With the Federal Reserve and a few other central banks poised to deliver policy updates in the next couple of days or, one might expect central bankers to be the main attraction in markets. Not so. The real drama is unfolding on the geopolitical stage, where speculation is intensifying over a potential US military intervention in Iran. For that reason, we saw no reaction in the euro in response to the stronger Eurozone sentiment data yesterday. Unsurprisingly, oil prices spiked once more yesterday, and with them, the US dollar found fresh safe-haven appeal and that caused the EUR/USD to drop back to the 1.15 handle. This morning, though, oil prices eased slightly, paving the way for a mild dollar selling, and so the EUR/USD bounced back a tiny bit. But the situation remains tense, keeping Bent oil steady near $75 handle. For the reason, the near-term risks for the EUR/USD forecast remains tilted to the downside.

FOMC rate decision to be overshadowed by Middle East tensions

As much as traders tune in for tonight’s Fed decision, it’s the chaos in the Middle East that’s truly driving sentiment – and the EUR/USD forecast and direction. The dollar’s recent strength appears to be more a function of risk aversion than anything to do with Fed policy – the flight to safety being driven by crude prices lurching higher. Israel’s renewed bombardment of Tehran has already ratcheted tensions and talks of Washington’s involvement are adding fuel to the fire. Should those whispers become reality, we may well see oil extend its gains – and with it, the greenback.

Still, one must be cautious. The bounce in the US dollar could easily be short-lived if oil’s ascent isn’t underpinned by genuine supply disruptions. Markets are running on headlines rather than fundamentals, and that makes for a fragile rally. Take yesterday’s tepid US retail sales figures – once the sort of print that would rattle FX markets, but now merely a sideshow. Geopolitics, it seems, have taken the wheel.

Turning back to the Fed, tonight’s decision will likely see rates left untouched, with the market laser-focused on the updated “dot plot” of rate projections. I expect it to show policymakers still pencilling in 50 basis points of cuts this year. Oil’s resurgence, coupled with lingering concerns over tariff-led inflation, may convince the FOMC to strike a more hawkish tone. That alone could lend the dollar some staying power.

Technical EUR/USD forecast and key levels to watch

Source: TradingView.com

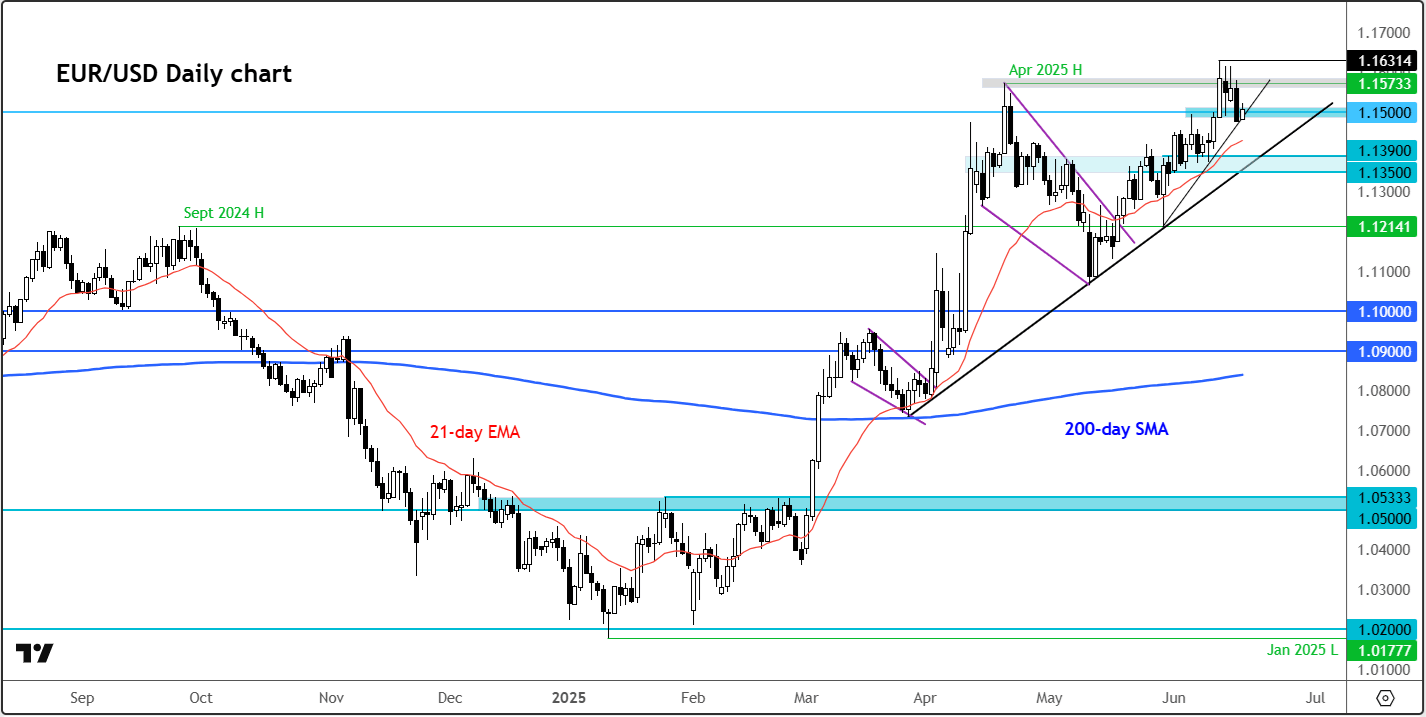

The bullish EUR/USD technical structure has been tested this week with rates taking a dip back to 1.15 handle. The recent pattern of higher highs and higher lows clearly defines the prevailing uptrend but should the trend lines break in the coming days then we could start to see a bit of a bearish momentum build up.

Until now every dip—major or minor—has been met with strong buying interest. If the buying pressure resumes, and we move back above Tuesday’s high of 1.1580, then the next immediate upside focus will be last week’s peak at 1.1631, with subsequent psychological levels such as 1.1700, 1.1800, and beyond offering potential targets.

But in light of the dollar’s bullish reversal, I am more interested in watching support levels break down. The 1.1500 level has been defended for now and continues to serve as key support this week. Should this level give way, attention will turn to the rising bullish trend line and prior support zone between 1.1350 and 1.1390 as the next critical area to watch.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R