The euro has recently appreciated by nearly 0.8% against the USD in the short term, as the European currency gains temporary bullish momentum. The buying bias has persisted toward the end of the week, driven by new comments from former President Trump targeting the European region. These remarks have prompted investors to seek shelter in the euro, thereby weakening the U.S. dollar.

Trade War Back on the Table

Today, former President Trump issued new threats against the European Union, warning that a 50% tariff could be imposed on European products exported to the United States starting June 1. He argued that the current negotiations have not progressed sufficiently, justifying the possible implementation of this measure.

Since May 15, both sides had agreed to intensify technical negotiations within a 90-day pause declared by the U.S., set to expire on July 9. However, this latest shift in tone from the White House suggests the talks could become significantly more confrontational, as the EU is reportedly preparing retaliatory measures.

It’s worth noting that the European Union had already begun evaluating tariffs on approximately €100 billion worth of U.S. goods, primarily affecting industrial and agricultural sectors. The verbal escalation from Washington may fast-track these countermeasures, rekindling commercial tensions between the two powers.

This new conflict has shifted the focus of U.S. trade policy away from China, placing Europe in the spotlight. As a result, European markets have reacted cautiously, and the euro has started to appreciate, seen by some as a temporary safe haven amid rising uncertainty.

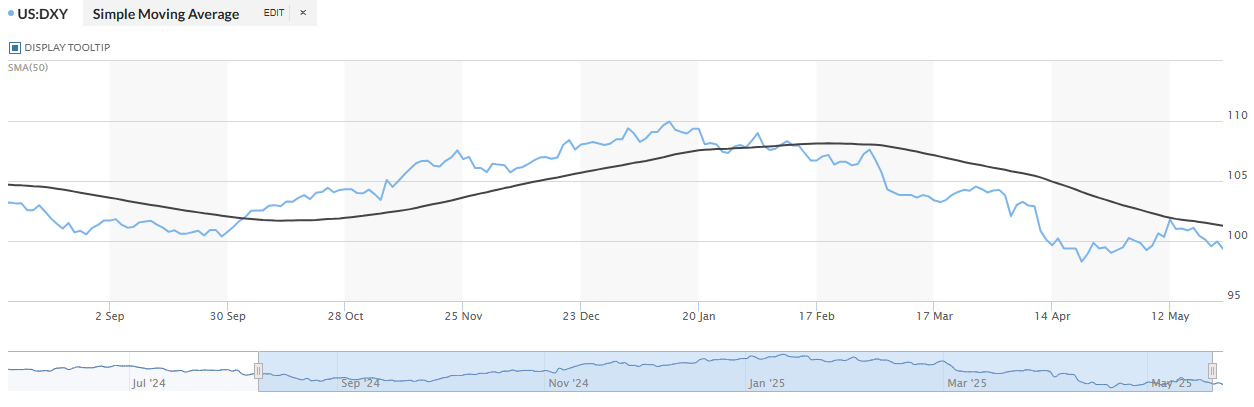

On the other hand, the U.S. dollar is showing growing weakness. The DXY index, which measures the dollar’s strength against a basket of currencies, has started to decline ahead of the weekly close and remains below the 100-point threshold, indicating broad-based downward pressure on the greenback.

Source: Marketwatch

This creates a new scenario of volatility in Europe, which currently favors the euro as a safe-haven asset. If trade tensions continue to escalate, buying pressure on the EUR/USD is likely to increase, especially if investors anticipate that the economic impact will be more severe in the U.S. than in the eurozone.

The Role of the ECB

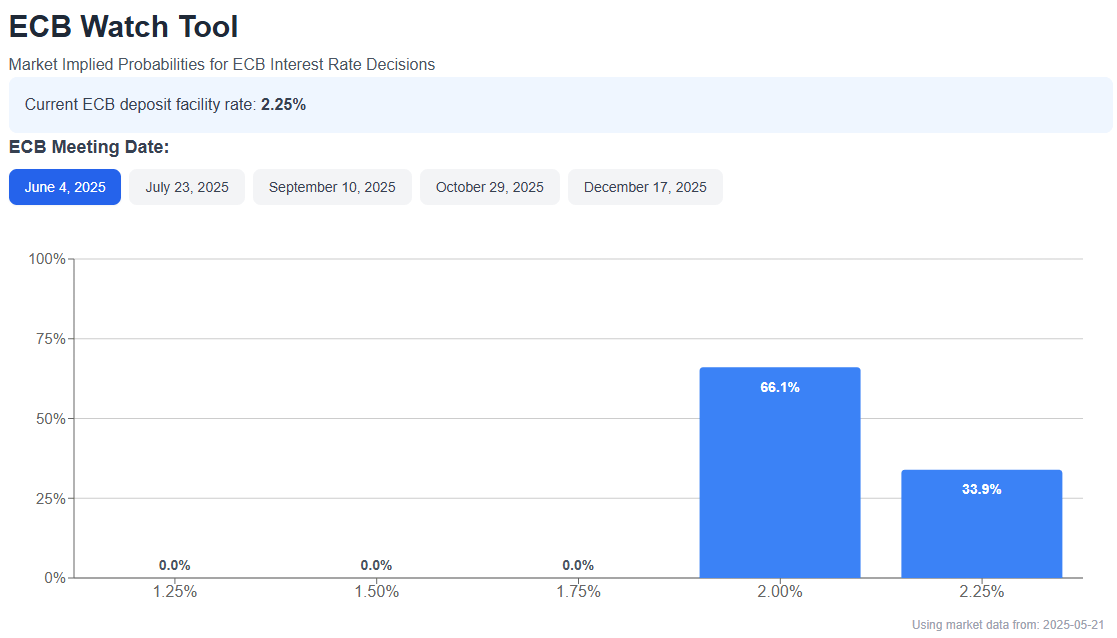

The next European Central Bank (ECB) policy decision is approaching, scheduled for June 4. According to ECB Watch, there is a 66.1% probability that the deposit rate will be lowered to 2.00%, versus a 33.9% probability that it will remain at 2.25%.

Source: ECB-WATCH

Although European rates remain well below the 4.5% currently maintained by the Federal Reserve, the ECB continues to pursue a monetary easing strategy, while the Fed has yet to initiate cuts. This interest rate differential may support the dollar in the short term, as investors seek higher yields from U.S.-denominated assets. Consequently, this dynamic could dampen some of the upward pressure on the EUR/USD as long as the rate gap persists.

EUR/USD Technical Outlook

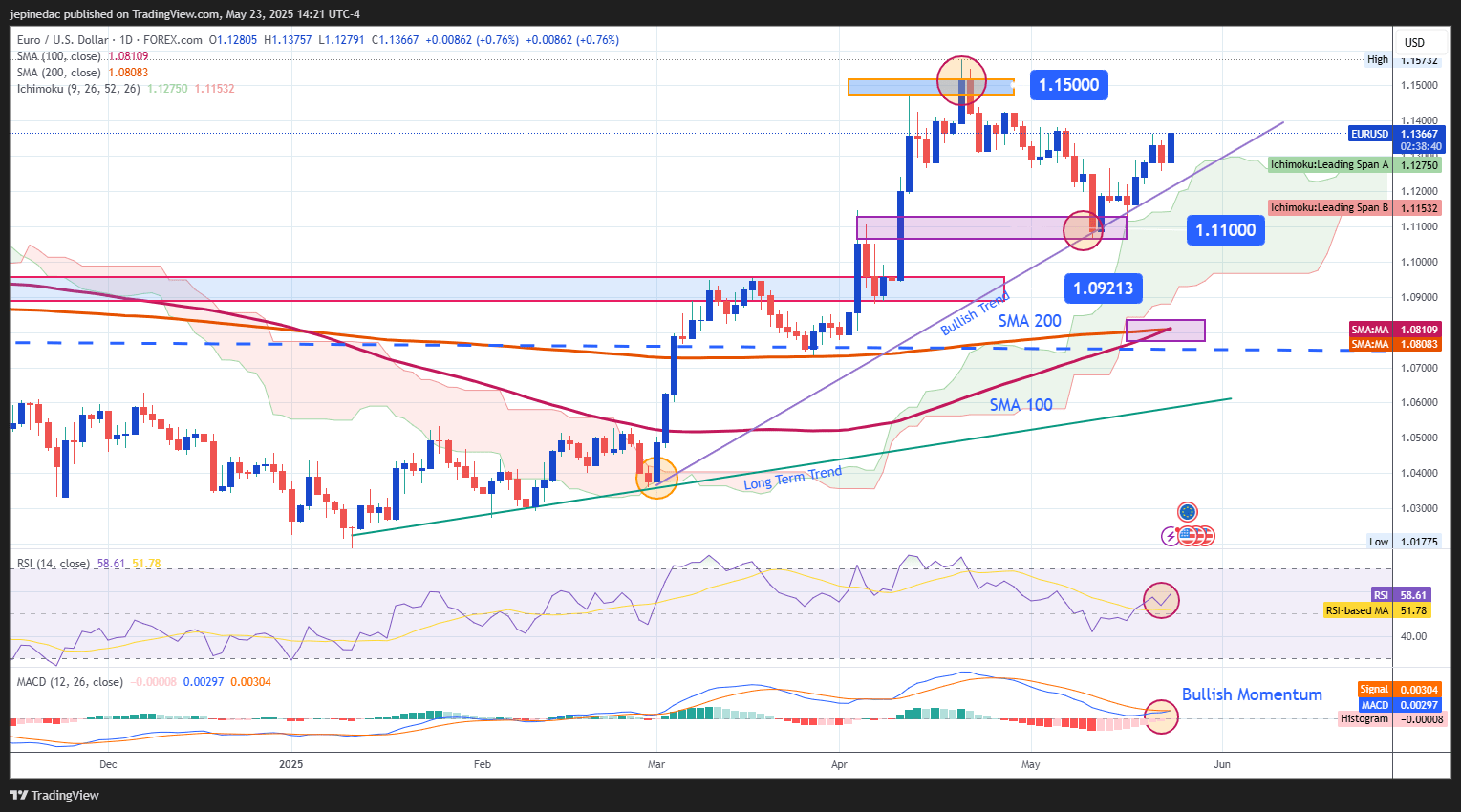

Source: StoneX, Tradingview

- Ongoing Trendline: Since March 3, the EUR/USD has followed a firm upward trend, characterized by a sequence of higher highs and higher lows that has remained intact. While some downward corrections have occurred, they have not been strong or persistent enough to reverse the prevailing bullish bias. Each pullback has found support at key levels, reaffirming buyer control. Furthermore, the recent crossover of the 100-period moving average above the 200-period moving average suggests continued strength in the current uptrend.

- RSI: The Relative Strength Index (RSI) remains consistently above the 50 level, indicating that bullish momentum continues to dominate recent market behavior. If the RSI keeps climbing and distances itself further from the neutral level, it may amplify buying pressure and increase the likelihood of further gains in the pair.

- MACD: The Moving Average Convergence Divergence (MACD) indicator has generated a bullish signal, with the MACD line crossing above the signal line, a classic sign of a new bullish phase. Additionally, the histogram has turned increasingly positive, reflecting a shift in momentum from bearish to clearly favorable for buyers. Together, these technical signals reinforce bullish pressure on EUR/USD in the near term.

Key Levels:

- 1.15000 – Major Resistance: A key psychological level and recent high. A clear breakout above this level would strengthen the current bullish move and could pave the way for further gains.

- 1.11000 – Crucial Support: This level has acted as a consolidation zone in recent sessions. A break below could undermine the bullish structure and signal a possible reversal.

- 1.09213 – Distant Support: A reference level observed in March. A move toward this area would suggest a deeper correction and might trigger a new sustained bearish trend if selling pressure intensifies.

Written by Julian Pineda, CFA – Market Analyst

Follow him on: @julianpineda25