Key Events

- Advance GDP drops sharply from 2.4% to -0.3%, yet the dollar strengthens alongside strong mega-cap earnings

- U.S. Core PCE declines from 0.5% to 0.0%

- BOJ holds rates steady at 0.5% amid rising trade war fears

- Up next: U.S. ISM PMI (today), Non-Farm Payrolls (tomorrow), and Amazon/Apple earnings (today)

Dollar Holds Rebound Despite Drop in GDP and PCE

Despite a notable contraction in U.S. GDP and a sharp drop in Core PCE — both pointing to increasing recession risk — the U.S. Dollar Index (DXY) managed to sustain its rebound.

Midweek, positive earnings from Microsoft ($3.46 EPS, $70.1B revenue) and Meta ($6.43 EPS, $42.31B revenue) provided support, creating a divergence between weak economic data and bullish investor sentiment. Momentum indicators now show signs of reversal from daily exhaustion levels last seen in 2020, suggesting that this bounce may represent a broader trend reset before directional clarity returns.

DXY Outlook: 4 Hour Time Frame – Log Scale

Source: Tradingview

On the 4-hour chart, DXY is pushing above the neckline of an inverted head-and-shoulders formation. However, confirmation is still needed — a clean hold above 100.30 is essential to avoid a bull trap.

Upside Levels in Sight (if 100.30 holds): 101.30, 102.00, and 103.50

Downside Risk (if neckline fails): 99.30, 98.90, and 98.00

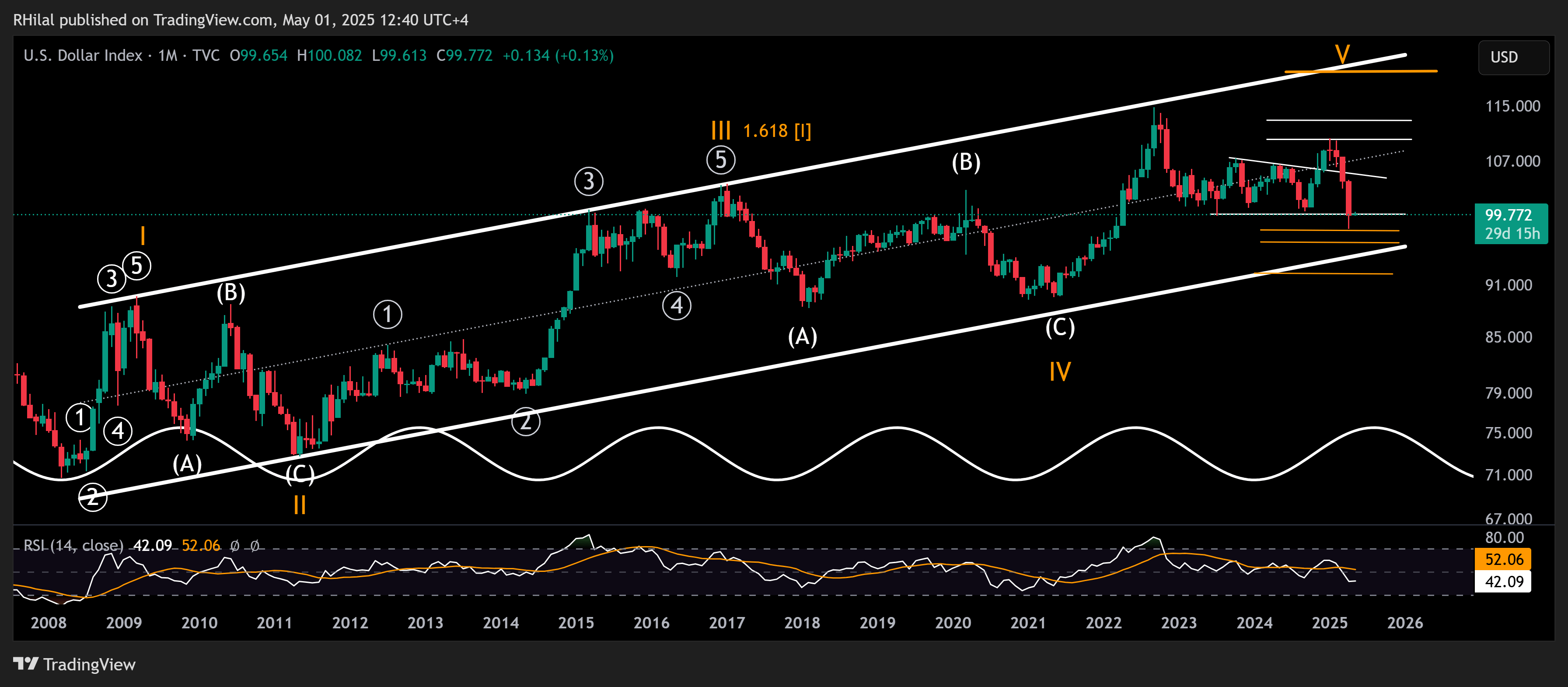

DXY Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

From a monthly perspective, DXY is holding above the 98 support and remains above the lower border of the up-trending channel extending from the 2008 lows, paving the way for another leg lower this year should the 98-support be decisively breached, aiming for the 96 and 92 zones.

Should the support hold above 100.30, the index might extend back into a neutral-to-positive phase, in line with levels 105 and 107, before confirming a sustained uptrend to the upper border of that channel beyond 110.

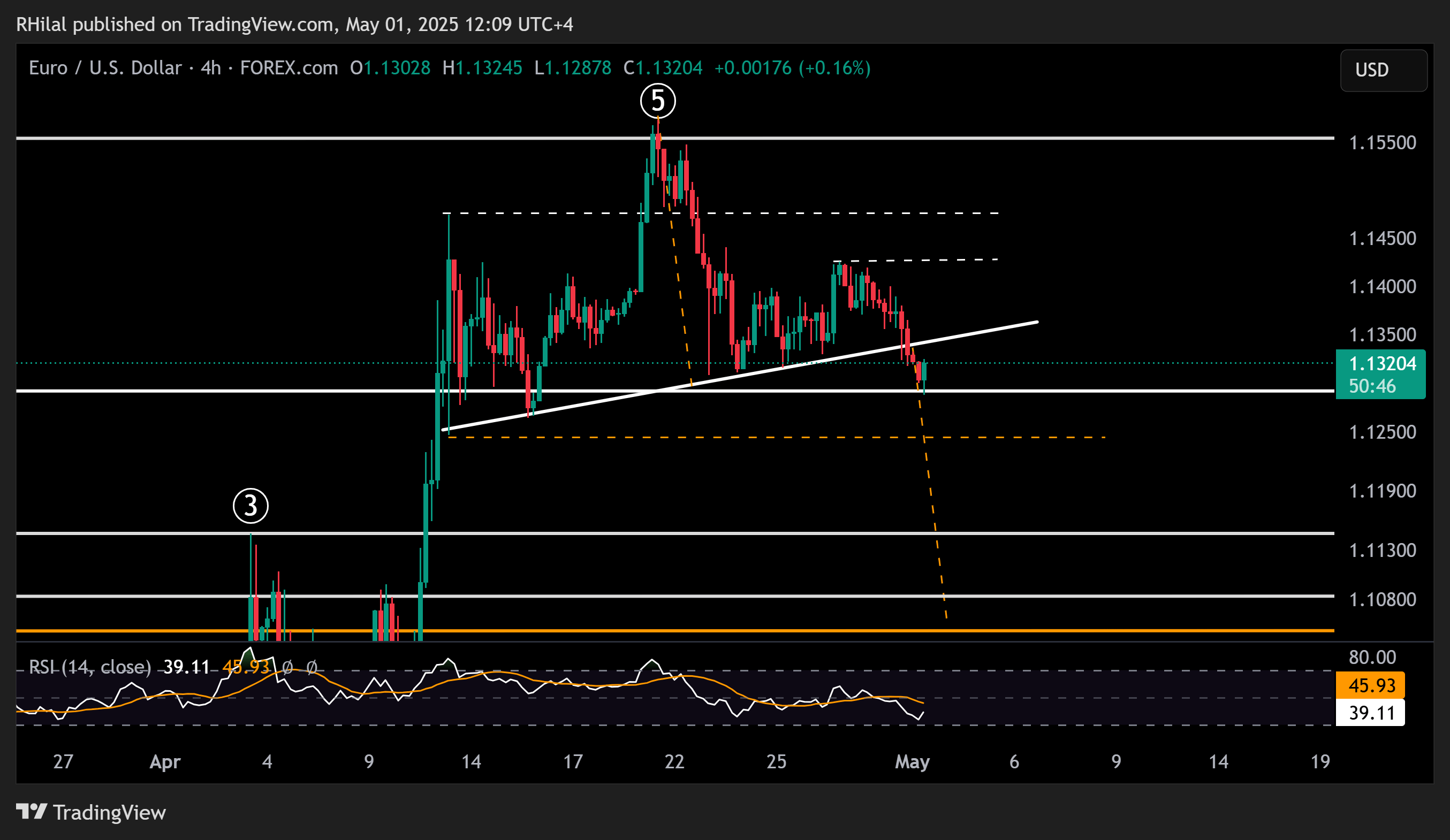

EURUSD Outlook: 4 Hour Time Frame – Log Scale

Source: Tradingview

Mirroring the DXY, the EURUSD appears to be holding below the neckline of a head and shoulders pattern formed from the 1.1570 highs. However, it still requires confirmation with a sustained move below 1.1270 to extend the forecast toward 1.1140 and 1.1040.

On the upside, if the 1.1270 support holds, EURUSD may reverse course, confirming a failed pattern and potentially rebounding toward 1.1420, 1.1470, and 1.1570.

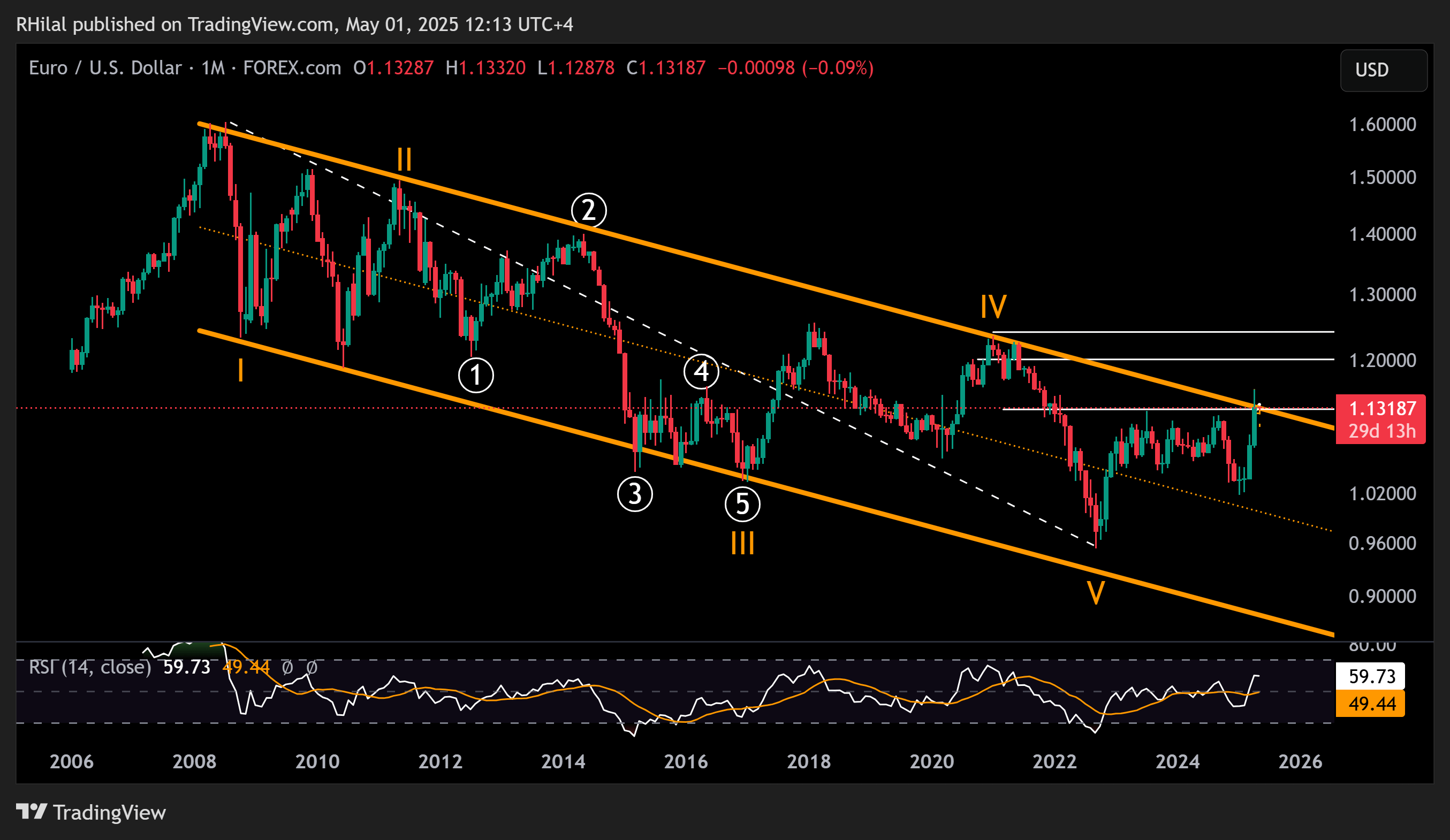

EURUSD Outlook: Monthly Time Frame – Log Scale

Source: Tradingview

From a monthly perspective, the EURUSD is pulling back from the upper boundary of the long-respected channel extending from the 2008 highs, currently holding near the key 1.1270 support.

If the pair holds above 1.1300 and moves back above 1.1570, the next key levels align with the 2021 highs at 1.2030 and 1.2400, respectively. However, a decisive move below support could pave the way for a momentum reset toward 1.0700, especially if the pair holds below 1.1000.

Written by: Razan Hilal, CMT

Follow on X: Rh_waves