Federal Reserve, FOMC Key Points

- Traders and economists confidently expect the Fed to leave interest rates unchanged in the 4.25-4.50% range.

- The Fed is likely to revise down its full-year GDP growth estimate from 1.7% to closer to 1.3% or 1.4% after a slow Q1.

- A dovish surprise from the Fed – perhaps a hint that the door remains open to a July rate cut or a strong lean toward cutting in September (currently “only” 60% priced in) – could lead to a bullish breakout in EUR/USD

When is the FOMC Meeting?

The June 2025 FOMC meeting will conclude on Wednesday, June 18th at 2:00 ET.

Fed Chairman Powell’s press conference will begin at 2:30 ET.

What are the FOMC Interest Rate Expectations?

Traders and economists confidently expect the Fed to leave interest rates unchanged in the 4.25-4.50% range.

As of writing, Fed Funds futures traders are pricing in 99%+ odds of no change to interest rates per CME FedWatch.

Assuming the Federal Reserve leaves interest rates unchanged as expected, the market’s focus will immediately shift to the central bank’s Monetary Policy Statement and the Summary of Economic Projections (SEP) for potential market-moving changes.

Once traders have digested any tweaks on those fronts, Fed Chairman Jerome Powell’s press conference will be the main volatility catalyst for traders as they seek more clarity on how the Fed is viewing the apparent slowdown in the labor market and outlook for inflation in the second half of the year.

FOMC Meeting Forecast

“There are good reasons to think the Fed would be preparing to cut interest rates this week due to recent improvements on inflation—if not for the risk that tariffs pose to prices.”

In his full Fed preview article, the Wall Street Journal’s “Fed Whisperer” highlighted the sticky situation Jerome Powell and Company find themselves in. With the overall economy and labor market humming along for most of the past half-decade, the Federal Reserve has essentially had to focus only on bringing inflation down, a task that it has (perhaps belatedly) mostly accomplished by now.

However, all economic data is backward-looking, and inflation is a particularly lagging indicator. As Jerome Powell, NY Fed President John Williams and others have outlined in recent weeks, the FOMC believes the economic outlook is unusually uncertain, and many policymakers are concerned that tariffs could drive (at least) a temporary spike in inflation.

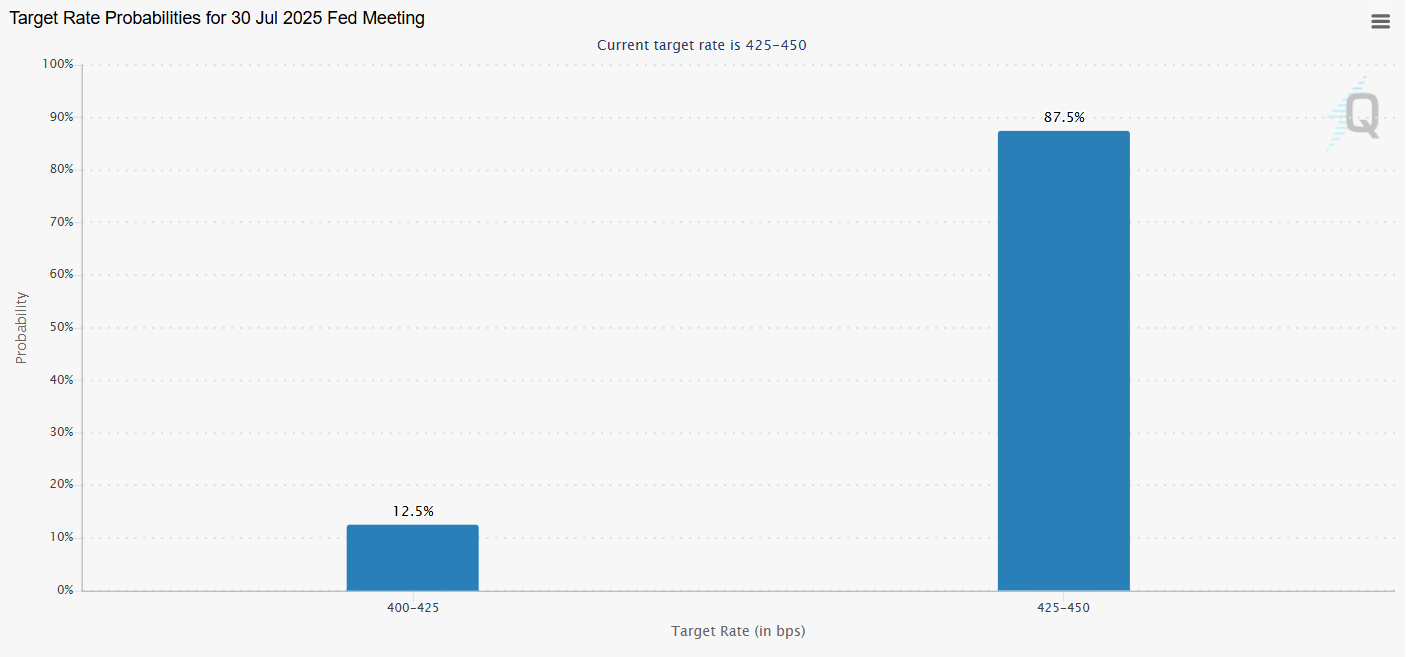

For that reason, the central bank is almost certain to remain on hold in June, and traders believe that a similar argument will hold through the July Fed meeting as well, where traders are pricing in only a 1-in-8 chance of an interest rate cut:

Source: CME FedWatch

As is often the case in the “forward guidance as a policy tool” era, the market impact of the Fed meeting will come more from the central bank’s Monetary Policy Statement, Summary of Economic Projections (SEP), and Chairman Powell’s press conference than the interest rate decision itself.

When it comes to the central bank’s Summary of Economic Projections, the FOMC is likely to reduce its full-year GDP growth estimate from 1.7% to closer to 1.3% or 1.4% after a slow Q1. The inflation forecast will be the most closely scrutinized component of the forecasts, with a small upward tweak from 2.8% to closer to 3.0% possible amidst tariff uncertainty.

As I’ve highlighted here and on Twitter in recent weeks, the US labor market is showing increasing cracks beneath the surface:

- The 4-week moving average of initial unemployment claims has edged up to 240K, the highest since 2023

- The 4-week moving average of continuing unemployment claims is at 1.91M, its highest reading since COVID.

- Each of the last 4 NFP reports has seen negative revisions to the prior months’ initial estimates

- The unrounded U3 unemployment rate has risen every single month since January, and a continuation of that trend could take it above 4.5% by the end of the year

Despite these signs, the Fed may nonetheless leave its year-end unemployment projection at 4.4%, with an outside chance that the central bank bumps it up to 4.5%.

The hotly-anticipated “dot plot” of interest rate projections will be a key area of focus, but the median expectation for two interest rate cuts this year may remain unchanged, even if several policymakers expect fewer interest rate cuts this year. As always, the oft-quoted median forecasts can hide relevant details about the distribution of forecasts among FOMC members.

Finally, we are likely to see more questions about the impact of tariffs, military conflicts in the Middle East, and the potential for tax cuts at Jerome Powell’s press conference. As usual, expect Powell to deflect and dodge questions about trade and fiscal policy instead re-emphasizing that the central bank doesn’t try to predict future policies (e.g. tariffs, tax cuts, etc), only respond to their economic impact if and when they are enacted. These types of questions will inevitably a bigger talking point over the next four years than they have been over the last four years.

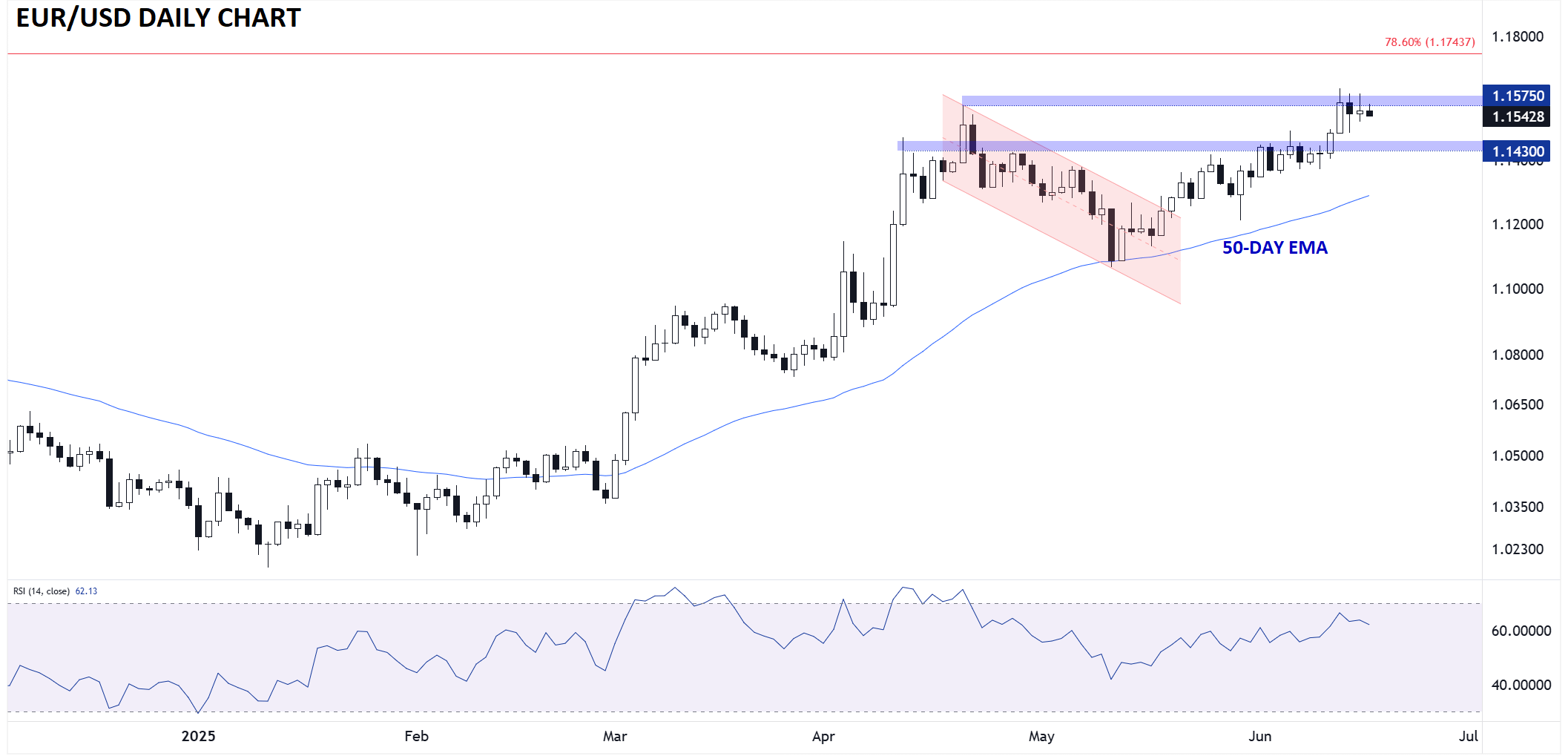

US Dollar Technical Analysis – EUR/USD Daily Chart

Source: StoneX, TradingView

From a technical perspective, the world’s most widely-traded currency pair is consolidating at its highest level since 2021. EUR/USD has put in back-to-back “inside candles,” where the high of the day is below the high of the previous day and the low of the day is above the previous day’s low. This price action signals near-term consolidation and is often seen prior to a higher-volatility breakout once a clear catalyst emerges.

A dovish surprise from the Fed – perhaps a hint that the door remains open to a July rate cut or a strong lean toward cutting in September (currently “only” 60% priced in) – could lead to a bullish breakout in EUR/USD, with potential for a continuation toward long-term Fibonacci retracement resistance in the mid-1.17s next. Meanwhile, a “steady as she goes” approach to monetary policy would likely prompt a near-term dip toward previous-resistance-turned-support at 1.1430 before the longer-term trend has a chance to reassert itself.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX