Euro Outlook: EUR/USD

EUR/USD stages a four-day rally even as the European Central Bank (ECB) delivers a 25bp rate-cut, with the recent rise in the exchange rate pushing the Relative Strength Index (RSI) into overbought territory for the first time since August.

EUR/USD Rally Persist Even as ECB Pursues Less Restrictive Policy

EUR/USD climbs to a fresh yearly high (1.0845) as it continues to carve a series of higher highs and lows, and the move above 70 in the RSI is likely to be accompanied by a further advance in the exchange rate like the price action from last year.

In turn, EUR/USD may further retrace the decline from the November high (1.0937) despite the ongoing shift in ECB policy, and it seems as though the Governing Council has yet to reach a neutral stance as President Christine Lagarde acknowledges that ‘our monetary policy is becoming meaningfully less restrictive.’

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

As a result, the Euro may face headwinds ahead of the next ECB meeting on April 17 as the ECB keeps the door open to implement lower interest rates, but the Governing Council may adjust the path for monetary policy as European lawmakers plan to boost fiscal spending.

With that said, the rally in EUR/USD may persist as it carves a series of higher highs and lows, but the RSI may show the bullish momentum abating if it struggles to hold above 70.

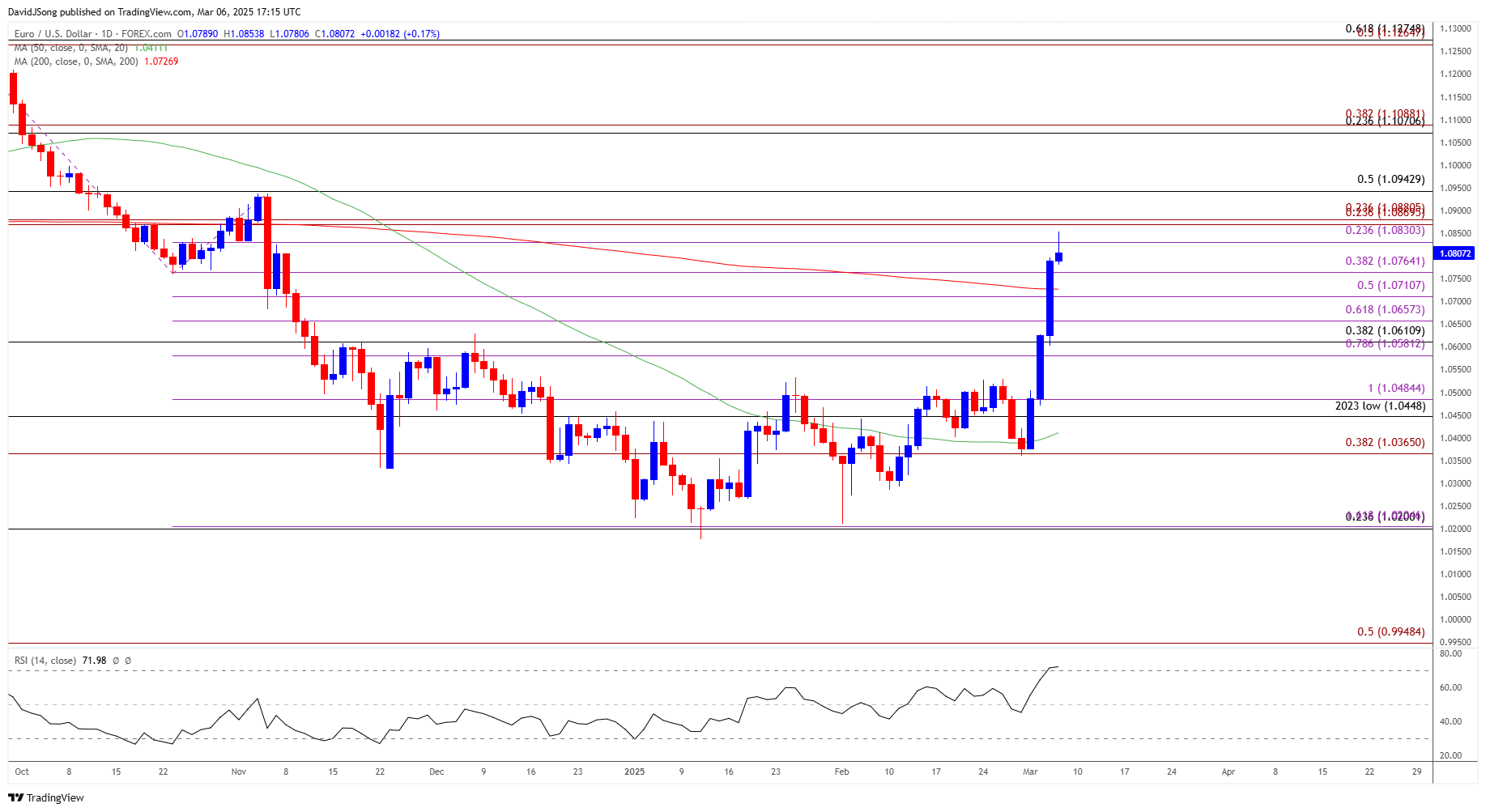

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD breaks out of the January range as it extends the rally from the start of the week, with a break/close above the 1.0830 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region raising the scope for a move towards the November high (1.0937).

- Need a break/close above 1.0940 (50% Fibonacci retracement) to open up the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) zone, but EUR/USD may snap the recent series of higher highs and lows should it struggle to hold above 1.0760 (38.2% Fibonacci extension).

- Need a move below the 1.0660 (61.8% Fibonacci extension) to 1.0710 (50% Fibonacci extension) zone to bring the 1.0580 (78.6% Fibonacci extension) to 1.0610 (38.2% Fibonacci retracement) region on the radar, with next area of interest coming in around 1.0448 (2023 low) to 1.0480 (100% Fibonacci extension).

Additional Market Outlooks

AUD/USD Rebounds Even as Trump Tariffs Go into Effect for China

GBP/USD Eyes December High as Ascending Channel Remains Intact

Canadian Dollar Forecast: USD/CAD Rally Persists with Trump Tariffs on Track

US Dollar Forecast: USD/JPY Rebound Retrained by Slowdown in US PCE

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong