Key Events:

- The DXY drops back below 100, supporting upside momentum in EURUSD and Gold

- Flash Services and Manufacturing PMIs on Thursday may introduce volatility to EURUSD’s uptrend

- U.S. indices climb on forward-looking optimism, while the Dollar remains weak on soft data

Despite recent headwinds, between credit downgrades and soft economic data, U.S. indices remain in bullish territory, while the U.S. Dollar Index (DXY) is hovering near key support levels. The second half of 2025 could see renewed volatility if these support levels break. As long as the DXY remains below the 100-mark, the door stays open for further upside across major currency pairs—including EURUSD, GBPUSD—and continued strength in Gold.

DXY Outlook: Daily Time Frame – Log Scale

Source: Tradingview

Current price action on the DXY can be interpreted in two ways:

1. A pullback toward the neckline of an inverted head-and-shoulders pattern.

2. A 61.8% Fibonacci retracement of the bullish rebound from the 97.92 low.

Both views suggest a potential for bullish continuation, as long as the 97.92 support holds. To regain upward momentum, the DXY must close back above 100.60, 101.30, and 102. Otherwise, continued weakness below 100 could push major currency pairs to fresh 2025 highs.

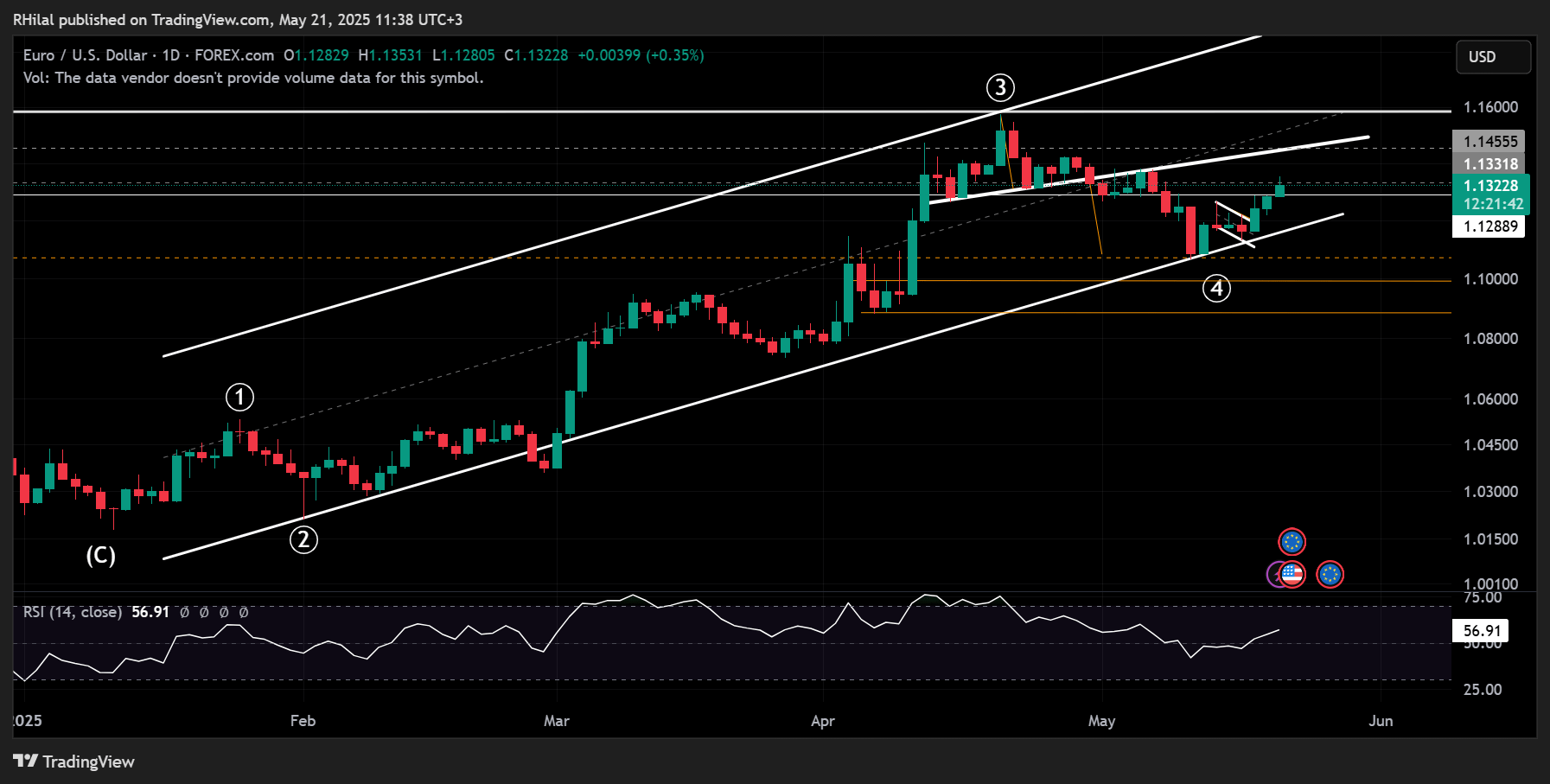

EURUSD Outlook: Daily Time Frame – Log Scale

Source: Trading view

On the daily chart, EURUSD is holding firmly to its bullish structure, rebounding from the yearly low around 1.1070. A clear hold above 1.1380 could lead the pair toward 1.1430, 1.1570, and potentially to new 2025 highs, revisiting the 1.20–1.24 zone last seen in 2021. If the channel breaks to the downside and EURUSD falls below 1.1070, the next key support levels to monitor are 1.0970 and 1.0890.

