flashpoints: Russia, Ukraine, Yemen, Israel, and Palestine

- Weekly Technical Forecast

Renewed Tariffs & Economic Consequences

Trump’s policies are increasingly facing public and market resistance, with many viewing them as detrimental to both the U.S. and global economies. The threat of additional 20% tariffs on Chinese exports adds further strain on China’s economic recovery and weakens global oil demand outlook.

Globally, reciprocal tariffs—such as the 25% duties on steel and aluminum—could drive inflationary pressures while simultaneously dampening growth, leaving markets cautious despite last week’s rebound. Although major currency pairs and equity indices reversed course following the recent Fed meeting, the sustainability of this move remains uncertain amid a turbulent political and geopolitical backdrop.

Flash manufacturing PMIs released today reflect a mixed picture:

- Eurozone: Manufacturing PMI rose slightly from 47.6 to 48.7, while Services PMI dipped from 50.6 to 50.4.

- UK: Manufacturing PMI dropped further into contraction territory from 46.9 to 44.6, whereas Services PMI rose from 51.0 to 53.2, reinforcing an overall mixed economic outlook—and by extension, mixed implications for oil demand.

U.S. PMI data will be released later today and is likely to further shape market sentiment.

Geopolitical Tensions and Sanction Risks

Geopolitical tensions continue to make headlines, with key flashpoints involving the U.S., Iran, Yemen, Russia, Ukraine, Israel, and Palestine—all significantly impacting oil prices.

- U.S.–Yemen: Tensions center around securing the Red Sea and protecting Israel from Iran-backed Houthi forces in Yemen. Given the Red Sea’s strategic role in global oil transportation, any escalation poses serious supply concerns and increases upside hedging risks.

- U.S.–Iran: Strained relations over Iran’s nuclear program have led the U.S. to impose sanctions targeting all Iranian oil exports. Further escalation could drive oil prices higher due to reduced global supply.

- Israel–Gaza Conflict: The recent collapse of a ceasefire deal has reignited fears of broader regional escalation, renewing upward pressure on oil prices through increased geopolitical risk premiums.

- Russia–Ukraine War: While diplomatic efforts continue, the prolonged conflict—especially attacks on critical energy infrastructure—remains a key factor in maintaining upside hedging demand in the oil market.

Although current price pressures are driven by geopolitical risk, the emergence of peace agreements or de-escalation in any of these regions could reverse sentiment and apply bearish pressure by reducing the need for risk hedging in oil.

Technical Analysis: Quantifying Uncertainties

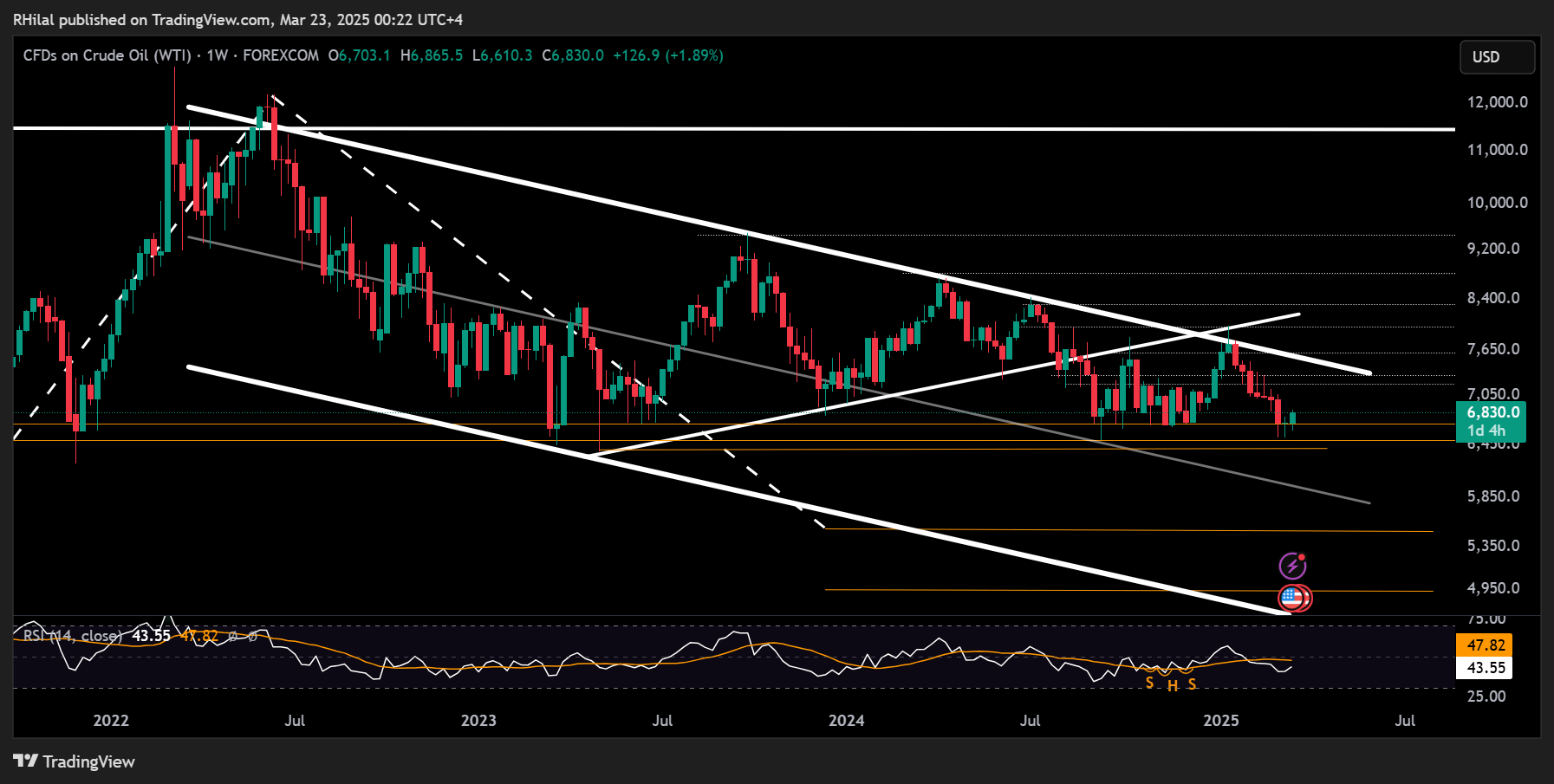

Crude Oil Week Ahead: Weekly Time Frame - Log Scale

Source: Trading view

From a weekly time frame perspective, oil prices have continued to respect the boundaries of a declining channel since the 2022 highs, reaching three-year lows in 2025, in alignment with the long-standing support zone between $64 and $66 that has held since 2021.

After recently rebounding from the $65 level, a decisive close below $63.80 would confirm further downside potential, opening the way toward key support levels at $60, $55, and, in more extreme scenarios, $49.

If the support zone holds, resistance levels within the declining channel may come into play at $72, $73, and $76. A breakout above the channel’s upper boundary and a sustained hold above $78 could shift the outlook to bullish, with potential resistance at $80, $84, $89, and the $93–$95 range.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves