- EUR/USD forecast steady at 1.1200

- US inflation and retail data weigh on the greenback

- Euro resilient as ECB prepares for June cut

The EUR/USD has been trending lower in the last few weeks, but without making too much downside progress with the dollar bulls having difficulty regaining control across the board. It looks like the positive vibes from the US trade truce with China has benefited stocks and other risk assets, while the forex market has shown a more muted response. The greenback hasn’t been helped by a dovish run of economic data. Following a weaker CPI report earlier this week, April's PPI print also surprised to the downside—falling 0.5% month-on-month versus expectations for a rise—while retail sales offered little cheer. Even a modest 0.1% headline gain was offset by a drop in the control group, which dipped 0.2% and may signal negative real consumption growth once adjusted for inflation. Against this backdrop, the EUR/USD forecast remains modestly positive in the near-term outlook.

UoM surveys coming up

Markets are gradually recalibrating expectations for the Federal Reserve, though traders remain hesitant to fully price in a cut before September. That caution stems from tariff noise and lingering stickiness in longer-term inflation expectations. Nonetheless, the broader market tone feels distinctly dollar-negative, with risk appetite returning and strategic dollar shorts gaining momentum.

There’s little of major significance on the US calendar today, barring housing starts and University of Michigan sentiment surveys. While inflation expectations within that report could move the needle, the market may well take the figures with a pinch of salt given the limited sample size and potential political skew.

Eurozone’s mixed data point to relative calm

On the euro side, things remain relatively calm. First-quarter growth was slightly below forecasts at 0.3%, but better-than-expected industrial output from March (+2.6% m/m) offered a glimmer of support, as too did the quarterly employment change (+0.3% q/q) and the latest German ZEW survey. The European Central Bank remains on course for a June rate cut, with policymakers from both dovish and hawkish camps showing little concern over the inflationary impact of US tariffs.

For now, the EUR/USD forecast looks comfortably anchored at around 1.1200, but with the path of least resistance pointing higher in the months ahead, owing to an overall risk-on backdrop. With dollar sentiment fragile, a push towards 1.1300, 1.1400 and even 1.15000 in the coming weeks is not out of reach.

Technical EUR/USD forecast: Stuck in consolidation

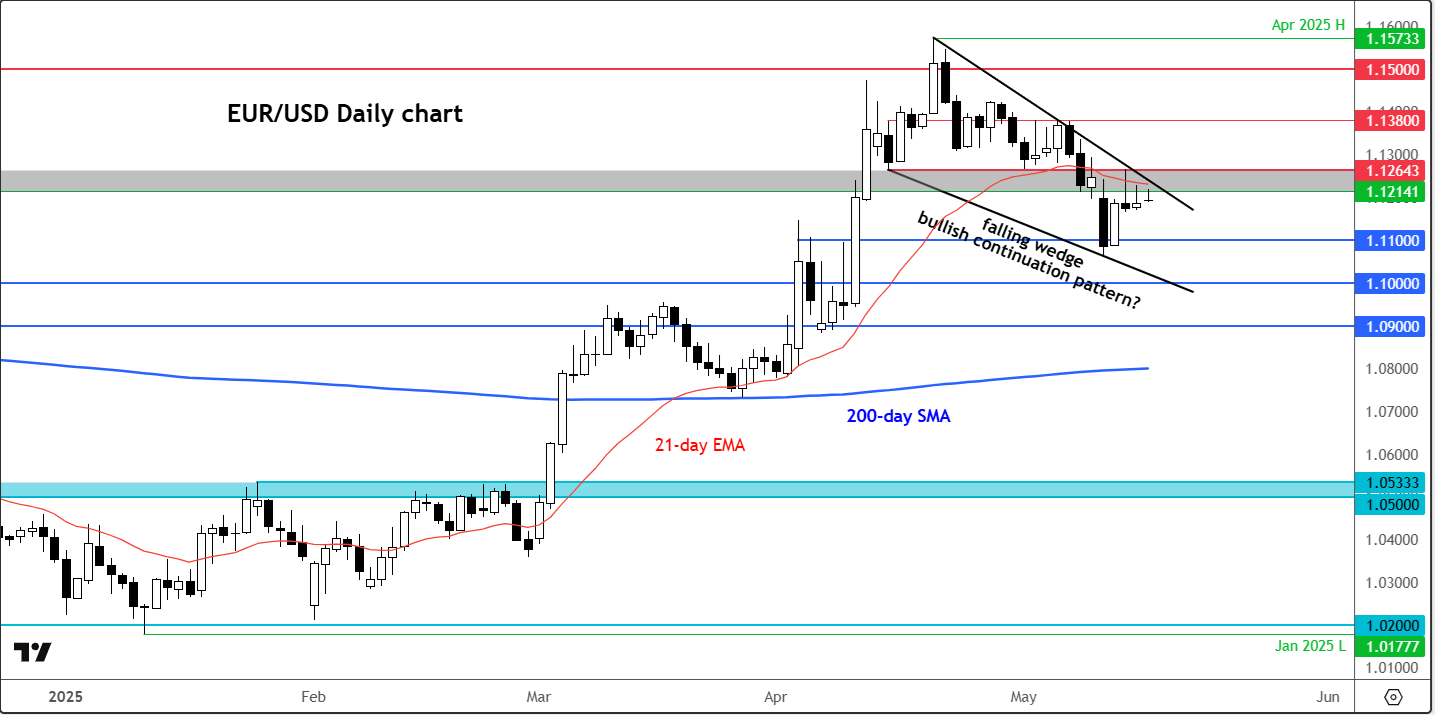

Source: TradingView.com

From a technical perspective, the EUR/USD continues to coil inside what appears to be a falling wedge continuation pattern. The pair has found good support at the 1.1100 region which appears to have created at least a near-term floor. The 200-day moving average, now around 1.0800, sits well below current price action, underlining the euro’s broader recovery since late Q1.

A daily close above 1.1265 resistance would strengthen the bullish case, potentially paving the way for a test of 1.1300 and then 1.1380 resistance.

On the downside, 1.100 is the key support to watch. Below this, 1.1000, a psychological level and horizontal resistance-turned-support, would be the next target, should the selling pressure resume.

However, the lack of bearish momentum makes me wonder if we will now see an upside breakout and a trend resumption.

All told, technicals and macro are aligned for a cautiously bullish EUR/USD forecast, with dips likely to find willing buyers in the short term.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R