Key Events

- Russia-Ukraine tensions threaten a potential peace deal, keeping oil prices above $66

- U.S. sanctions on Iran's oil minister and shadow fleet add upward pressure on prices

- Trade war risks and OPEC supply quotas limit the potential for further gains

- Key monetary policy decisions from the Fed, BOE, BOJ, and SNB next week could influence overall market sentiment

The combination of weak oil prices, declining inflation and growth forecasts, and surging gold prices above $3,000 signals severe market distress amid the escalating trade war. Until a clear trade agreement is reached with the U.S., economic growth concerns will continue to drive expectations of further central bank rate cuts.

U.S. indices hit extreme lows this week and rebounded from key levels: Nasdaq is holding above 19,000, Dow Jones above 41,000, and S&P 500 above 5,490. with momentum levels reaching oversold conditions last seen in 2022. This contributed to a late-week rebound, lifting oil prices above $66, in line with U.S.-imposed sanctions on Russian and Iranian oil.

Trade War Risks Persist

Despite the impact of oil sanctions, more significant bearish factors remain. The unwinding of OPEC supply quotas in April, coupled with declining oil demand forecasts and ongoing trade war uncertainties, continue to weigh on the market. The week ended with escalating trade tensions between the U.S., Canada, and the Eurozone. Retaliatory measures against Trump’s 25% tariffs on steel and aluminum led to further threats from the U.S., escalating uncertainty. Trump raised tariff threats to 50% against Canadian retaliation and 200% against Eurozone countermeasures, driving gold prices past $3,000 due to increased safe-haven demand.

Upcoming Monetary Policies

Falling oil prices are reinforcing expectations of rate cuts, as central banks respond to economic risks stemming from trade tensions. The Bank of Canada (BOC) cut rates to their lowest level since 2022 last week in an effort to support economic activity. Meanwhile, the Fed, BOJ, and BOE are expected to hold rates steady next week, with their press conferences being closely watched for insights into the economic outlook. The evolving trade war scenario is likely to heighten market volatility and influence oil demand forecasts.

Technical Analysis: Quantifying Uncertainties

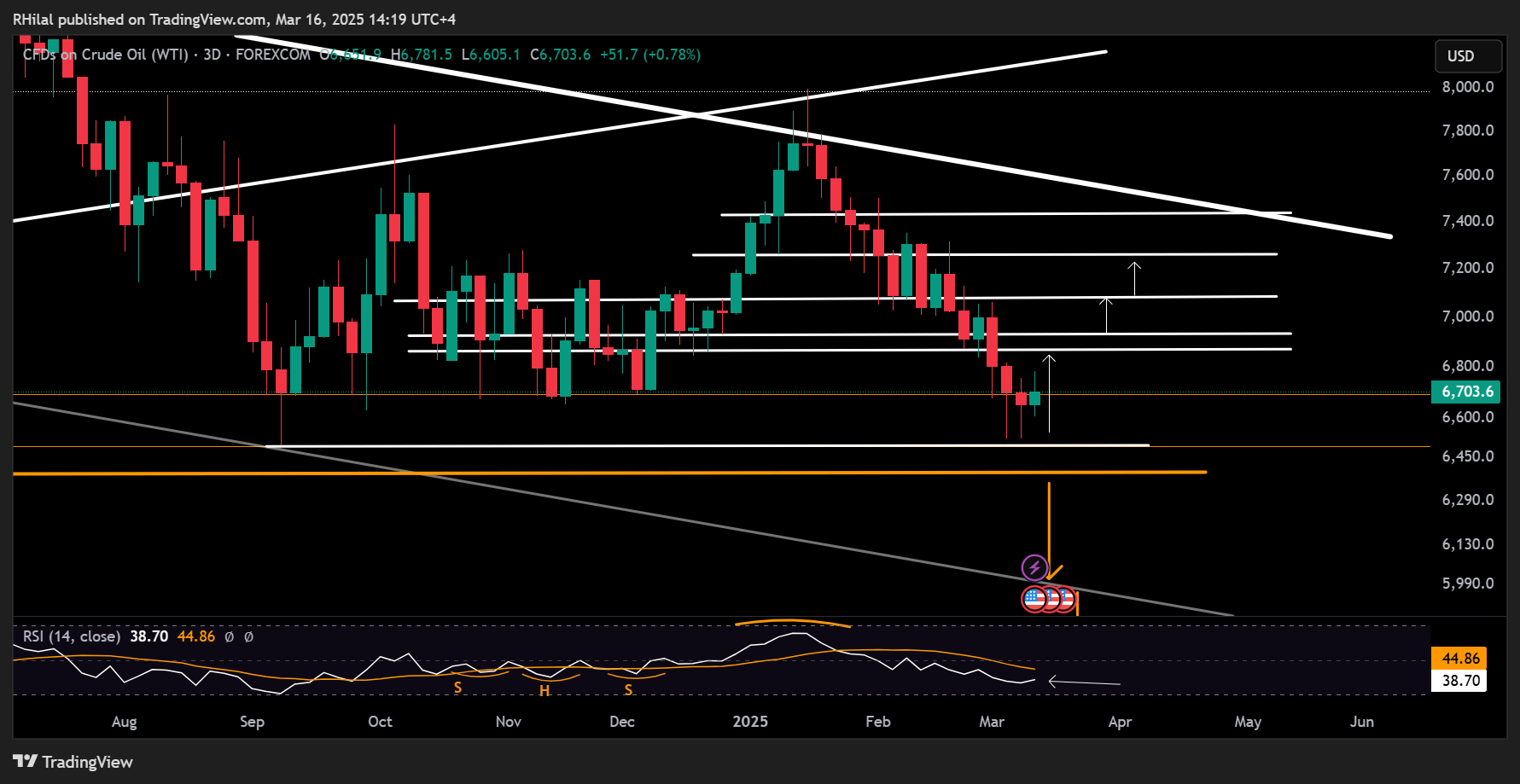

Crude Oil Week Ahead: 3-Day Time Frame – Log Scale

Source: Tradingview

Oil's rebound from September 2024 lows—and three-year lows—has coincided with oversold momentum and a shift in market sentiment. However, key resistance levels must be cleared before altering the dominant bearish outlook.

- Upside levels to watch: A sustained close above $68.70 could extend gains towards $69.30, $70.80, $72.70, and $74.30

- Downside risks: A confirmed break below $65.12 may extend losses towards the psychological $60 level, with further downside potential towards $55

Written by Razan Hilal, CMT

Follow X: @Rh_waves