Tesco Q1 earnings

Tesco will report Q1 results on Thursday, which will provide some clues about the health of the UK grocery sector and what to expect for the whole year ahead. The focus will be on like-for-like sales, fuel, and details about the Booker business and European operations.

Tesco is trading close to 12-year highs despite a potential looming supermarket price war, the recent increase in the UK minimum wage, and a higher tax burden on companies.

Expectations for operating profits are between £2.7 and £3 billion for the 12 months to February 2026, down from £3.1 billion in the last financial year. Free cash flow of £1.4 billion to £1.8 billion is forecast, compared to £1.75 billion previously.

Retail sales in April were stronger than expected, boosted by a rebound in food store spending at the expense of non-food sales. However, retail sales are very volatile. Kantar data for the four weeks to 18 May showed grocery sales up 4.4%, with food inflation at 4.1%, the highest level since February 2024.

In those 12 weeks, Tesco improved its market share to 28%, up from 27.6% a year ago. However, discounters Aldi and Lidl gained the most ground, accounting for a combined 19.2%, up from 18.2% last year. This may be a clear sign that consumers are looking for cheaper prices.

How to trade TSCO results?

Tesco's share price has recovered from the April low of 300, rising above the 200 SMA to a peak of 397 last week, a level last seen in April. The 50 SMA appears to be on the verge of crossing over the 200 SMA in a bullish signal. Buyers would need to retake the 397 high to extend the bullish momentum and create a higher high towards 425.

On the downside, support is at 385, which is the February high. Below here, the 200 SMA is 350.

Bellway trading update

The housebuilder will release a trading update on Tuesday, June 10th. This comes after the company's first-half results in March showed some improvement. Revenue increased 12% to £1.43 billion, while profits before tax were up almost 20% to £140.8 million.

The firm said it remained on track to deliver volume output of at least 8500 homes for the full year and expected the order book to build in the second half to support further growth in 2026.

The share price trades modestly higher than a year ago but is still 1/3 lower than pre-COVID amid ongoing housing affordability and planning regulation issues.

There are still doubts over the outlook for interest rates, which are reflected in the valuation. The Bank of England cut interest rates by 25 basis points in June; however, Bank of England governor Andrew Bailey said this week that the central bank will continue to cut rates gradually and carefully. His comments come as inflation rose by more than expected to 3.5% year on year.

Bellway has set three key targets, including an increase in completions of more than 10% to at least 8500, an average selling price of £310,000, and an increase in its order book to set up growth for 2026. The market will want to see how both ways are doing against these measures.

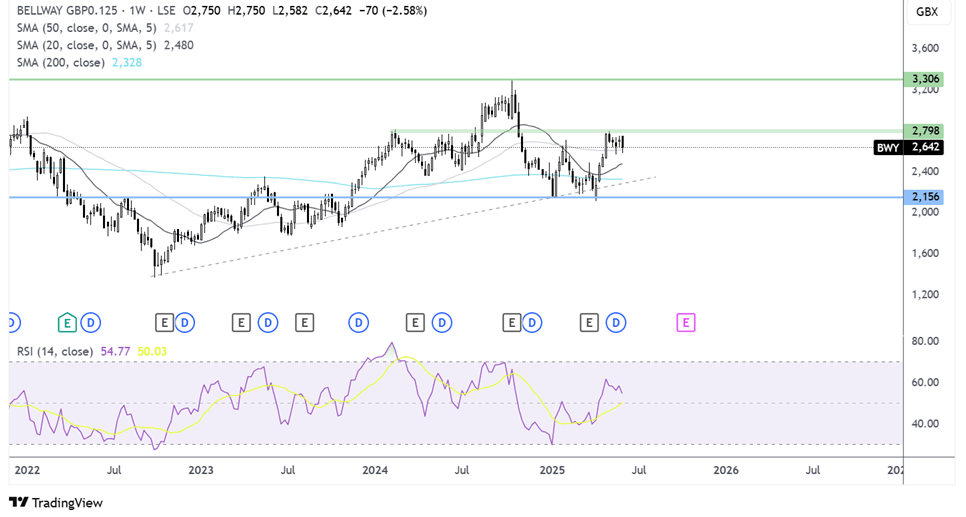

How to trade the BWY trading update?

Bellway continues to hold above the rising trendline dating back to 2023. The price has recovered from the 2210 low, rising above the 200 and 50 SMA but failing to rise above 2800. It is now trading caught between the 2800 SMA and the 50 SMA at 2624. The RSI is above 50 but points lower as momentum slows.

Should sellers break below the 50 SMA 2614, the 200 SMA is exposed at 2320, and below here, 2150.

Should buyers extend the recovery above 2800 towards 3000, 3300, the 2024 high.

TSMC trading update

TSMC is due to release its monthly sales on Tuesday. The world's largest chipmaker’s share price popped last week after CEO CC Wei said that demand remains strong for AI chips.

The market looked through warnings from Wei at the annual shareholder meeting on Tuesday that US tariffs were having some impact on the company. While these were not direct impacts as tariffs are imposed on importers, not exporters, and TSMC is an exporter. However, when prices go up, demand falls, which does impact TSMC.

Attention is turning to the monthly sales figure, which comes after the chip maker posted revenue of up 48% from the same month last year and 22% from March. For the second quarter, TSMC guided to revenue of between $28.49 billion and $29.9 billion U.S. dollars.

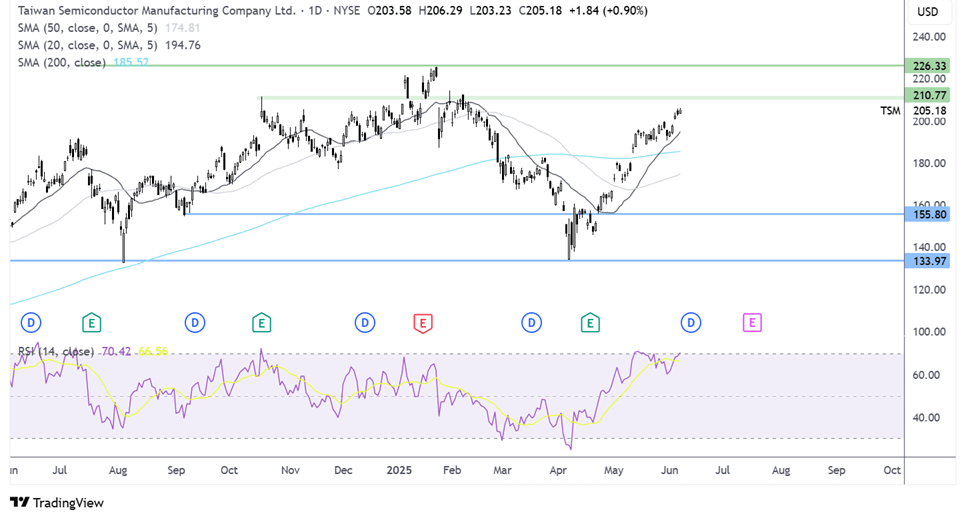

How to trade the TSM trading update?

The TSMC share price has recovered from the 134 April low, rising towards the 210 resistance. Buyers will need to retake this level to extend gains towards 225, the 2025 high.

The RSI is tipping into overbought territory, so there could be a period of consolidation or a pullback. Support can be seen at 186 the 200 SMA. Below here, sellers could gain traction.