EUR/USD rises on continued USD weakness amid debt concerns

- German PPI -0.9% YoY

- USD falls to 12-day low after Moody’s

- EUR/USD rises above 1.1250

EUR/USD rises above 1.1250, gaining for a second straight day amid USD weakness following the Moody’s downgrade.

USD is still struggling off after Moody's rating agency downgraded the US sovereign credit rating by 1 notch to Aa1, citing concerns over its mounting debt pile. The USD index has fallen to a two-week low against its major peers.

Concerns over debt are particularly in focus, as Trump’s huge tax cut bill narrowly passed the House Budget Committee on Sunday and will be debated in Congress today.

Trump's bill would add between $3 and $5 trillion to the debt, which the US is already at $36 trillion debt pile. Concerns, however, suggest that the US fiscal position could be a driver for dollar weakness over the coming quarters.

There is no US economic data today, but Fed speakers will be in focus. The Fed has not cut rates so far this year and has signaled that it is prepared to stick with its patient approach until more data show the impact of Trump's trade tariffs on the US economy.

Yesterday, Atlanta Federal Reserve President Bostic said the US central bank may only be able to cut interest rates by 25 basis points over the rest of the year, given concerns of rising inflation sparked by higher tariffs.

The EUR is heading higher, capitalising on the weaker U.S. dollar despite signs of weakness in German producer prices. Inflation at the factory gate level fell 0.6% month on month in April, well below the 0.3% full forecast. On an annual basis, PPI fell 0.9%, down from 0.2% in March.

PPI is often considered a lead indicator for CPI inflation, which has already cooled towards the ECB's 2% level. The data support the view that the central bank will cut interest rates again in the June meeting.

ECB policymaker Schnabel said that disinflation is on track. She added that tariffs could be disinflationary in the short run but potentially pose upside risk over the medium term.

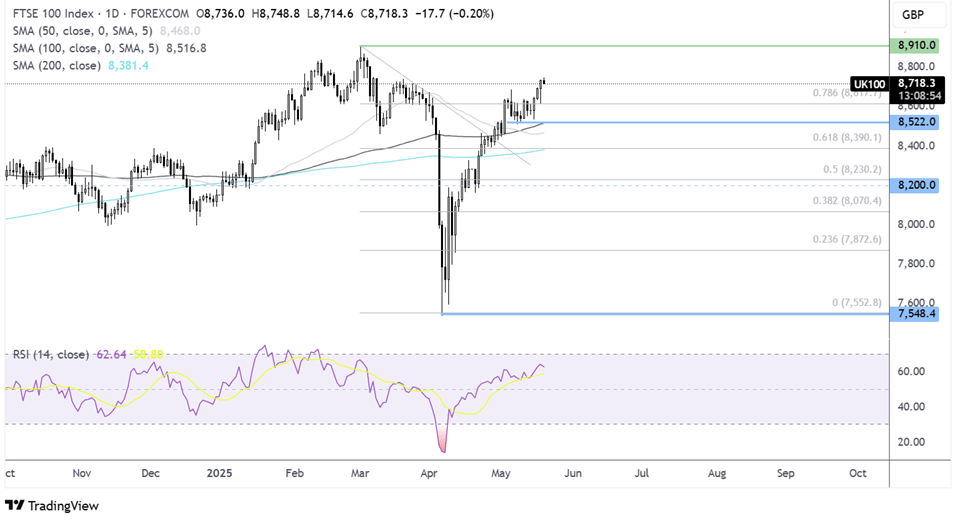

EUR/USD forecast – technical analysis

After falling below its multi-month rising channel, EUR/USD found support on the 50 SMA and recovered higher, pushing above 1.12 to current levels of 1.1270.

Buyers will look to extend the recovery above 1.1280 and towards 1.1350 to re-enter the rising channel. A rose above 1.14 crate a higher high.

Should EUR/USD face rejection at 1.1280, the price could ease lower to test the 1.12 round number. A break below here exposes to 50 SMA AT 1.1120.

FTSE rises, boosted by earnings

- Greggs jumps 8% after strong revenue growth

- Diploma rises over 15% after lifting guidance

- FTSE 100 has extended gains above 8700

The FTSE is rising for a fourth straight session, following gains in the US overnight and as investors focus on corporate earnings.

Diploma, the technical products and services distributor, lifted its revenue growth guidance, saying it sees strong performance across three divisions. The stock is trading over 15% higher, leading the Footsie 100 northwards.

Greggs is rising over 8% after the High Street bakery chain posted improving trading conditions and stronger revenue growth. Like-for-like sales increased 2.9% in the first 20 weeks of the year, while total sales climbed to 7.4%.

Meanwhile, Vodafone shares have been relatively muted after top-line results showed some regional disappointments. The telecom giant's service revenue growth came in above estimates, although weakness in Germany dragged on Europe's results.

Vodafone provided a profit forecast range of €11 billion to €11.3 billion, roughly in line with forecasts.

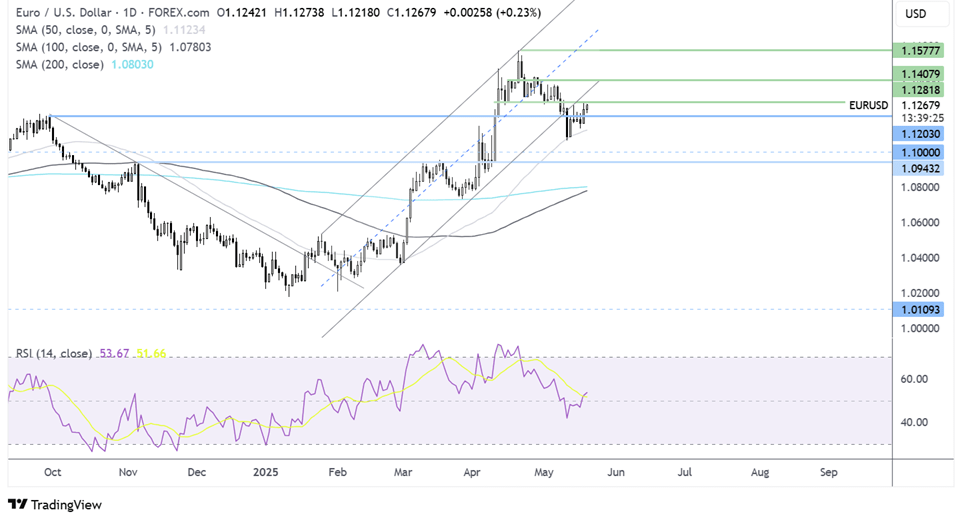

FTSE forecast – technical analysis

The FTSE has extended its recovery from the 7535 low, rising above the 200 SMA to a peak of 8720. The RSI supports further gains while remaining above 50.

Buyers will look to extend gains towards 8900 and fresh record highs.

Support can be seen at 8615, the 78.6% Fib retracements of the 8910 high and the 7535 low. Below here the 8500 support level came into focus, which is also the 100 SMA.