US futures

Dow futures -1.16% at 41465

S&P futures -1.3% at 5765

Nasdaq futures -1.7% at 20750

In Europe

FTSE -0.76% at 8660

DAX -2.1% at 23494

- Stocks fall as Trump threatens 50% tariffs on the EU

- Apple falls 3% on Trump’s 25% tariff threat

- Trump’s Big Beautiful Bill passed a House vote yesterday

- Oil falls across the week on supply worries

Trump threatens 50% tariffs on the EU

U.S. stocks are falling sharply after Trump threatens new tariffs, shifting attention away from US fiscal concerns, firmly onto trade tariff policies.

Trump threatened to impose 50% trade tariffs on goods from the European Union starting in June after saying that discussions with them were going nowhere. Trump's latest trade announcement comes after the year earlier this week revived its trade proposal with the US to try to jumpstart talks. However, the signals are that the US is not happy with the offer.

If negotiations fail, the EU is preparing countermeasures, putting together plans to impose additional tariffs on €95 billion of US exports.

Trump also said he would hit apple with tariffs of at least 25% if it didn't make its iPhone in the US.

These latest measures shifted the focus away from the US fiscal deficit after Trump's big, beautiful bill was voted through the House of Representatives yesterday.

The sell-America trade is still firmly in play, with stocks and the USD set to book losses across the week.

Corporate news

Apple is falling sharply after Trump threatened 25% tariffs on the company's products if they're not manufactured in the US. Apple had said the Indian factories would supply the majority of iPhones sold in the US in the coming months in an attempt to avoid the tariffs on Chinese-made goods. However, Trump is insistent that tariffs will be applied to items manufactured outside of the US.

This would mean that prices for US iPhones would rise substantially, potentially hitting demand. Apple would also need to absorb the increased labour costs, hitting margins.

Tesla is set to open lower following Trump's announcement and after reports showed that the Chinese EV giant BYD outsold its US rival for the first time in Europe

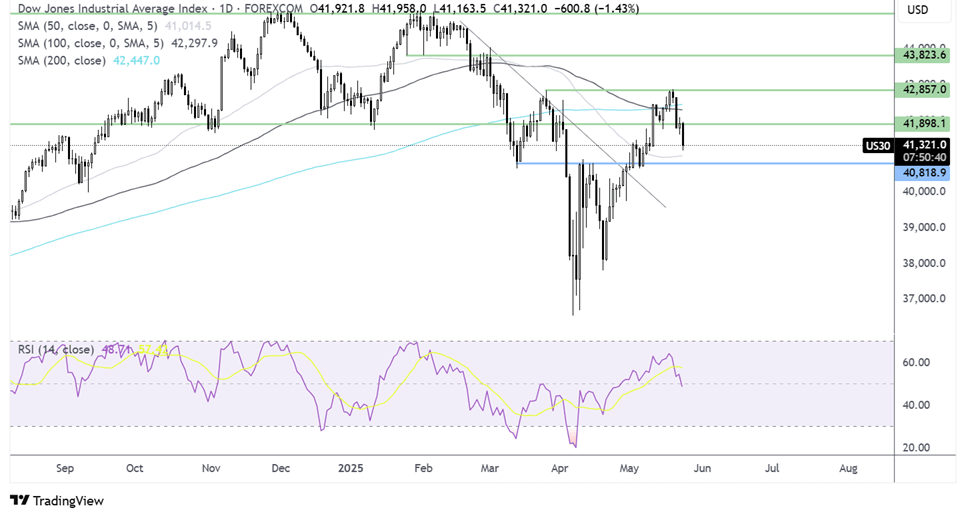

Dow Jones forecast – technical analysis.

The Dow Jones extended its recovery to 42,670 before turning lower, takin out the 200 SMA and 42k support this combed with the bearish crossover on the MACD keeps buyers hopeful of further downside. Sellers will look to take out today’s low of 41,160 to extend losses towards 40,750. Buyers would need to rise above 41.9k to 42k resistance zone to expose the 200 SMA.

FX markets – USD falls, GBP/USD rises

The USD is falling to a two-week low following Trump's trade tariff announcement, which comes as the market is already concerned about the fiscal outlook after Trump’s sweeping tax cuts passed a vote in the House.

The EUR/USD is still trading higher on the day despite Trump's threat of 50% tariffs on the EU. Whilst this would hit the economic outlook for the region, the euro is benefiting from the selling out of the USD given it's the most liquid alternative.

GBP/USD is rising towards 135 due to the stronger-than-expected UK retail sales. Sales rose 1.2% month on month up from -0.1% in March and well above the 0.2% forecast by economists. The data comes amid a still solid jobs market, strong wage growth and signs of improving consumer sentiment.

Oil falls across the week

Oil prices are falling for the fourth straight day and are set to drop over 1% across the week on fears of oversupply at a time when the demand outlook is also deteriorating. This marks the first weekly decline in 3 weeks.

This week report that APEC plus kids support further output increases in July has pulled prices lower. The meeting next week is expected to result in 411,000 barrels per day being added for July. The group has already raised output targets by 1,000,000 barrels per day for April may and June.

The supply increase comes as trump threatens 50% tariffs on Europe raising concerns over the economic outlook and therefore the demand outlook.