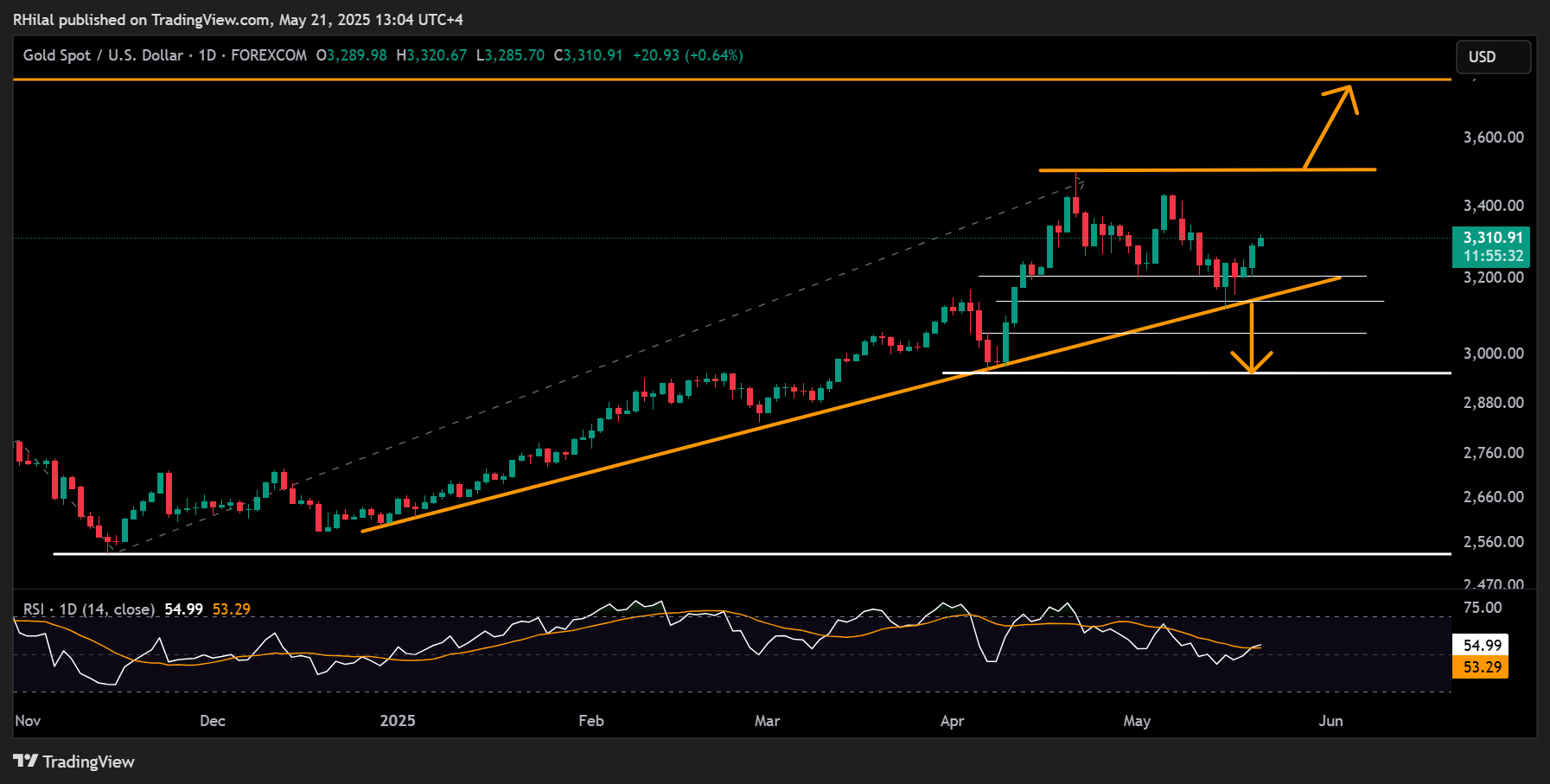

Gold Outlook: 3-Day Time Frame – Log Scale

Source: Trading view

With the DXY remaining weak below 100, Gold is sustaining its rebound off the December 2024–April 2025 trendline and is trading back above the 3,300 zone. A key level to watch is 3,350—a breakout above this resistance may extend gains toward 3,430, 3,500, 3,700, and ultimately 4,000. On the downside, if Gold slips below 3,300, support levels to monitor are 3,250, 3,200, and 3,120.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves