The EUR/USD pair has risen by over 0.5% following the release of the latest U.S. Consumer Price Index (CPI). The euro has gained ground on growing expectations that lower inflation could pave the way for a less restrictive monetary policy in the United States. For now, this remains the primary catalyst behind dollar weakness, which has brought renewed buying pressure to the pair in the short term.

Inflation Day

U.S. inflation data was published earlier today. While the market had anticipated a reading of 2.5%, the final figure came in at 2.4%, slightly below expectations but still above the revised previous figure of 2.3%.

This result has had a significant impact on EUR/USD, as it reinforces the view that the Federal Reserve could reconsider its current monetary policy stance. With inflation slowly approaching the Fed’s 2% target, the possibility of future rate cuts becomes more realistic.

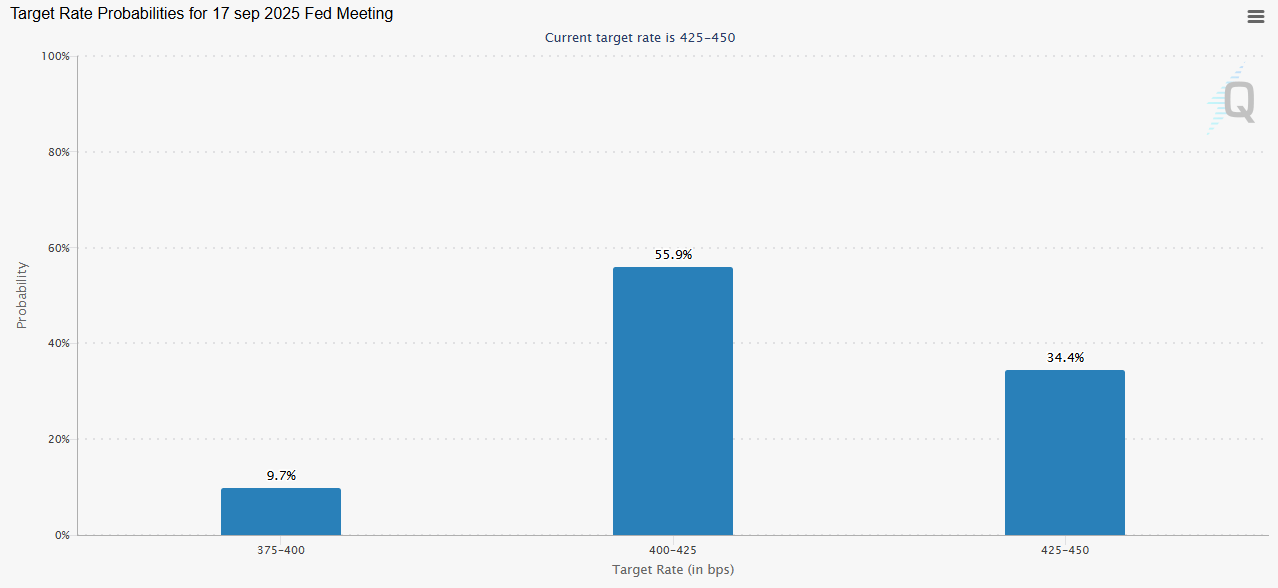

However, this outlook still requires confirmation from official Fed communication. According to the CME FedWatch Tool, there is a 55.9% probability of a rate cut from 4.5% to 4.25% at the September 17 meeting. For the two decisions prior to that date, the market still expects rates to remain unchanged.

Source: CMEGroup

This scenario is important because the prospect of lower interest rates, which hasn’t been on the table for several months, could start to undermine confidence in the U.S. dollar in the short term. Although the Fed has not confirmed this path, the market is interpreting recent inflation data as a potential turning point. Should the Fed signal rate cuts soon, buying pressure on EUR/USD could increase significantly.

What Is the Role of the European Central Bank?

At its latest meeting on June 5, the European Central Bank (ECB) announced a rate cut, lowering its key rate to 2.25%, supported by encouraging inflation data within the eurozone.

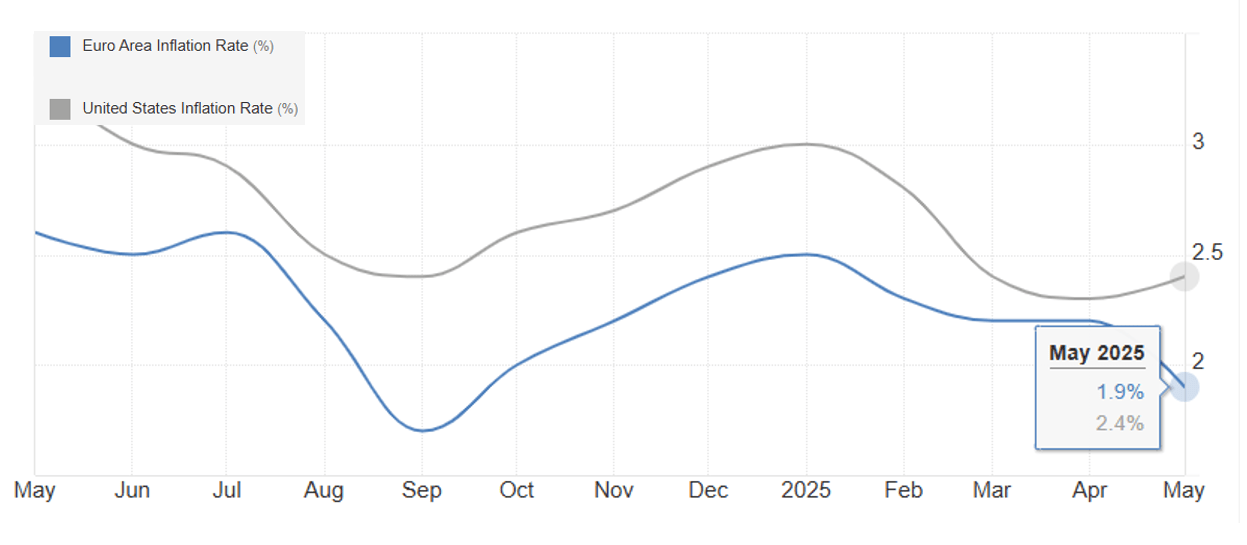

Currently, inflation in Europe stands near 1.9%, slightly below the ECB’s 2% target. While eurozone inflation continues to decline steadily, U.S. inflation has recently rebounded, highlighting a growing divergence between the two regions.

Source: TradingEconomics

Given this context, it’s likely that Europe will maintain a flexible rate policy as long as inflation trends lower. In contrast, the U.S. remains in a more uncertain position, leaving doubts about when rate cuts might begin.

At present, a significant rate differential persists: the U.S. maintains its rate at 4.5%, while the eurozone sits at 2.25%. If this gap remains in place over the long term, the higher U.S. rate may continue to attract capital into dollar-denominated assets. This could lead to renewed demand for dollars and a weaker euro, potentially creating downward pressure on EUR/USD.

EUR/USD Technical Outlook

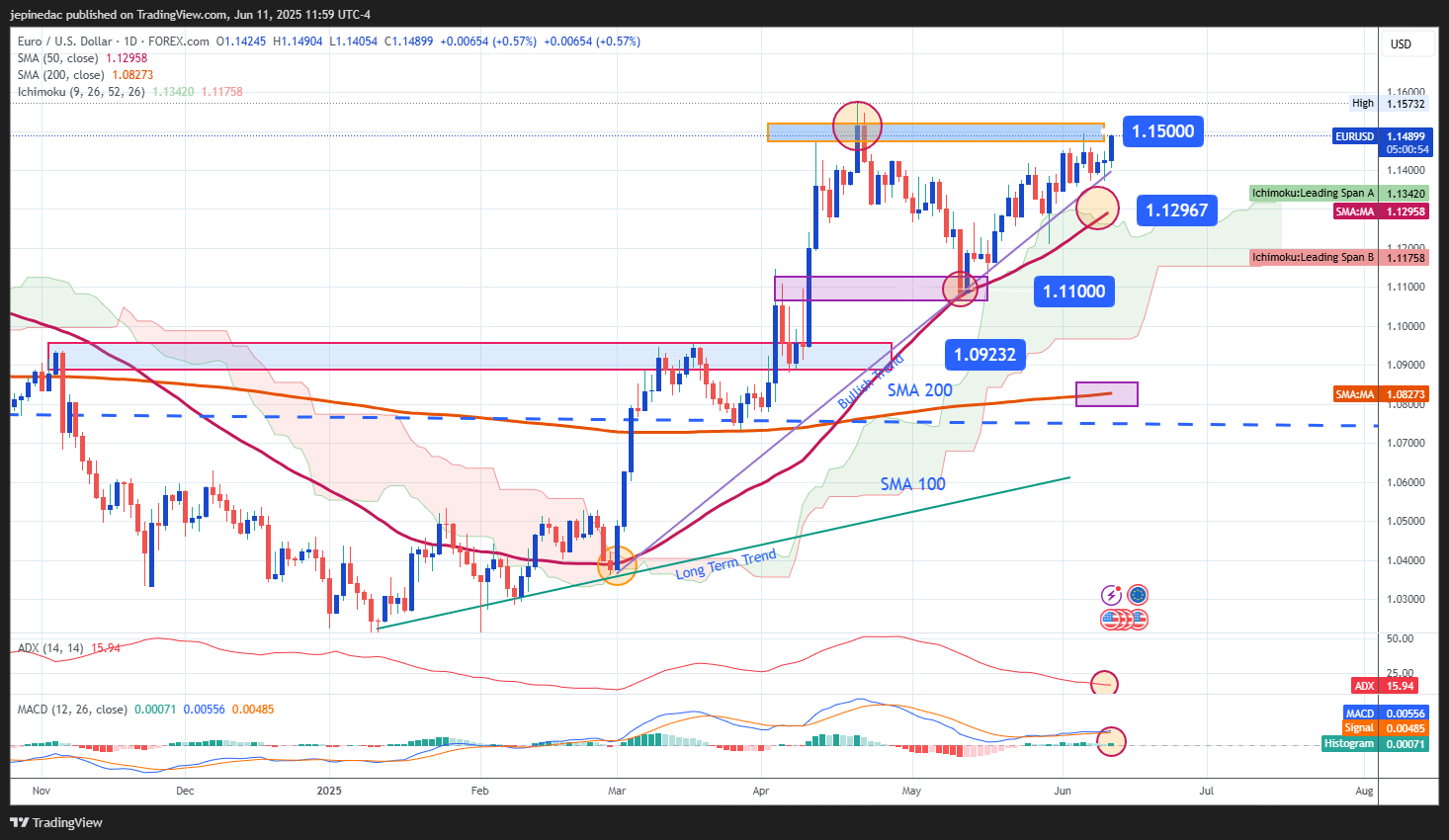

Source: StoneX, Tradingview

- Persistent Uptrend: The EUR/USD chart continues to show a sustained bullish structure. The pair is currently retesting previous highs, and if buying momentum holds, the uptrend could gain further strength. While some minor pullbacks have occurred in recent weeks, they have not been strong enough to challenge the overall trend, suggesting that bullish sentiment remains intact in the long term.

- ADX: The ADX line has begun to display steady movements below the neutral 20 level, indicating reduced volatility. If this behavior continues, it could signal a period of technical consolidation, especially as the pair tests key resistance zones.

- MACD: The MACD histogram reflects a similarly neutral context, showing oscillations near the zero line, which implies a lack of strong directional momentum. As long as the moving averages fail to diverge meaningfully, the price may remain in a consolidation phase.

Key Levels:

- 1.15000 – Near-Term Resistance: A key psychological and technical level that aligns with recent highs. A breakout above this zone could confirm stronger bullish momentum.

- 1.12967 – Near-Term Support: A technical neutral area, aligned with the 50-period simple moving average. It may act as support against short-term pullbacks.

- 1.11000 – Major Support: The recent multi-week low, also aligned with the ascending trendline. A drop below this level would put the current bullish structure at risk and could trigger a shift to a bearish bias.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25