- EUR/USD under pressure as haven flows fade

- Risk appetite improves on US trade deal optimism

- Eurozone data starts to disappoint, U.S. pessimism already priced

- Key support at 1.1276; February 2025 Uptrend

Summary

With the ‘sell U.S. markets’ trade unwinding rapidly as optimism towards a softening of Donald Trump’s tariff stance builds, havens that motored higher in early April are struggling for traction—including the euro. With bullish momentum waning and sellers emerging on even the smallest of pops, the uptrend that took EUR/USD over ten big figures higher in a little over one month may soon come under threat, especially if concerns around hard U.S. economic data fail to materialise. On that front, Friday’s U.S. non-farm payrolls report looms large for traders.

Safe Haven Flows Dry Up

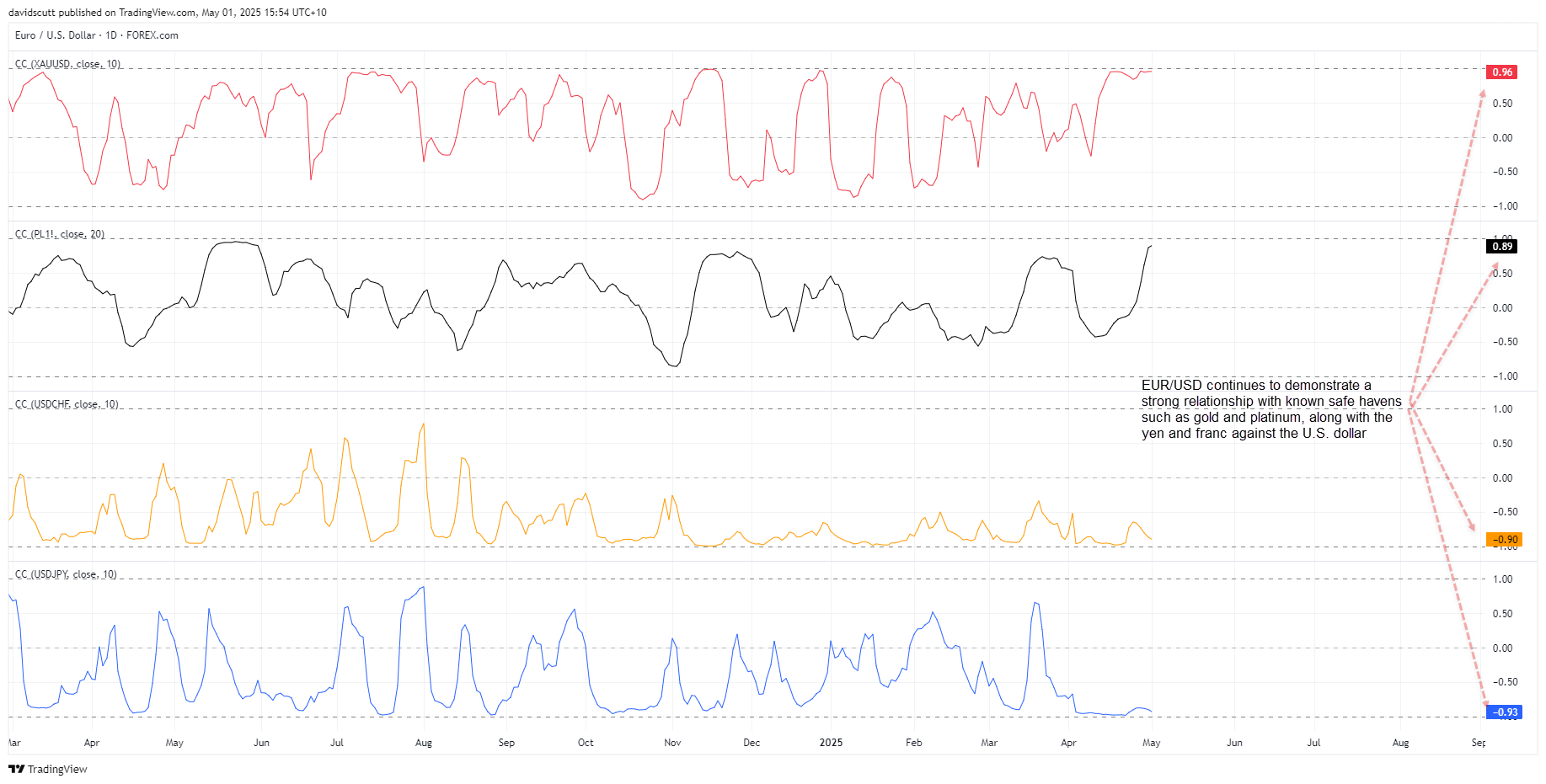

Just as strong buying following U.S. liberation day helped propel safe havens higher in early April, so too has renewed risk appetite helped starve the rallies of oxygen in the period since. The correlation analysis below suggests EUR/USD should be included in that list, demonstrating incredibly strong relationships with havens such as gold and platinum, along with the franc and yen over the past fortnight against the U.S. dollar.

Source: TradingView

European Activity Starts to Whiff

But with U.S. equity and fixed income markets now rallying in unison as the threat to activity from reciprocal tariffs is temporarily delayed, demand for havens has subsided, resulting in a noticeable shift in price action in EUR/USD over the past week. Gone is the relentless bid, replaced by evidence of profit-taking and selling into strength.

It may only be a little over two big figures from the recent highs, but the risk of this modest pullback developing into something more significant is arguably growing, especially with signs the Euro area economy is starting to disappoint relative to what were increasingly optimistic expectations only a few weeks ago.

