Euro, EUR/USD Talking Points:

- U.S. Dollar strength has shown since the FOMC rate decision and that’s pushed a pullback in EUR/USD.

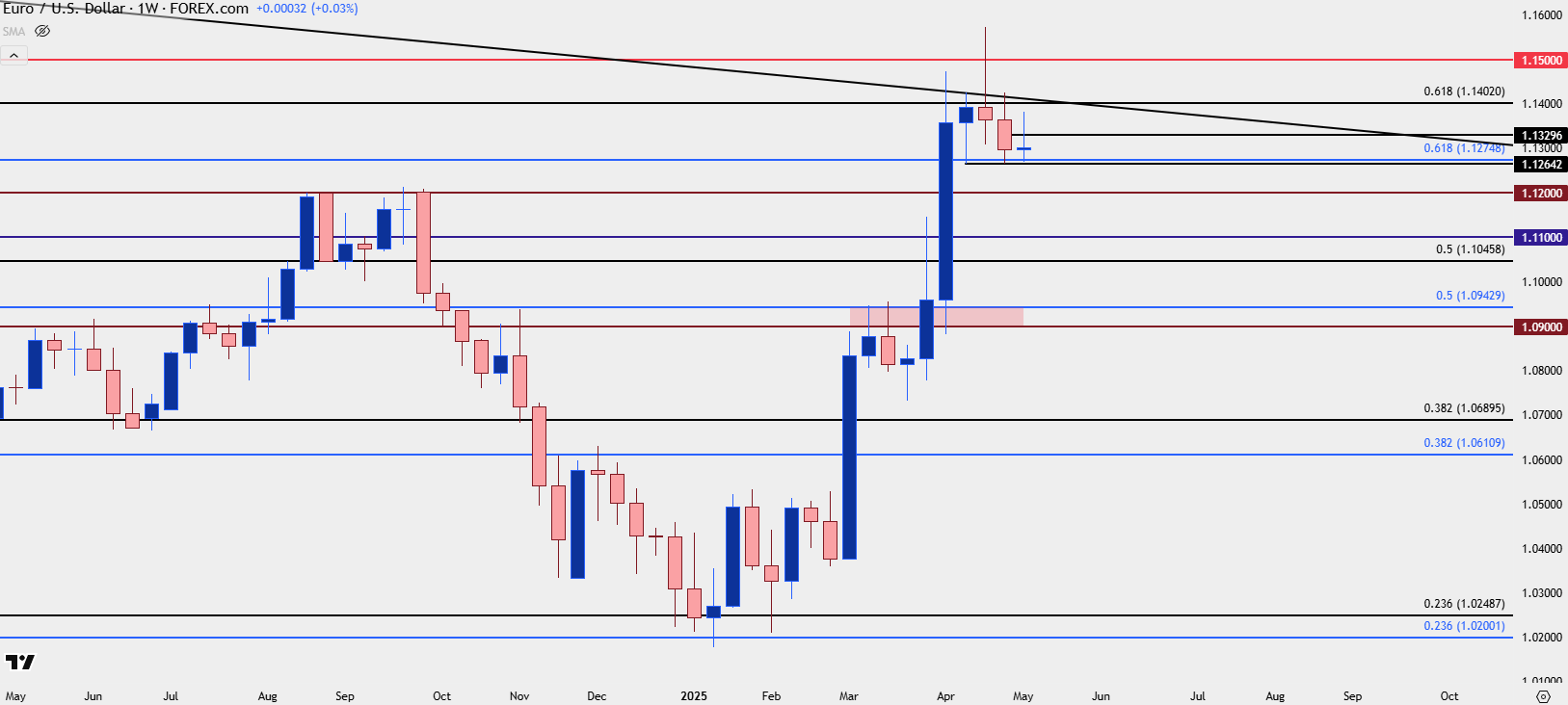

- The pair is now re-testing a key Fibonacci level at 1.1275 which has so far held support since mid-April. This was also the 2023 swing high as well as the 61.8% marker of the 2021-2022 sell-off in the pair.

