Wall Street opened lower after US equity futures fell along with European markets overnight, as oil prices rose after Trump called for the evacuation of Tehran. This caused the Dow to stay below the 200-day moving average, potentially triggering a technical bearish signal for the markets. Investors are watching the Israel-Iran war and wondering whether the US will be drawn into the conflict. Meanwhile, there was no trade agreement between the US and Japan, at the G7 meetings. Trump leaving the summit early means the prospects of any more deals look slim in the days ahead. The Dow Jones forecast was further undermined by a soft set or macro data, not least retail sales. Pointing to struggling US consumer, headline retail sales slumped 0.9% m/m while core sales slipped 0.3% m/m, both more than expected. Industrial Production, Capacity Utilization Rate and NAHB Housing Market Index all also came in weaker.

Trade uncertainty hangs over markets

Meanwhile, the July 9 deadline is approaching. That’s when the 90-day pause on reciprocal tariffs ends. It is quite possible that the deadline may get pushed out again to allow for more time for negotiations. But striking trade deals has been a lot more difficult to achieve than Trump had hoped. That is raising concerns for markets worried about higher inflation, especially with the geopolitical instability in the Middle East sending oil prices higher.

Trump leaves G7 summit early as Iran-Israel tensions rise

Donald Trump departed the G7 summit in Canada a day ahead of schedule, brushing aside speculation that his early exit was connected to brokering a ceasefire between Israel and Iran. According to the president, his reason for leaving was, in his words, “much bigger than that.”

He floated the possibility of dispatching either Senator JD Vance or real estate mogul Steven Witkoff to engage with Iranian officials, but firmly denied any claims that he had initiated peace overtures toward Tehran.

Earlier in the day, markets were slightly rattled after Trump called for the evacuation of the Iranian capital—remarks that injected a measure of alarm into an already volatile geopolitical situation. Oil pries rose again and down went stocks and future. Meanwhile, Israel pressed on with its bombardment of Iran, prompting a forceful response from Tehran in the form of missile and drone strikes.

Technical Dow Jones forecast: Index holds below 200-day average

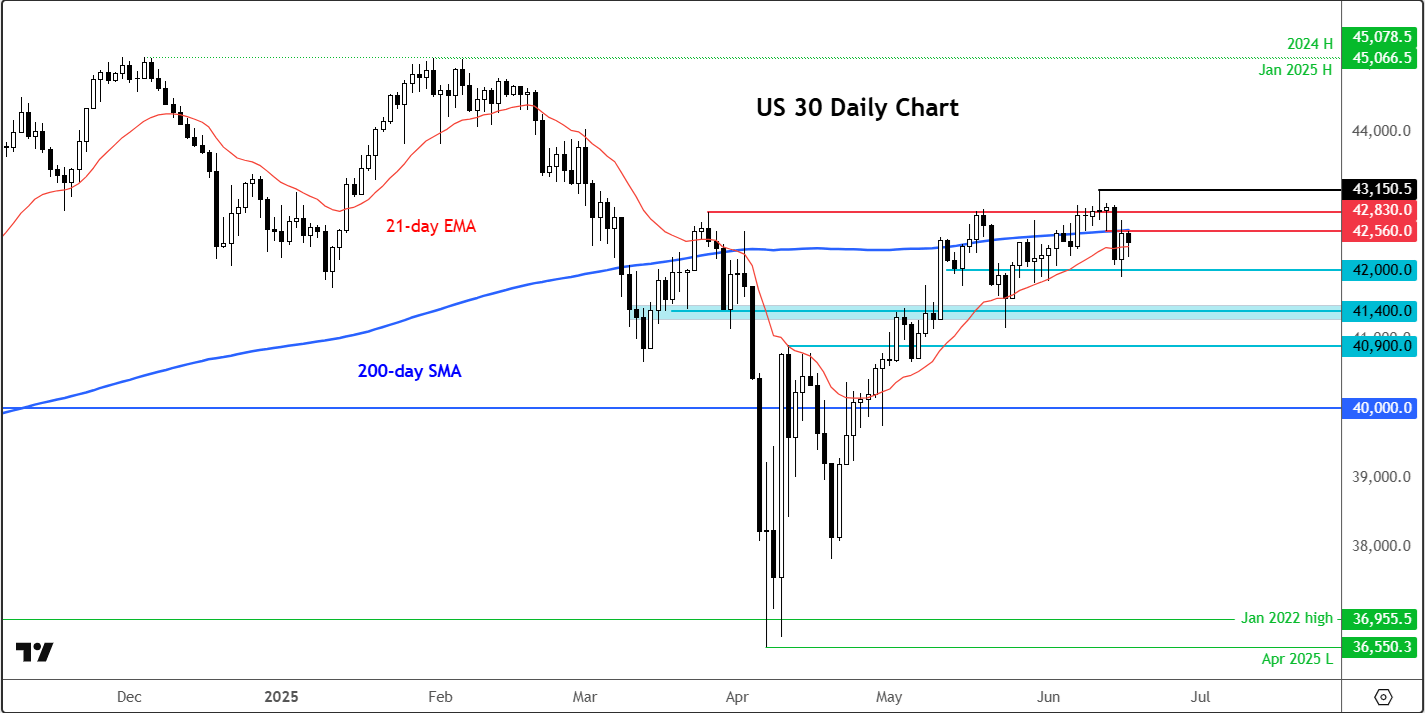

From a technical perspective, the Dow Jones chart is starting to look a little shaky again after the impressive rally from the April lows lost steam in the last few weeks. The index broke down on Friday after failing to hold above the key 42,830 level (the high it had created near the end of March, before Trump’s reciprocal tariffs caused markets to tank). With the market Dow refusing to hold above this level it shows investors are not ready to commit to the upside without any further progress in trade talks with major economies.

Source: TradingView.com

The fact that the Dow Jones chart has also broken below the 200-day moving average (around 42,560) is another bearish signal. This moving average has turned into resistance today, after the index failed to close above it the prior day.

If in the coming days the 200 day MA continues to offer a ceiling then this would tilt the Dow Jones forecast bearish from a technical perspective. In that case we could see a bit of a correction again as we head deeper into the summer, especially with pause on the 90-day pause on reciprocal tariffs looming on July 9.

If we do see some downside pressure, the first support that needs to break from a bearish perspective is at 42,000. Below that, liquidity testing below Monday’s range at 41,900 will come into focus. Then there is not much further support until around 41,400.

Meanwhile, a close above the aforementioned 42,830 level would be deemed a positive outcome. For the index to breach this threshold, you’d expect some further progress in trade talks with China.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R