DAX falls, snapping a 9-day rally on trade uncertainty

- Trump announces more trade tariffs

- German Composite PMI rises to 50.1

- DAX eases from 23,400 but uptrend remains intact

The DAX along with its European peers has opened lower on Tuesday as investors weigh up PMI data, corporate earnings and tariff developments ahead of tomorrow's Federal Reserve interest rate decision. News that Friedrich Merz failed to get the majority needed to be elected as Chancellor is also being weighed up, however, the news didn't spark an extension of the selloff..

Merz secured 310 votes, less than the 316 needed to achieve the widely expected win. A second vote is now expected to take place, however, Merz is widely expected to win which explains the lack of a reaction to the news.

Trade tariffs continue to be a central focal point for the markets, with attention on whether US-China trade tensions will escalate following comments from China last week that it was considering an offer from Washington to hold talks. However, a lack of concrete progress and Trump announcing a new slate of tariffs are hurting the market mood.

Trump announced 100% tariffs on movies produced outside of the US and said he will consider announcing pharmaceutical tariffs in the coming weeks.

These announcements come ahead of Wednesday's Federal Reserve interest rate decision. The central bank is widely expected to leave rates on hold to gain more clarity over the outlook in light of Trump's tariffs.

On the data front, German PMI figures were stronger than expected in April. The services PMI rose to 49, up from 48.8 in the preliminary reading, while the composite PMI for Germany rose to 50.1, up from 49.7 in the premium reading, putting business activity just back into expansionary territory.

On the earnings front, MTU Aero Continental AG and Fresenius Medical Care released earnings reports today.

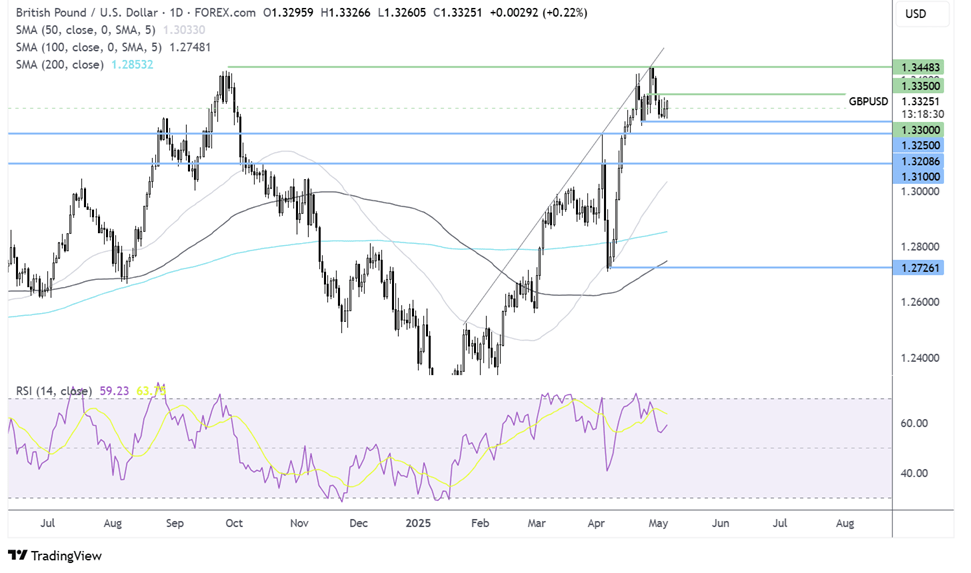

DAX forecast - technical analysis

DAX has extended its rally from the 20,675, April low, rising above the 50 SMA and several key resistance levels reaching a peak of 23,400 on Friday. The price is slipping today but the uptrend remains intact.

Buyers will look to rise above 24,477 to fresh record highs.

Immediate support is at 23k and below, here the 50 SMA comes into play at 22,230.

GBP/USD rises ahead of central bank bonanza

- Federal Reserve is expected to leave rates unchanged

- BoE is expected to cut rates by 25 bps to 4.25%

- GBP/USD consolidates above 1.33

GBP/USD is rising for a second day amid U.S. dollar weakness. Trump's incoherent trade policies hurt demand for USD and ahead of a central bank double this week.

The U.S. dollar is falling after Trump announced further tariff developments over the weekend, including a 100% tariff on movies produced outside the US and a promise of pharmaceutical tariffs soon.

Trump’s announcements come ahead of tomorrow's Federal Reserve interest rate decision. The central bank is expected to keep interest rates on hold for now, which could draw more ire from the Trump administration. The labour market and inflation figures remain largely on balance, giving Jerome Powell time to assess the impact of the White House's erratic trade policies before making any decisions on when to cut rates again.

The Bank of England will announce its rate decision on Thursday and is expected to cut rates by 25 basis points to 4.25%. The vote is expected to be nine to one. Until now, the Bank of England has been adopting a careful and gradual approach to reducing rates. However, should the central bank remove its reference to cutting rates at a gradual rate amid concerns over a slowing economic outlook due to Trump's trade tariffs, the pound could come under pressure.

Data released today showed that the UK services PMI remained in contraction at 49 and the composite PMI at 48.5 below the level of 50, which separates expansion from contraction.

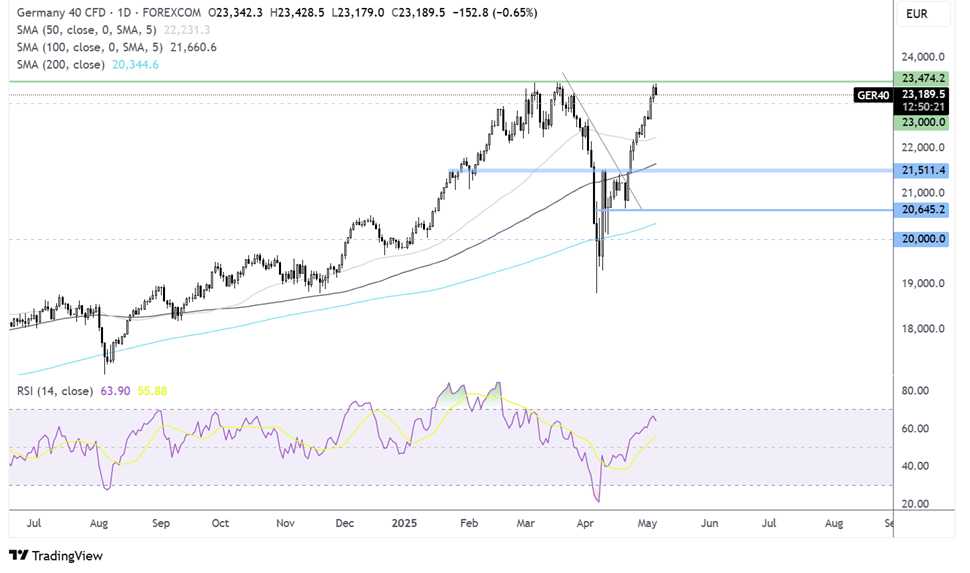

GBP/USD technical analysis

After running into resistance at 1.3440, the 6-month high, GBP/USD corrected lower and is consolidating above 1.33, swinging between gains and losses in recent sessions.

A rise above 1.3350 opens the door to 1.34 and 1.3440. A rise above here creates a higher high.

Sellers would need to decline below 1.3250 to bring support at 1.32 into focus.