Euro Technical Forecast: EUR/USD Weekly Trade Levels

- Euro rally extends to multi-year highs- bulls stall into uptrend resistance

- EUR/USD threat for further exhaustion within broader uptrend- Fed rate decision on tap

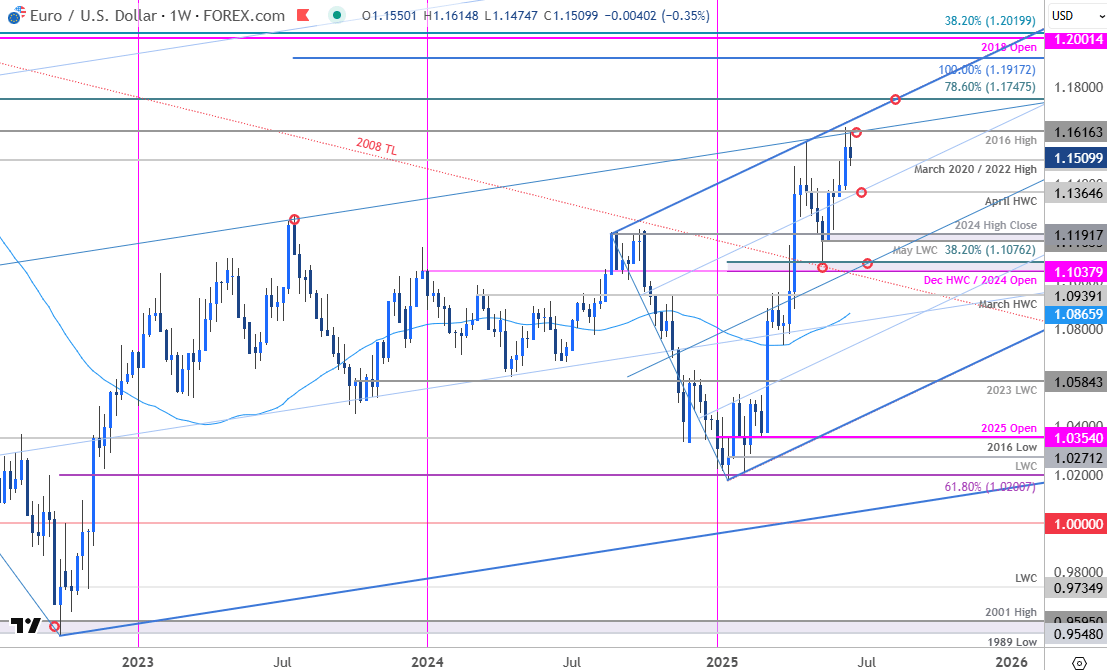

- Resistance 1.1616 (key), 1.1748, 1.1917- Support 1.1365 (key), 1.1164/94, 1.1038/76

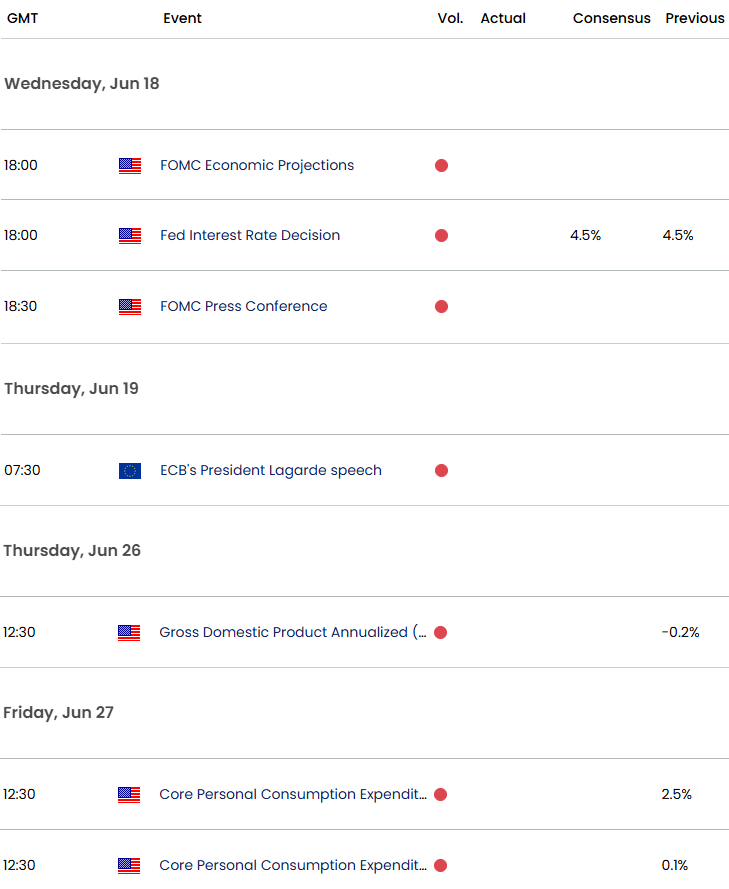

The Euro rally exhausted into uptrend resistance this week at fresh multi-year highs with EUR/USD threatening to snap a two-week winning streak. The focus now shifts to the Federal Reserve interest rate decision later today with monthly rally vulnerable while below the 1.16-handle. Battle lines drawn on the Euro weekly technical chart heading into the FOMC.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; EUR/USD on TradingView

Technical Outlook: In last month’s Euro Technical Forecast we noted that, “A rebound off the median-line failed into uptrend resistance this week and threatens a deeper setback here. From a trading standpoint, losses should be limited to 1.1164 IF price is heading higher on this stretch with a close above the 75% parallel / the weekly highs needed to mark resumption of the yearly uptrend.” Euro briefly registered an intraweek low at 1.1210 the following day before marking an outside-day reversal. The subsequent rally extended more than 5.1% off the May lows with price exhausting into resistance this week at the 2016 high near 1.1616. The advance has been marred by ongoing momentum divergence and while the broader outlook remains constructive, the rally may be vulnerable here while below uptrend resistance.

The immediate focus is on initial support near the March 2020 / 2022 highs at 1.1497- watch this week’s close with respect to this level. Medium-term bullish invalidation now rests with the April high-week close (HWC) at 1.1365- note that the 75% parallel converges on this threshold and losses below this slope would threaten a larger correction towards the median-line. Subsequent support seen at the May low-week close (LWC) / 2024 high-close at 1.1163/91 and 1.1038/76- a region defined by the December HWC and the 38.2% retracement of the yearly range. Look for a larger reaction there IF reached.

A breach / weekly close above 1.1616 would threaten uptrend resumption towards subsequent resistance objectives at the 78.6% retracement of the 2021 decline at 1.1747 and the 100% extension of the 2022 advance at 1.1917- both levels of interest for potential topside exhaustion / price inflection IF reached.

Bottom line: Euro is testing uptrend resistance on building momentum divergence with the Federal Reserve interest rate decision on tap later today. From a trading standpoint, any losses would need to be limited to 1.1365 IF price is heading higher on this stretch with a close above 1.1616 needed to fuel the next leg of the decline.

Keep in mind we get the release of the Fed’s updated quarterly economic projections on growth, inflation, and unemployment. Stay nimble into the release and watch the weekly close here for guidance. Review my latest Euro Short-term Outlook for a closer look at the near-term EUR/USD technical trade levels.

Key Euro / US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- Crude Oil (WTI)

- Gold (XAU/USD)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- US Dollar Index (DXY)

- British Pound (GBP/USD)

- Swiss Franc (USD/CHF)

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex