US futures

Dow futures 0.4% at 41253

S&P futures 0.47% at 5656

Nasdaq futures 0.66% at 19996

In Europe

FTSE -0.30% at 8530

DAX 0.67% at 23271

- Stocks rise on US-UK trade deal hopes

- Chip stocks rise on hopes of less stringent AI chip export restrictions

- The Fed left rates unchanged and warned of higher inflation

- Oil rises on trade deal optimism

Stocks rise on UK-US trade deal hopes

U.S. stocks opened higher on Thursday on news that the US was on the brink of signing a trade deal with the UK. Meanwhile, chip stocks added to gains on optimism of fewer export curbs on AI semiconductors.

Trump teased a trade deal announcement on his Truth social platform at 10:00 AM ET. This will mark the first trade deal since he paused country-specific tariffs imposed on world economies last month.

Meanwhile, the US and China will meet in Switzerland for icebreaker trade talks after weeks of tit for tat tariffs have sparked concerns over global economic growth.

Chip stocks are outperforming on expectations that Trump will modify Biden-era rules curbing the export of sophisticated AI chips. Such a change could boost exports of the likes of Nvidia.

These updates help lift the market mood, boosting equities and the US dollar amid some unwinding of the sell America trade.

Investors also continued to weigh the Federal Reserve's interest rate decision yesterday. The Fed left interest rates unchanged at 4.25% to 4.5% but warned against a stagflationary outlook, in which inflation and unemployment could rise.

Corporate news

Warner Bros. is falling 2% after the media giant missed Q1 revenue estimates. The company's lack of big box office hits and weakness in the traditional TV business contributed to the decline.

Holdings is falling over 7% after the chip technology provider issued a weak revenue forecast, warning about a hit from tariff economic uncertainty.

Peloton is falling 3% after the fitness company posted a Q3 loss. Even as it raised its 2025 revenue forecast, the company expected an increase in instructional video subscriptions.

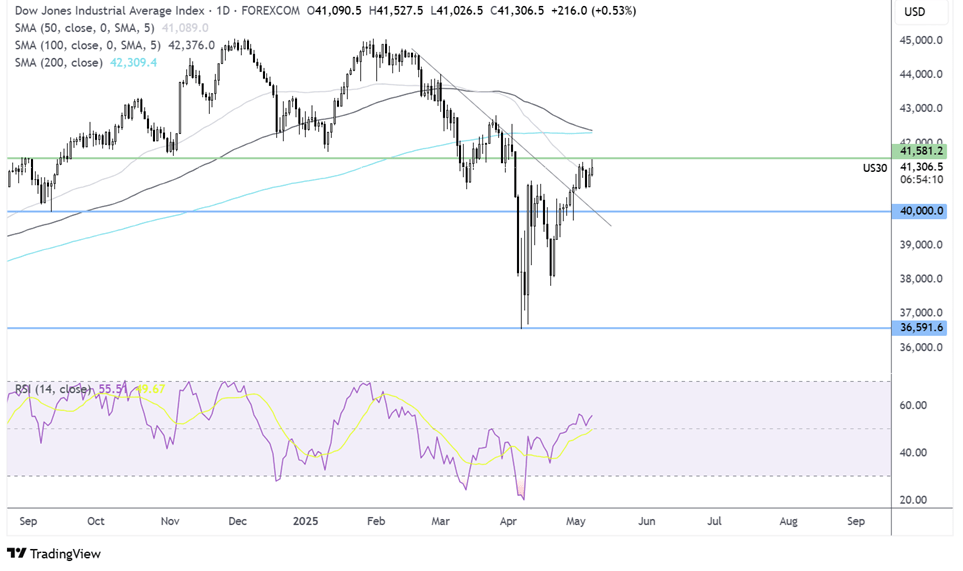

Dow Jones forecast – technical analysis.

The Dow Jones is extending its recovery from the 36,600 2025 low testing resistance around the 41,500 level. Buyers supported by the RSI above 50 will look to rise above here to expose the 200 SMA at 42,325, Above here buyers could gain momentum. Support is seen at 40,700 and 40k..

FX markets – USD falls, GBP/USD rises

The USD is inching higher, adding to yesterday's gains after the Federal Reserve left rates on hold and highlighted concerns over stagflation. Meanwhile, optimism surrounding trade deals is also lifting the US dollar higher.

The EUR/USD is unchanged, never on the 113 level, amid mixed cues from the region. While Frederick Merz's winning position as Chancellor in Germany is helping to support prices, recent data has been mixed. Eurozone retail sales fell, and German industrial production was stronger than expected, though this is due to a pull ahead in front of Trump's tariffs.

GBP/USD is rising after the Bank of England cut interest rates by 25 basis points in line with expectations. However, the vote was slightly more hawkish, with two members voting to leave rates on hold overshadowed two policy makers voting to cut rates by a larger 50 basis points. The BoE also increased its growth forecast for this year to 1%. Trump has also teased a full and comprehensive trade deal with the UK.

Oil rises on trade talk optimism

Oil prices are rising, recovering from yesterday's losses amid rising optimism surrounding trade talks between the US and China this weekend.

U.S. Treasury Secretary Scott Bessent will meet with China's top economic official in Switzerland for icebreaker negotiations, a sign of the escalation of the trade war disrupting the global economy.

All the trade deals also being announced, such as with the UK, could also be supporting the oil demand outlook.

However, the upside is being limited by OPEC+ increasing oil output for a second straight month.