The US dollar eked out a third week of gain against a basket of foreign currencies last week, despite falling back slightly on Friday. The gains were driven by two familiar forces: upbeat trade headlines and a Federal Reserve that’s not ready to back down. The latest bump came from Trump’s warmer tone on US-China negotiations and a headline-grabbing – but light-on-substance – US-UK trade deal. It's the first bilateral pact since his so-called 'Liberation Day', but let’s be honest: it doesn’t move the needle. The 10% base tariff is still firmly in place, and that’s likely to be the new normal for the rest of Trump’s term. Markets seem to be making peace with that reality. Risk assets didn’t flinch much, which tells you a lot. But for the dollar to really extend this rally, it’ll need more than just optimistic soundbites – especially on China. If we hear more positive news regarding the US-China trade talks in the week ahead, then the current bullish EUR/USD forecast could be tested as the dollar potentially makes a comeback.

US-China trade talks start

Trump’s trade optimism, whether it’s credible or not, has tilted sentiment in the dollar’s favour for now. Bearish bets are losing steam – and that’s enough to keep the euro on the defensive, for now. Senior US and Chinese officials met in Geneva over the weekend, hoping to cool tensions in their spiralling trade war. China’s vice-premier He Lifeng and US Treasury Secretary Scott Bessent sat down after tariffs between the two economic giants shot past 100%, rattling global markets and threatening supply chains. On Friday, Trump said an 80% tariff on Chinese goods “seems right,” marking the first time he’s floated a concrete alternative to the current 145% import duties. Markets fell slightly, suggesting investors want to see a much lower level to sustain the Wall Street rally, and in doing so, support the dollar recovery. That, in turn, could see the EUR/USD forecast turn more bearish.

US CPI & Consumer Sentiment could impact EUR/USD forecast

The dollar has seen a modest rebound recently, thanks to a slight easing in trade war tensions. One of the major fears around tariffs was their inflationary impact—something that likely nudged the Trump administration into a more market-friendly posture. Now, with China's exports to the US plunging over 20% in April, all eyes turn to Tuesday’s US CPI release at 13:30 BST. Economists aren’t expecting fireworks just yet, with headline inflation projected to hold steady at 2.4% year-on-year. If price pressures are already building, the Fed may have some thinking to do.

Later in the week, at 15:00 BST on Friday, the University of Michigan’s consumer sentiment data will give us a temperature check on Main Street. Confidence indicators have been jittery under the shadow of the trade war, even as inflation expectations creep higher. The US and China may only be talking for now, but the equity market has surged like the ink on a deal is already dry. The big question: will consumers follow the market’s optimism, or are they waiting for actual results before loosening the purse strings?

EUR/USD forecast: Eurozone Sentiment, Inflation, and Growth data in focus

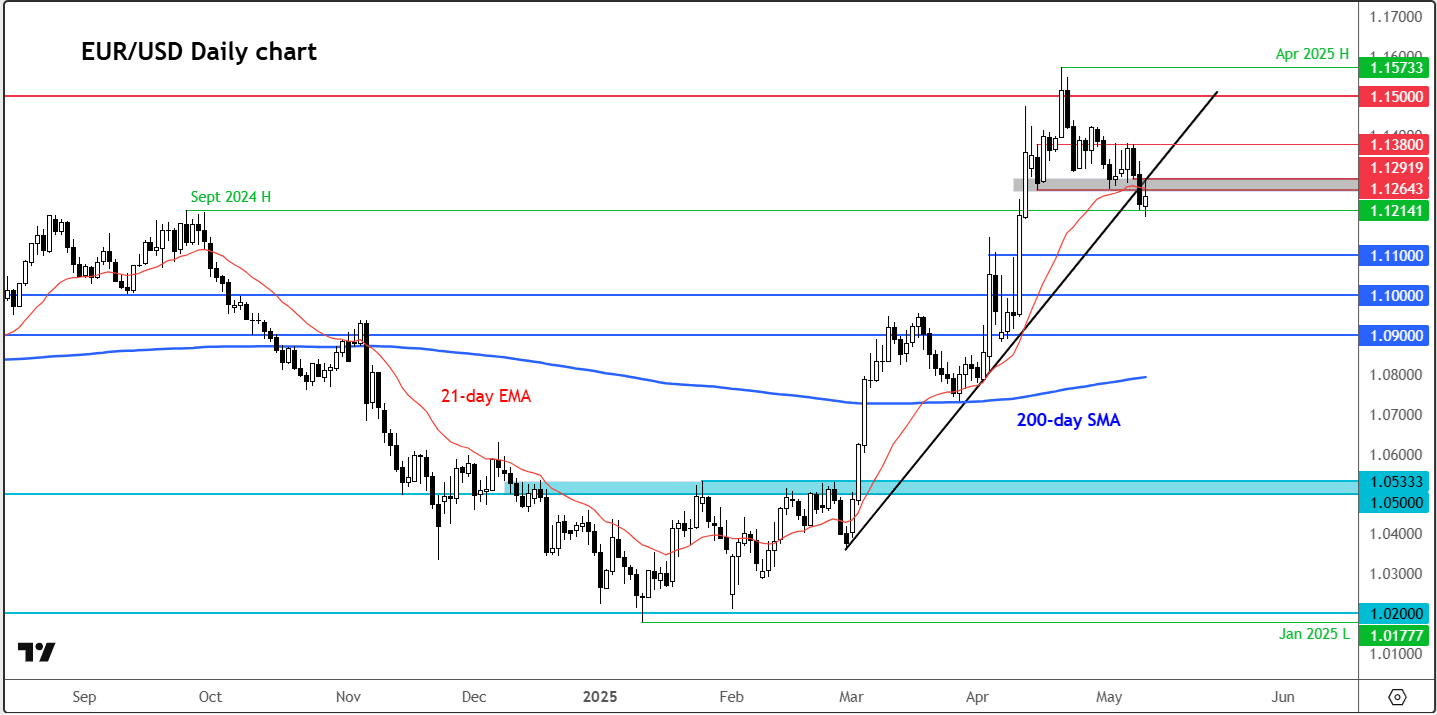

Source: TradingView.com

The Eurozone has a relatively light economic calendar next week, but a few key data releases could still shape market sentiment. The action begins on Tuesday with Germany’s ZEW survey, where investor sentiment is forecast to rise to +9.8 from -14, potentially signaling a shift in economic outlook. Markets will be watching closely to see if this points to genuine recovery or lingering post-slowdown caution.

On Wednesday, attention turns to Germany’s final CPI figures, alongside comments from Bundesbank President Nagel, and a 30-year bond auction that may test investor demand in the current rate environment. Thursday brings more momentum with Eurozone employment and GDP data—both expected to remain stable—and a projected 1.7% increase in industrial production, which could offer a positive surprise.

The week wraps up on Friday with trade data from Italy and the wider Eurozone, which may shed light on how well external demand is holding up amid ongoing global economic uncertainty. While no blockbuster data is expected, these releases will still help shape expectations for the region’s recovery path.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R