Today has all been about Europe. Germany’s move to exempt defence spending from its stringent fiscal constraints—prompted by waning US support—has sent ripples through financial markets. We have seen European bond yields surge higher, alongside the euro and European stocks. Sentiment has been boosted because Germany’s incoming Chancellor Friedrich Merz has unveiled plans to inject hundreds of billions of euros into defence and infrastructure, which marks a significant departure from Germany’s traditionally rigid borrowing rules, fuelling optimism for a broader economic uplift across Europe. The focus is now turning to the ECB rate decision and President Lagarde’s press conference tomorrow, which could influence the DAX forecast.

More on that below, but first let’s have a quick look at the DAX index…

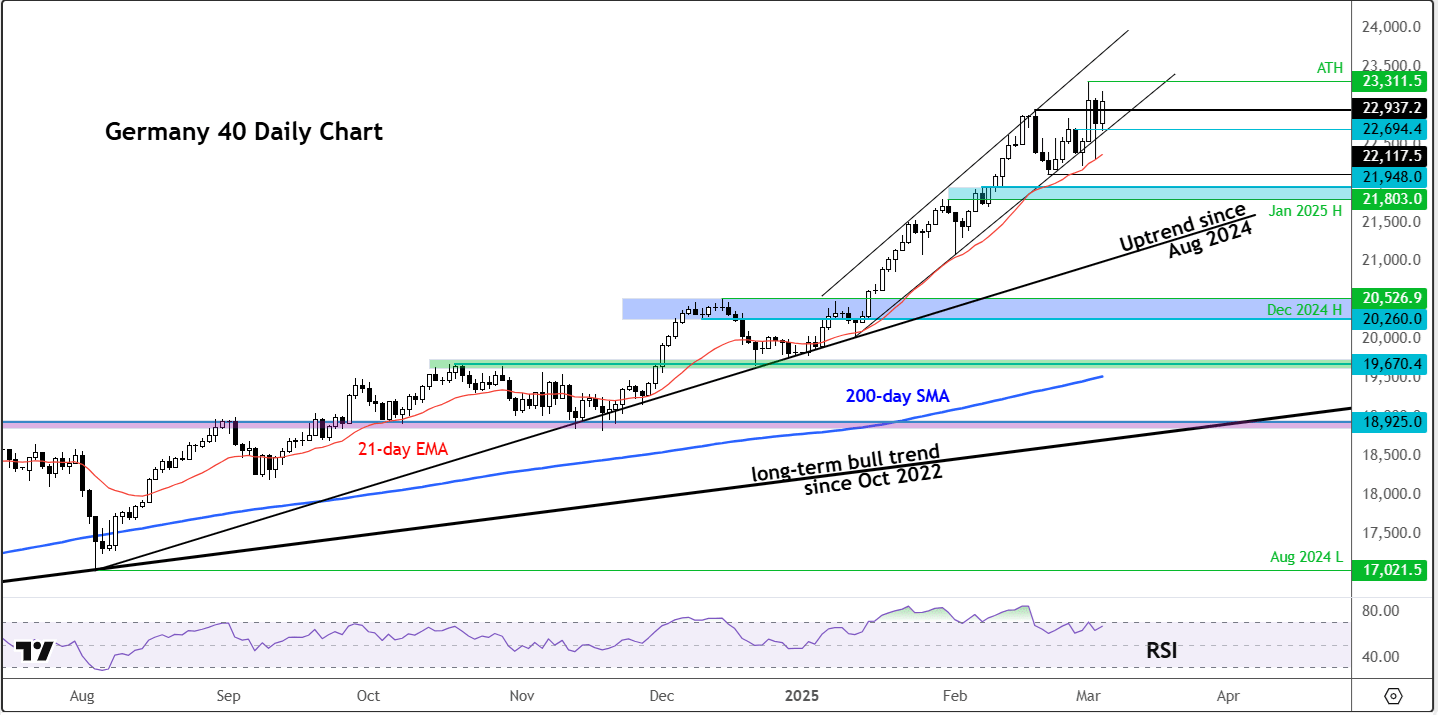

Technical DAX forecast: Key levels to watch

Source: TradingView.com

Well, the bears had a real attempt at pushing the index lower yesterday when concerns about tariffs were at the forefront. But despite the 700+ point drop from the day’s high, we saw a sharp recovery at the day’s end and that momentum has carried forward to today’s session. As a result, yesterday’s losses have been wiped out and we are edging closer to the record high of 23,311 set on Monday. The sharp rebound means the DAX is remaining inside the strong bullish channel it has been residing inside since the turn of the year. Until such a time it breaks out of this channel, the technical DAX forecast will remain bullish. Key short-term support levels to watch include 22,935 and 22,695.

Bunds sink on German debt plan

On the back of news from Germany, we have seen European bond yields surge higher, with those on the benchmark 10-year German bund rising nearly sharply to 2.75%, the highest level since November 2023. Among individual stocks shares of Heidelberg Materials were up 15% at the top of the DAX index, while Deutsche Bank and Commerzbank shares rose around 10% a piece. The euro has rallied across the board, with the EUR/USD climbing to 1.0770. The single currency has also gained ground against most other major currencies, including the pound, franc and yen. The expectation that increased government expenditure could stoke inflation has, in turn, reinforced the case for tighter European Central Bank policy.

But the ECB is unlikely to keep its policy unchanged at Thursday’s meeting, with almost all economists expecting the central bank to trim rates by a further 25 basis points.

Slightly hotter Eurozone CPI won’t stop the ECB cutting rates

Ahead of the ECB meeting, we had Eurozone CPI on Monday, which came in slightly hotter than expected. Headline inflation registered at 2.4% year-on-year, edging past the anticipated 2.3%, while core CPI held steady at 2.6%—broadly in line with expectations. However, this data is unlikely to prompt any immediate shift in the European Central Bank’s stance when it decides on monetary policy on Thursday. That said, if inflation remains stubbornly above target, it could influence rate decisions later in the year, particularly when you take into account the impact of Germany’s huge spending plans.

The ECB remains locked in an internal debate over the trajectory of its rate-cutting cycle. Dovish policymakers are pushing for a policy rate of 2% by summer, whereas hawks are hesitant to see cuts fall below 2.5%. A 25-basis point cut appears the most probable outcome, bringing the benchmark rate down to 2.65% from 2.90%. With inflationary pressures still lingering and economic growth faltering, the ECB must tread cautiously—especially as US tariffs loom on the horizon. Markets will also be watching ECB President Christine Lagarde’s press conference closely, as any signals on future policy direction could shift the DAX’s momentum.

China’s growth goal another potential source of support

China’s National People’s Congress reaffirmed its economic growth target of around 5% for 2025—the third consecutive year it has maintained this objective. With global uncertainty mounting over tariffs and geopolitical tensions, expectations are growing that Chinese policymakers will step in with additional stimulus measures to shore up the economy. Now China is a major export destination for Germany, which means the news has helped to support the DAX outlook, all else being equal.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R