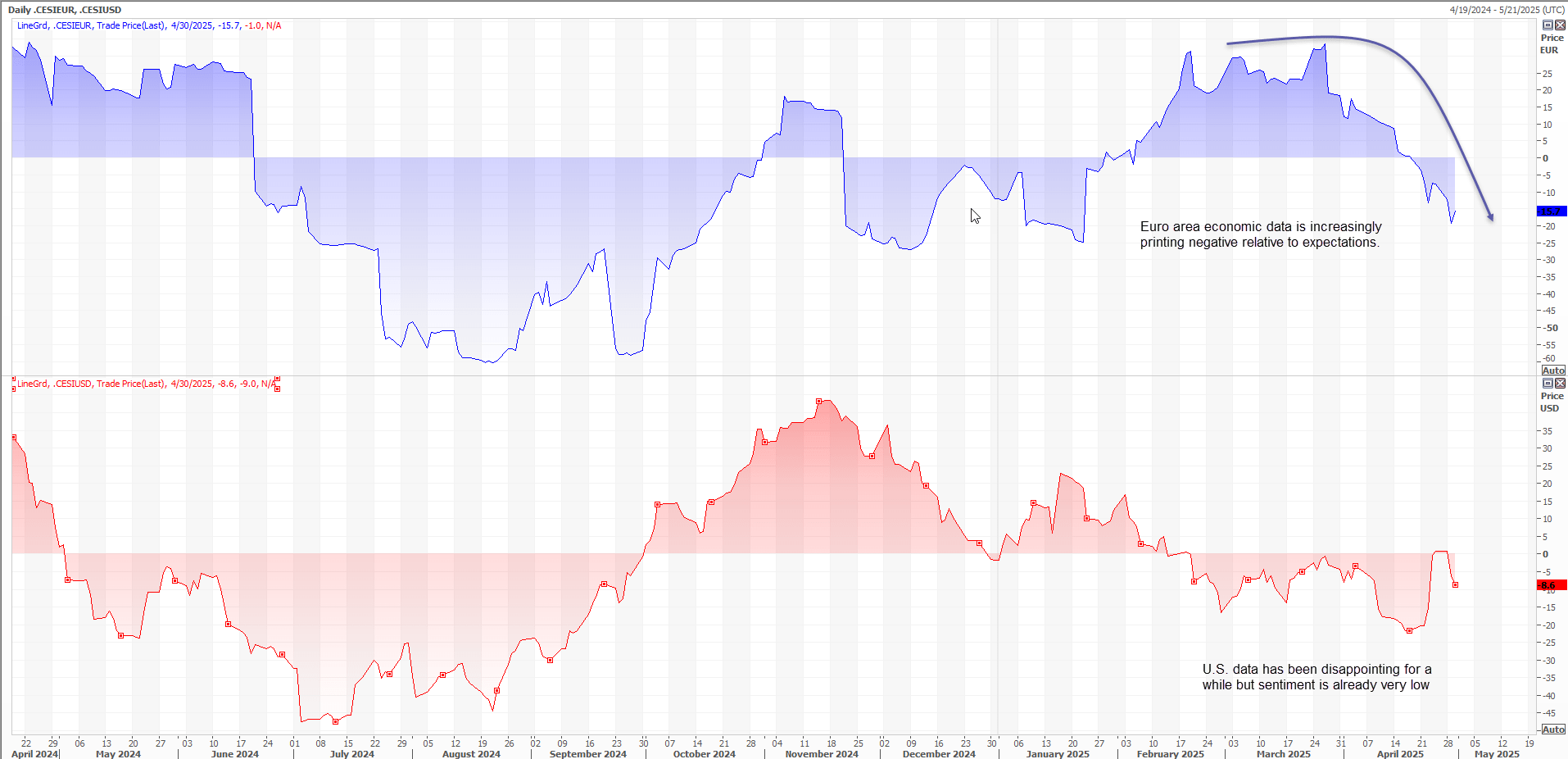

Source: Refinitiv

Citi’s EUR economic surprise index—which measures how data prints relative to expectations and is weighted by market impact—has slipped into negative territory almost by stealth recently, a stark turnaround from when most releases were beating on the topside earlier this year. While the USD version is also negative, sentiment towards the U.S. economic outlook is already low. For the Euro area, the recent chatter has been about how growth across the bloc exceeded expectations in Q1.

Key Economic Data Looms Large

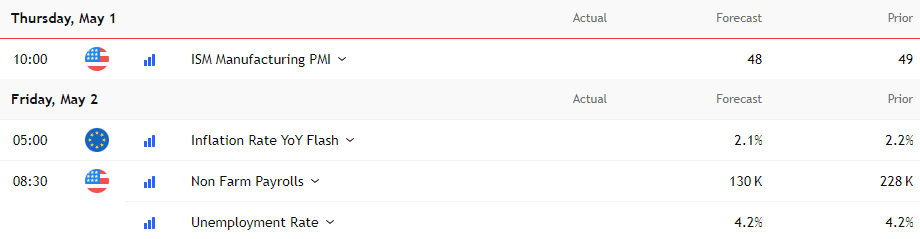

Source: TradingView

But can the economic divergence on either side of the Atlantic continue, with so much demand for European goods brought forward by U.S. tariff policy uncertainty? On that front, Friday will be important for EUR/USD traders, with flash euro area inflation data and U.S. non-farm payrolls scheduled for release. Both—especially payrolls, given the linkages are direct—will provide evidence of how economic activity is faring. It will be an important volatility event.

EUR/USD Bears Selling into Strength

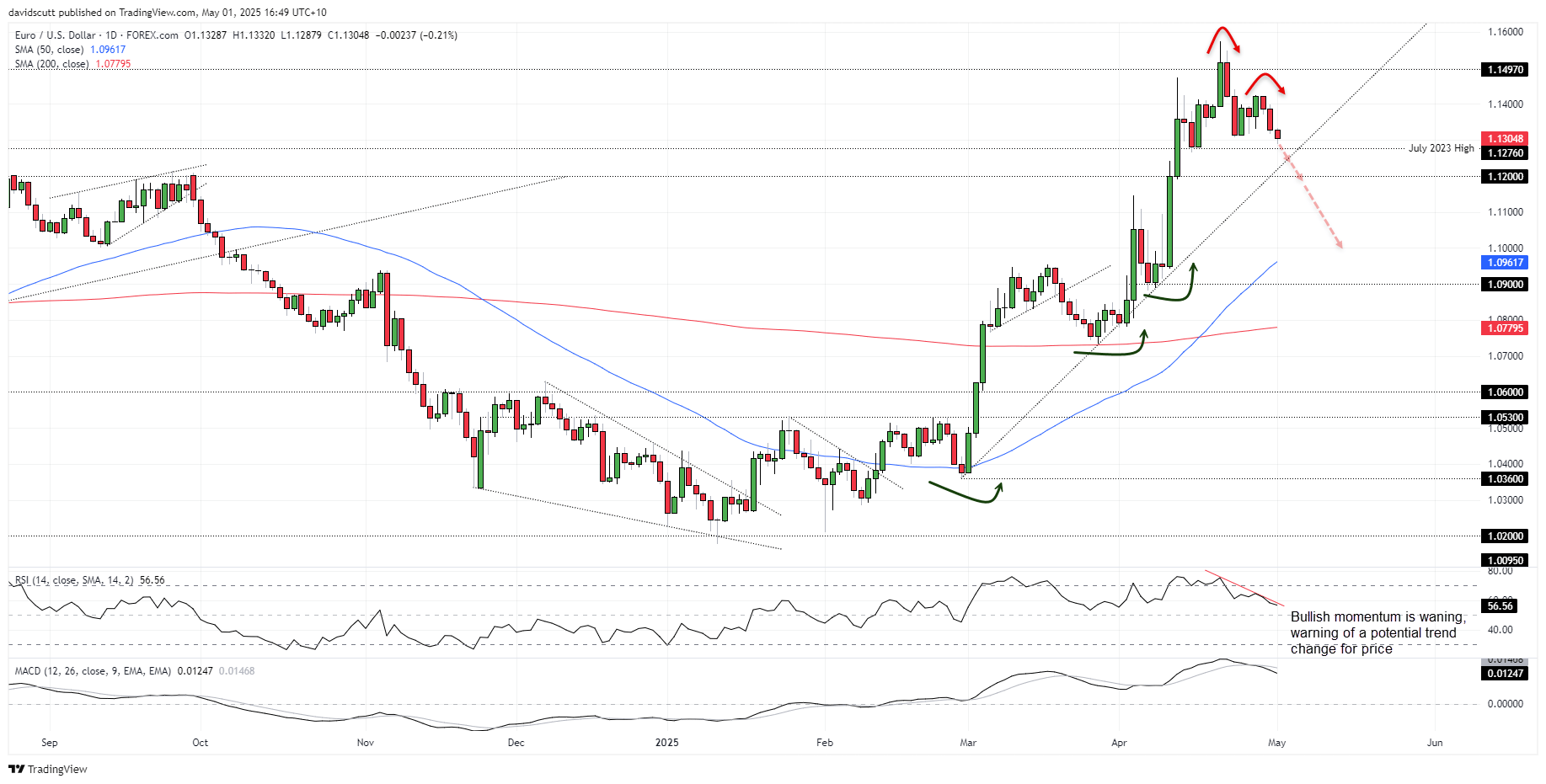

The high of 1.1573 set on April 21 may well prove to be the cycle high for EUR/USD if U.S. economic exceptionalism defies the bears again. Bullish momentum is waning, with RSI (14) and MACD trending lower even if they remain in positive territory, hinting we may be in the early stages of a broader bearish shift.

Source: TradingView

For now, horizontal support at 1.1276 remains the immediate area of focus, along with uptrend support dating back to the start of the bullish run in late February. If those levels were to give way, only support at 1.1200 stands in the way of a potential unwind back towards 1.0900 or even the 200-day moving average. Overhead, sellers have emerged on pushes towards 1.1420 recently, making that a zone of interest for those contemplating short setups.

-- Written by David Scutt

Follow David on Twitter @scutty