- ONS credibility hit after labour survey breakdown and Diamond resignation

- Wages growth expected to slow, but still key for inflation and GBP outlook

- U.S. inflation up later—core and headline both seen reaccelerating

Summary

Trade headlines will temporarily take a backseat to economic data for GBP/USD traders on Tuesday, with inflation figures out of the United States and jobs data from the U.K. taking centre stage. When it comes to the latter, mistrust over figures produced by the Office for National Statistics (ONS) means more weight will be placed on wage growth than the unemployment rate given its link to domestic inflation pressures. With GBP/USD on the back foot and U.S. trade negotiations seemingly progressing swiftly, it may take stronger-than-expected U.K. data—and softness in the U.S. inflation print—to turn the pound's fortunes around.

Data Drama Clouds U.K. Labour Market Signal

Britain’s ONS is under fire after its labour force survey fell apart last year, forcing a switch to modelled estimates as participation rates collapsed. With the rollout of the replacement survey delayed and trust in the data gone, National Statistician Sir Ian Diamond submitted his resignation effective immediately late last week.

Amid the fallout, the Bank of England now leans heavily on PAYE and business survey data to judge labour market conditions. Its latest projections have the unemployment rate rising to 4.7% by 2026, up from 4.4% currently. For now, wage growth remains the cleanest signal on labour market tightness, making it the number to watch later today.

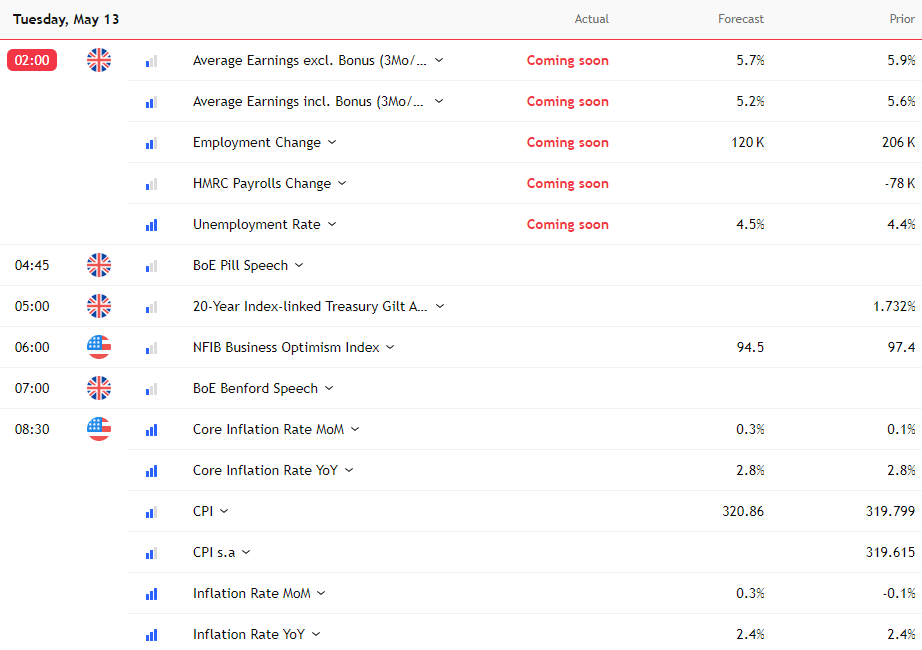

Source: TradingView

Excluding bonuses, wages growth over the past quarter is seen lifting 5.7% from a year earlier, down from 5.9% previously. The private sector figure, last at 5.6% y/y in the three months to February, will be closely watched. Unemployment is tipped to edge up a tenth to 4.5%. These are the two figures most likely to move GBP/USD.

Later in the session, attention shifts to U.S. inflation. Both the core and headline rates are expected to reaccelerate to 0.3% in April. While inflation remains a key input into Fed rate expectations, the pace of change in U.S. trade policy means the report risks being drowned out by broader macro shifts. A surprise could deliver a kneejerk reaction, but it may not stick—momentum in these markets is fleeting.

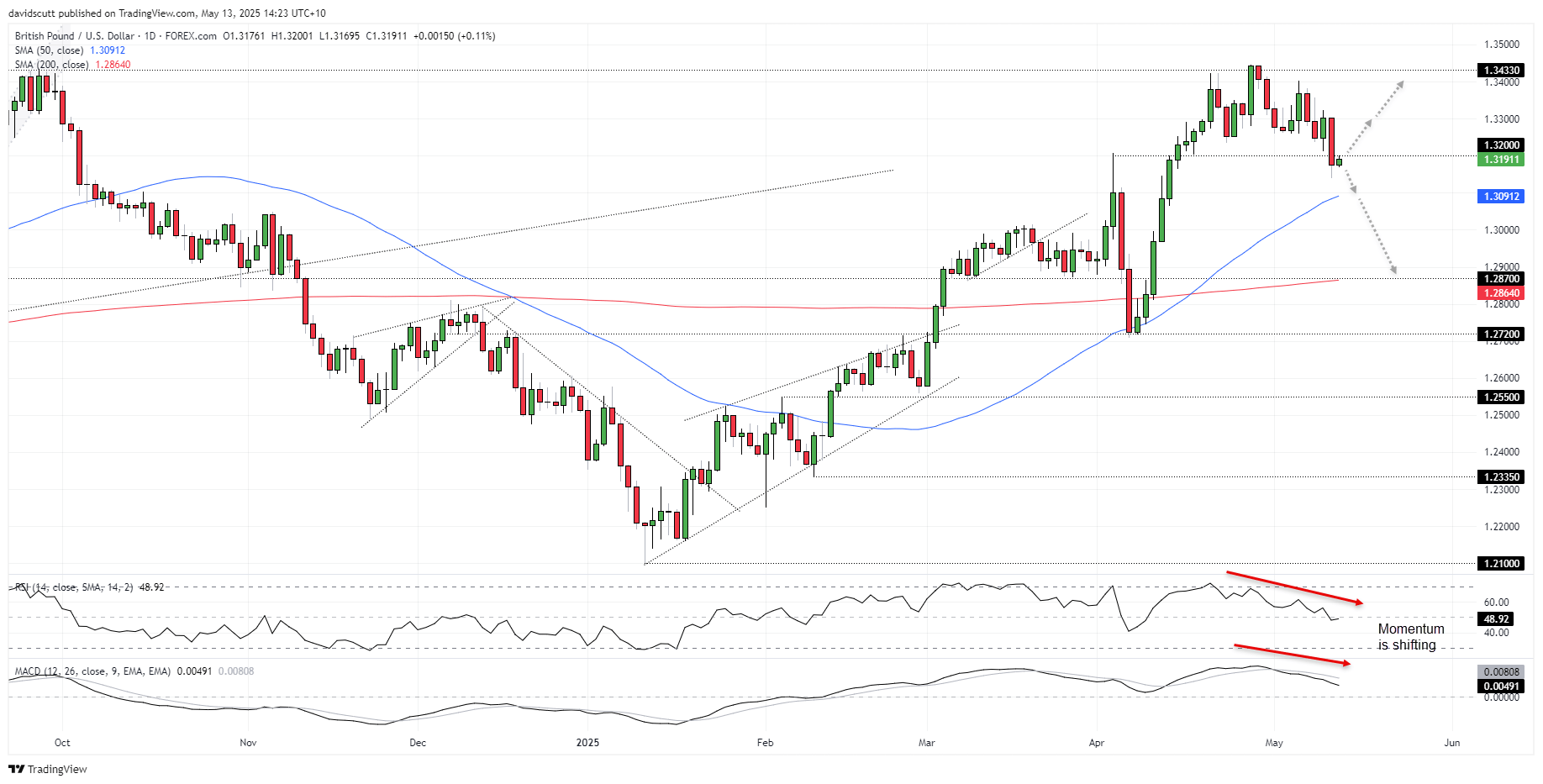

GBP/USD Break Generates Fresh Setups

Source: TradingView

GBP/USD sits just below 1.3200 ahead of the data, a level that’s acted as both support and resistance recently. That makes it a natural pivot point for traders to build setups around depending on how price reacts. For now, rallies are still being sold, putting Monday’s low of 1.3142 and the 50-day moving average at 1.3091 on watch. Aside from the psychological 1.3000 mark, there’s little visible support until 1.2870 near the 200-day moving average. On the topside, sellers may re-emerge near the big figures of 1.3300 and 1.3400.

Momentum has shifted from bullish to neutral, with both RSI (14) and MACD trending lower. If that continues in the days ahead, both indicators could flip to outright bearish, reinforcing the case for a deeper pullback.

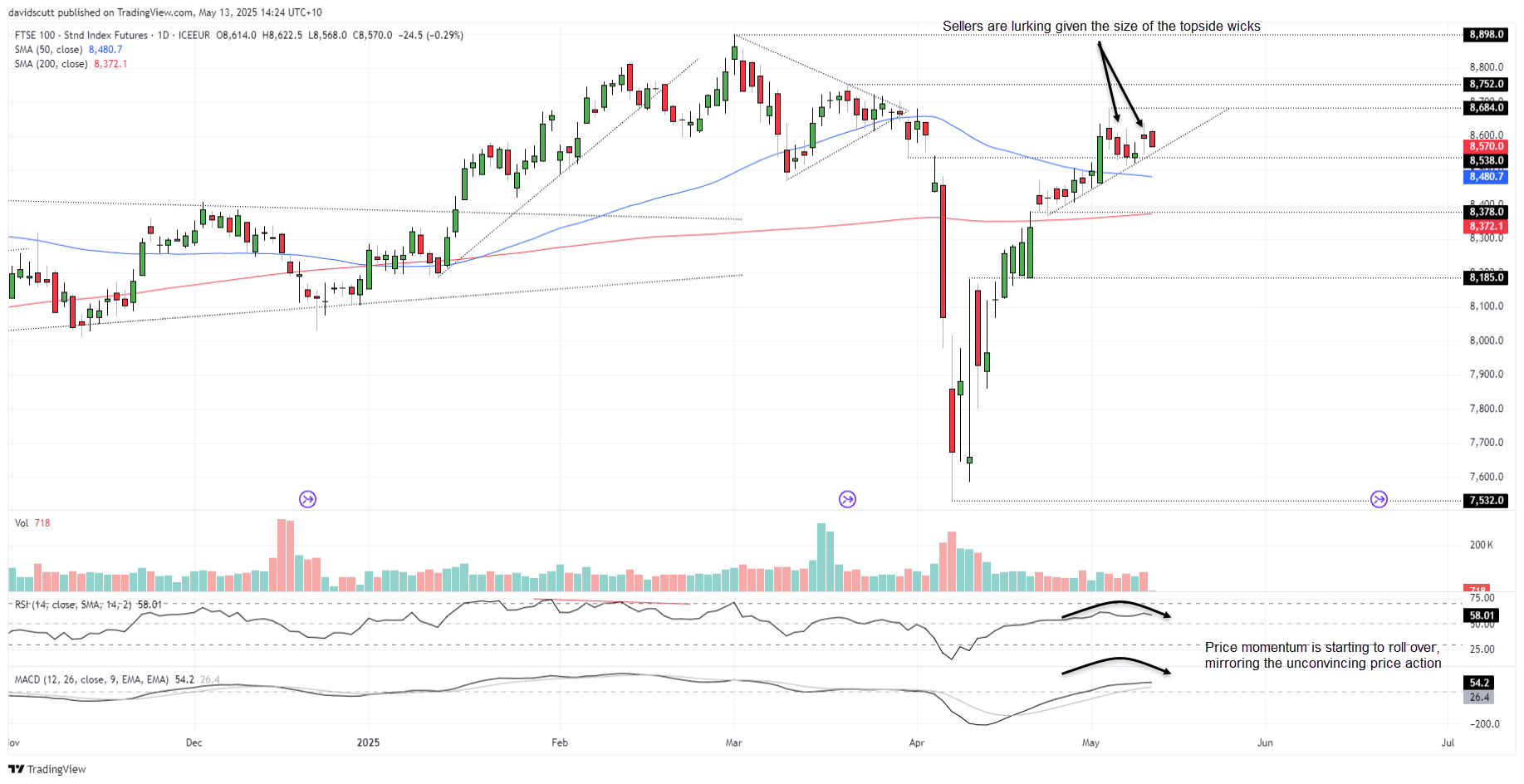

FTSE 100 Future Look Heavy

Source: TradingView

For those watching FTSE 100 futures, recent price action hasn’t convinced the bulls despite the index still holding an uptrend from mid-April. Lengthy topside wicks suggest sellers are waiting above 8600, with the price squeezing up against the trendline. If the uptrend breaks, 8538 is the only level standing between a potential retest of the 50- and 200-day moving averages. On the topside, a clean break through 8684 would invalidate the bearish tilt. While momentum remains in bullish territory, the story is one of fading strength. A slight divergence between RSI (14) and price also adds to the cautious picture.

NOW READ: NZD/USD: Kiwi cracks as trade reset sparks USD surge

-- Written by David Scutt

Follow David on Twitter @scutty