Euro, EUR/USD Talking Points:

- EUR/USD bulls made a push last week but fell five pips short of re-testing the 1.1500 psychological level.

- That price remains a big point for the pair as it was tested in April before a 400+ pip reversal appeared.

- I look into EUR/USD in-depth in each weekly webinar, and you’re welcome to attend the next. Click here to register.

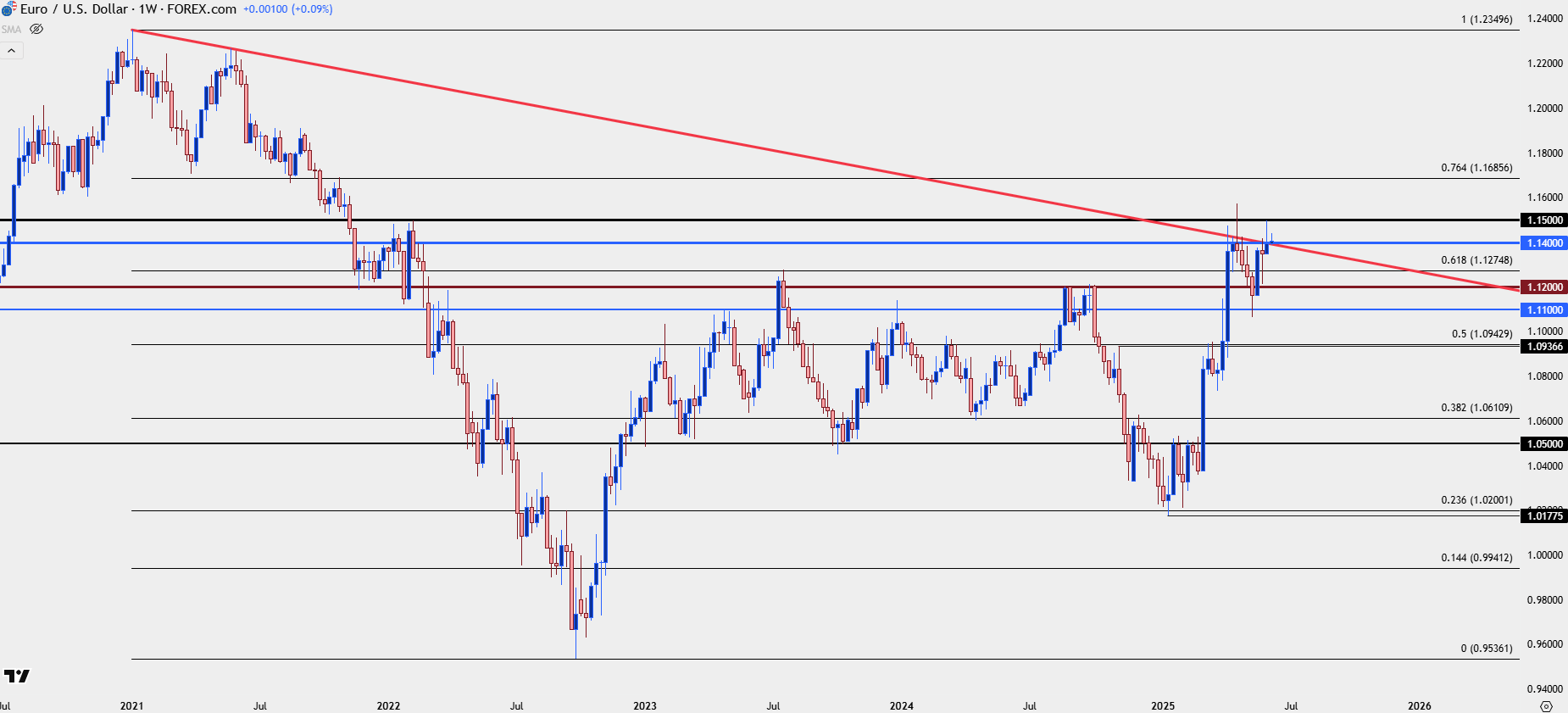

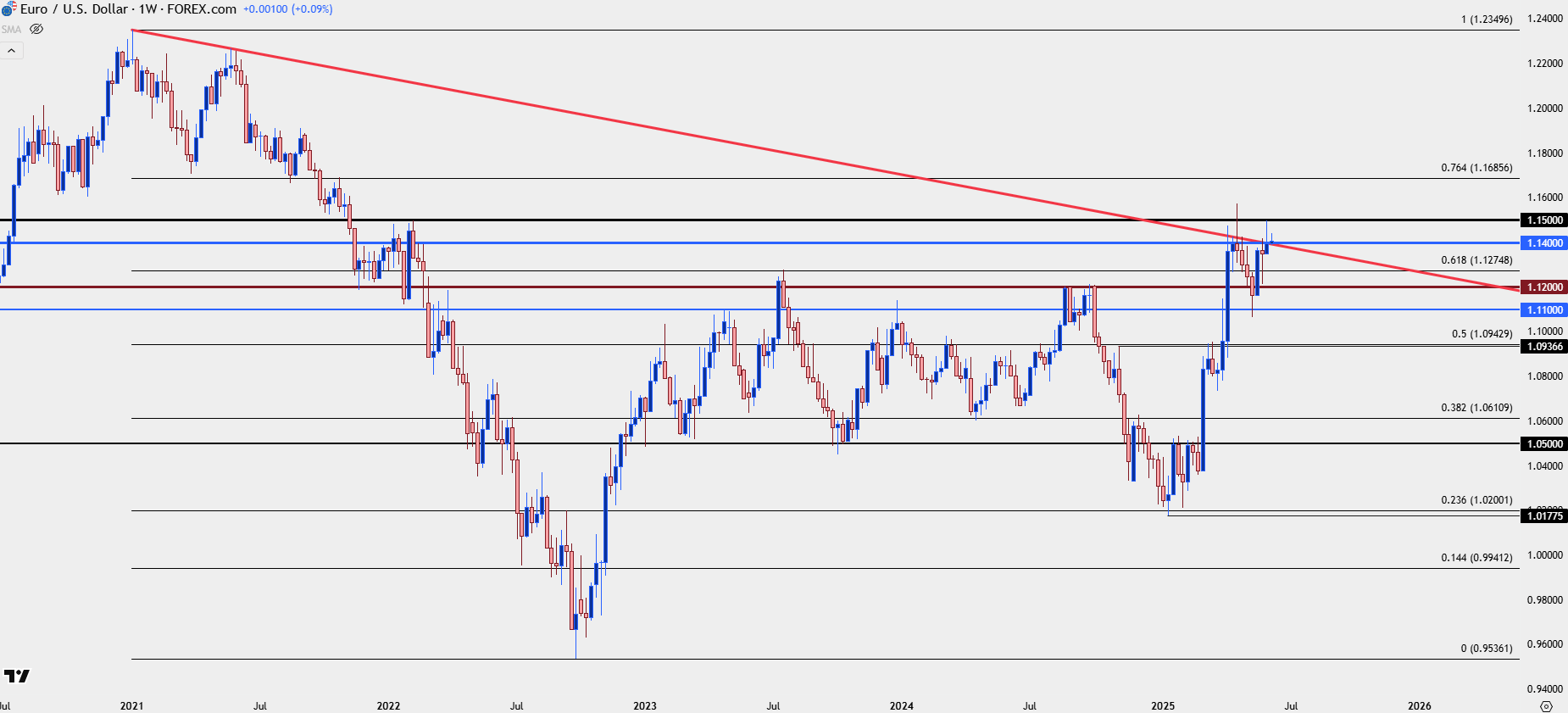

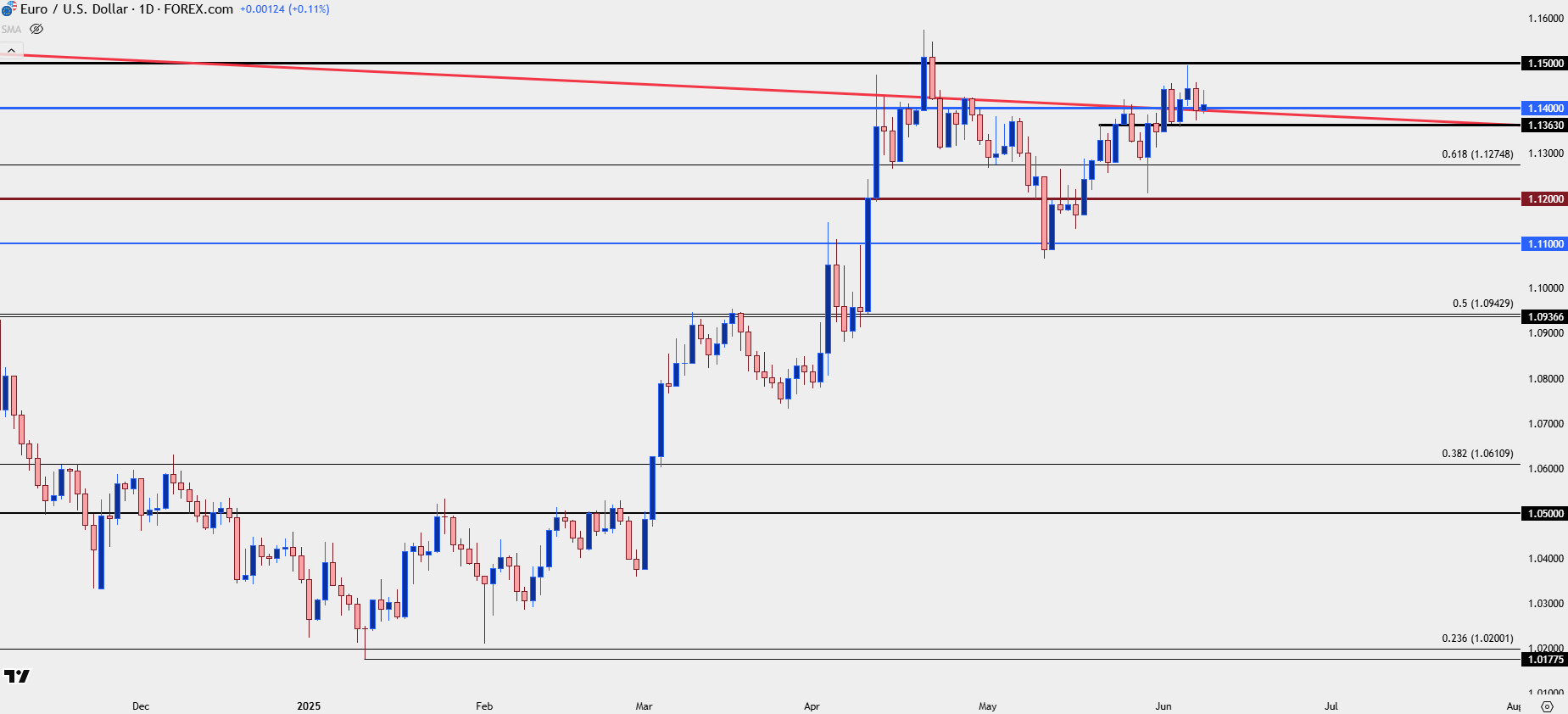

It’s been a surprisingly strong year for EUR/USD as the pair came into 2025 with many forecasting another parity test. In Q4 of 2024 the Euro had dropped like a rock against the U.S. Dollar, setting a fresh two-year-low before finally finding some support around the 1.0200 handle in January.

The change wasn’t fast, as there was continued grind into the February open, but it was that first trading day of February when matters began to shift to a ‘less bearish’ backdrop as a higher-low held above the 1.0200 Fibonacci level, and bulls started to hit back with repeated tests of the 1.0500 handle.

March is when matters began to shift more visibly as a hard sell-off in the USD on the back of recession fears helped to drive a massive move in EUR/USD that could even be considered as historic in scope. That drive continued through the first few weeks of April, even if the reasons in the backdrop began to shift with President Trump taking a softer stance with tariffs.

It was Easter Monday when EUR/USD finally re-tested the 1.1500 handle. That was the first test there since February of 2022, when that price set as a lower-high before sellers took over – and eventually drove below the parity level later that year. When it was re-tested in April, bulls couldn’t get very far above and then a pullback started to show until the 1.1100 level provided a bit of support, leading into a bounce.

The 1.1500 level was almost back in-play last week around the ECB rate decision. The bank sounded less-dovish than expected, and EUR/USD vaulted towards the big figure before bulls suddenly stalled five pips below the level. That remains resistance as we move deeper into June trade.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Grinding Higher

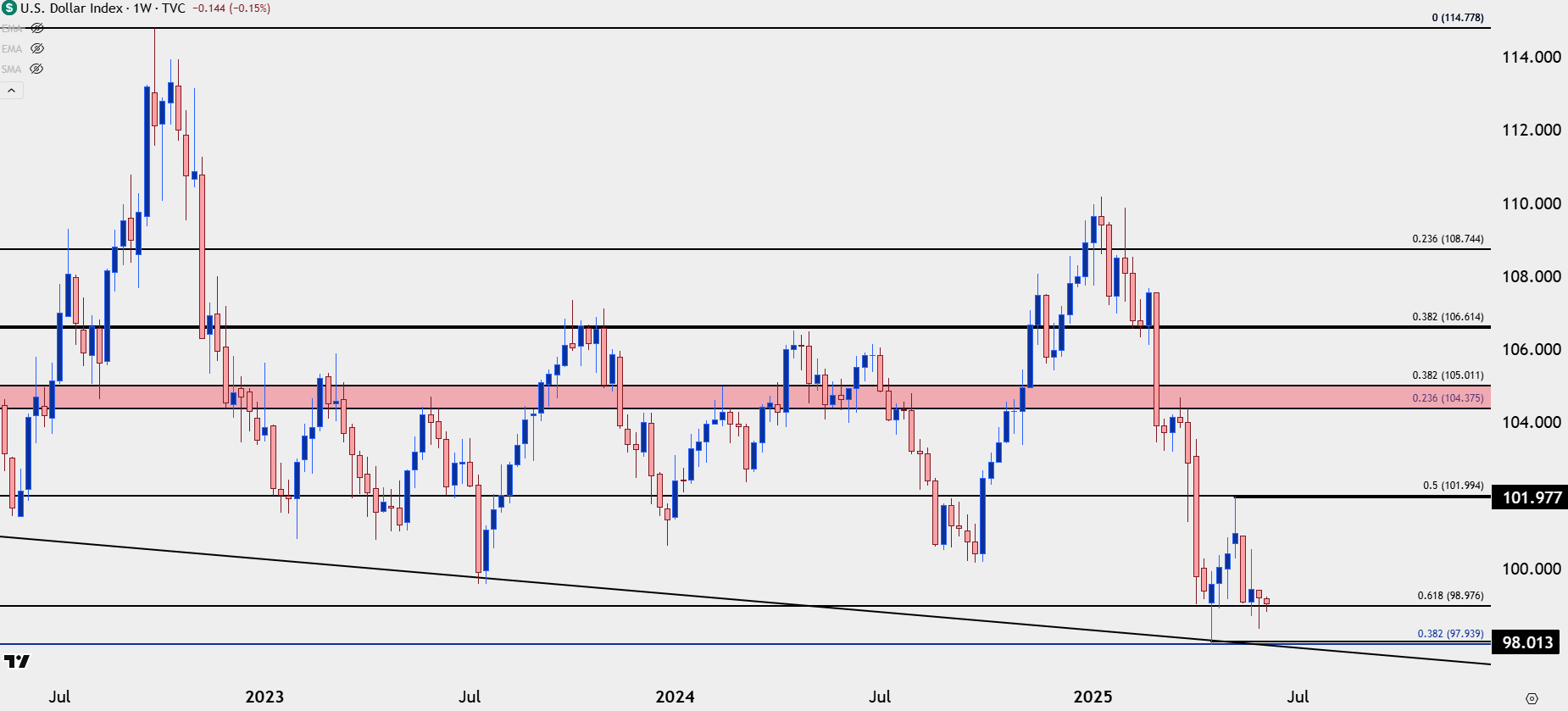

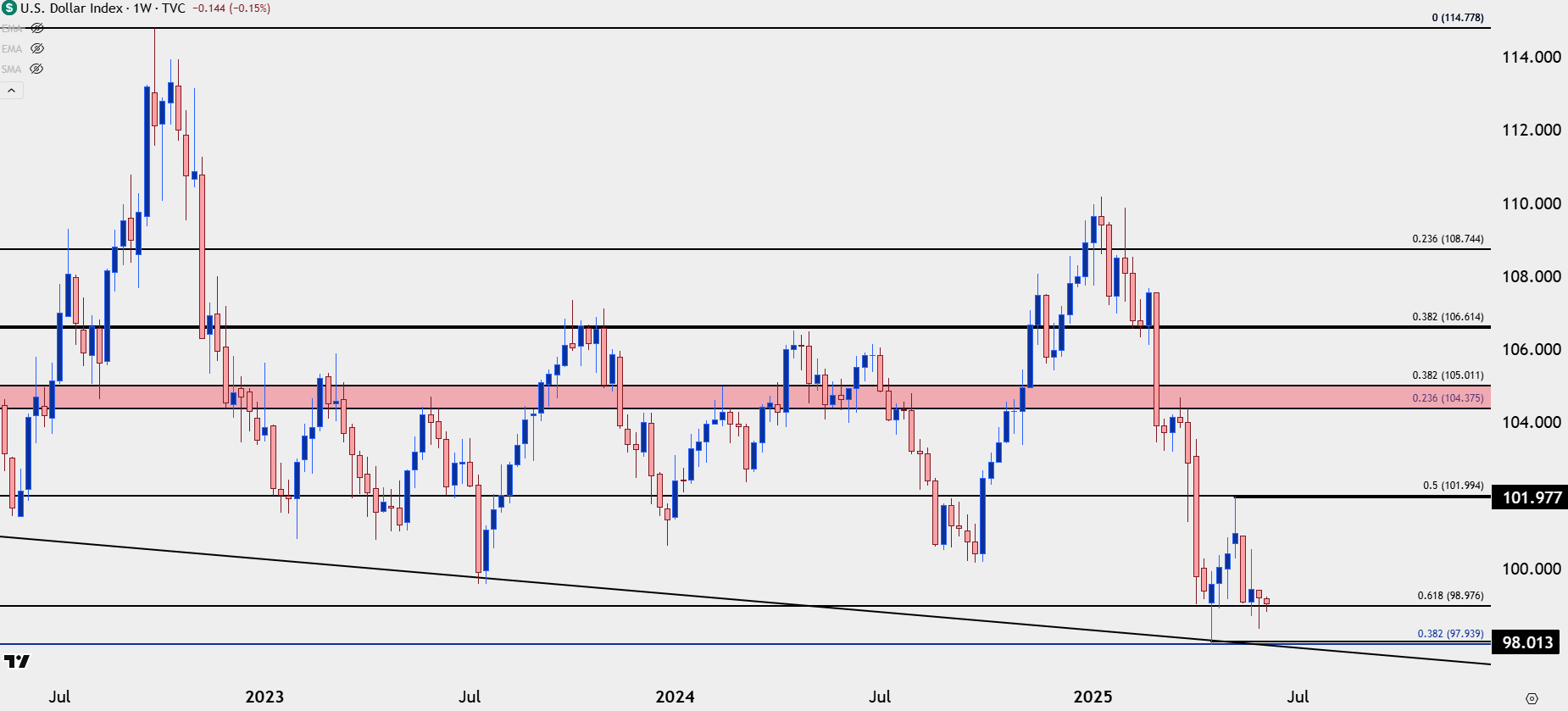

Since the 1.1100 test about a month ago, EUR/USD bears haven’t been able to show much for progress, and this goes along with a generally weaker USD that has continued to fall since the resistance test at 102.00 in DXY.

What could make the pair more attractive on the short side is comparison to other majors: While EUR/USD is holding at a lower-high, GBP/USD set a fresh three-year-high last week, and USD/CAD a fresh 2025 low last Thursday. On a relative basis, there could be attraction on the short-side of the Euro for those that are looking for a bounce in the U.S. Dollar. But that’s the big question at this point, and this puts attention to this week’s CPI report out of the United States.

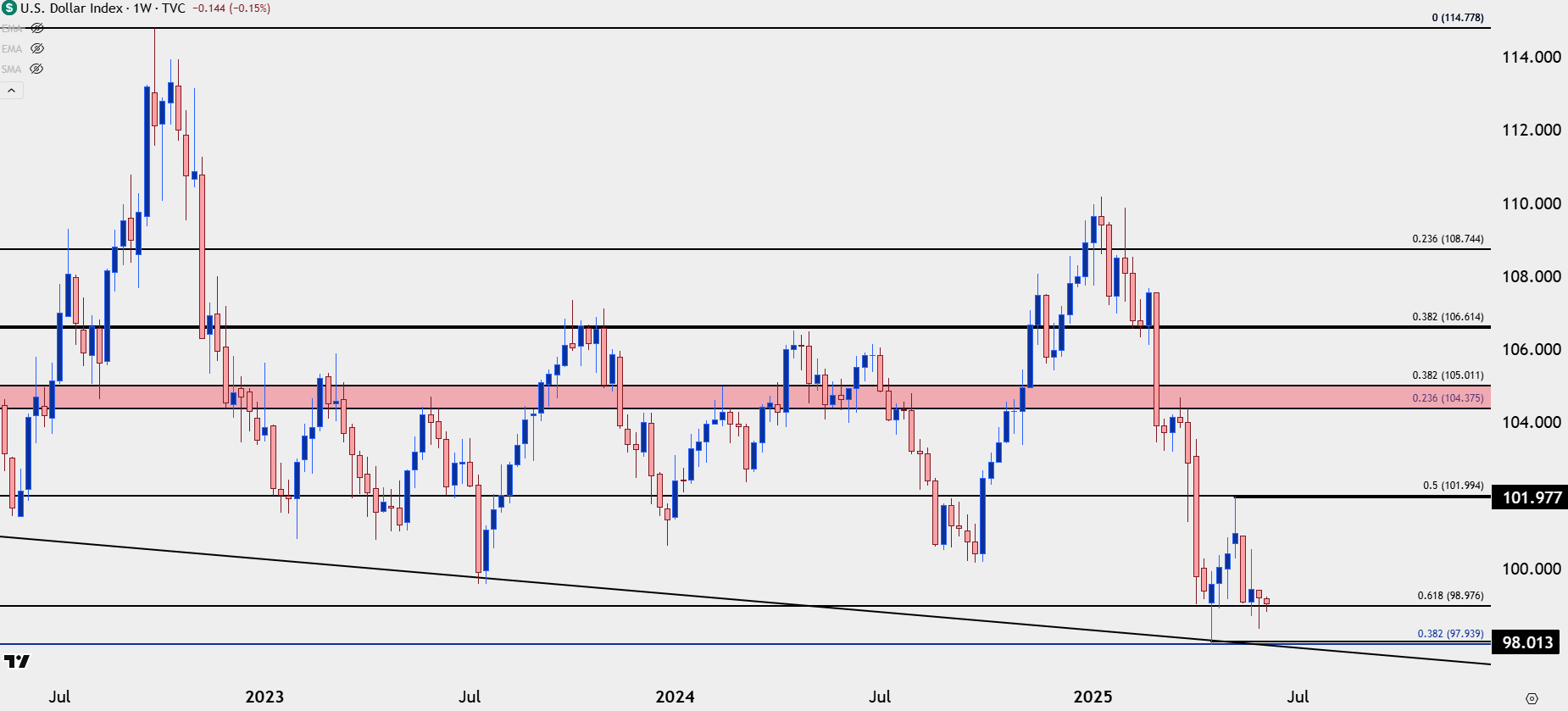

From the weekly chart of DXY, there could be a case for a USD bounce scenario, as so far the Dollar has held a higher-low at a key Fibonacci level of 98.98. That coincides more with the lower-high in EUR/USD than the fresh highs in GBP/USD or the fresh lows in USD/CAD.

I think there will be a strong USD/JPY component in the mix for the US Dollar, as well, although that pair has shown a tendency to brew traps on either side of the market; and collectively that can make reversal strategies in EUR/USD as one of the more attractive ways of approaching bullish USD setups.

U.S. Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

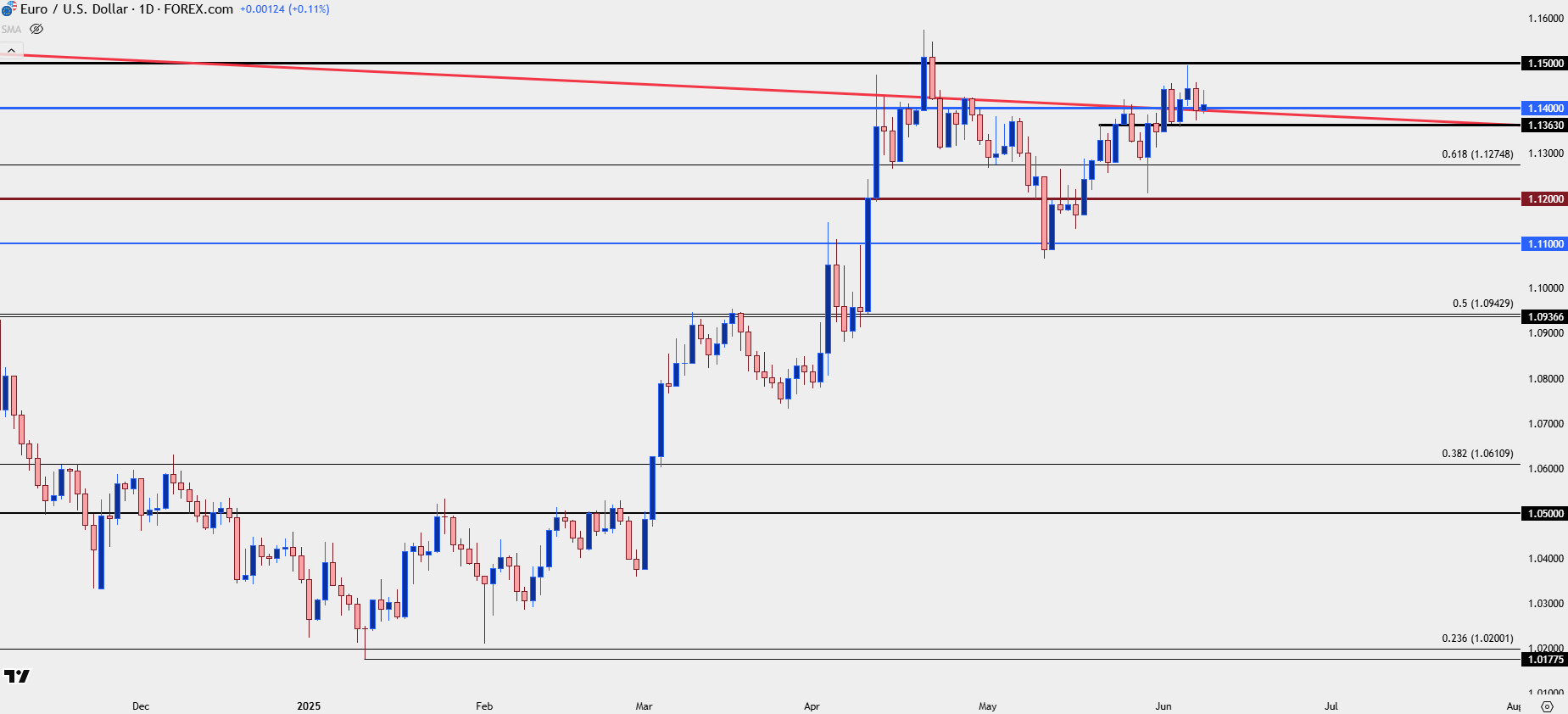

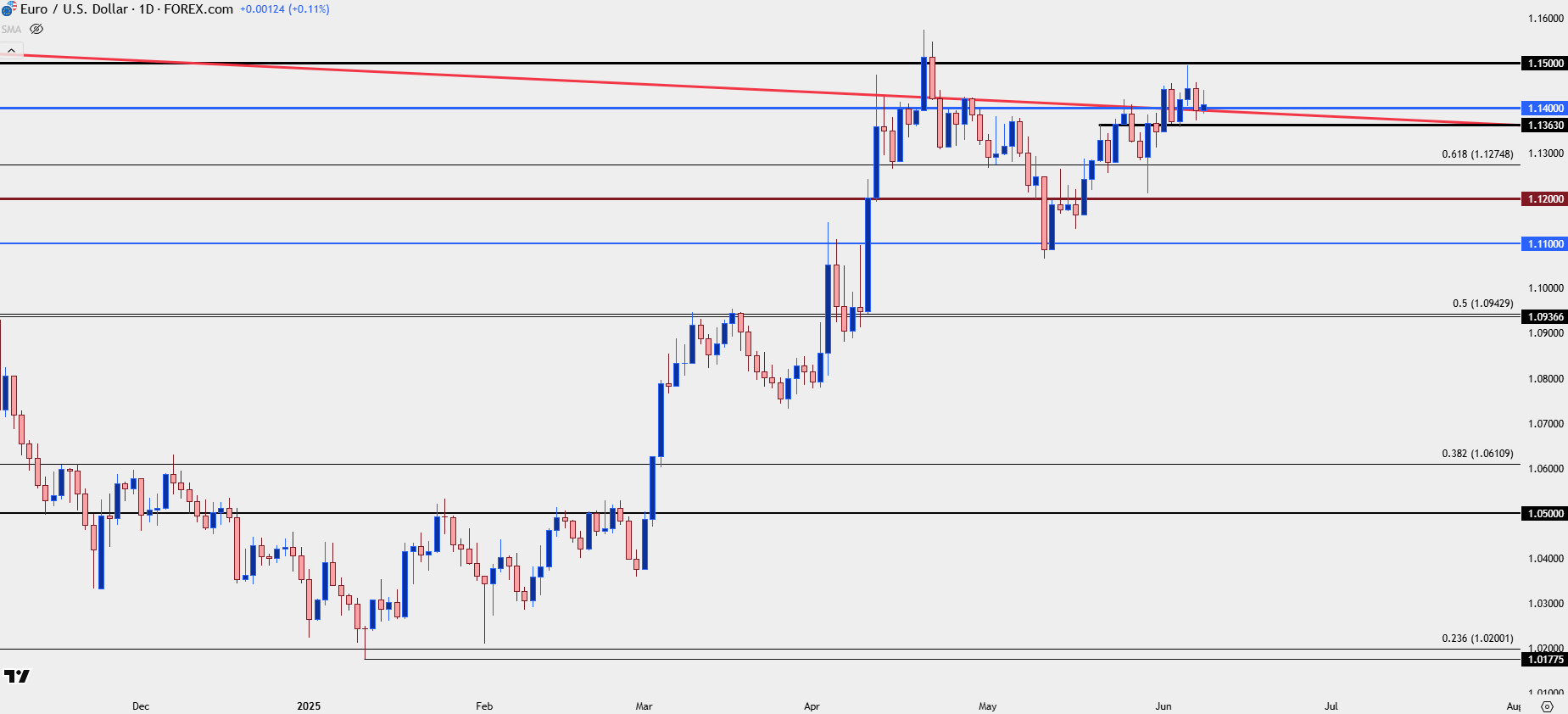

EUR/USD Shorter-Term

At this point the daily would continue to show a bullish lean as we have a higher short-term high last week along with a series of higher-lows. So far this week, it’s the 1.1400 level that’s been in as support, so there’s not yet a backdrop for a turn via price action.

This then sets up for a couple of different scenarios: The first would be a test and failure above the 1.1500 handle. This would need to be supported by an upper wick showing sellers reacting to a run above that level. Or, alternatively, a breach of 1.1363 which set support last week, after which the 1.1275 level comes into view as the next area of support potential. If bears can chew through those prices, it’ll be evidence of their willingness to take on more control, and that would then highlight supports at 1.1200 and then 1.1100 as levels of interest for downside continuation.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Euro, EUR/USD Talking Points:

- EUR/USD bulls made a push last week but fell five pips short of re-testing the 1.1500 psychological level.

- That price remains a big point for the pair as it was tested in April before a 400+ pip reversal appeared.

- I look into EUR/USD in-depth in each weekly webinar, and you’re welcome to attend the next. Click here to register.

