Weekly – Europe Forecast | 5 May 2025

🇺🇸 US Labor Market & Economy

- April NFP: +177,000 jobs (above expectations by ~40K), but prior months revised down by 58K.

- Unemployment steady at 4.2%, labor force participation ticked up to 62.6%.

- Wages: +0.2% MoM / +3.8% YoY (both slightly below expectations).

- Result: Fed rate cut bets slightly reduced, pushing yields, USD, and equities higher.

- ISM Manufacturing PMI: down to 48.7, remains in contraction. Export orders and production weakened.

- Persistent economic uncertainty is pressuring margins and slowing growth.

📉 Markets Recap (April)

- S&P 500 saw large swings:

- -5th biggest 2-day drop since 1945 after April 2 tariffs.

- +9.5% rally on April 9 after tariff pause – biggest since 2008.

- Finished April down just 0.7%.

- USD Index fell 7.6% (Mar–Apr), largest 2-month drop since 2002.

- Gold: Strongest yearly start since 2006.

- Oil (Brent/WTI): -15%+ amid demand fears.

- Late April trade talk optimism boosted risk appetite modestly.

🇪🇺 Eurozone Inflation & Labor

- Headline inflation: Held at 2.2% YoY, vs expectations for a decline.

- Core inflation: Rose to 2.7% (from 2.4%), driven by services inflation (+3.9% YoY).

- Unemployment rate: Steady at 6.2%, a record low.

- Implication: Rising wage pressures could limit ECB rate cuts beyond the one priced for June.

- Bond yields in the eurozone rose; EUR firmed slightly.

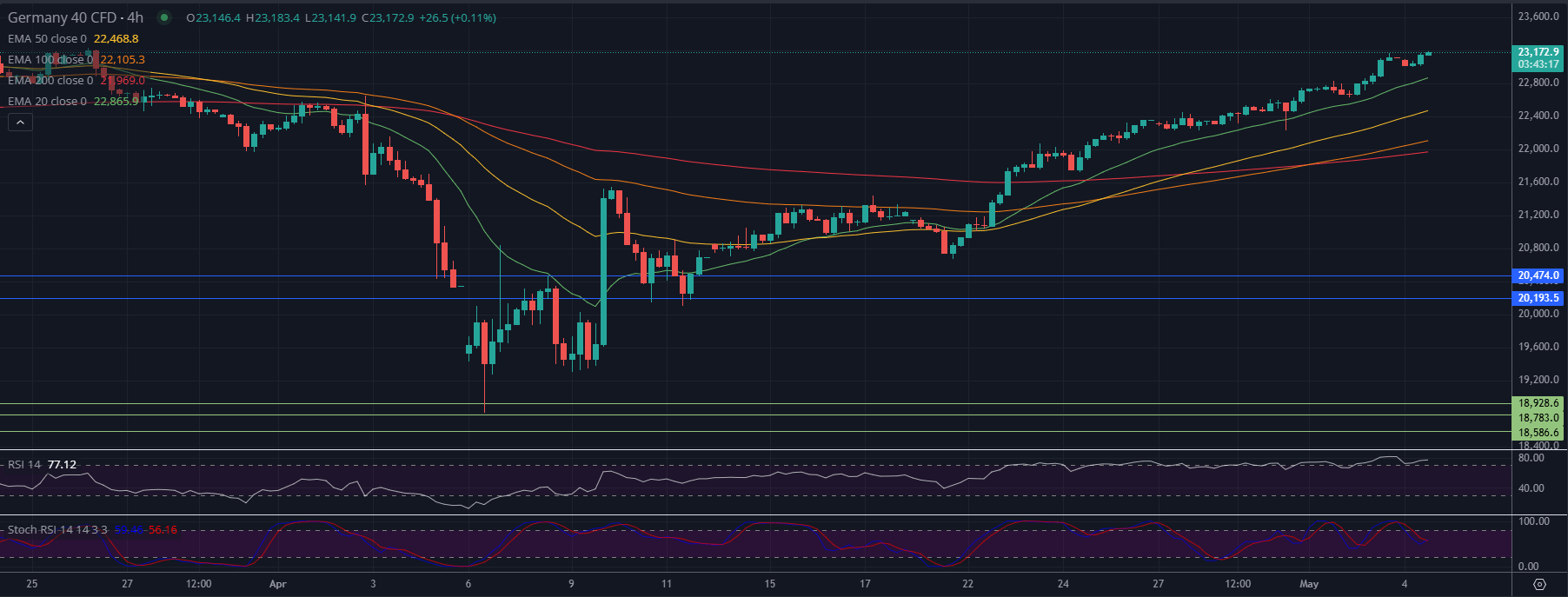

DE – DAX 4H Technical Analysis

The Germany 40 (DAX)– 4H chart shows the index trading at 23,172.9 (+0.11%), pressing into a key resistance zone near previous swing highs from early March. The rally from the April lows has been sharp and well-structured, with price now at a critical decision point.

🔍 Technical Breakdown:

- EMA Alignment:

- Price remains well above all major EMAs (20/50/100/200), showing strong trend momentum.

- All EMAs are now in a bullish sequence (20 > 50 > 100 > 200), supporting continued upside unless broken.

- Momentum Indicators:

- RSI is at 77.12 — firmly in overbought territory, which doesn't imply reversal, but warns of potential consolidation.

- Stochastic RSI is also cooling from overbought levels (crossing down), reinforcing the idea that the rally might be pausing.

📌 Key Levels:

Resistance:

- 🔴 23,200–23,300 → Key resistance from the March breakdown; current area of interest

- 🔺 Breakout above this could open the door to 23,500+

Support:

- 🟢 22,865 (20 EMA) → First intraday dynamic support

- 🟠 22,468 (50 EMA) → Next major support level if momentum fades

- 🔵 20,474 → Structural pivot and key zone from April breakout

⚠️ Outlook:

The DAX is still strongly bullish, but short-term indicators suggest upside may be temporarily stretched. If price fails to break cleanly above 23,200–23,300, expect a healthy pullback toward 22,800–22,500 to refresh momentum.

📈 Bias: Bullish, but cautious at resistance. Watch for breakout above 23,300 or rejection/pullback into EMA support.

🌐 This Week’s Calendar Highlights

Monday

- Quiet start due to holiday closures.

- Data: Swiss CPI, US ISM Services PMI.

- Palantir earnings after market.

Tuesday

- Calm day; watch for SNB Chair Schlegel (London session) and Canada Ivey PMI.

- AMD & Electronic Arts earnings after market.

Wednesday

- Busy day:

- NZ employment (early Asia),

- UK Construction PMI,

- Fed rate decision – key event of the week.

- Earnings: Uber, Walt Disney (premarket).

Thursday

- Focus: Bank of England rate cut expected.

- US Weekly Jobless Claims also due.

- Earnings: Rheinmetall, Shopify, Coinbase.

Friday

- Speakers: BoE's Bailey, then multiple Fed officials (Kugler, Waller, Williams, etc.).

- Canada employment data released at NY open.

🔍 Asset Snapshot

- Asia equities opened soft (0% to -0.5%).

- EU indices slightly subdued.

- Silver +1%.

- Crude oil -3% at $56, pressured by OPEC+ output hikes and looming surplus.

Key Focus This Week

➡️ Fed rate decision (Wednesday)

➡️ Bank of England (Thursday)

➡️ Central bank speeches + earnings → tone for global markets.