Stock indices extend their gains initially as the positive sentiment from the previous day carried forward into the early European trade. But at the time of writing, markets were coming off their best levels, possibly on the back of the Time Magazine’s interview with Donald Trump. While Trump has claimed that China’s Xi has called him and that his admiration is in active talks with China to strike a deal, the bit where Trump said he “would consider it a victory if US has 50% tariffs a year from now” is what has probably cased the mild selling. Anyway, the DAX forecast remains highly uncertain as things could flip in an instant with a character like Trump at the helm. For that reason, continue to trade from level to level, and avoid becoming wedded to any particular view. Instead, stay nimble, and keep risk on a short leash, as it is traders’ market, not investors.

Stocks off best levels on lingering trade uncertainty

Markets were up across the board earlier, after Bloomberg had reported that China was considering exempting some US goods from tariffs, and following yesterday’s sentiment-boosting comments from Trump. In addition, stronger earnings results from Alphabet were also soothing nerves a little. With risk appetite taking a boost from renewed optimism over a potential US trade deal with China and other nations, safe haven gold was down initially below the $3,300 level. Trade war concerns were the main reason behind all the prior gold buying. But it could still be a while before we see actual progress and so those concerns are not completely gone just yet, not when Trump says he would consider 50% tariffs a YEAR from now on China a success. I think gold could hold its ground and consolidate a little, while equity indices may also reverse, or pause. It is far too early to call the end of the recent market turmoil, even if the worst of the risk selling is potentially behind us now.

Trump says Xi has called him, but 50% tariffs would be a success

US President Donald Trump revealed in a Time Magazine interview that Chinese President Xi Jinping has personally called him, and that his administration is actively engaged in discussions with China aimed at striking a new deal.

Meanwhile, in the interview, Trump also reiterated his stance on Crimea, stating that it will remain with Russia. Reflecting on US trade policy, he said he would consider it a success if the United States were to implement 50% tariffs within a year—an aggressive reminder that underscores his protectionist trade agenda, even if he has promised to reduce tariffs on Beijing significantly.

He also downplayed concerns over the bond market stress observed this month, saying he wasn't worried at the time.

Technical DAX forecast: Index enters major resistance zone after strong

Source: TradingView.com

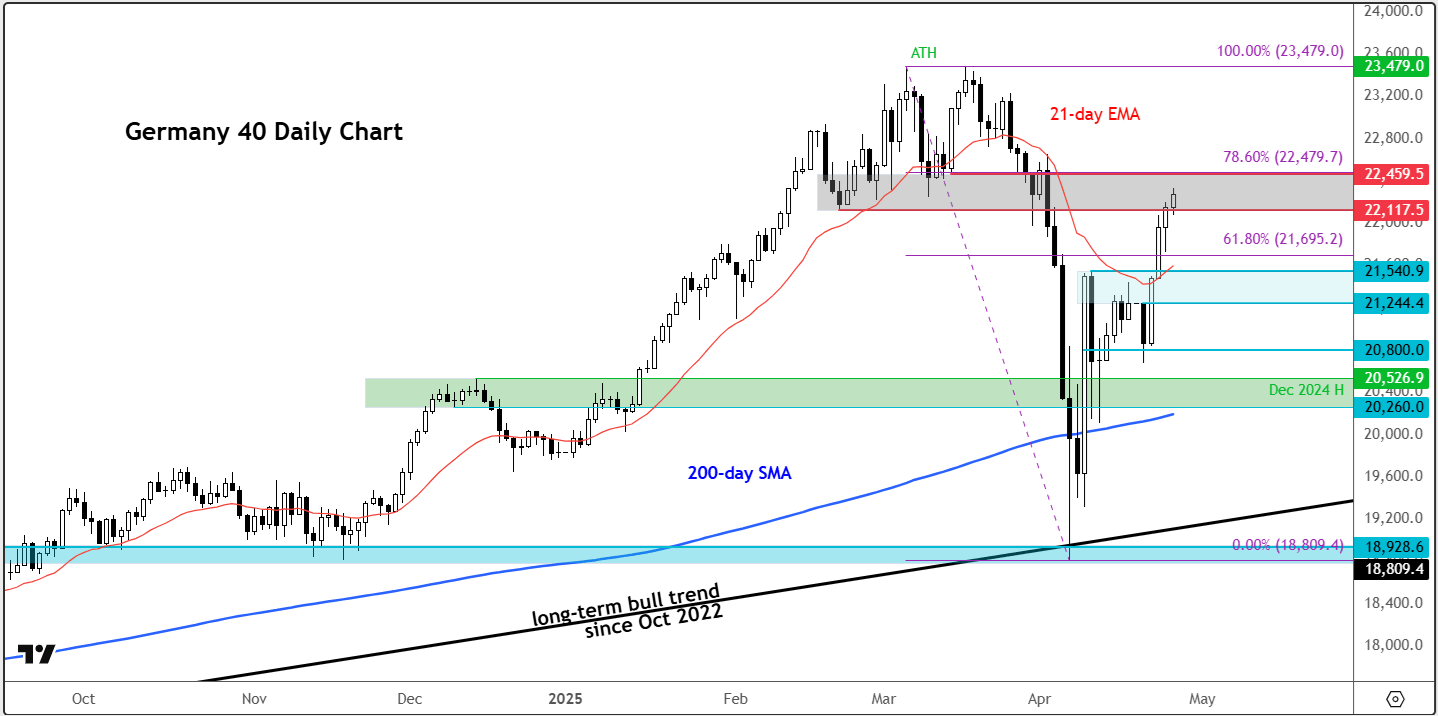

The DAX forecast has improved materially from a technical standpoint, but it is not completely out of the woods just yet. The German index has staged an impressive rebound from its lows earlier this month, outpacing many of its global peers in the process. But even this high-flying German benchmark may be running out of steam, as it now tests a rather significant area of resistance.

As the chart shows, the zone between 22120 and 22,460 stands out as a key battleground. This region had previously served as a critical support base before collapsing under the weight of tariff-related tensions, triggering a swift and severe sell-off.

With Trump now softening his rhetoric, European markets have managed to claw back much of the ground lost. Still, with the trade dispute far from resolved, there remains every chance that we could see the index falter from these levels.

Should the index begin to turn south, there are several key support zones to keep an eye on — the first of which sits around the 22,000 area. Below that, 21,245–21,540 region, marked in light blue on the chart, is now a key battle ground. That’s the area the bulls will be keen to defend if momentum begins to shift.

However, if the DAX clears the abovementioned resistance zone first, then that would be the clearest sign yet that the trend has well and truly shifted back in the favour of the bulls.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R