The euro continued its advance on Thursday, with EUR/USD climbing above recent resistance as the US dollar slipped across the board. Weaker-than-expected jobless claims and soft PPI data bolstered expectations that the Federal Reserve may need to cut rates sooner than anticipated. Adding to the pressure, former President Trump publicly criticised Fed Chair Powell for falling behind the curve on inflation and growth. With US yields slipping and the US Dollar Index breaking technical support, bullish momentum in EUR/USD could extend — especially if upcoming data keeps the Fed under pressure.

View related analysis:

- US Indices Technical Outlook: Wall Street Bulls Tread Carefully Near Highs

- USD/JPY Outlook: Japanese Yen Gains as Risk-Off Mood Lifts Safe Havens

- USD/CAD, AUD/JPY Outlook: Trade Hopes Fuel Commodity FX Strength

EUR/USD Climbs as Trump Slams Powell, US Inflation Cools, and Fed Cut Bets Rise

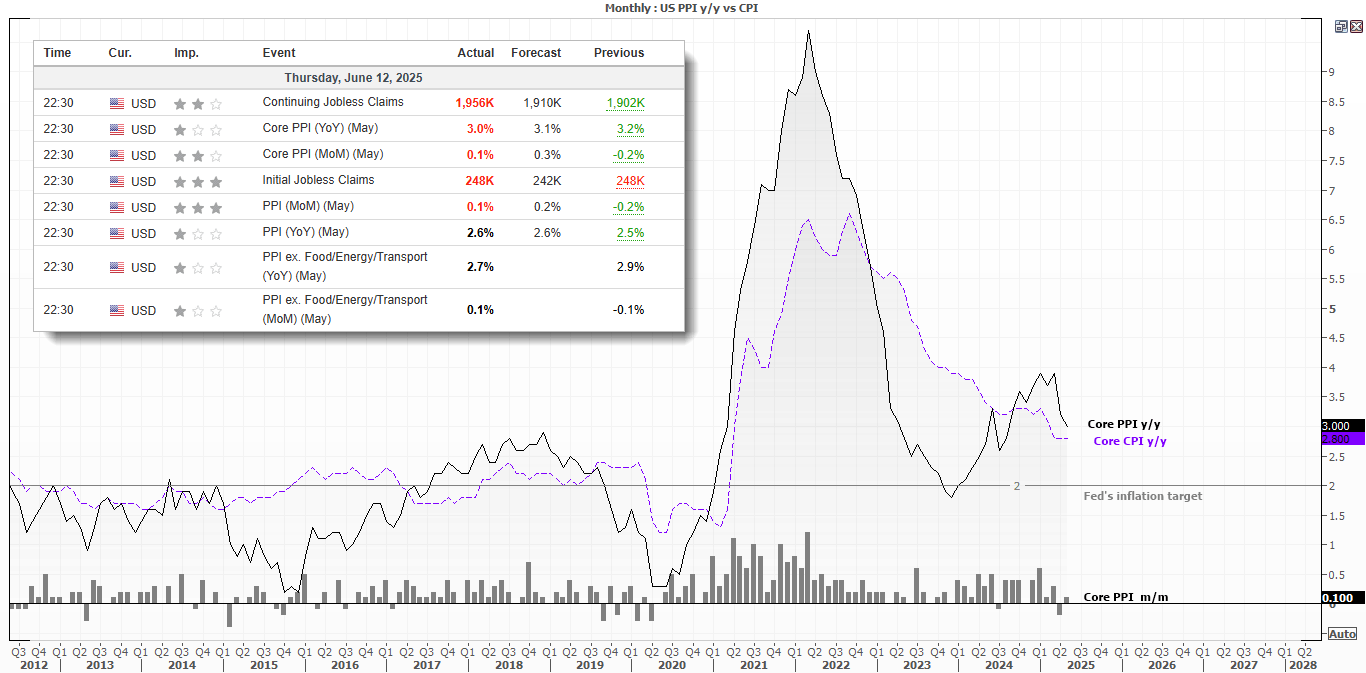

Softer US producer prices and higher jobless claims are the latest data points to fuel hopes that the Federal Reserve (Fed) will ease interest rates further. Core producer prices slowed to 3% YoY (3.1% expected) and 0.1% MoM (0.3% expected) in May, and an earlier report this week revealed that core inflation also slowed to 0.1% MoM and remained at 2.8% YoY. Separately, continuous jobless claims rose to 1.956 million, its highest level since November 2021 and the MoM 54k increase its fastest in six months.

Right on cue, President Trump jumped onto the case to pressure Jerome Powell into swift action, insisting for a full 100bp of cut on Wednesday and calling the Fed Chair “a numbskull” on Thursday. I doubt Trump’s ribbing will coax the Fed into action next week, though it does provide them the opportunity to at least begin internal dialogue of when to cut. I doubt they’ll commit to overtly dovish forward guidance in the messaging, but it will be interest to see if their updated forecasts are dovish enough to feed speculation of a July or September cut.

Fed fund futures currently imply a 96.9% chance of a hold next week, a 76.9% chance of a hold in July and a 59.9% chance of a cut in September. We could see odds of a cut increase should the Fed’s projections be revised lower. And that could weigh further on the US dollar, especially in light of promising US-China trade talks.

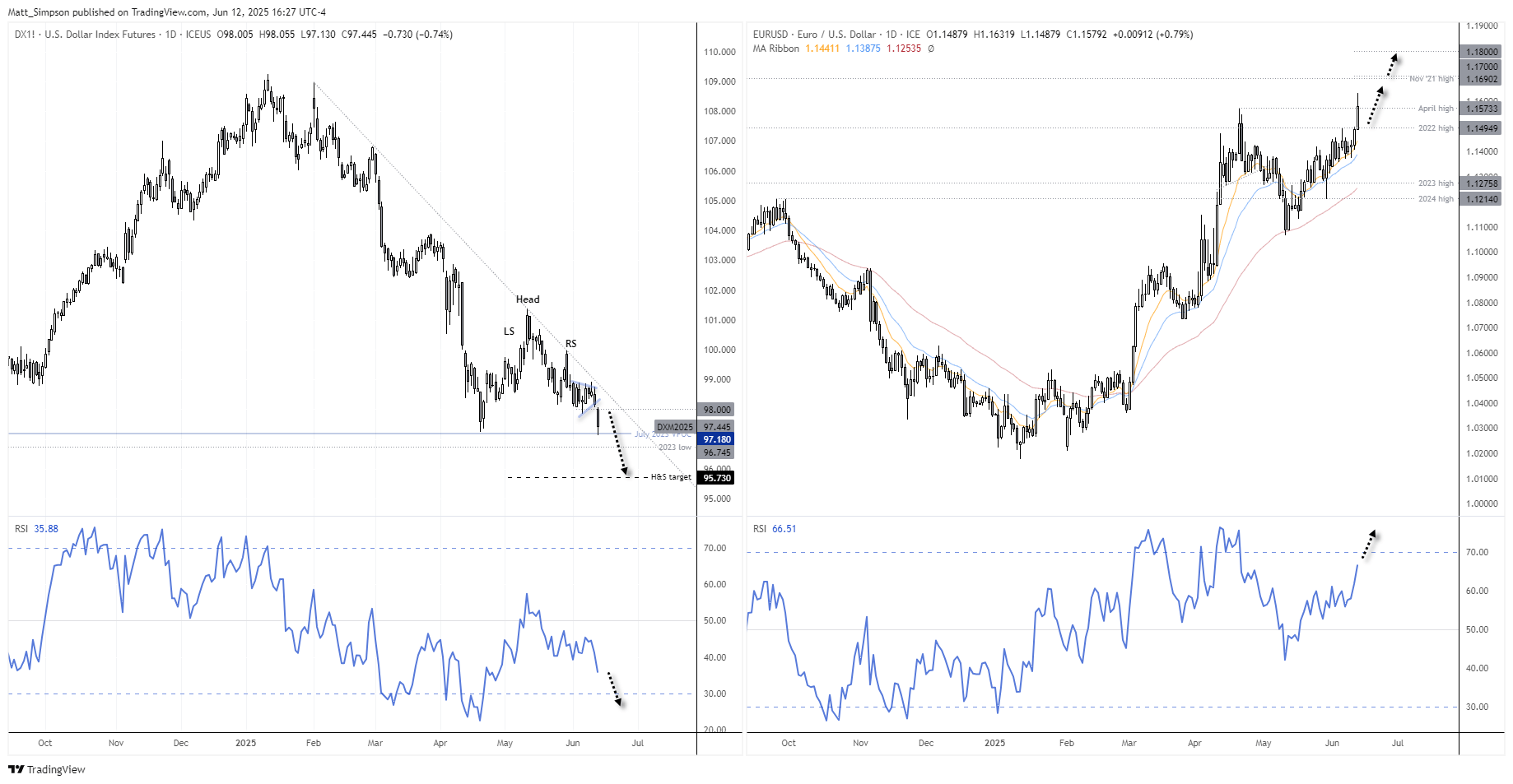

US Dollar Index (USD) Technical Analysis

The USD index briefly fell to a 3-year low on Thursday, though support was found around the July 2023 VPOC (volume point of control) and April low. Prices have retraced slightly from support, but the bias is for an eventual break beneath 97 while prices remain below 98.

I have revived the head and shoulders top on the US dollar index, which projects a target just beneath the 96 handle. While it is not a textbook neckline, the head and shoulders are well formed and momentum has turned sharply lower – as we’d expect to see from such a pattern.

It’s worth noting that while the head and shoulders is traditionally viewed as a market-top formation, it can also act as a continuation pattern within an established downtrend — which makes its presence on the US dollar index particularly compelling for traders anticipating further weakness in the greenback.

EUR/USD Technical Analysis: Euro vs US Dollar

With the euro accounting for ~57% of the USD index weighing, EUR/USD should continue higher if the dollar index continues to fall. Bullish momentum has increased on EUR/USD the past two days to show bulls back in control, after a period of drifting higher in a lacklustre fashion.

The daily RSI (14) is confirming the move higher and is yet to reach overbought. Bulls could seek dips on lower timeframes in anticipation of a move to the 1.17 and 1.18 handles. Though they may want to warrant caution given the initial breakout of the April high is on track to close on or near that swing high, which could prompt a minor pullback over the near term. Bulls could seek dips within Thursday’s range and maintain a bullish bias while prices remain above the 1.15 handle.

Economic Events in Focus (AEST / GMT+10)

- 08:30: NZD Business NZ PMI (May) (NZD/USD)

- 14:30: JPY Capacity Utilization, Industrial Production, Tertiary Industry Activity (Apr) (USD/JPY, Nikkei 225)

- 16:00: EUR German CPI, HICP, WPI (May) (EUR/USD, DAX)

- 18:30: GBP Inflation Expectations (GBP/USD)

- 19:00: EUR Industrial Production, Trade Balance (Apr) (EUR/USD)

- 22:30: CAD Capacity Utilization, Manufacturing & Wholesale Sales, Vehicle Sales (Apr) (USD/CAD)

- 00:00: USD University of Michigan Consumer Sentiment, Inflation Expectations (Jun) (USD, S&P 500, Gold)

- 01:00: EUR ECB’s Elderson Speaks (EUR/USD)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge