- EUR/JPY forecast remains clouded by global bond volatility and fiscal jitters

- Rising US yields and deficit concerns weigh on sentiment, but haven demand supports yen

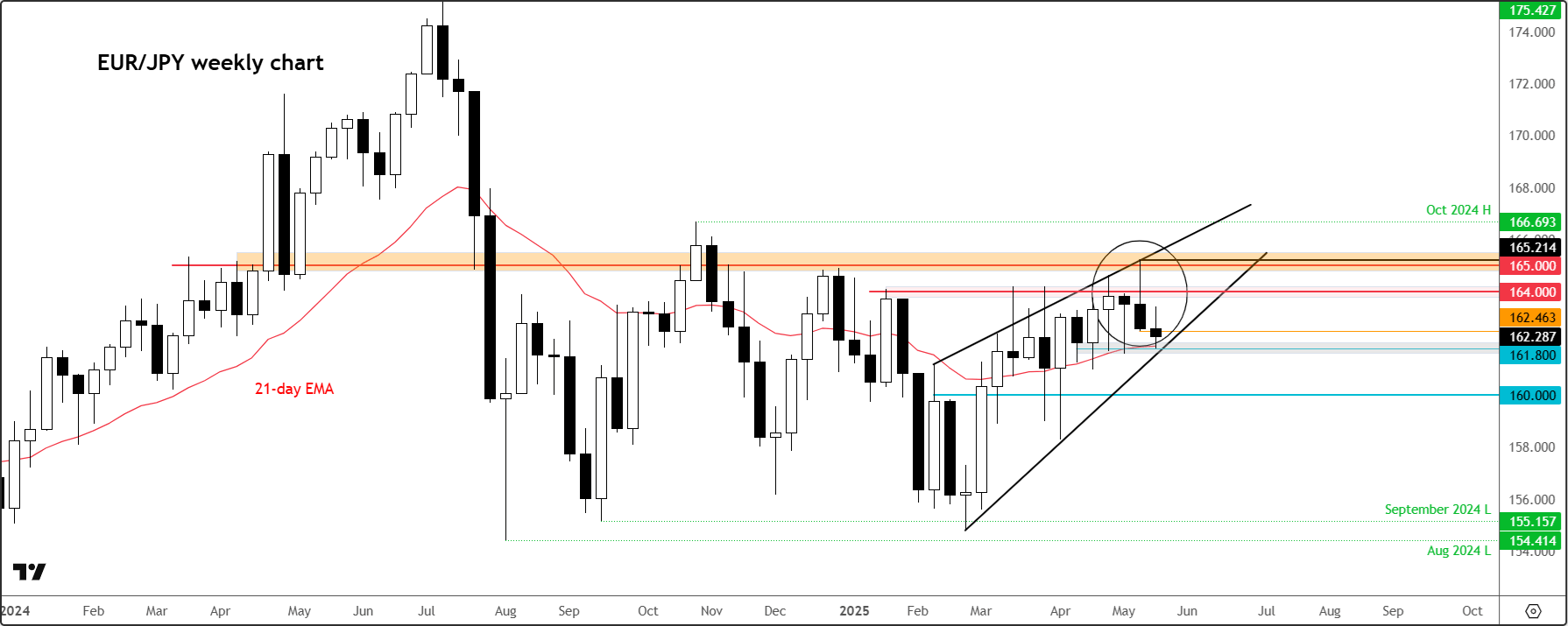

- EUR/JPY’s bearish weekly candle points lower

Although at the time of writing risk appetite had improved a little with long-term US bond yields come down from their earlier highs, markets remained on edge nonetheless, with the Japanese yen, a traditional safe-haven, finding itself at a crossroads. The EUR/JPY forecast has become increasingly tricky to pin down, caught between global bond market turmoil and the eurozone’s own set of macroeconomic challenges. But the path of least resistance is starting to tilt to the downside again. The selling could gather momentum should Japan’s long-term bond yields continue to press higher.

Before discussing the macro factors driving the EUR/JPY forecast and other yen crosses, let’s first take a look at the chart, because that is where all the action is happening…

EUR/JPY forecast: Technical factors and levels to watch

The EUR/JPY is among a growing list of yen pairs we are monitoring for increased volatility, all due to the ongoing bond market sell-off, causing long-term yields to rise to alarming rates. Last week, most yen crosses created bearish-looking candlestick patterns on their weekly charts, putting a negative spin on the EUR/JPY forecast. As far as this pair is concerned, the reversal was even more interesting given that some long-term resistance levels held the test from underneath.

Source: TradingView.com

The inverted hammer-like candle on its own is a bearish pattern. But what make it really intriguing is the fact we saw a false breakout attempt above prior resistance at 164.00. While rates initially rose above 164.00 and went on to momentarily surpass the long-term resistance at 165.00, the breakout ultimately failed as rates reversed and closed the weekly sharply lower.

The selling has, for now, stalled near the support trend line around 161.80 area. But should this level also give way, then that would put the EUR/JPY forecast firmly in the bearish side of things.

If the bears continue to exert pressure, then the next big downside target is at 160.00, the psychologically important level.

In terms of resistance, well last week’s low at 162.46 is the most important level to watch on this time frame now. Should we go above this level then I wouldn’t rule out the potential for a short squeeze rally back towards that 164.00 resistance. However, my base case is that the bearish scenario will play out.

Rising bond yields underpin bearish EUR/JPY forecast

At the time of writing, the EUR/JPY was bouncing back a little, along with other yen crosses as Wall Street, having endured its worst equity rout in over a month in the previous session, attempted to regain some composure. Long-dated US Treasuries also managed to claw back losses. Yet, with yields still elevated, risk appetite remains subdued. The dollar firmed as markets digested the implications of rising US borrowing costs and widening fiscal deficits. It will be interesting to see whether the greenback will be able to hold onto its gains, especially against the yen. In this climate, the yen – sensitive to risk sentiment and US-Japan yield differentials – has held steady, even as EUR/JPY edges cautiously higher.

All told, investors remain fixated on the structural issue haunting Washington: ballooning debt. Trump's tax bill is fiscally controversial and traders are waking up to the reality that without a course correction in US fiscal management, the cost of government borrowing may spiral.

And this matters deeply for the yen. Elevated US yields usually spell weakness for the yen due to carry trade dynamics, yet recent fiscal alarm bells have also stirred a flight to safety. That duality is tilting the EUR/JPY forecast lower, especially as there is not enough eurozone momentum to drive it significantly higher from here as we saw with this morning’s release of poor PMI data.

In summary

The bond market sell-off is creating volatility, and with it, traders are likely to stay cautious. As Japanese yields press higher, this could spell trouble for the yen-funded carry trades. EUR/JPY bulls will need clear signs of euro strength and stable risk appetite, otherwise any upside may prove fleeting. Indeed, the EUR/JPY forecast is mired in uncertainty, with bond markets and broader macro risk all pulling in different directions. Caution remains the order of the day.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R