US futures

Dow futures -0.12% at 42,358

S&P futures -0.05% at 5965

Nasdaq futures 0.14% at 21738

In Europe

FTSE 0.05% at 8802

DAX 0.24% at 24306

- US stocks fall as worries over the jobs market rise

- US jobless claims rise to an 8-month high

- NFP report is due tomorrow

- Oil holds steady after losses yesterday

Jobless claims rise to an 8-month high

U.S. stocks are full length after US jobless claims unexpectedly rose last week to the highest level since October, adding signs that the job market is cooling.

US jobless claims rose by 8,000 to 247k in the week ending May 31st, ahead of a decline of 235k, which economists had expected. While weekly jobless claims tend to be volatile and fluctuate, recent data points to a slowdown in economic activity and weakness in the job market.

Yesterday, ADP payrolls came in at just 37k, well below the forecast of 120k. There are services that ISM has also unexpectedly contracted, adding to signs of the negative impact of Trump's trade tariffs on the economy.

Attention will now turn to you, as someone from payroll data, tomorrow, which is expected to show that 130,000 jobs were added, and may be down from 177,000 in April. Weaker-than-forecast NFP data could raise concerns of an economic slowdown, hurting risk sentiment.

Corporate news

Apple is falling 0.5%. The iPhone maker announced it has bought the Tata group to handle repairs for iPhones and MacBooks in the Indian market.

Procter & Gamble is falling 2% after the consumer goods giant announced plans to cut 7000 jobs, or 15% of its non-manufacturing workforce, over the next two years.

Uber is rising 0.7% after the ride-hailing company announced that Palo Alto Networks' CEO will be joining the rideshare company's board of directors.

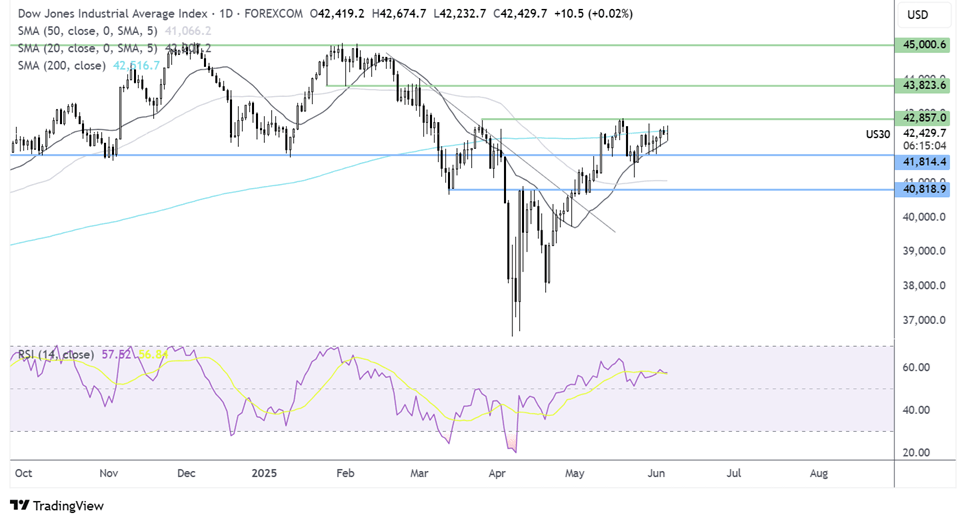

Dow Jones forecast – technical analysis.

The Dow Jones’ recovery has stalled at the 200 SMA at 42,500. A breakout of this dynamic resistance and 42,850 is needed to create a higher high and bring 45,000 the ATH into play. Sellers will need to take out 41,800 to gain traction towards 40,800.

FX markets – USD falls, EUR/USD rises

The USD is falling after the week's US jobless claims, which rose to the highest level since October, raising concerns over the outlook for the US account. The Fed may need to start cutting rates sooner should the labour market we can

The EUR/USD is rising after the ECB cut interest rates by 25 basis points, as expected, to 2%. The central bank lowered its 2026 inflation forecast to 1.6% from 1.9% and its growth forecast for next year to 1.1% from 1.2%. However, ECB president Christine Lagarde adopted a more hawkish tone in the press conference, sending the euro higher.

GBP/USD is rising to 1.36 amid USD weakness and despite UK construction sector activity contracting in may will be it at a slower pace UK contracts construction PMI rose to 47.9 in may up from 40 point 6.6 in April up firms staff numbers at the fastest pace in nearly five years back to higher wage costs and reduced demand.

Oil holds steady after falling 1% yesterday

Oil prices are holding steady after falling over 1% in the previous they, after US gasoline and diesel inventories built, and after cuts to Saudi Arabia's July prices for Asia.

Data yesterday showed that US gasoline and distillate stockpiles grew by more than expected reflecting weak demand in the world's largest economy.

Meanwhile, geopolitical tensions and Canadian wildfires are supporting prices, even as OPEC plus is expected to increase production over the second half of the year.

Saudi Arabia the world's largest oil exporter reduces July prices for Asian crude buyers to the lowest in nearly two months.