EUR/USD Talking Points:

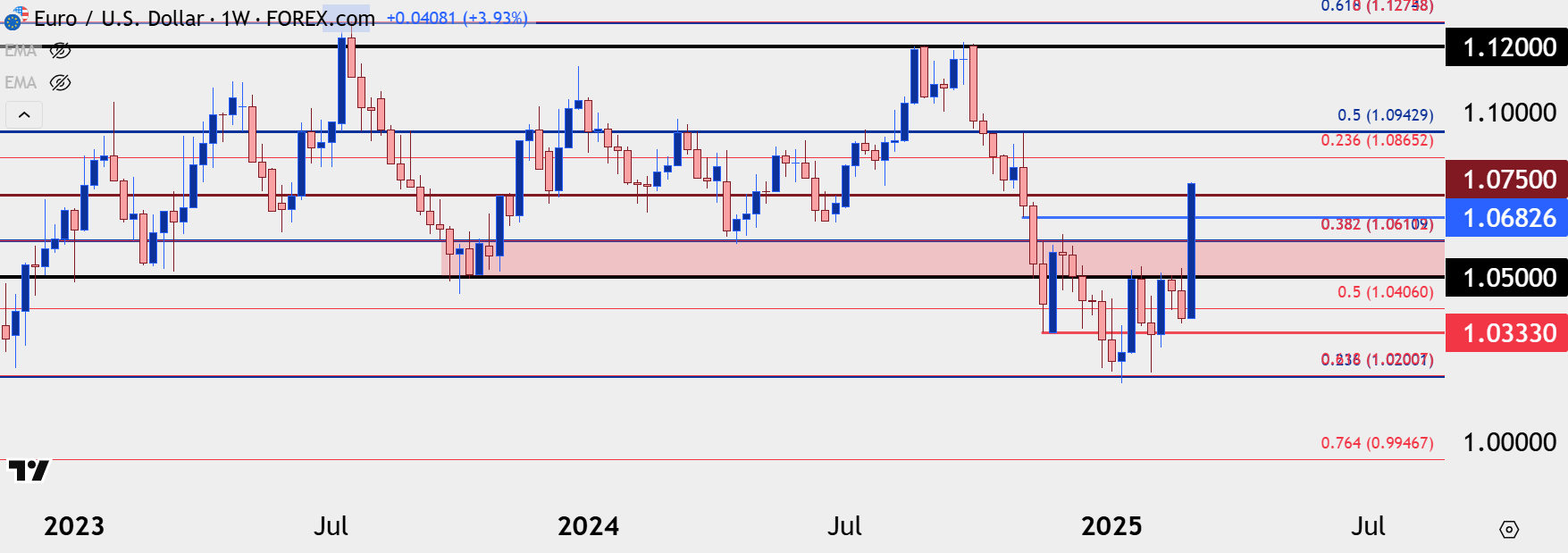

- As of this writing, EUR/USD is up more than 3.9% this week, which is the second largest weekly gain for the pair in the past year, rivaled only by an outing in November of 2022 when the ECB had ramped up rate hikes to 75 bp increments (3.87%), and the bounce from the Covid sell-off in the pair (4.16%). The video below was recorded when EUR/USD was at its 3rd strongest weekly gain, and the pair has increased more since that video was created.

- The ECB is expected to cut rates again tomorrow, so the pair is showing a ‘rate cut rally,’ but perhaps more to the point, it’s dynamics around the U.S. Dollar and fears of a recession in the United States that are driving USD-losses across a number of major FX pairs.

EUR/USD had spent most of February showing indication of being less bearish, and the pair had continually pushed up for tests of the 1.0500 psychological level. Now we’re seeing what a pent-up breakout looks like when bulls are finally able to take out resistance.

As of this writing EUR/USD is showing its second highest weekly gain in the past decade, rivaled only by the November 2022 outlay when the ECB was ramping up rate hikes, and the bounce from Covid in March of 2020. When the video linked above was produced, the pair was up by less than 3.87% so it was the third strongest weekly outing, but now that gain in the pair has increased and it’s the second strongest. Details, I know, but those details matter, and I wanted to specify the nuance.

Making matters more interesting is the fact that the ECB is actually expected to cut rates again at tomorrow’s rate decision. But, the driving force here appears to be more U.S. related as USD-weakness has shown in a pervasive fashion.

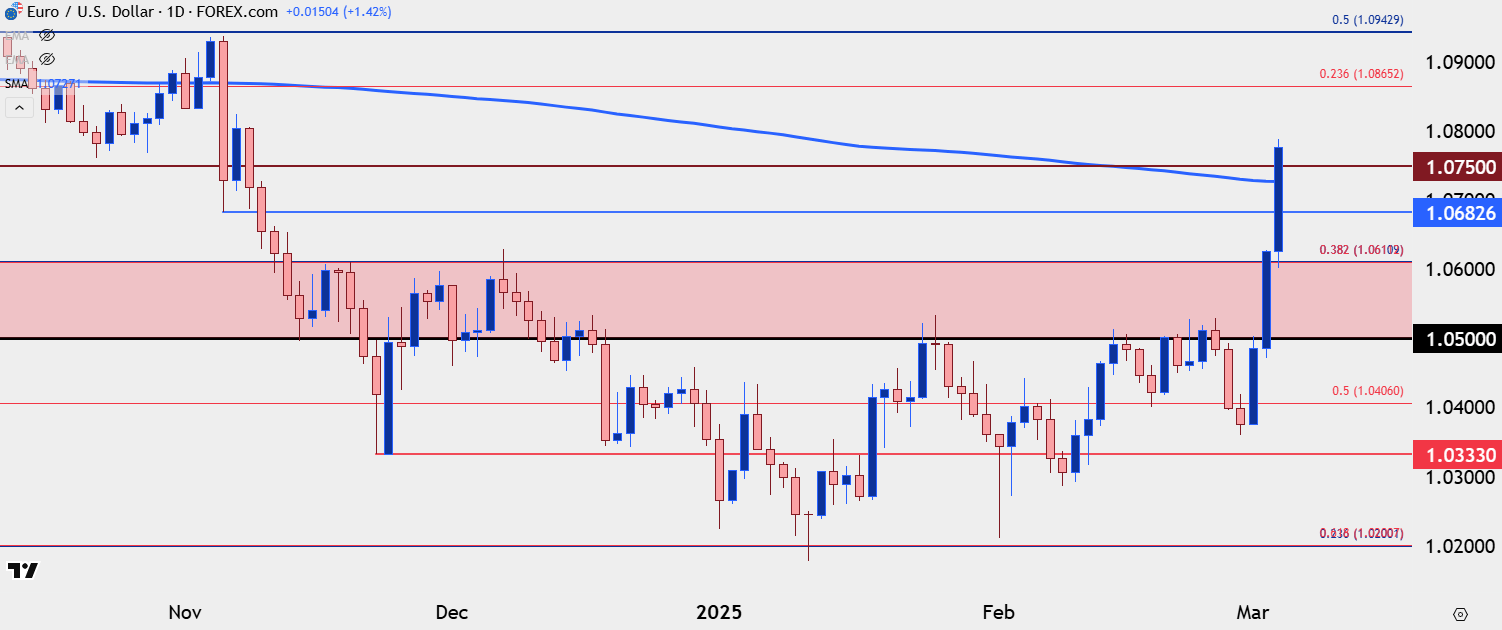

The challenge at this point is chasing EUR/USD higher. At this point, RSI on the daily chart is already pushing into overbought territory, which highlights caution around chasing. The pair is also pushing above the 200-day moving average for the first time since the election, which adds some additional reference for higher-low support potential.

EUR/USD Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Shorter-Term

It was the increasing frequency of tests at the 1.0500 handle that highlighted bullish potential in the pair, but it wasn’t until this week, and more specifically yesterday, that bulls were finally able to break on through to the other side.

Since then buyers have run amok and RSI is deeply overbought on the four-hour chart. This would be a difficult area to chase the pair-higher, especially considering that DXY is testing a big spot of long-term support.

But, given recent price action there’s a few different areas of interest for support potential. The 1.0611 Fibonacci area, which has two different 38.2% Fibonacci retracements, from both the 2021-2022 major move, and the 2022-2023 major move. And below that, the 1.0500 level that had held as resistance so many times until this week’s breakout.

And from a shorter-term, more aggressive perspective, there’s even the possibility of the 1.0750 psychological level or the 1.0683 prior swing. There’s also the 200-day moving average, which currently plots at 1.0727. All three of those would be more aggressive, but this has been an aggressive trend. And the big question is how dovish Christine Lagarde might sound at tomorrow’s widely-expected rate cut.

EUR/USD Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

What’s Behind the Push?

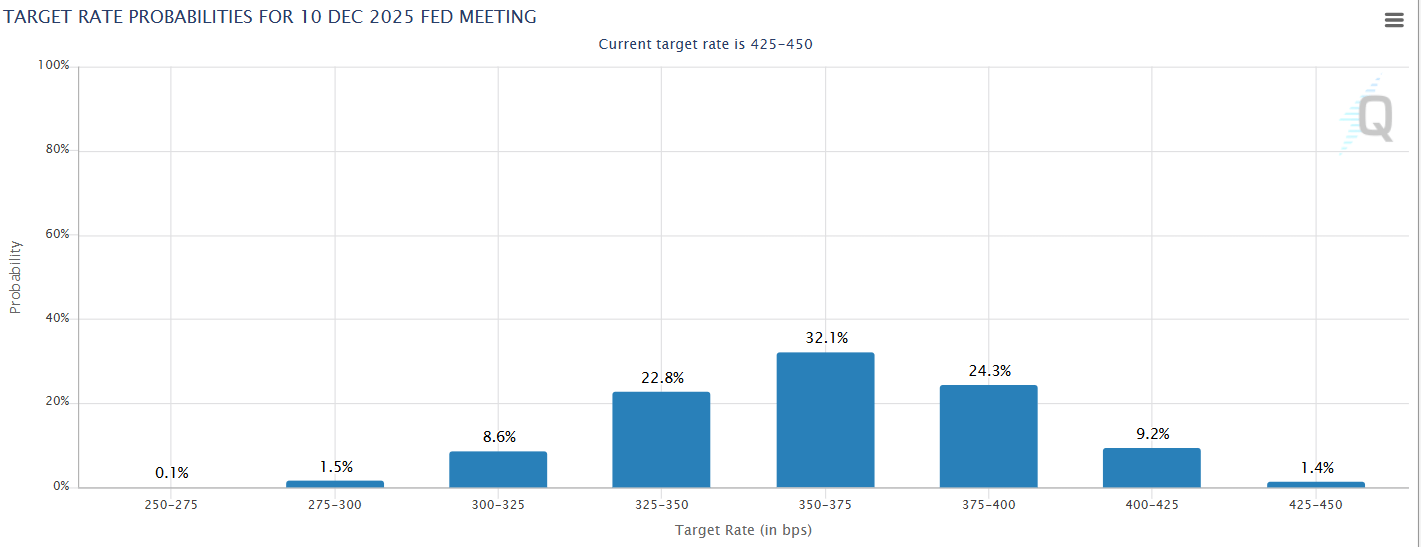

I covered this in the video linked above, but this seems to be more of a USD item than a EUR/USD or Euro scenario. It’s been the dimming in US data that’s triggered fears of recession that’s been the big change of pace this week. Earlier this week, the Atlanta Federal Reserve’s GDP Now forecast for Q1 GDP was downgraded to an expectation of -2.8% for Q1. This stands in stark contrast to the almost +4% read from not even two months ago.

But given the shifting in the yield curve that was seen late last year, when the 10-year/3-month spread normalized, it seems there were already some harbored fears of recession for this year. And now that economic data has started to push lower, markets have begun to respond.

In rates, there’s been a widening out in expectations for more rate cuts this year by the Fed, and that has a USD-negative impact. So, even though the ECB is expected to cut tomorrow, that’s no surprise as it’s been expected for a while. The big item of recent change has been the building expectation for more cuts from the Fed, brought upon by weaker U.S. economic data which is also pushing fears of recession in 2025.

Rate Expectations for December 2025

Chart prepared by James Stanley; data derived from CME Fedwatch

Chart prepared by James Stanley; data derived from CME Fedwatch

--- written by James Stanley, Senior Strategist