EURUSD AD

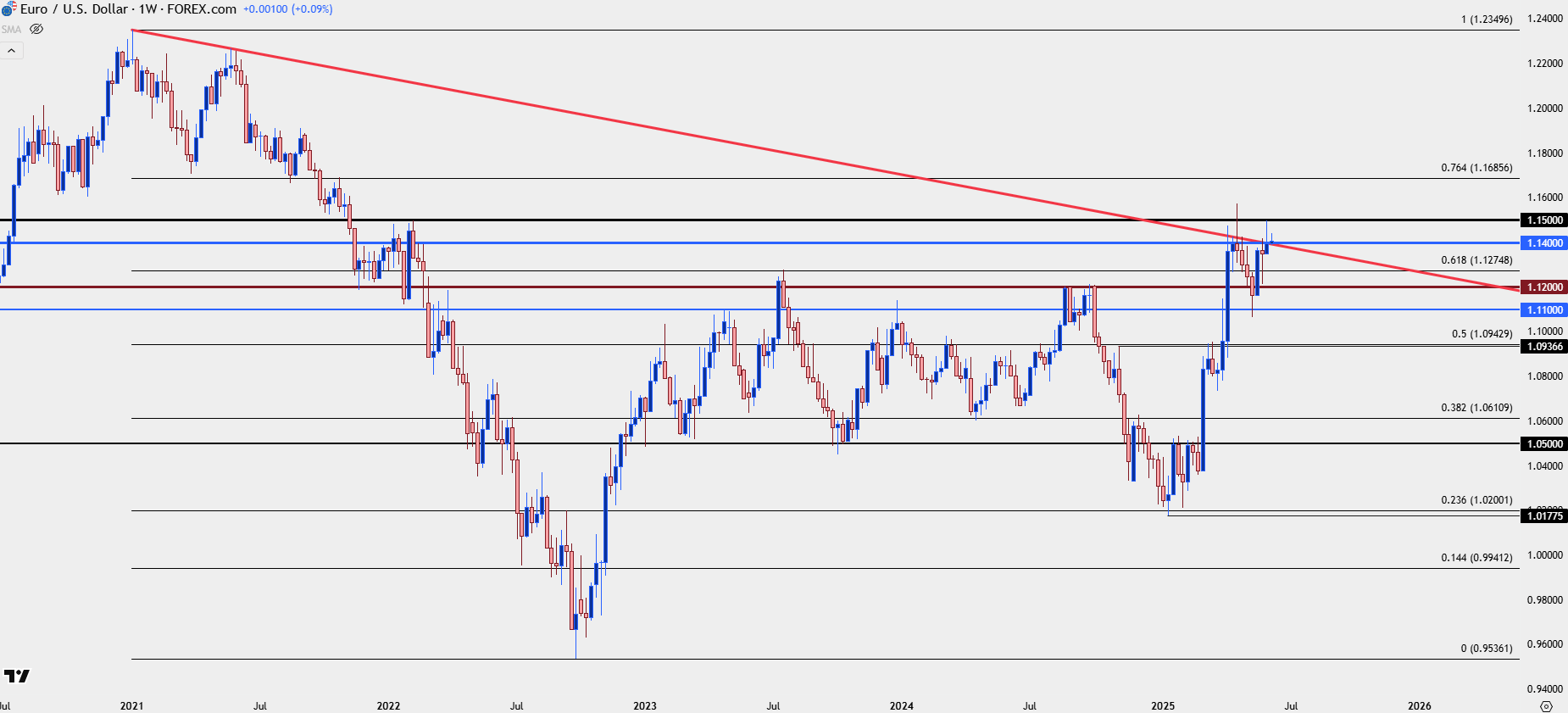

It’s been a surprisingly strong year for EUR/USD as the pair came into 2025 with many forecasting another parity test. In Q4 of 2024 the Euro had dropped like a rock against the U.S. Dollar, setting a fresh two-year-low before finally finding some support around the 1.0200 handle in January.

The change wasn’t fast, as there was continued grind into the February open, but it was that first trading day of February when matters began to shift to a ‘less bearish’ backdrop as a higher-low held above the 1.0200 Fibonacci level, and bulls started to hit back with repeated tests of the 1.0500 handle.

March is when matters began to shift more visibly as a hard sell-off in the USD on the back of recession fears helped to drive a massive move in EUR/USD that could even be considered as historic in scope. That drive continued through the first few weeks of April, even if the reasons in the backdrop began to shift with President Trump taking a softer stance with tariffs.

It was Easter Monday when EUR/USD finally re-tested the 1.1500 handle. That was the first test there since February of 2022, when that price set as a lower-high before sellers took over – and eventually drove below the parity level later that year. When it was re-tested in April, bulls couldn’t get very far above and then a pullback started to show until the 1.1100 level provided a bit of support, leading into a bounce.

The 1.1500 level was almost back in-play last week around the ECB rate decision. The bank sounded less-dovish than expected, and EUR/USD vaulted towards the big figure before bulls suddenly stalled five pips below the level. That remains resistance as we move deeper into June trade.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Grinding Higher

Since the 1.1100 test about a month ago, EUR/USD bears haven’t been able to show much for progress, and this goes along with a generally weaker USD that has continued to fall since the resistance test at 102.00 in DXY.

What could make the pair more attractive on the short side is comparison to other majors: While EUR/USD is holding at a lower-high, GBP/USD set a fresh three-year-high last week, and USD/CAD a fresh 2025 low last Thursday. On a relative basis, there could be attraction on the short-side of the Euro for those that are looking for a bounce in the U.S. Dollar. But that’s the big question at this point, and this puts attention to this week’s CPI report out of the United States.

From the weekly chart of DXY, there could be a case for a USD bounce scenario, as so far the Dollar has held a higher-low at a key Fibonacci level of 98.98. That coincides more with the lower-high in EUR/USD than the fresh highs in GBP/USD or the fresh lows in USD/CAD.

I think there will be a strong USD/JPY component in the mix for the US Dollar, as well, although that pair has shown a tendency to brew traps on either side of the market; and collectively that can make reversal strategies in EUR/USD as one of the more attractive ways of approaching bullish USD setups.

U.S. Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Shorter-Term

At this point the daily would continue to show a bullish lean as we have a higher short-term high last week along with a series of higher-lows. So far this week, it’s the 1.1400 level that’s been in as support, so there’s not yet a backdrop for a turn via price action.

This then sets up for a couple of different scenarios: The first would be a test and failure above the 1.1500 handle. This would need to be supported by an upper wick showing sellers reacting to a run above that level. Or, alternatively, a breach of 1.1363 which set support last week, after which the 1.1275 level comes into view as the next area of support potential. If bears can chew through those prices, it’ll be evidence of their willingness to take on more control, and that would then highlight supports at 1.1200 and then 1.1100 as levels of interest for downside continuation.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview