- Bullish DAX forecast underscored by index clearing March highs

- US-China tariff thaw and ECB rate cut hints drive momentum

- Technical breakout targets 24,000, with short-term support at 23,400

The DAX forecast remains firmly to the bullish side as we head towards the end of another eventful week. Germany’s benchmark stock index has become the first major European market to reclaim—and push beyond—its March record highs. The move caps a powerful rebound that’s been fuelled by softening rhetoric from the Trump administration on trade and growing expectations of looser monetary policy in the eurozone. Germany’s own stimulus plans are additional factors behind this powerful rally. Other European markets could play catch up as sentiment improves further.

Thawing US-China trade tensions boost stocks

Bullish momentum picked up for global stocks after reports emerged that the US is considering reducing tariffs on Chinese goods to below 60%, a significant pullback from the punitive 100%+ levies imposed earlier. However, Trump has posted on his social account that the levy could be reduced to only 80%, which “seems right” according to him, although that it is up Scott Bessant ahead of the weekend talks with Beijing. Meanwhile, China’s exports to the US have already taken a hit, with the latest data showing a marked slump. But the real damage from those tariffs is only just starting to show. Markets, though, are forward-looking—and any sign of easing tensions is enough to get investors back into risk assets, as we have seen in the last few weeks.

Add to that a dovish undertone from the European Central Bank, where policymakers are now openly floating the idea of another rate cut next month, and you’ve got a perfect storm for European equities. The DAX forecast now leans on this blend of political relief and central bank support to justify further upside.

Beyond the trade talks, Trump’s proposal for a higher tax bracket on ultra-wealthy Americans (39.6% for individuals making $2.5 million or more) may sound out of place, but for markets, it’s a side note compared to the bigger picture: trade talks and stimulus.

However, it is worth pointing out that it is not a given that trade talks with China will result in a quick resolution. Anything could still happen, so it is always best to trade with extreme care as markets remain headline driven.

Technical DAX forecast: Index clears old highs, eyes 24,000

Source: TradingView.com

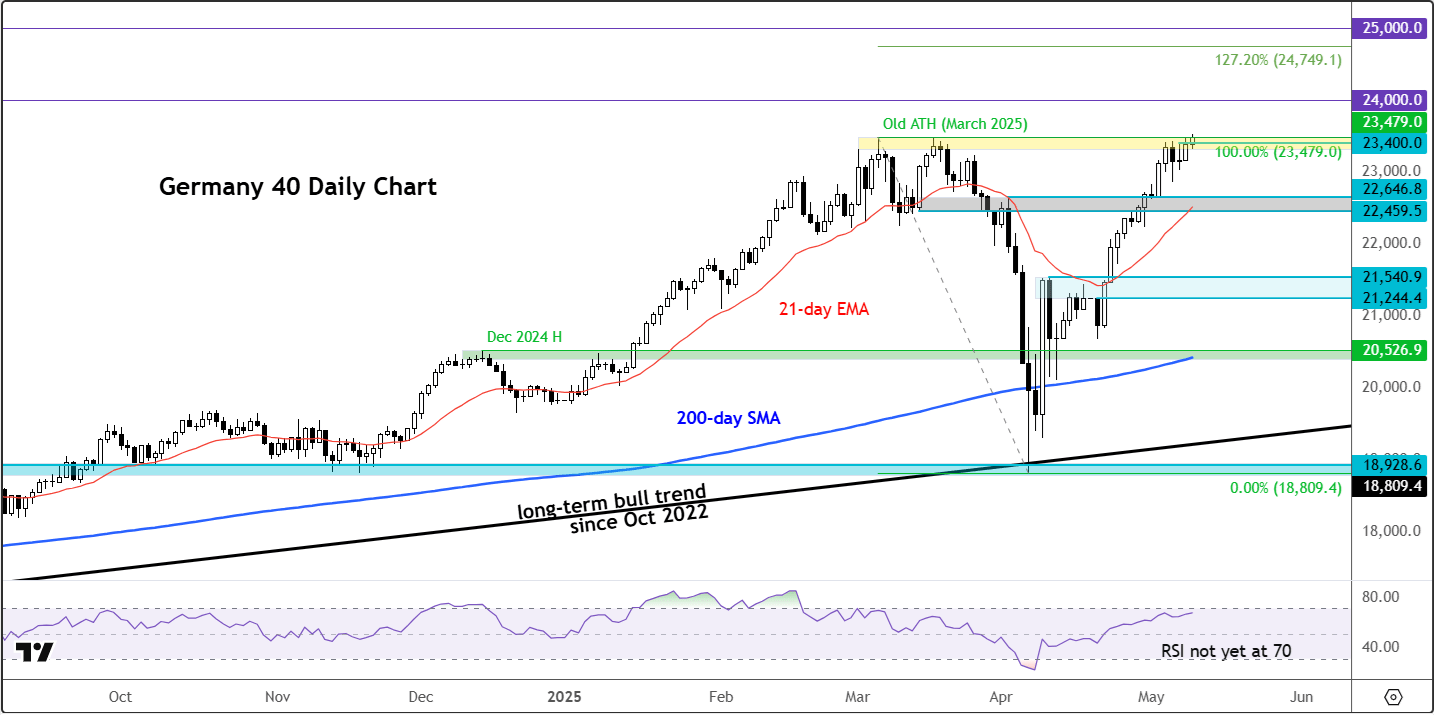

From a technical perspective, the DAX has broken decisively above its previous resistance zone around 23,480. This breakout is significant—it not only invalidates any lingering hints of bearish bias but confirms what we have been suggesting since markets bottomed in early April when the DAX found strong support from its long-term bullish trend line that goes back to October 2022. The latest breakout will not open new trade ideas and opportunities. Does the index hold the breakout, or does it go back down? Our base case is that more gains could be on the way, and with no obvious resistance levels in sight, the next major upside targets could well be round handles like 23,500 and 24,000.

If the breakout fails and the index closed decisively in the red today, then that would be a warning sign for the late-buyers chasing this rally.

On the downside, initial support now comes in at the 23,400 area, with stronger support situated near the 22,460-22,650 area, which coincides with the 21-day exponential moving average and the last major resistance area. As long as the DAX holds above these levels, the short- to medium-term DAX forecast remains constructive.

Meanwhile, momentum indicators like the RSI remain in bullish territory but aren’t yet overbought, suggesting room for continued gains.

In a nutshell

With US-China trade tensions showing early signs of thawing and the ECB possibly stepping in to support growth, the DAX forecast is now firmly tilted to the upside. If macro conditions continue to improve and the ECB follows through with rate support, 24,000 could be the next step for the German index.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R