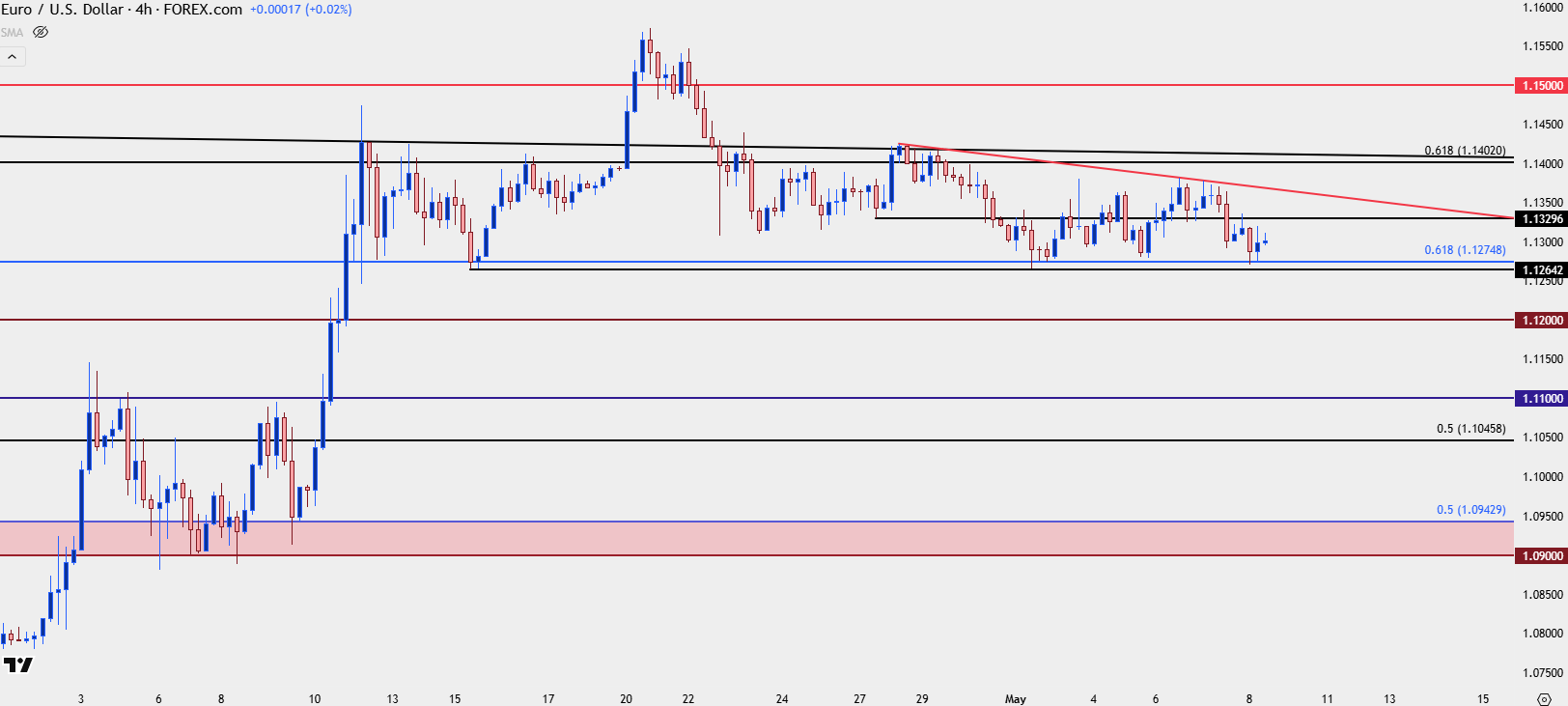

- Given the lower-highs that have held along with that horizontal resistance, there’s now a short-term descending triangle, which keeps the door open for deeper pullback potential in the pair.

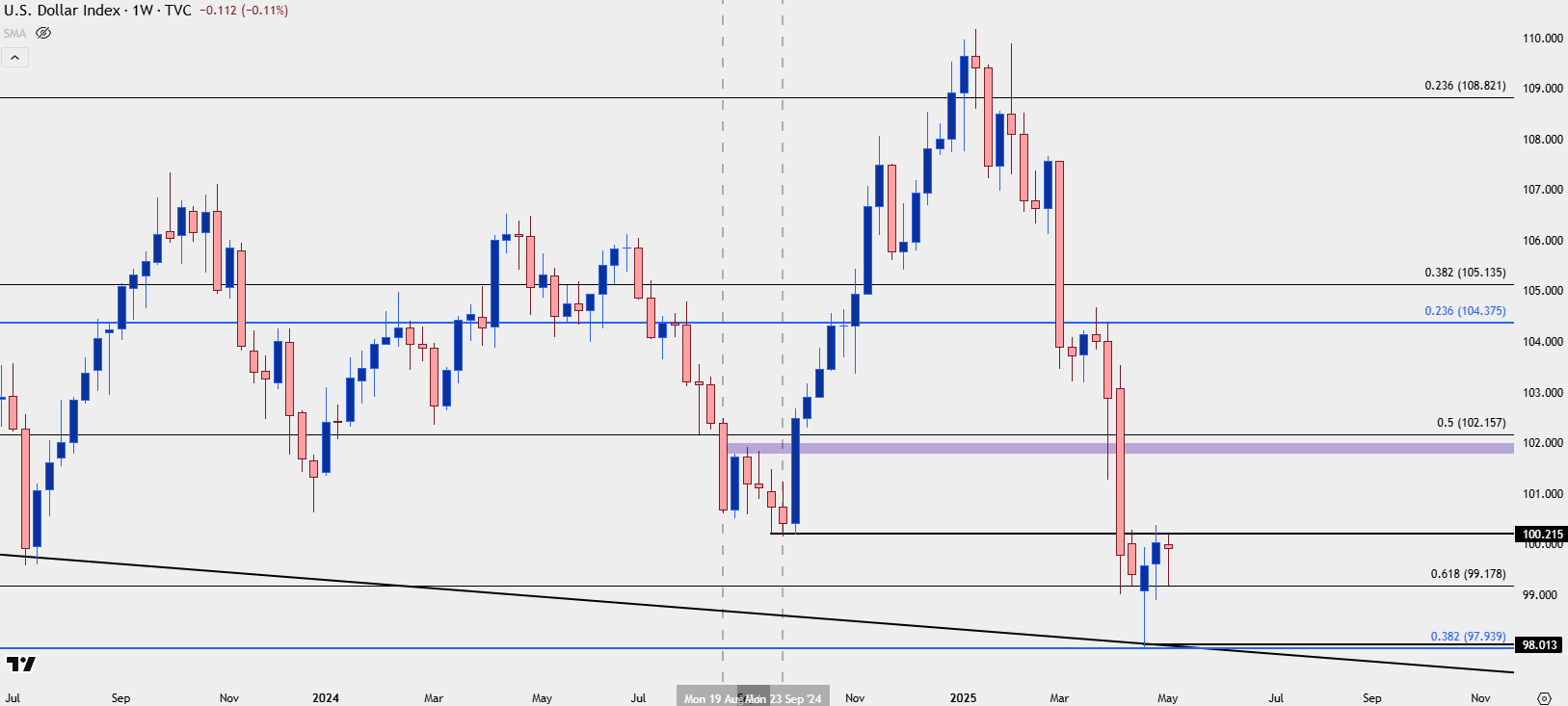

The FOMC rate decision for May is now in the rear view and as anticipated Chair Powell refrained from leaning too hard in either a dovish or hawkish direction. The net impact on the US Dollar has been interesting however as DXY clawed back earlier-week losses and at this point, sits as an indecisive doji on the weekly chart. With some additional context, we can also see a hold of a higher-low so far this week, with the Fibonacci level of 99.18 coming to hold support thus far.

As looked at in the webinar on Tuesday, this presents a mirror image of the scenario in EUR/USD as the pair has held resistance inside of the 1.1500 level but so far, hasn’t been able to elicit much of a break below the 1.1275 Fibonacci level.

U.S. Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Weekly

Presenting that case on the weekly chart shows the 1.1275 level holding support for three of the past four weeks, including this week. But perhaps more notable has been the lower-highs that have shown last week and so far this week, setting the stage for deeper pullback potential in the pair if bears can finally negotiate a break below the Fibonacci level.

The move could be short-lived, however, at least from a momentum perspective, as the 1.1200 level also presents support potential as this was resistance on multiple cases last year until bears finally prevailed with the Q4 reversal.

EUR/USD Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD Four-Hour

The daily chart of EUR/USD looks choppy and erratic over the past couple of weeks but I think the shorter-term four-hour chart looks a bit more clear, as the build of a descending triangle highlights diminishing impact of the support at 1.1275. Each bounce has grown more and more shallow, and as such, these formations are often approached with aim of bearish breakdown potential.

Forecasting how much of a breakdown becomes another matter, as the big question at that point is whether bulls come in to stage a strong defense of the next level down, which in this case is that 1.1200 psychological level that lurks below the 1.1275 Fibonacci level. From the four hour chart, it would denote a lower-low to go along with the recent series of lower-highs, so at that point 1.1275 could be looked to for resistance potential on bounces from 1.1200, which could substantiate bearish continuation scenarios if it does in fact hold.

For even deeper support, 1.1100 is of interest, as is the 1.1046 level. Naturally the 1.1000 handle stands out, but the higher-low a month ago around the 1.0943 Fibonacci level is what stands out as notable.

EUR/USD Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist