Key Events

- Explosion at Iran’s port increases geopolitical risks, potentially impacting oil prices at the weekly open

- OPEC+: Disputes over quota compliance increase the chance of a supply cut rollback in June

- US-Ukraine minerals deal raises expectations of sanction relief, boosting Russian oil drilling activity

- Upcoming Macro Data: US ISM PMI, Chinese PMIs, US Advance GDP, and US NFP — all keeping oil and FX markets on edge, awaiting a decisive catalyst

Global markets, investors, and consumers are navigating heightened uncertainty, with Trump-era tariffs, falling oil prices, and a weakening US Dollar all influencing investment strategies, policies, and wealth management decisions.

Sustaining market share amid slower economic growth has become a growing challenge for major producers like OPEC+, which may unwind supply cuts — even at the expense of short-term price stability — while positioning for longer-term gains once trade deals materialize.

Meanwhile, reports of increased Russian drilling activity, fueled by hopes of easing sanctions, have strengthened the $65 resistance zone in oil markets.

WTI prices are increasingly vulnerable to upside speculation amid rising Middle East tensions; however, a sustainable upturn likely still hinges on progress in trade talks and supportive economic data before confirming a broader breakout alongside overall market strength.

Macro Data in Focus Next Week:

Eurozone CPI, US Core PCE, Advance GDP, ISM PMIs, and NFP data are expected to offer crucial insights into inflation and growth prospects amid persistent tariff risks. These releases are likely to test multi-year support and resistance levels across oil and FX markets and could play a pivotal role in shaping the next directional move, alongside developments in US-China trade negotiations.

What are the key levels to watch?

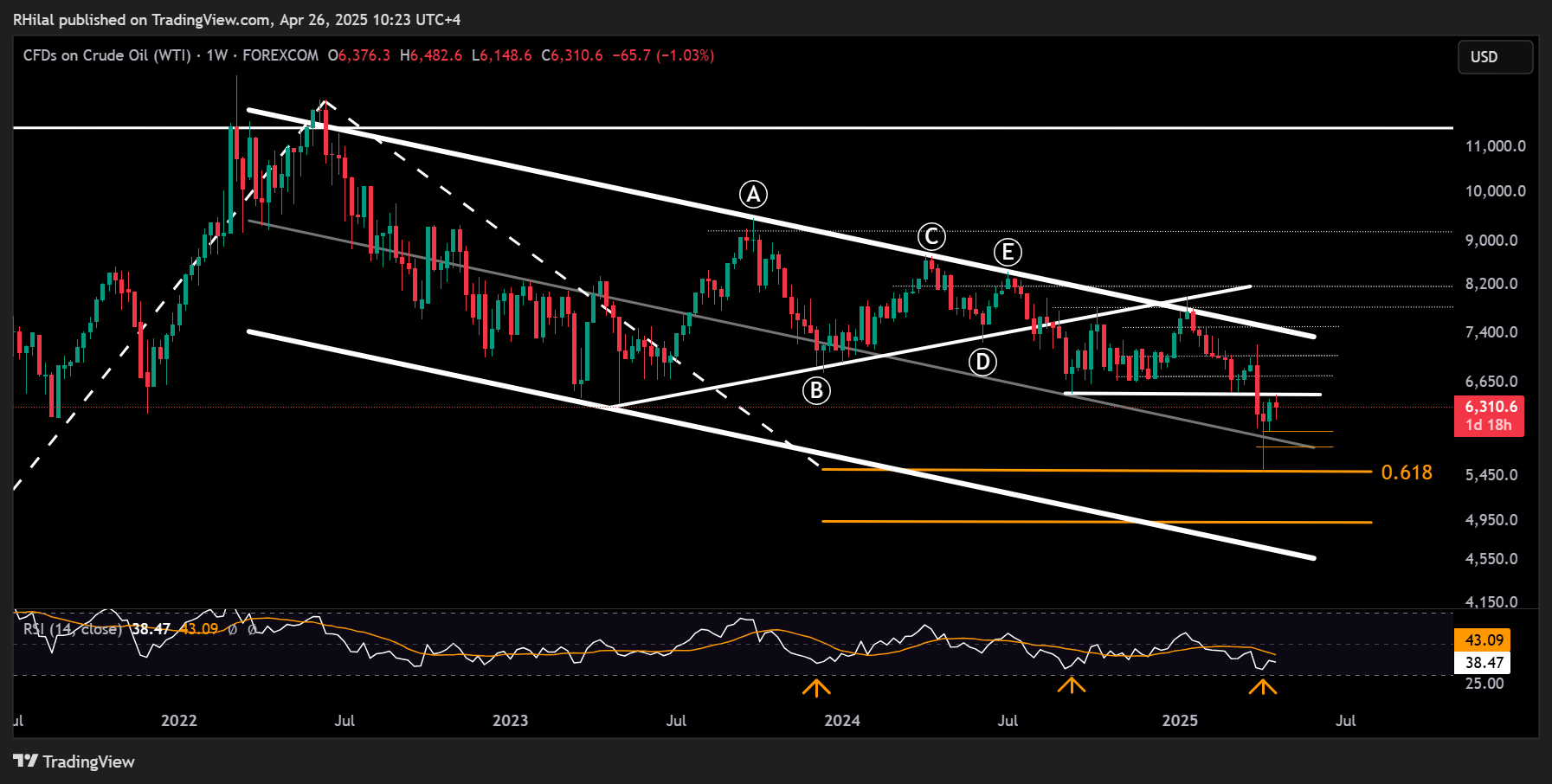

Crude Oil Weekly Outlook: Weekly Time Frame – Log Scale

Source: Tradingview

Between speculation over OPEC+ unwinding supply cuts, uncertainty surrounding trade deals and tariffs, and shifting expectations around sanctions on Iran and Russia, oil continues to hold its positive rebound, in line with broader market sentiment. Prices are currently challenging the $65 resistance zone.

A confirmed close above $65 may pave the way for further upside, with potential targets at $66, $67.40, $70.40, and $74.50 — aligning with the upper boundary of the long-term descending channel extending from the 2022 highs.

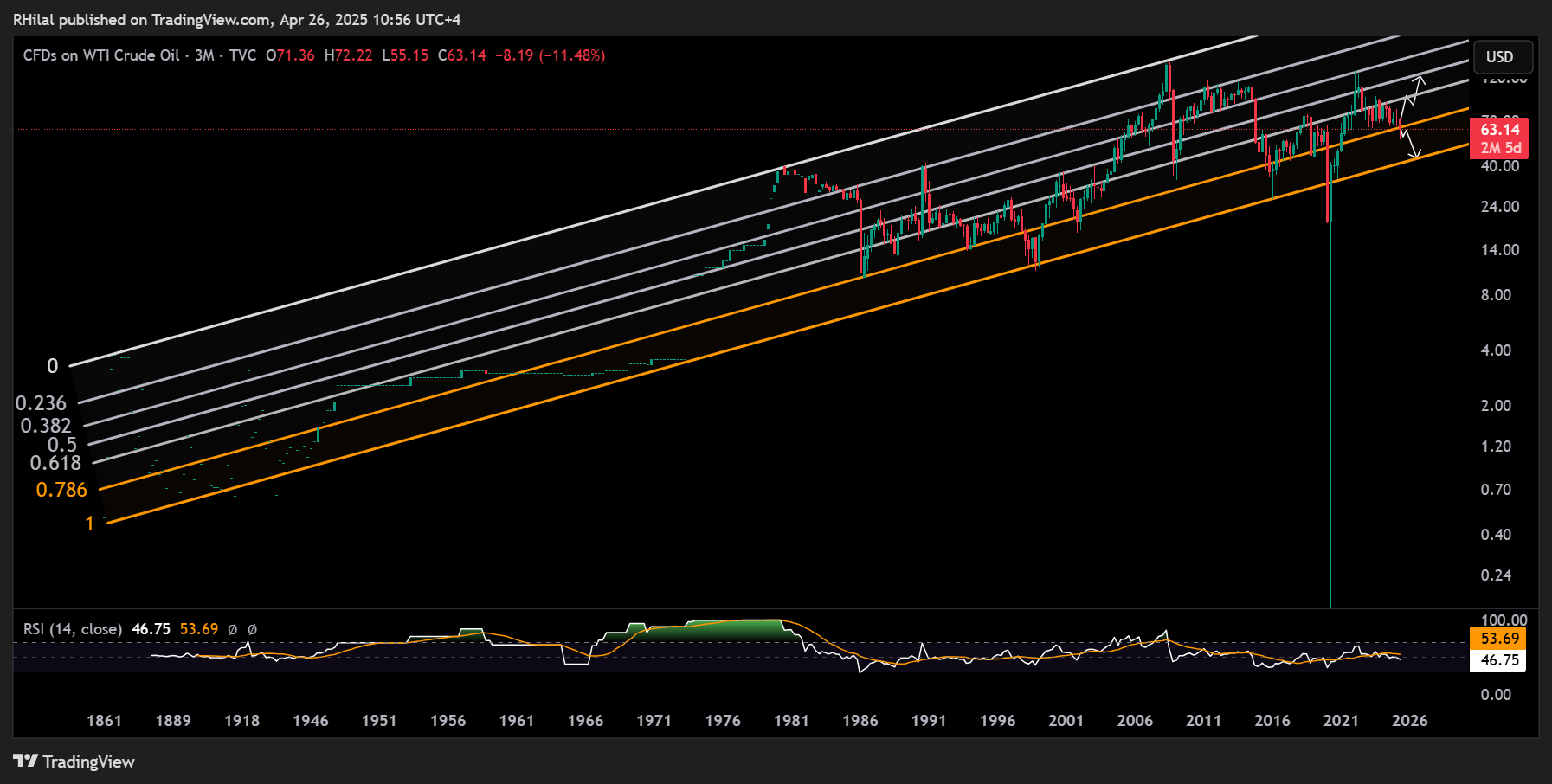

On the downside, a break below the $60 level could bring $58 and $55 back into play as support. A decisive close below $55 would increase the likelihood of a deeper correction toward $49, aligning with the lower boundary of the long-term uptrend channel originating from the historic lows of the 1800s, as illustrated on the chart below.

Crude Oil Weekly Outlook: 3-Month Time Frame – Log Scale

Source: Tradingview

Written by Razan Hilal, CMT

Follow on X: @Rh_waves