Euro Outlook: EUR/USD

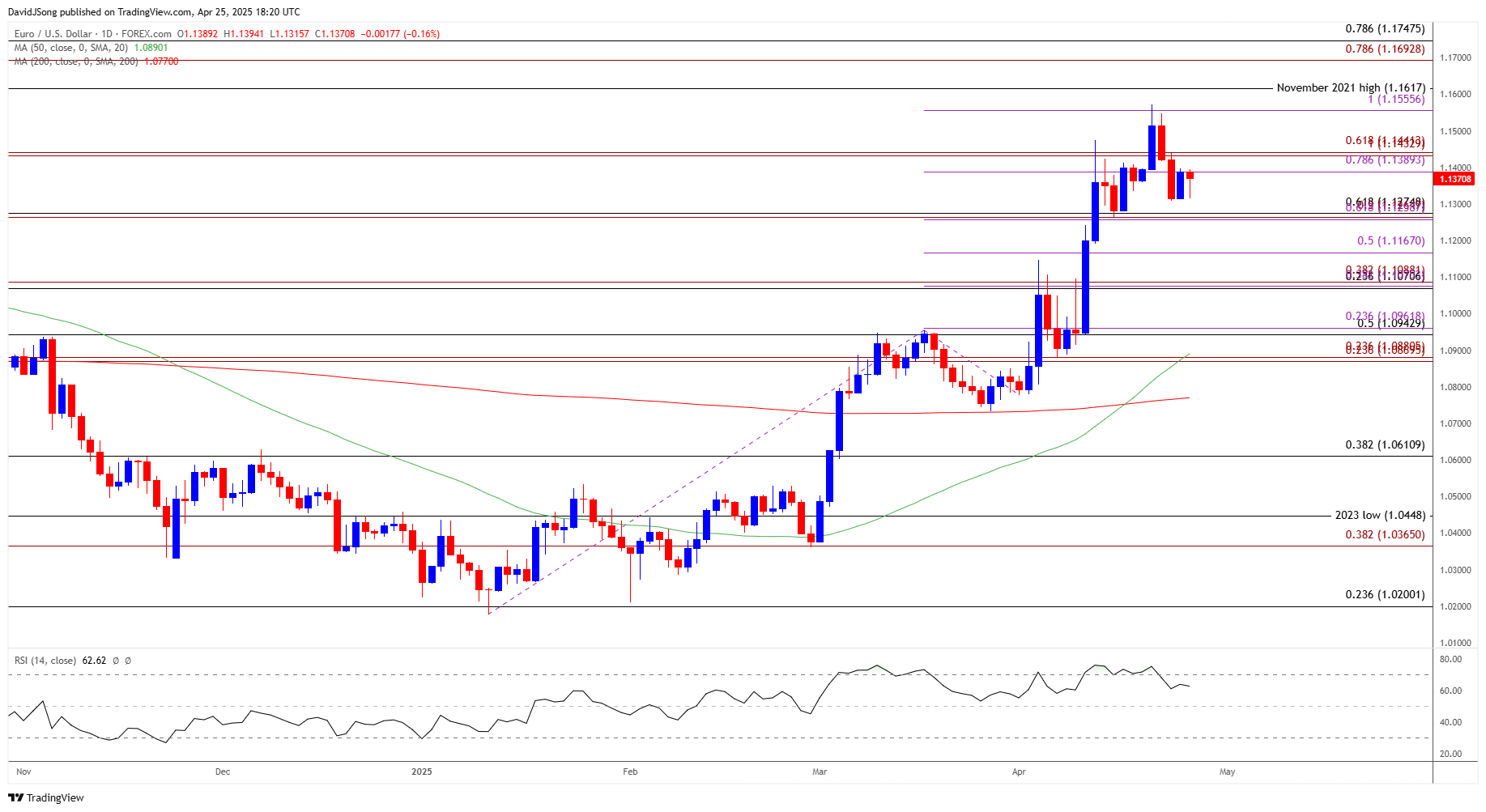

EUR/USD is little changed from the start of the week amid the failed attempt to test the November 2021 high (1.1617), but the exchange rate may continue to coil above the 50-Day SMA (1.0890) as it defends the weekly low (1.1308).

Euro Forecast: EUR/USD Defends Weekly Low Ahead of Euro Area GDP Report

The range bound price action in EUR/USD may turn out to be temporary as it fulfilled a cup-and-handle formation earlier this month, and the exchange rate may continue to establish a bullish trend as it appears to be tracking the positive slope in the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Euro Economic Calendar

Looking ahead, data prints coming out of the Euro Area may sway EUR/USD as the Gross Domestic Product (GDP) report is anticipated to show the economy growing another 0.2% in the first quarter of 2025, and a positive development may push the European Central Bank (ECB) to the sidelines as the economy shows little signs of a recession.

In turn, waning expectations for another ECB rate cut may generate a bullish reaction in the Euro, but a weaker-than-expected GDP print may drag on EUR/USD as it puts pressure on the Governing Council to implement lower interest rates.

With that said, EUR/USD may face a larger pullback should it fail to defend the weekly low (1.1308), but the exchange rate may stage further attempts to test the November 2021 high (1.1617) as it establishes a bullish trend.

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD may consolidate over the remainder of the month as the Relative Strength Index (RSI) no longer reflects an overbought reading, but failure to hold above the weekly low (1.1308) may push the exchange rate towards the 1.1260 (61.8% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region.

- A break/close below 1.1170 (50% Fibonacci retracement) brings the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) zone on the radar, with the next area of interest coming in around 1.0940 (50% Fibonacci retracement) to 1.0960 (23.6% Fibonacci extension).

- At the same time, a move above the 1.1390 (78.6% Fibonacci extension) to 1.1440 (61.8% Fibonacci extension) region may push EUR/USD back towards 1.1560 (100% Fibonacci extension), with a breach above the monthly high (1.1573) raising the scope for a test of the November 2021 high (1.1617).

Additional Market Outlooks

AUD/USD V-Shape Recovery Stalls Ahead of December High

GBP/USD Rebound Vulnerable to Weak UK Retail Sales Report

Gold Price Coils Above 50-Day SMA

Canadian Dollar Forecast: USD/CAD Cracks November Low Ahead of Election

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong