US futures

Dow futures -0.42% at 42,685

S&P futures -0.1% at 6017

Nasdaq futures 0.01% at 21850

In Europe

FTSE -0.02% at 8868

DAX -0.86% at 23779

- US PPI rises 0.1% MoM & jobless claims rose to 248k

- Trump to send tariff letters to trading partners

- Boeing falls after plane crash

- Oil eases but remains close to its 2-month high on geopolitical tensions

US data shows signs of weakness, Trump trade warning

U.S. stocks are falling after weaker-than-expected data raises concerns over the health of the US economy, and as Trump rattles the markets with more trade tariff uncertainty.

Data showed that US jobless claims were higher than expected, rising to 248K up from 247K and defying expectations of a decline to 240K. Meanwhile, US producer price inflation also remained muted in May, another sign that tariffs have yet to increase prices.

The PPI report rose 0.1% month on month below forecasts of a 0.2% increase. This is the fourth straight month that the data showed tame inflation.

The data comes after yesterday's US CPI inflation, which was also cooler than expected. This means that the impact of higher tariffs on the US economy has been modest so far. However, price pressures are expected to ramp up in the second half of the year as companies look to pass on the increased costs to their consumers.

However, tame inflation is fueling expectations that the Federal Reserve could cut interest rates sooner, pulling the US dollar lower.

Meanwhile, the US and China agreed to a trade framework yesterday, which puts them back where they were after the Geneva talks. However, Trump warned that he will be sending take-it-or-leave-it letters to swathes of trading partners over the coming two weeks, informing them of their reciprocal tariff levels. This announcement has rattled the market ahead of the July 9 reciprocal tariff deadline.

Corporate news

Oracle is rising over 9% after the cloud computing group lifted its annual revenue growth target and highlighted solid demand from customers aiming to harness AI.

Boeing is falling over 8% after the Air India aircraft, reported to be a 787 Dreamliner, crashed minutes after taking off.

GameStop is falling 15% after the video game retailer posted a decline in Q1 revenue. Customers are increasingly opting for digital downloads.

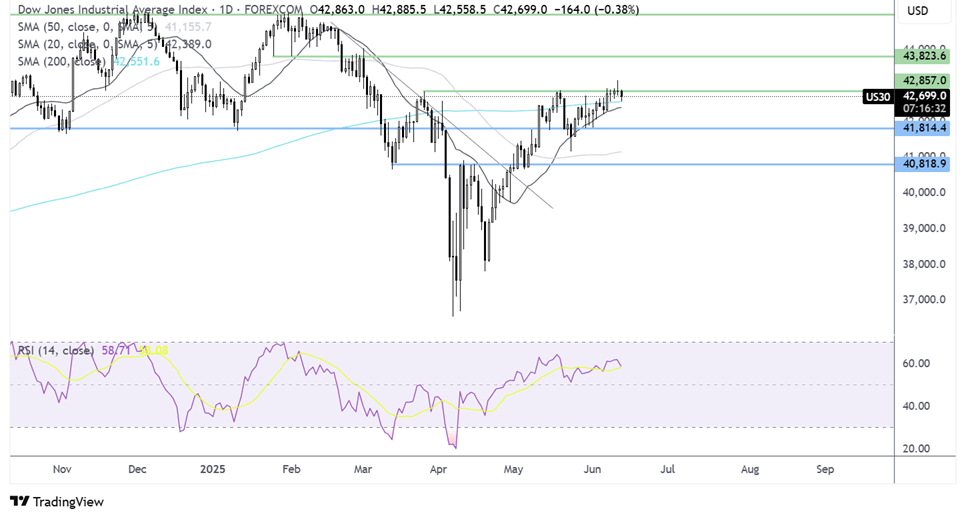

Dow Jones – technical analysis.

The Dow Jones recovery from April lows pushed above the 200 SMA before running into resistance around 42,800. The price is easing lower, testing the 200 SMA at 42,600. Meanwhile, the 20 SMA is guiding the price higher. Should the 200 SMA hold, buyers will look to extend gains above 43,150 towards 44,000. Should sellers break below the 200 SMA and the 20 SMA at 42,400, the door opens to 41,800 horizontal support.

FX markets – USD falls, EUR/USD rises

The USD is falling after weaker-than-expected US jobless claims and inflation, which suggests that a summer Fed rate cut could be in play.

The EUR/USD is surging to a 2.5-year high due to the weak U.S. dollar, even as ECB headlines remain relatively weak. Growth in the region is still stagnant, and ECB policymakers have offered a mixed message regarding the easing cycle.

GBP/USD is rising above 136 on USD weakness, despite the UK GDP contracting by more than expected in April. UK GDP contracted 0.3% MoM in April, worse than the 0.1% contraction forecast, marking the steepest decline in almost 18 months. This comes as consumers and firms are navigating rising unemployment, increasing taxes, and Trump's trade tariffs.

Oil eases but remains close to a 2-month high.

Oil prices are easing but remain close to an almost two-month high as Middle East tensions escalate, raising concerns of a potential disruption to supply.

The US is moving some personnel out of the Middle East on reports that Israel could launch an operation into Iran in the coming days. As a result, the risk premium on the oil has spiked, lifting the price sharply yesterday.

Meanwhile, news that the US and China have reached an agreement to supply a trade framework could help the oil demand outlook.