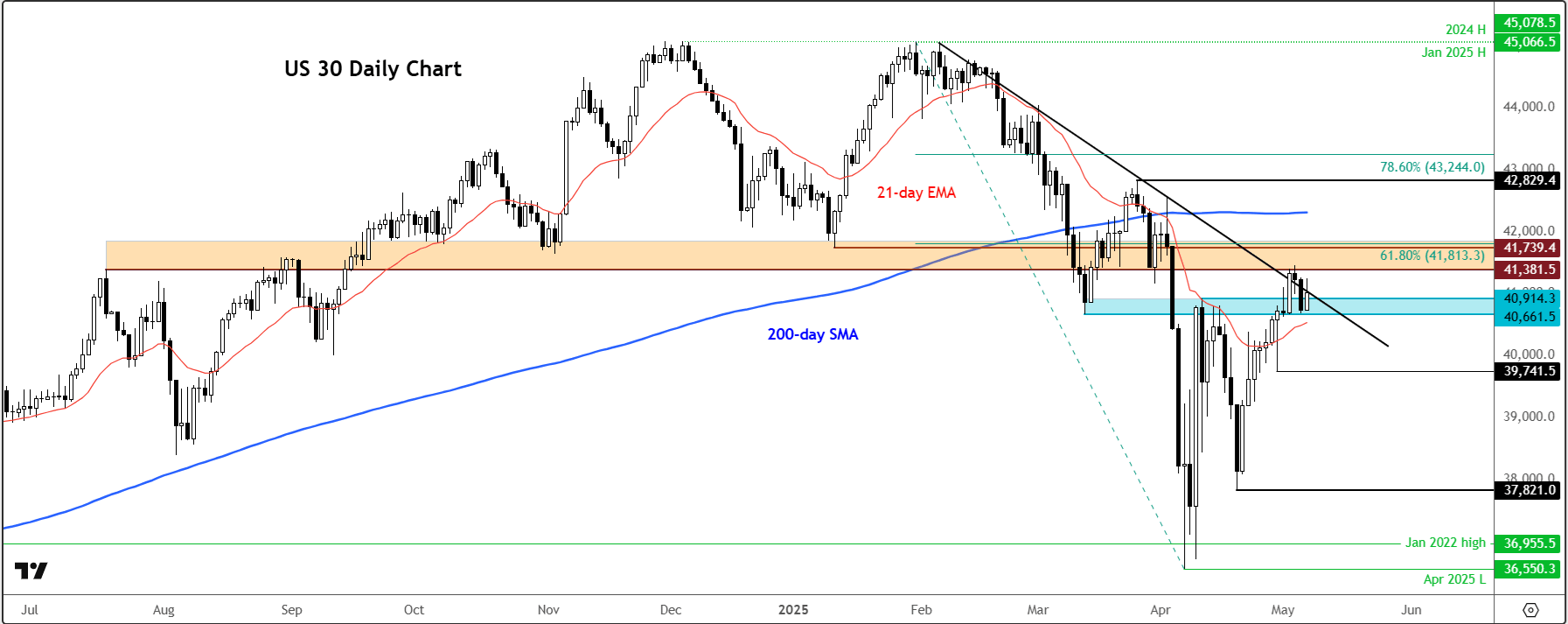

US stock markets remained largely on the front-foot during Wednesday’s first half of the session, if a little on the quieter side after a mixed European session. A couple of hours after the open of Wall Street and at the time of writing, US indices were clinging onto their gains, but evidently the bulls were no in their usual mood with intra-day price action looking a little on the heavy side. Hopes that the US will strike some trade deals with its large trading partners ahead of the weekend meeting between US and Chinese trade representatives is helping to keep risk appetite mildly positive. This is keeping the Dow Jones forecast neutral as the index tests a major resistance area, shown in the chart below.

Source: TradingView.com

Dow Jones forecast: Why are stocks struggling?

Well, there are a few reasons for this, and it could just be markets have already priced in the potential trade deals between the US and some of its large trading partners. Questions remain as to what sort of deals there will be and about the ability of US and China to start negotiations again. A trade deal between the world’s two largest economies could take months, so there will be some uncertainty hanging over the markets despite talks potentially starting soon. On top of this, the growing dispute between nuclear-armed nations India and Pakistan may be a reason for the lack of a more meaningful rally. Then you have shares in Alphabet dropping more than 8% on news Apple is exploring AI search in its browser.

FOMC in focus but don’t expect any fireworks

Investors’ attention will turn to the Fed meeting later, so you can understand the hesitancy somewhat. But even after the Fed meeting, don’t expect to see major fireworks. Indeed, no one is really expecting anything from the Fed in terms of actual rate changes. Not yet, not when your credibility is on the line. The US central bank is almost certain to keep the Fed funds rate at 4.25–4.50% when it decides on monetary policy later. But with political noise from Trump in the background, Powell and team may instead focus on projecting stability and highlight its independence. Still, there is a lot at stake, with market keen to see any clear hints of a potential cut at the June FOMC meeting. If the Fed leans more towards the dovish side, then this may provide a boost to the Dow Jones forecast.

Is trade optimism enough to keep markets supported?

We saw a rebound in major indices yesterday after the Trump administration delivered the latest dose of jawboning on trade deals, before news emerged that China and US representatives will meet at the weekend to discuss their first trade talks since Trump unleashed his global tariff war. However, with markets coming off their best levels and not rallying sharply on the news, this suggests some of the positivity was already priced in. It all started yesterday when US trade secretary Scott Bessent said trade negotiations with several partners are going well and that there is a possibility of “substantial reduction” in tariffs on US goods. He added some deals could be announced as early as this week. That was enough to trigger dip-buying, causing major indices to bounce off their earlier lows. Later, Trump followed suit. However, the excitement has been contained after Bessent told Fox News that the meeting with China will focus on de-escalation, instead of reaching a deal, even if he admitted that the current tariff rates are not sustainable.

China unveils stimulus ahead of US trade talks

Ahead of pivotal trade talks with Washington, Beijing has rolled out a broad suite of policy measures aimed at shoring up its markets, fuelling tech innovation, and extending a lifeline to small businesses. At the heart of the package are sweeping rate cuts poised to inject some 2.1 trillion yuan into the Chinese economy — a substantial boost that’s widely viewed as an attempt to fortify China’s negotiating stance before the diplomatic curtain rises on Saturday. These upcoming talks carry significant weight, with both sides eager to dial down tariffs and find common ground. The incentives are plainly there, but the path to a deal remains fraught with uncertainty. The Dow Jones forecast could take a boost if the two sides can deliver results. So, expectations are lofty — now it’s a matter of whether the rhetoric can be matched by results.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R