- Dollar forecast pressured by rising Japanese yields and unwinding carry trades

- USD/JPY struggles below 145.00 as bond yield spread narrows

- G7 FX policy talks, debt jitters, and CDS levels cloud dollar outlook

The US dollar remains decidedly on the back foot as we head towards the business end of the week, a week where macro data has been on the quieter side but FX volatility on the increase. With the USD/JPY drifting cautiously lower as traders digest an increasingly chaotic global bond market – led, somewhat unsurprisingly, by Japan, the traditional haven yen and gold are both reasserting themselves just as cracks appear in America's own fiscal structure. With concerns about US debt situation also on the rise, this is increasing bearish calls on the dollar forecast.

Japan's rising yields could shake the yen carry trade

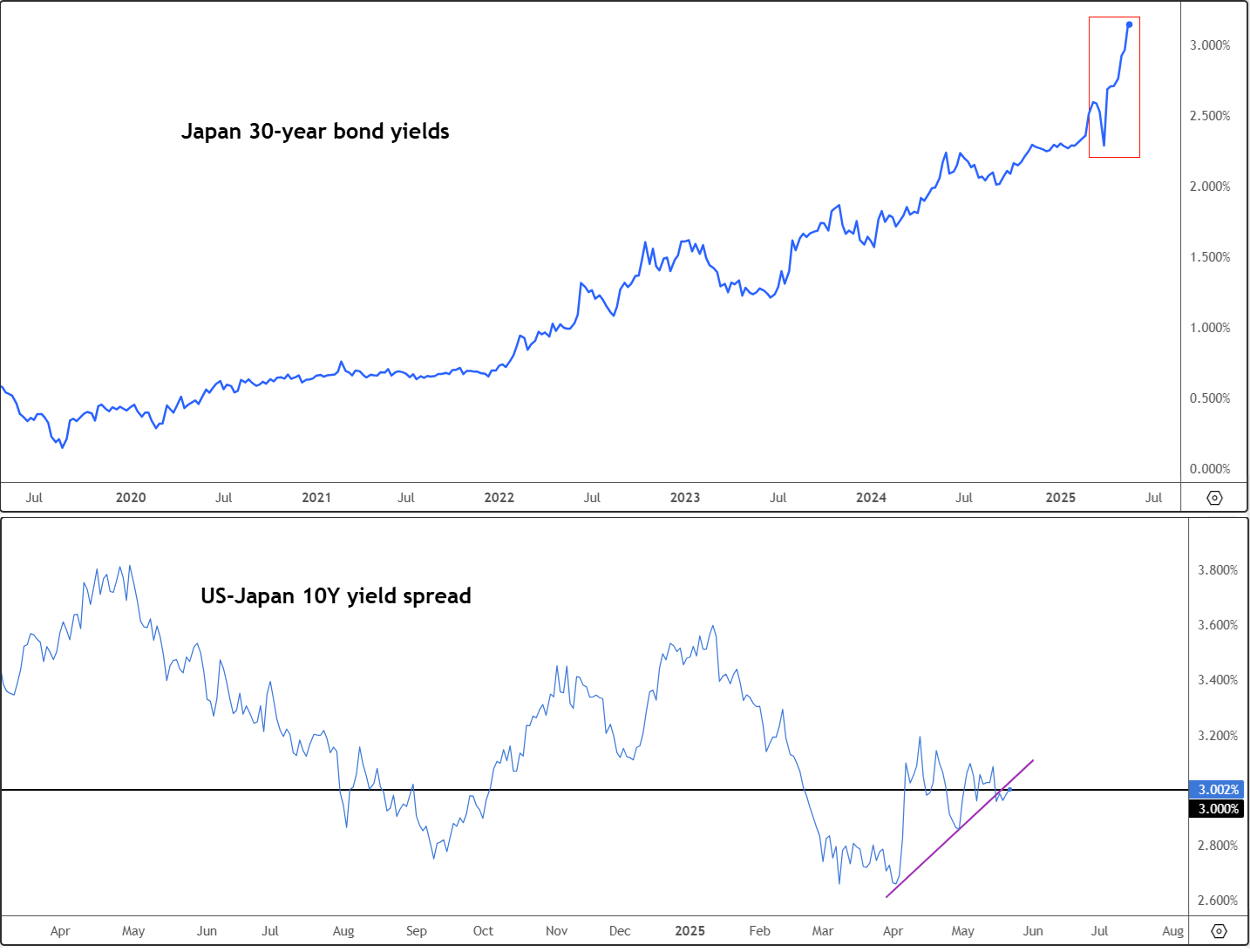

Let’s begin with the elephant in the room: Japan's 30-year government bond yield has soared to a staggering 3.197% at its peak today – the highest on record. That may not sound much by Western standards, but for a country long synonymous with ultra-low rates, it’s a seismic shift. With inflation finally baring its teeth and the Bank of Japan slowly tiptoeing toward policy normalisation, the once-lucrative yen carry trade – borrow yen at zero and plough it into anything yielding more – could be coming undone again as we saw last summer.

