Euro Outlook: EUR/USD

EUR/USD still carves a series of higher highs and lows with the US on track to impose reciprocal tariffs on April 2, but data prints coming out of the Euro Area may drag on the exchange rate as the Consumer Price Index (CPI) is anticipated to show slowing inflation.

Euro Forecast: EUR/USD Cup-and-Handle Formation Takes Shape

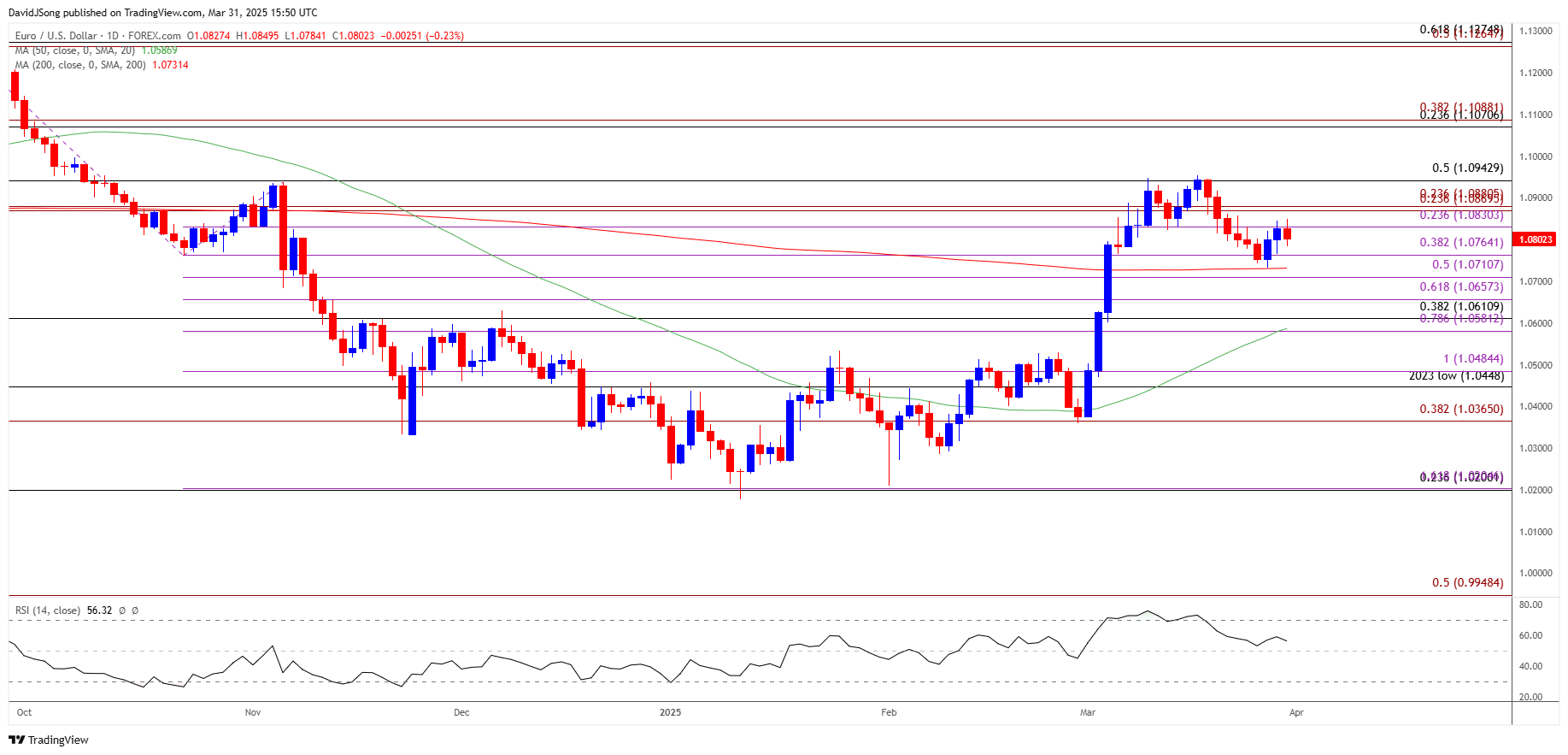

The opening range for April is in focus for EUR/USD as a cup-and-handle formation seems to be taking shape, and the exchange rate may track the positive slope in the 50-Day SMA (1.0587) should it continue to retrace the decline from the monthly high (1.0955).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Euro Area Economic Calendar

However, the update to the Euro Area CPI may produce headwinds for EUR/USD as both the headline and core rate of inflation is expected to narrow in March, and signs of slower price growth may encourage the European Central Bank (ECB) to implement lower interest rates as ‘most indicators of underlying inflation are pointing to a sustained return of inflation to our two per cent medium-term target.’

At the same time, a higher-than-expected CPI print may push the Governing Council to the sidelines as President Christine Lagarde and Co. pledge to ‘follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance,’ and indications of sticky price growth may keep EUR/USD afloat as it curbs speculation for another ECB rate-cut.

With that said, EUR/USD may further retrace the decline from the monthly high (1.0955) should the bullish price series persist, but the exchange rate may negate the cup-and-handle formation if it struggles to defend the advance from the monthly low (1.0377).

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- A cup-and-handle formation seems to be taking shape as EUR/USD attempts to extend the rebound from last week, and a move above the 1.0830 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region may push the exchange rate towards the monthly high (1.0955).

- A close above 1.0940 (50% Fibonacci retracement) brings the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) zone on the radar, but EUR/USD may negate the reversal pattern if it struggles to defend the recent series of higher highs and lows.

- Failure to hold above the 1.0660 (61.8% Fibonacci extension) to 1.0710 (50% Fibonacci extension) region may push EUR/USD towards the 1.0580 (78.6% Fibonacci extension) to 1.0610 (38.2% Fibonacci retracement) zone, with the next area of interest coming in around 1.0448 (2023 low) to 1.0480 (100% Fibonacci extension).

Additional Market Outlooks

Gold Price Halts Decline from Record High Ahead of Trump Tariffs

Australian Dollar Forecast: AUD/USD Coils Ahead of RBA Rate Decision

Canadian Dollar Forecast: USD/CAD Continues to Coil with More Trump Tariffs on Tap

USD/JPY Pulls Back Ahead of Monthly High with US PCE in Focus

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong