Euro, EUR/USD Talking Points:

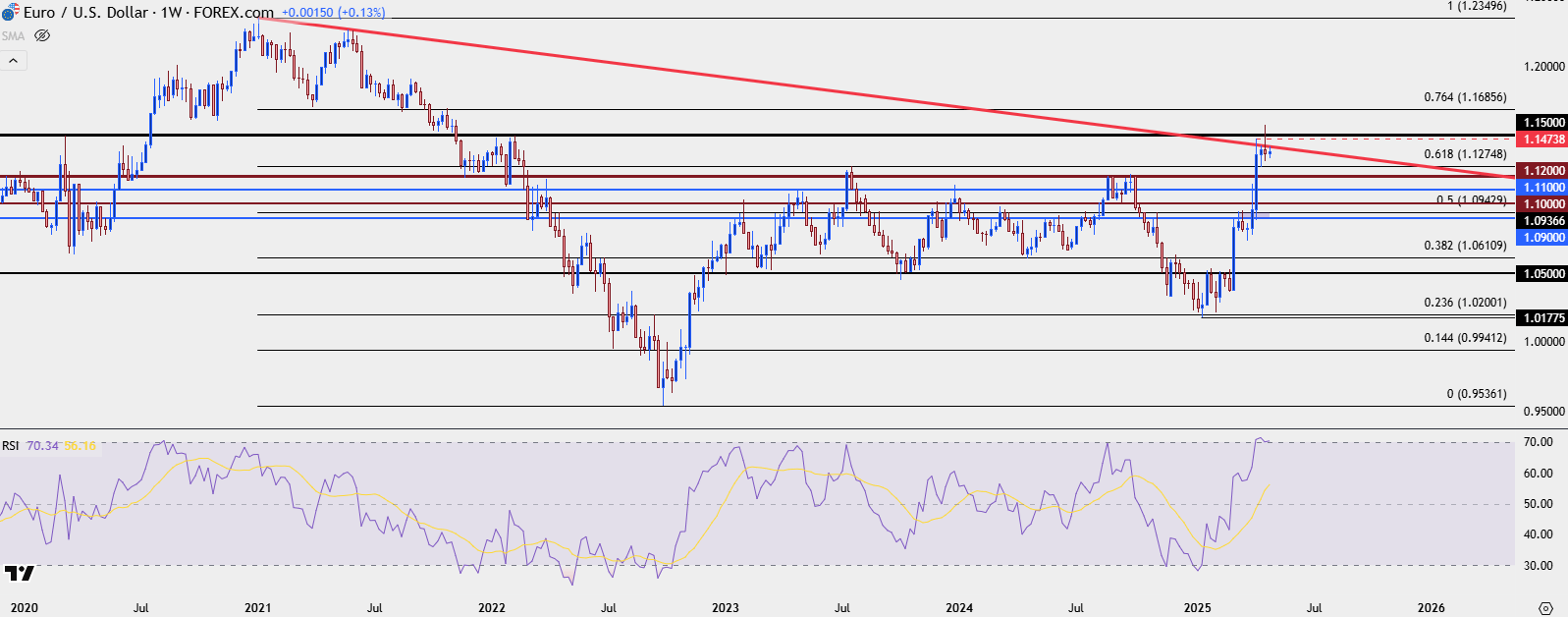

- EUR/USD remains elevated and the weekly chart remains in overbought territory, and that’s the first such test via RSI since the summer of 2020.

- While that resistance is clear, bears have had an open door to prod a pullback for a few weeks now and haven’t yet been able to. The big question now is whether the USD can force a larger pullback, which can drive a similar mirror image theme in EUR/USD.

- I’ll be looking at both markets front-and-center in tomorrow’s webinar: Click here for registration information.

While the USD retains some attractive longer-term technical context, the backdrop in EUR/USD is shorter-term in nature. The pair has posed an impressive rally of more than 12% off the year’s lows, and for a non-levered currency pair that’s an impressive move in a little more than three months. Perhaps most interesting has been the sentiment surrounding it, as the Euro seemed extremely weak coming into the New Year and more recently, it’s been the USD that’s been getting hammered.

Realistically, it’s probably best for both economies for the currencies and the pair to retain a degree of stability, like what showed in 2023 and for most of 2024. When we do have an imbalance, and a massive trend in one, the other can feel some dramatic repercussions of that. In 2022 as the Fed continued to hike rates even with the European Central Bank remaining cautious, the U.S., in essence, exported their inflation to Europe.

At this point, EUR/USD is holding resistance at a key area on the chart around the 1.1500 psychological level. Last week was the first red bar in more than a month, and the overbought condition on the weekly remains in place. While that doesn’t necessarily mean automatic reversal, it does make the prospect of chasing breakouts beyond the 1.1500 level as a more challenging scenario.

That weekly bar also takes on the form of a shooting star formation, which is often approached with aim of topping patterns or in front of bearish reversals. So for sellers looking into short-side swings, there could be some context to work off of if the market continues to build on that backdrop.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Directional Dilemmas

As mentioned above, RSI being in overbought on the weekly doesn’t mean that price has to fall. And we can look at the prior episode of overbought RSI on the weekly back in 2020 to see that the pair didn’t top then as it rose to another fresh high five months later.

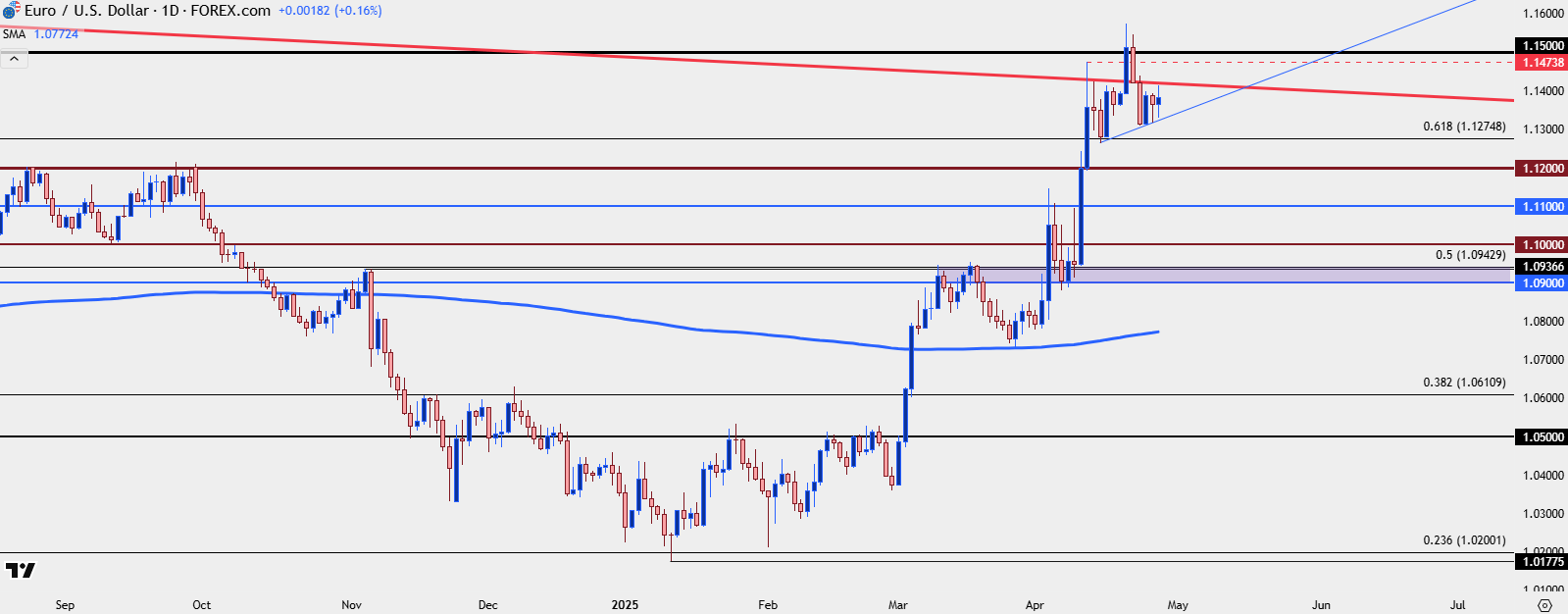

So, at this point I wouldn’t want to assume bearish control just yet as bulls have continued to bid support, even with price near this area of longer-term resistance.

On that front, there was strong defense of the 1.1275 level two weeks ago, and that led to a higher-low last week. In the event of a deeper pullback, the 1.1200 level is still of interest as this was the highs in 2024 on two separate occasions and since the breakout earlier in April, it hasn’t yet come in as support. Even the 1.1100 level could have claim as higher-low support on a bigger picture basis; and I’d be careful of getting optimistic about reversal scenarios until sellers were able to start testing below the 1.1000 psychological level again.

The 200-day moving average projects below 1.0800 still, which illustrates just how quickly this bullish move has come on. That level was the higher-low in late-March so it helps to put into context just how aggressively bulls pushed in early-April.

EUR/USD Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist