EUR/USD slips amid a firmer USD, German GDP contracts

- German GDP -0.2% QoQ & CPI data coming up

- USD firms as trade fears ease, US GDP data due

- EUR/USD consolidates below 1.14

EUR/USD continues to consolidate below 1.14 after small losses on Tuesday.

Data from Germany showed that GDP contracted in line with expectations at an annual rate of nought .2% in Q1 and failed to trigger a new table market reaction, given that the figures relate to prior to Trump's Liberation Day reciprocal tariff announcement.

German inflation data is also due to be released. It is expected to remain close to the ECB's 2% target. The data is unlikely to spark a big reaction, given that it would take significantly weaker than expected inflation for the market to price in more rate cuts from the ECB. The central bank cut rates for a seventh time in April and is expected to cut rates by a further 25 basis points in June.

Meanwhile, the US dollar is trading slightly firmer after Trump's latest tariff backtrack. However, it is still on track for its weakest monthly performance since November 2022 amid concerns over U.S. trade policies and their impact on U.S. economic growth.

US GDP data, core PCE inflation are due later in the session, and nonfarm payrolls are on Friday. Together, they will provide a clearer picture of the outlook on the world's largest economy.

Trump eased auto tariffs yesterday, and U.S. Treasury Secretary Scott Bessent also announced progress on trade tariff negotiations with one deal across the line. These developments have helped ease some tensions over the impact, with peak tariff fear now in the rear-view mirror. However, confidence has been hit hard and that showed in data yesterday with US consumer confidence dropping to a 5-year low.

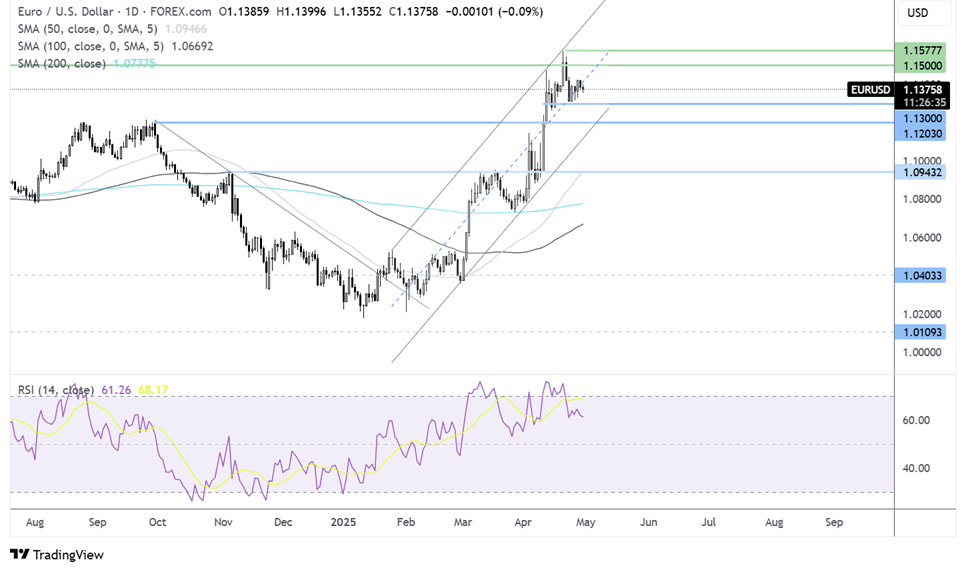

EUR/USD forecast – technical analysis

EUR/USD continues to trade in its rising channel but has eased back from the three year 1.1575 high and consolidates around 1.1375. The price is tipping below mid-line of the rising channel and the RSI is pointing lower as momentum slows.

Sellers will need to break below 1.13, with a break below here opening the door to 1.12.7

Buyers will look to rise above 1.1425, the weekly high, before bringing 1.15 into focus. A rise above 1.1575 is needed to create a higher high.

FTSE steady as upbeat earnings offset weaker miners

- Miners drop as Chinese manufacturing PMI falls to a 16-month low

- Barclays & GSK impress with forecast-beating numbers

- FTSE tests 50 SMA resistance

The FTSE is unchanged as markets weigh up a slew of corporate earnings and economic data.

The hope of a de-escalation in Trump’s trade tariff war has helped global stock indices recover from the early April lows. Just yesterday, Trump rolled back some tariffs on automobiles.

However, further gains could be limited as attention turns to data and clues about the impact of Trump's trade tariffs. Overnight, PMI data from China showed that manufacturing activity contracted in April as the trade war bites. Chinese manufacturing PMI fell to 49, a 16-month low down from 50.5 and well below expectations of 49.7. This marked a noticeable slowdown, but it's still far from the shock of the COVID era.

Even so, the data has pulled miners on the Footsie sharply lower, with Glencore, Antofagasta, and Anglo American falling 3 to 4%.

The drag of miners was being offset by encouraging earnings. Barclays posted better-than-expected 19% increasing Q1 profits thanks to frenzied trading activity in the first three months of the year,, which boosted investment banking revenue and dealmaking fees.

Glaxo Smith Kline is rising 3.5% after the pharma giant said it was well positioned to show the fresh US tariffs after beating forecasts and reaffirming its 2025 outlook. GSK reported Q1 turnover of £7.5 billion and core profit of 44.9 pence per share, ahead of forecasts of £7.42 billion and 40.9p per share.

Looking ahead, attention will turn to USD data releases, with US GDP and core PCE due to be released. Weak data could impact risk sentiment.

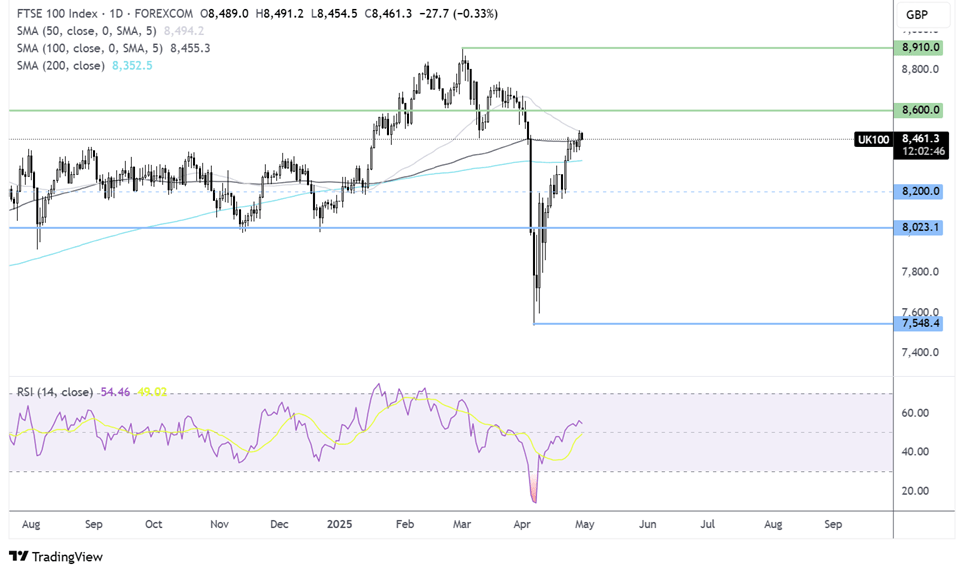

FTSE forecast – technical analysis

The FTSE’s recovery from the 7535 April low rose above the 200 SMA and is testing the 50 SMA resistance at 8500. Buyers supported by the RSI above 50 would need to rise above the 50 SMA to extend gains towards 8600.

Should the FTSE face rejection at the 50 SMA, support can be seen at 8350, the 200 SMA. A break below here could see sellers gain momentum.