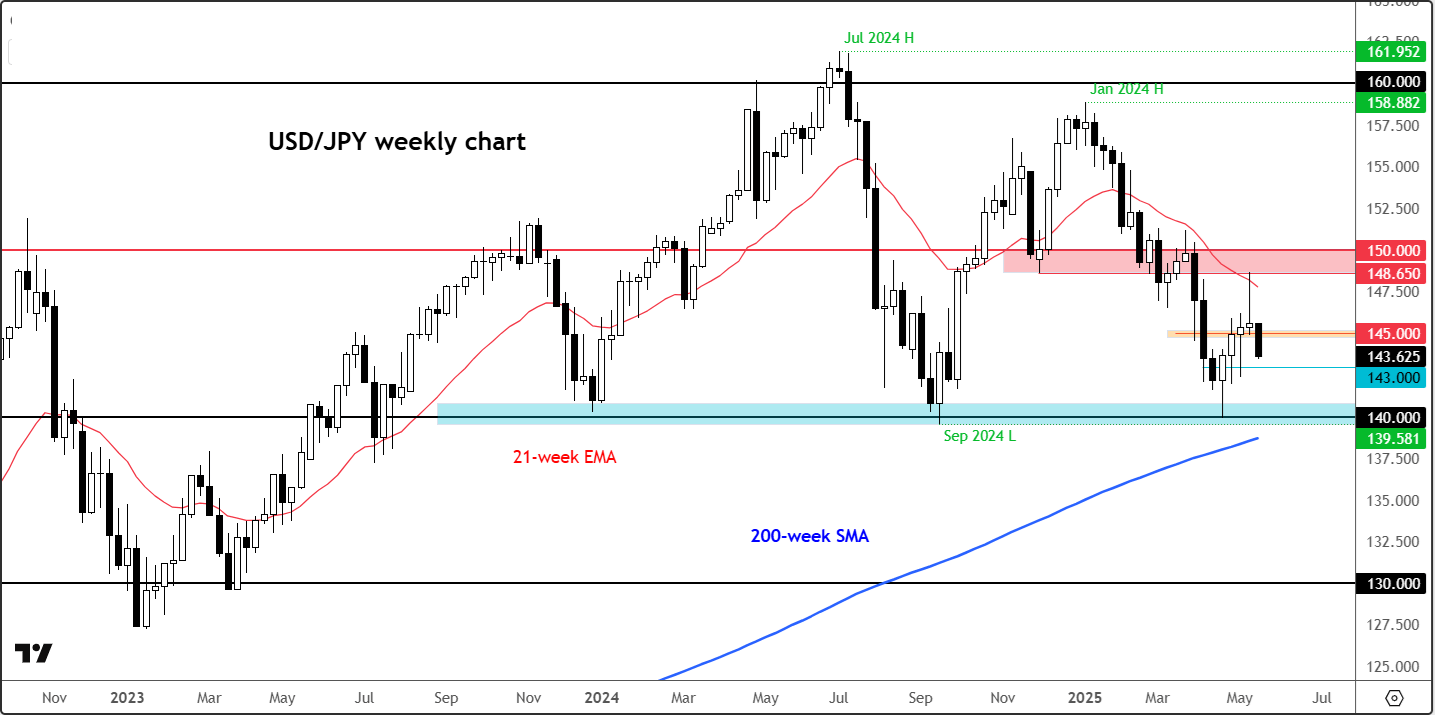

And why, you may ask, does this matter for USD/JPY? Because higher Japanese yields narrow the gap with US Treasuries, reducing the incentive to hold the dollar. Indeed, last week’s price action showed USD/JPY faltering below key resistance between 148.65 and 150.00, forming an ominous inverted hammer on the weekly chart – a classic sign of a bearish reversal. More on this below. But with the Japanese yields on the rise, the yen could strengthen significantly further.

Meanwhile, the narrowing spread between US and Japanese bond yields continues to favour yen strength. With Japanese 10-year bonds climbing and US yields holding steady, the tide may be turning for the USD/JPY. The currency pair which found short-lived relief around 140.00, looks vulnerable again. Should price remain capped below the 145.00 resistance, bears will eye a return to the 140.00 handle – possibly lower.

Other macro factors watch: G7 meetings, US credit default swaps

Looking ahead, there is not much on the macro calendar today, but some attention will be to the G7 meeting in Canada, where finance ministers from the US and Japan are expected to touch on currency policy. Tokyo has been silent about the yen’s previous weakness – until now. Prime Minister Ishiba recently likened Japan’s fiscal state to that of Greece, no less, hinting that capital flight is becoming a serious worry.

It’s not just Japan feeling the fiscal heat. US credit default swap spreads have climbed to 55.1 basis points in May – a whisker below the 2011 debt ceiling crisis peak. While these levels still trail those of weaker sovereigns, they signal rising concern about America’s ballooning debt and persistent inflation.

Now consider this: Japan, with its own crisis unfolding, holds a whopping $1.1 trillion in US Treasuries. If Tokyo is forced to defend its currency or shore up domestic markets by offloading these holdings, US yields could spike just as America’s credit rating has taken a knock. In short, the world’s two largest debt markets are dancing on a knife’s edge.

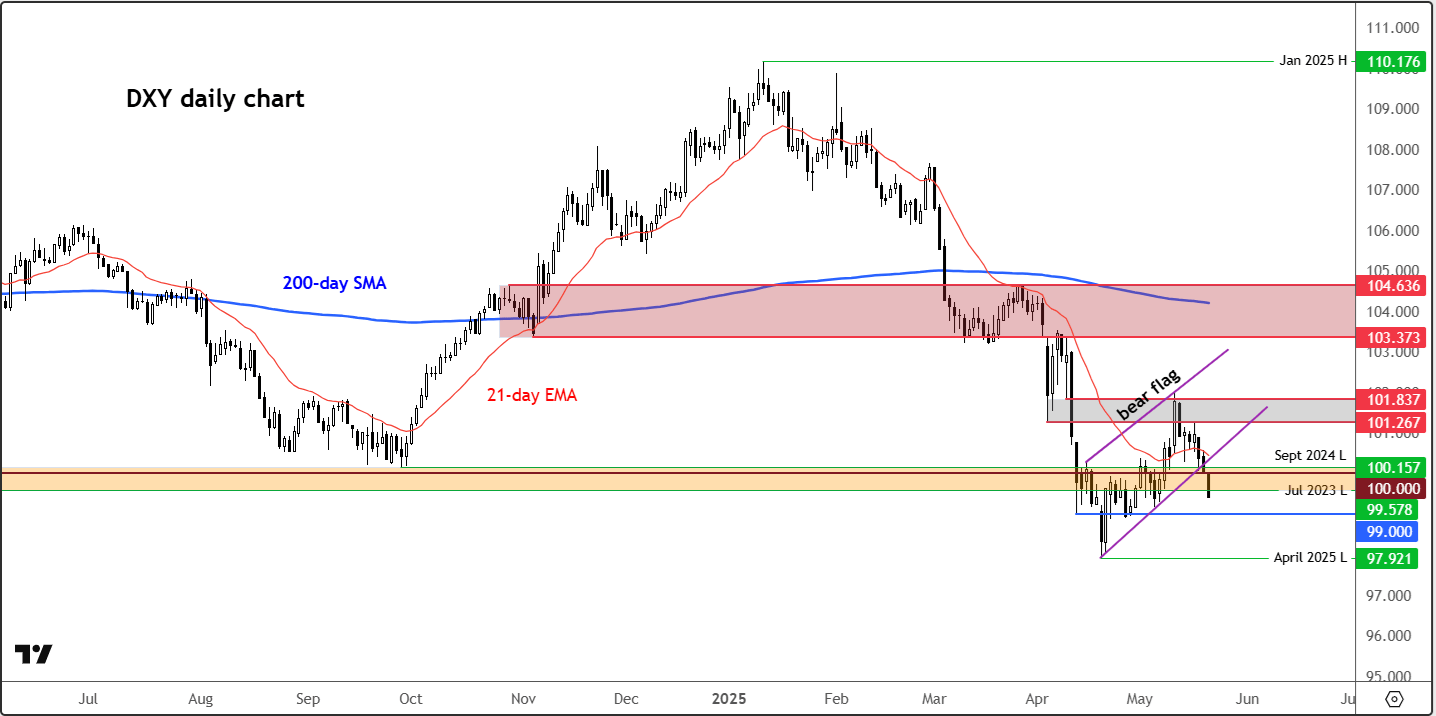

Technical dollar forecast: Dollar index (DXY) breaking lower

From a purely technical point of view, the dollar index is looking quite bearish after breaking down from a bear flag pattern a couple of days ago. The DXY has also broken below support at 100. It is now below the July 2023 low of 99.57. From here, the next downside target for the dollar index is at 99.00. Below 99.00, the next downside target is the April 2025 low of 97.92. As things stand, the path of this resistance looks to be to the downside. The DXY will only turn bullish from a technical viewpoint if we go back above the broken support trend of the bear flag pattern. If that happens, it could then pave the way for a more significant recovery than we have seen in the prior four weeks.

USD/JPY could be heading to 140.00 again

The USD/JPY has broken below 145.00 handle this week, which is a significant technical development. As well as a psychologically important handle, it also marks the previous week’s lows. Last week, the pair created an inverted hammer candle after finding good resistance between 148.65 to 150.00. This area was previously a major support area which gave way in late March, leading to the big drop we saw in early April. Once a support, this area turned into strong resistance. The downside follow through in the USD/JPY pair suggests that more weakness could be on the way, with next support seen at around 143.00. The big support area comes in at around 140.00, where it last tested in April. Below that we have the September 2024 low of 139.58. For the USD/JPY to get to these levels and potentially break below it, we will need to see further strengthening in the Japanese bond yields.

On an intra-day basis, the USD/JPY chart may find brief support at Fibonacci levels around 143.24 (61.8%) and 141.76 (78.6%), levels not shown on this chart. But unless 145.00 is reclaimed with conviction, the broader risk points to further dollar weakness.

Final word: risk tilts toward yen strength

The days of yen complacency are well and truly over. And if Japan’s bond implosion leads to a liquidation of US assets, then global investors may be in for a rude awakening. Against this backdrop, the US dollar forecast is bearish, with the USD/JPY in particular at risk of a bigger decline, possibly sub-140.00.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R