Netflix Q1 earnings preview

The streaming giant will report quarterly earnings after the market closes on April 17. This will be the first time that Netflix will not give quarterly subscriber numbers, as it wants investors to focus on revenue and operating margin instead.

This change was announced a year earlier, and Netflix ended 2024 with 301.63 million subscribers, which sent this share price 9.7% higher. Wall Street is expecting Q1 EPS at $5.70 on revenue of $10.5 billion which would translate to year over year growth of 8% in earnings and 12% in sales which would be the slowest earnings and sales growth in seven quarters for the coming quarter Wall Street is expected to see earnings of $6.27 a share up 28% on sales of $10.9 billion.

Attention will be on the advertising business as it's not immune to the effects of the US trade war. Should companies start imposing retaliatory fees on US-based services, Netflix could come under pressure. While this isn't the case yet, trade wars create uncertainty.

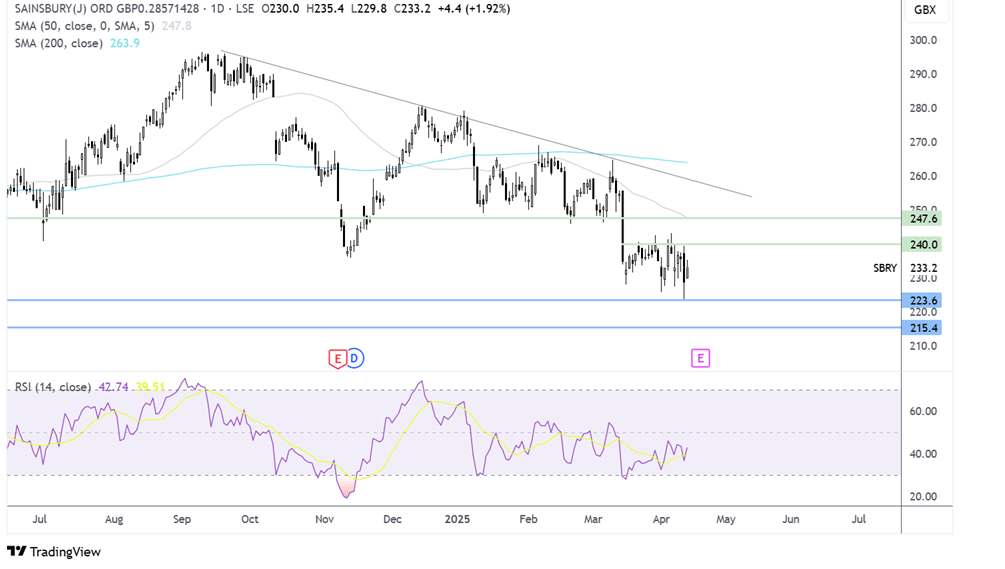

How to trade NFLX earnings?

Netflix has trended lower from its record high of 1064, falling to a low of 820 on April 7 before rebounding higher to test resistance at 950, marking a lower high. Buyers would need to rise above 1000 to create a higher high and change the structure of the chart.

Meanwhile, support is at 850, and a break below 825 is needed to create a lower low.

Goldman Sachs Q1 earnings

Investment banking giant Goldman Sachs is due to post earnings on Monday, ahead of the open. These come after JP Morgan's Q1 result impressed on Friday and following Goldman Sachs's solid quarterly profits for Q4 of last year, which were the largest quarterly profit in over three years.

However, Goldman Sachs shares are down 14% this year amid concerns over Sudan investment banking activity, rising expenses, and concerns of a recession as Trump ramps up a trade war with China.

Wall Street expects EPS of $12.32, marking a 6.4% increase year over year; meanwhile, revenue is expected to fall by 54% from a year ago to $14.77 billion. Governance sucks depends heavily on investment banking which tends to take a hit first when markets turn shaky. Over 60% of the company's revenue is from constant variable banking and markets, meaning it's more sensitive to a slowdown than other big banks.

In Q4 last year, the global banking and markets segment generated $8.48 billion in revenue, accounting for around 61% of the total quarterly revenues of $13.87 billion.

The outlook will be watched closely, particularly given that the outlook for deals, M&A, and IPOs is deteriorating due to the uncertainty created by Trump’s policies.

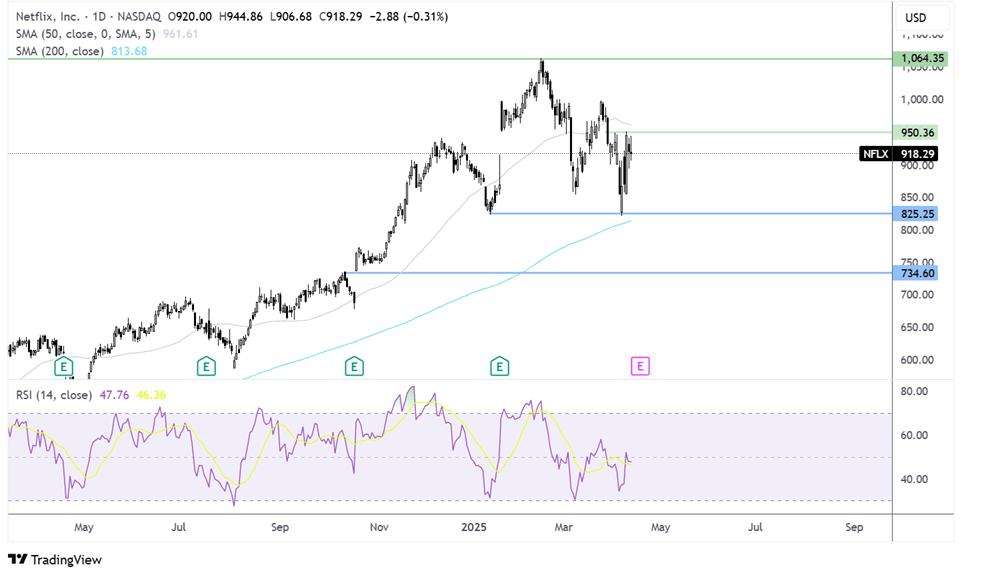

How to trade GS earnings?

Goldman Sachs fell from its record high of 667, breaking below its 200 SMA and the multi-year rising trendline, falling to a low of 439. The price has recovered from the low. However, the downtrend remains intact.

Buyers would need to extend the recovery above 524 to create a higher high and above the 200 SMA at 540 to gain momentum.

Meanwhile, sellers will look to take out 439 to create a lower low and head toward 430 and 378, the April 2023 low.

Sainsbury

Supermarket Tesco reported last week and warned they expected lower profits as competition over prices heats up. Attention is now turning to Sainsbury's. The market will be watching to see if Sainsbury's is also feeling the pressure from competitors such as Asda and Lidl.

In the Q3 trading statement released in January, Sainsbury's expected full-year retail operating profit in the midpoint of its £1.01 billion to £1.06 billion guidance range, which would mark growth of around 7%.

Despite encouraging Christmas trading updates in January, Sainsbury's shares are at their lowest point since January 2023.

Sainsbury's has been holding its own, keeping its market share above 15% and staying second behind Tesco; however, there is a revival of Asda’s rollback scheme, which stokes fears of a price war. This comes when retailers are bracing for increased staffing costs owing to the rise in National Insurance contributions. Sainsbury has previously said that the increase in NI costs would add around £140 million to annual costs, and that’s before the minimum wage hikes. Investors will listen to see how management plans to offset this increased cost.

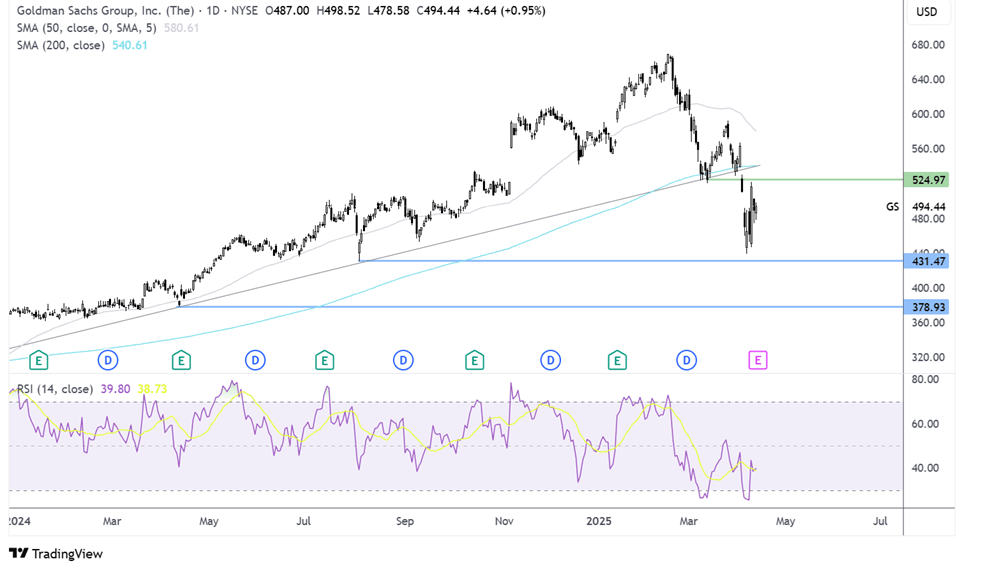

How to trade SBRY results?

Sainsbury's share price has been trending lower since October last year. The price trades below its falling trendline, reaching a low of 223, a level last seen in 2023. While the price has recovered from the low, the downtrend remains intact. Sellers will look to take out 223 to extend the fall towards 215a level last seen in January 2023.

Buyers would need to rise above 240p resistance to bring 247p resistance into focus.