Key Drivers This Week:

- India-Pakistan tensions raise regional risk despite limited impact on actual supply routes

- Russia-Ukraine ceasefire headlines remain fluid, contributing to geopolitical uncertainty

- U.S.-China trade reset in Geneva could be a pivotal moment for market risk sentiment

- OPEC Monthly Report likely priced in, while U.S. CPI data may test oil and dollar price action this week

India–Pakistan: Geopolitics Lifting the Oil Risk Floor

While there is no confirmed disruption to physical oil flows, renewed hostilities and ceasefire violations between India — the world’s third-largest oil importer — and Pakistan have lifted oil supply risks. The situation has added to the support that pushed oil back above $60, despite OPEC's plan to gradually unwind supply cuts amid uncertainty around U.S.-China tariff deals.

Geneva Talks: A "Total Reset" or More Market Drift?

This weekend's U.S.-China negotiations in Geneva are framed as a “total reset” in trade relations, aiming to ease global financial tensions. A successful outcome may catalyze breakouts in U.S. equity indices like the Dow, S&P, and Nasdaq, helping the U.S. dollar stabilize above 100 — and lifting oil further above the $60 handle.

OPEC Report & U.S. CPI: Supply Meets Sentiment

OPEC’s monthly report this week, largely priced in, confirms a phased return of supply, starting with a 411,000 bpd increase in June 2025. This planned unwind has already been reflected in the $55 test, but further clarity may add volatility.

Meanwhile, U.S. CPI data could influence Fed expectations and the dollar, but trade headlines are likely to dominate market reactions this week. With Powell holding rates steady and expressing confidence, traders will watch to see whether inflation surprises reignite volatility.

Technically Speaking:

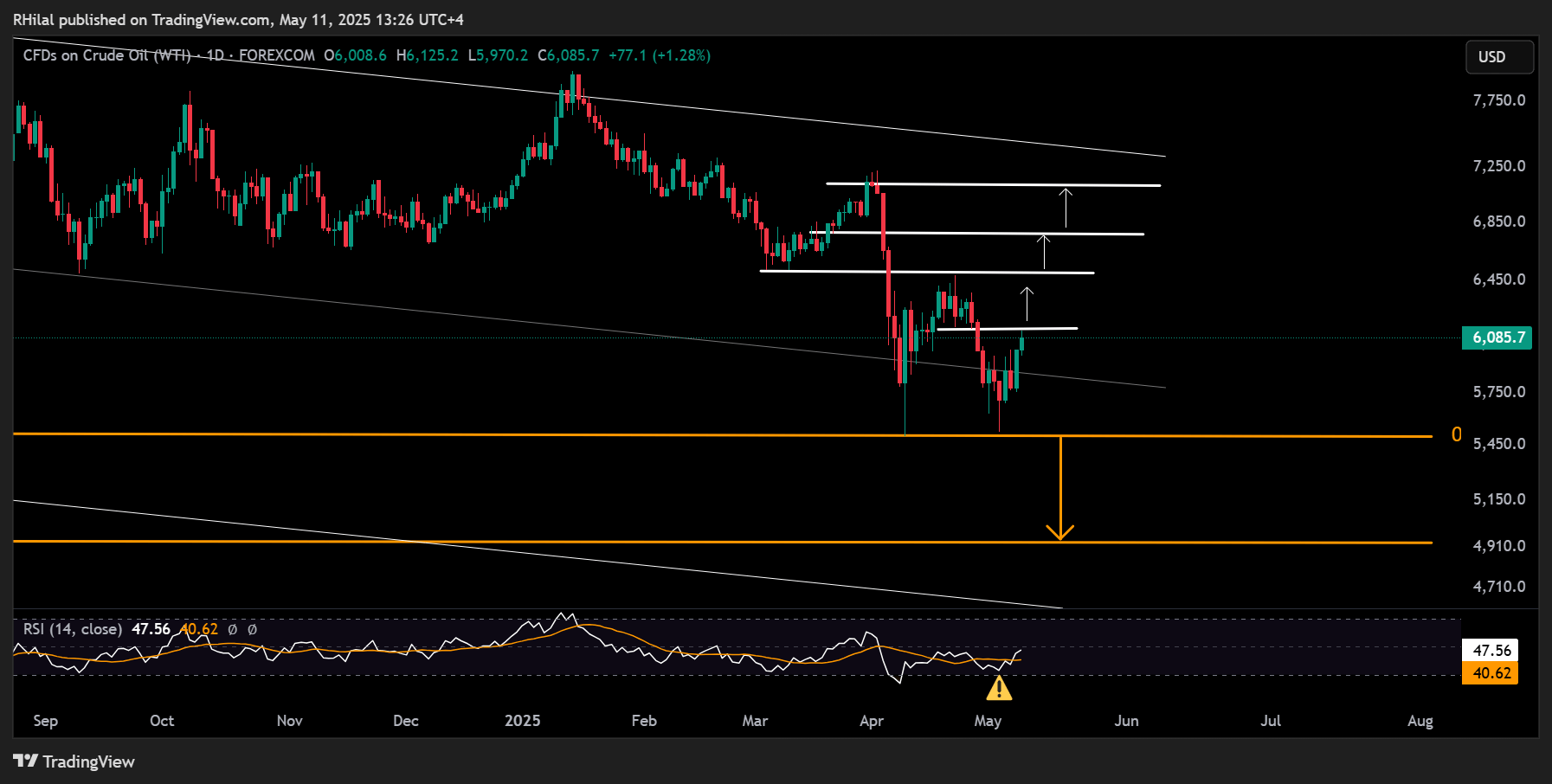

Crude Oil Weekly Outlook: 3-Day Time Frame – Log Scale

Source: Tradingview

The double bounce from the $55 mark — which aligns with the 0.618 Fibonacci retracement of the 2020–2022 uptrend — is now testing the 0.618 extension of the 55–64.80–55 formation, currently centered around the 61.25 zone.

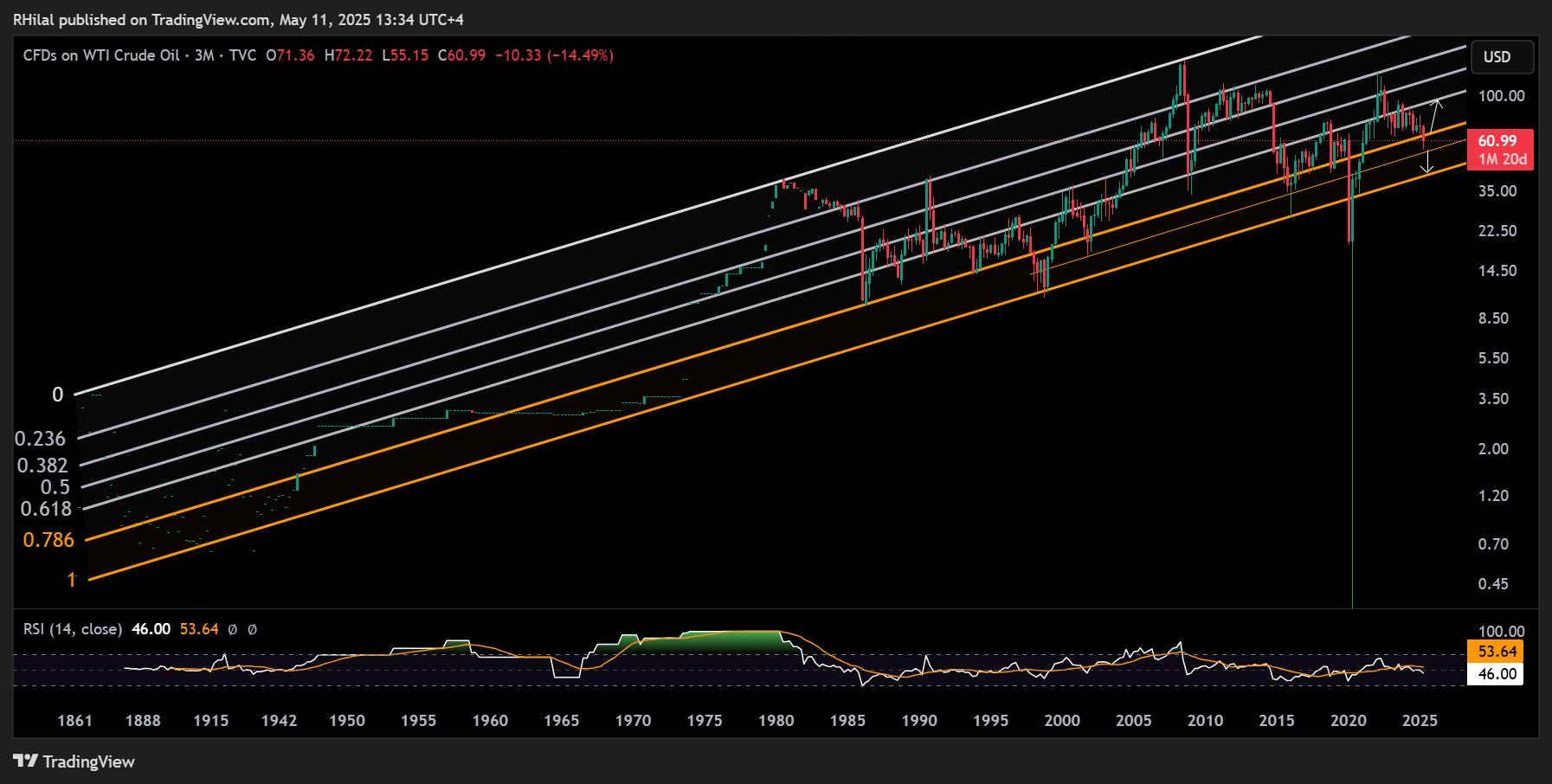

A sustained hold above this level could extend the bullish rebound toward the next resistance levels at $64.80, $67.80, and $71.30. On the downside, if oversupply concerns resurface — especially in conjunction with unresolved tariff risks — a decisive break back below $58 and $55 could trigger a sharper drop toward $49, in line with the lower boundary of the long-standing up trending channel since the 1800 lows, as shown in the chart below.

Crude Oil Weekly Outlook: 3 Month Time Frame – Log Scale

Source: Tradingview

Written by Razan Hilal, CMT

Follow on X: Rh_waves