Euro, EUR/USD Talking Points:

- EUR/USD has broken out to a fresh three-year high this morning, pushed along by the US Dollar breaking down to a fresh low after a below-expected CPI report yesterday and a below-expected PPI report this morning.

- The question now is one of continuation:As looked at in yesterday’s USD video, EUR/USD had the appearance of an inverse head and shoulders pattern, although I wanted to see bulls make a move before entertaining the long side of the pair. That’s since happened, and the question now is whether buyers can continue the move.

- I look into both EUR/USD and the USD during each webinar, and you’re welcome to join the next. Click here to register.

EUR/USD bulls are making their move. After being thwarted at the 1.1500 level in late-April buyers have forced a break above that price this morning following two below-expected U.S. data items in the form of CPI yesterday and PPI this morning. That’s helped to push expectations for U.S. rate cuts and given last week’s turn at the ECB, where the bank sounded less-dovish and hinted that their rate cut cycle may be nearing its end, this exposes a possible imbalance in forward-looking monetary policy between the two economies.

I looked at this in yesterday’s CPI reaction video, highlighting an inverse head and shoulder like formation but still hesitating to get aggressive on the bullish side of the matter given the continued failure to push through the 1.1500 handle. That happened overnight and bulls made a jump all the way through the 1.1600 handle, opening the door for bullish continuation scenarios as the USD has broken down to fresh lows.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Whether the trend has more continuation potential on a softening backdrop around U.S. rates, we will have to wait for confirmation on that topic as next week brings the FOMC rate decision and to this point, the Fed has been cautious around talking up rate cuts due to the possible impact of tariffs. Interestingly, it was the rate cuts last year that led into the push higher in inflation through the open of this year, with headline CPI peaking at 3.0% YoY in February. At the time the tariff topic had started to take over and the Fed pointed to that as the reason why they wanted to remain cautious with policy in the near-term. But, realistically the fact that inflation had moved up probably had something to do with it, as well, and given that inflation has been pushing back down, markets are getting more warm to the idea that the Fed may push a rate cut sooner than previously expected.

Next Wednesday’s FOMC rate decision is a quarterly rate decision so we’ll also get updated guidance and forecasts, which will help to add some additional color to the situation. But until then, price action is showing bullish continuation and that keeps the door open for topside momentum strategies. Price has already tested the 1.1600 handle in EUR/USD and chasing an already developed breakout could be a challenging way of moving forward. But, from prior structure there’s a few spots of interest for higher-low support potential, and this is what could draw interest for bullish continuation scenarios.

The swing high in April was at 1.1573, and that’s nearby, as of this writing. Below that, the 1.1500 level seems an obvious area of focus but, ideally, bulls would jump in a bit earlier if they remain very bullish about continuation setups, so I’m going to add an ‘s2’ level at the swing high that showed overnight after the initial break of the 1.1500 level, and that plots at 1.1529. Below that 1.1500 will function as the ‘s3’ spot of support, and if bulls fail to hold that into the end of the week, this will start to look like a failed breakout which could draw attention back towards reversal strategies in the pair as we move towards that pivotal FOMC meeting next Wednesday.

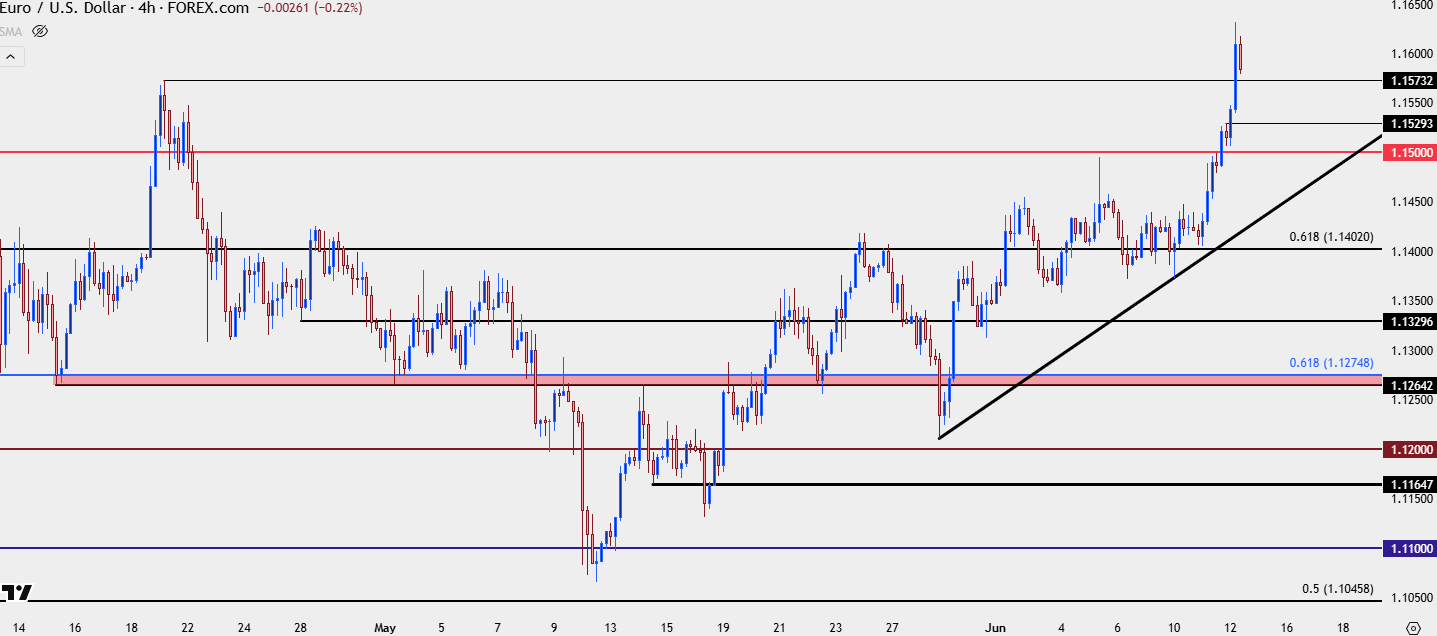

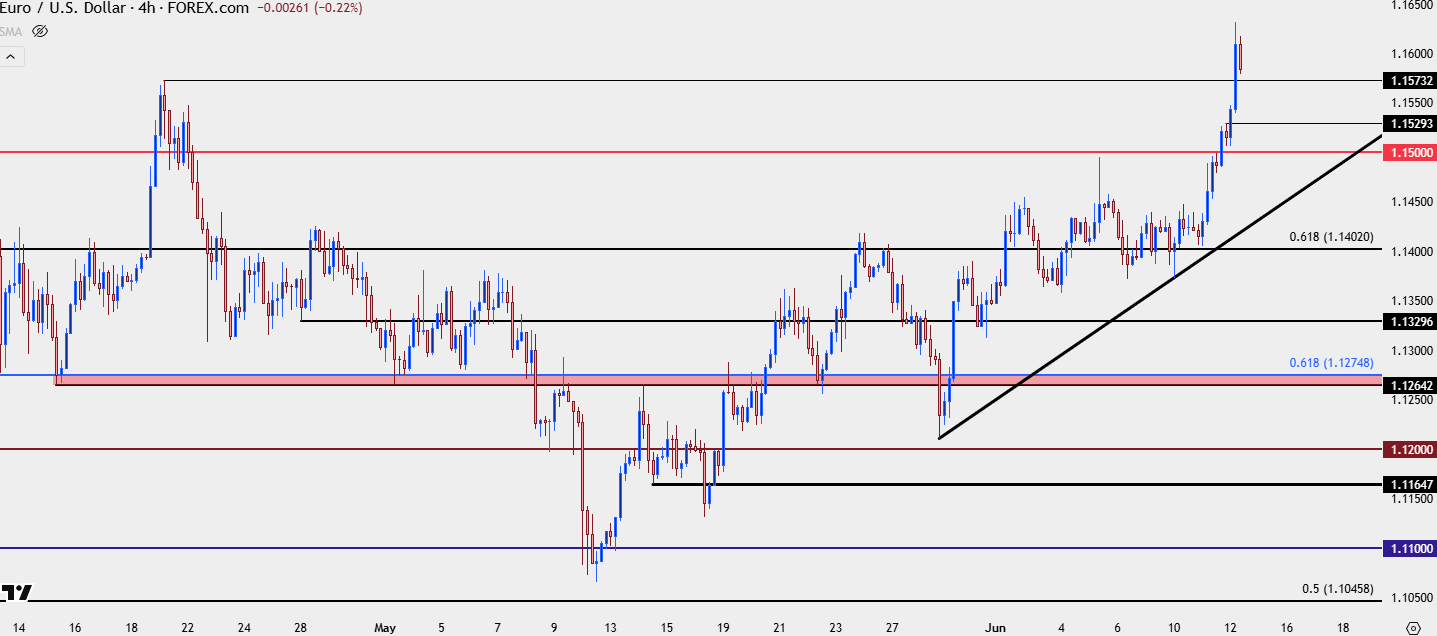

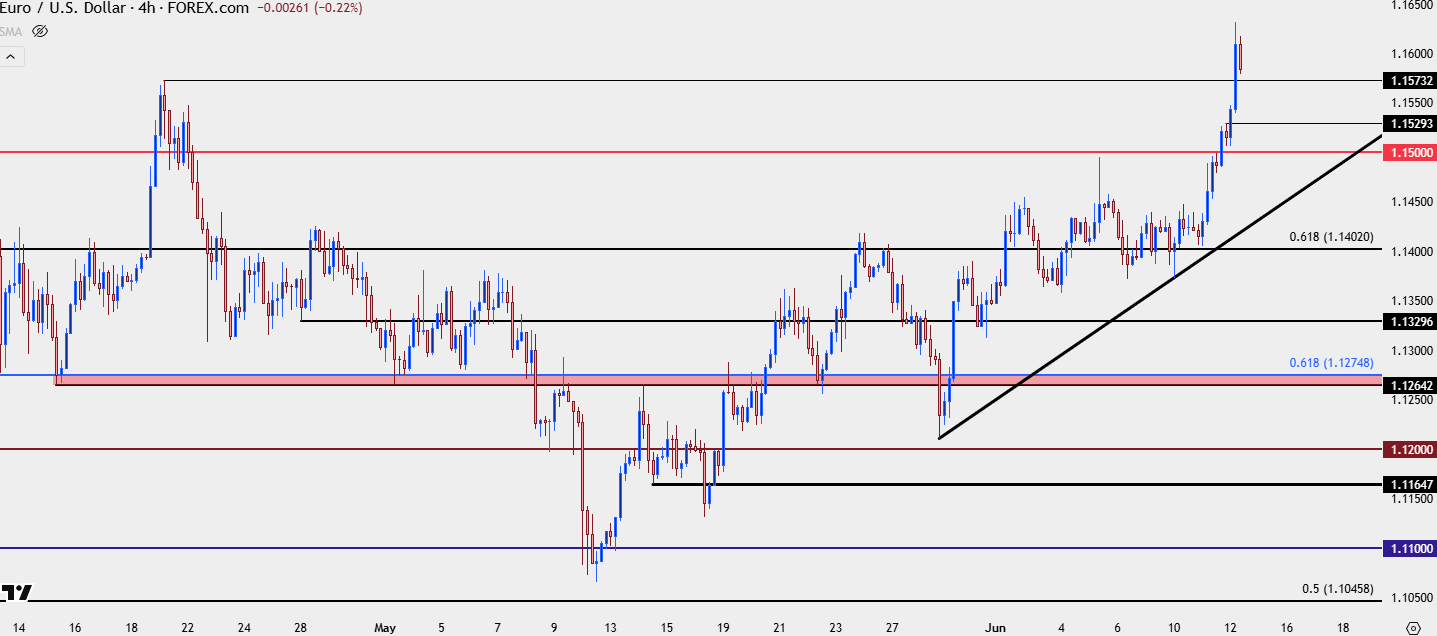

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Euro, EUR/USD Talking Points:

- EUR/USD has broken out to a fresh three-year high this morning, pushed along by the US Dollar breaking down to a fresh low after a below-expected CPI report yesterday and a below-expected PPI report this morning.

- The question now is one of continuation:As looked at in yesterday’s USD video, EUR/USD had the appearance of an inverse head and shoulders pattern, although I wanted to see bulls make a move before entertaining the long side of the pair. That’s since happened, and the question now is whether buyers can continue the move.

- I look into both EUR/USD and the USD during each webinar, and you’re welcome to join the next. Click here to register.

EURUSD AD

EUR/USD bulls are making their move. After being thwarted at the 1.1500 level in late-April buyers have forced a break above that price this morning following two below-expected U.S. data items in the form of CPI yesterday and PPI this morning. That’s helped to push expectations for U.S. rate cuts and given last week’s turn at the ECB, where the bank sounded less-dovish and hinted that their rate cut cycle may be nearing its end, this exposes a possible imbalance in forward-looking monetary policy between the two economies.

I looked at this in yesterday’s CPI reaction video, highlighting an inverse head and shoulder like formation but still hesitating to get aggressive on the bullish side of the matter given the continued failure to push through the 1.1500 handle. That happened overnight and bulls made a jump all the way through the 1.1600 handle, opening the door for bullish continuation scenarios as the USD has broken down to fresh lows.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Whether the trend has more continuation potential on a softening backdrop around U.S. rates, we will have to wait for confirmation on that topic as next week brings the FOMC rate decision and to this point, the Fed has been cautious around talking up rate cuts due to the possible impact of tariffs. Interestingly, it was the rate cuts last year that led into the push higher in inflation through the open of this year, with headline CPI peaking at 3.0% YoY in February. At the time the tariff topic had started to take over and the Fed pointed to that as the reason why they wanted to remain cautious with policy in the near-term. But, realistically the fact that inflation had moved up probably had something to do with it, as well, and given that inflation has been pushing back down, markets are getting more warm to the idea that the Fed may push a rate cut sooner than previously expected.

Next Wednesday’s FOMC rate decision is a quarterly rate decision so we’ll also get updated guidance and forecasts, which will help to add some additional color to the situation. But until then, price action is showing bullish continuation and that keeps the door open for topside momentum strategies. Price has already tested the 1.1600 handle in EUR/USD and chasing an already developed breakout could be a challenging way of moving forward. But, from prior structure there’s a few spots of interest for higher-low support potential, and this is what could draw interest for bullish continuation scenarios.

The swing high in April was at 1.1573, and that’s nearby, as of this writing. Below that, the 1.1500 level seems an obvious area of focus but, ideally, bulls would jump in a bit earlier if they remain very bullish about continuation setups, so I’m going to add an ‘s2’ level at the swing high that showed overnight after the initial break of the 1.1500 level, and that plots at 1.1529. Below that 1.1500 will function as the ‘s3’ spot of support, and if bulls fail to hold that into the end of the week, this will start to look like a failed breakout which could draw attention back towards reversal strategies in the pair as we move towards that pivotal FOMC meeting next Wednesday.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview