Federal Reserve, FOMC Key Points

- The Fed left interest rates in the 4.25-4.50% range, while lowering its 2025 GDP forecast and raising the 2025 inflation and unemployment forecasts as expected.

- Chairman Powell remains less concerned about jobs and equally if not more focused on the inflation side of the central bank’s mandate.

- The US dollar is rallying a handful of pips against most of its major rivals, while US indices have fallen back to flat on the day

FOMC Interest Rate Decision

For its fourth consecutive meeting, the Fed left interest rates unchanged in the 4.25-4.50% range as expected.

FOMC Monetary Policy Statement

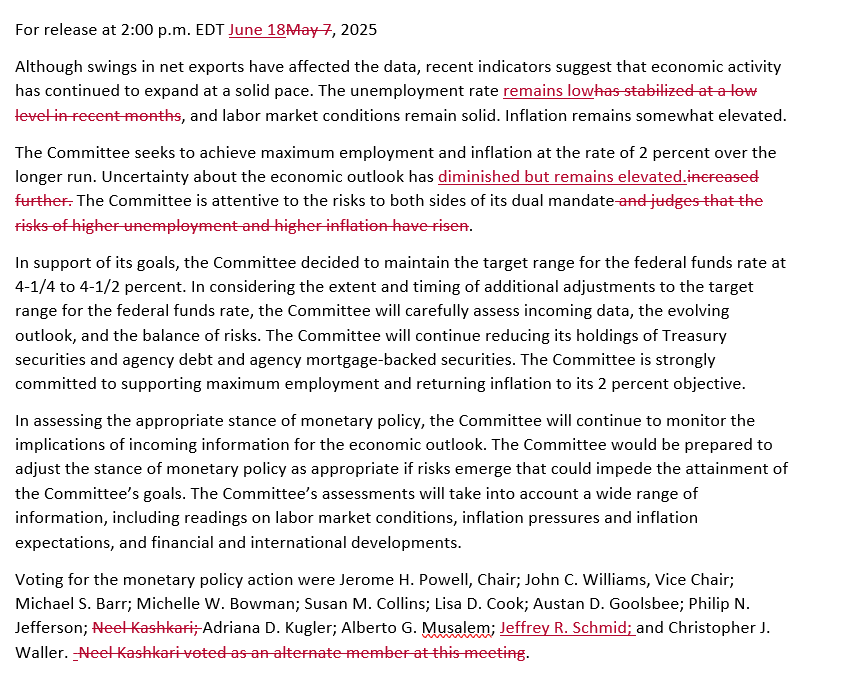

Beyond the administrative tweak to the date and one voter update, there were only two changes of note to the central bank’s monetary policy statement:

- Uncertainty around the economic outlook has "diminished but remains elevated" from "increased further"

- Removes line that "risks of higher unemployment and higher inflation have risen"

Source: FOMC

The line about economic uncertainty may refer to the (slight) progress on trade talks between the US and China. Recall that the joint reduction in tariffs between the world’s two largest economies came on May 12, five days after the last FOMC meeting.

FOMC Summary of Economic Projections and “Dot Plot”

With essentially no one anticipating any tweaks to the current interest rate, the central bank’s economic forecasts from its Summary of Economic Projections (SEP) were always going to be closely scrutinized by traders.

For 2025, the median Federal Reserve member made the following tweaks to his/her economic projections:

- Year-end 2025 GDP forecast revised DOWN from 1.7% to 1.4%

- Year-end 2025 inflation forecast revised UP from 2.8% to 3.1%

- Year-end 2025 unemployment forecast revised UP from 4.4% to 4.5%

Crucially, the year-end 2025 interest rate forecast (the so-called “dot plot”) remained unchanged at 3.9% (or two 25bps interest rate cuts this year).

Looking out a bit further, the median FOMC member sees fewer interest rate cuts in 2026 and 2027, despite a lower GDP and unemployment forecasts and a higher inflation forecast in 2026. At the margin, this is a move toward a more “stagflationary” forecast, leaving Chairman Powell in a difficult position as we head into his press conference.

FOMC Chairman Jerome Powell’s Press Conference

In my FOMC preview report, I highlighted the consistent deterioration we’ve seen in the US labor market so far this year. Based on his press conference (which is winding down as I write this), Chairman Powell is seemingly less concerned with jobs and remains equally if not more focused on the inflation side of the central bank’s mandate.

Highlights from Chairman Powell’s press conference follow [emphasis mine]:

- NEAR-TERM INFLATION EXPECTATIONS HAVE MOVED UP, TARIFFS DRIVING FACTOR

- MOST MEASURES OF LONGER-TERM INFLATION ARE CONSISTENT WITH GOAL

- FOR THE TIME BEING, WELL POSITIONED TO WAIT BEFORE POLICY ADJUSTMENTS

- MANY FIRMS EXPECT TO PUT ‘SOME OR ALL’ OF TARIFF EFFECT THROUGH, ULTIMATELY, TO THE CONSUMER

- UNCERTAINTY PEAKED IN APRIL, HAS COME DOWN BUT STILL ELEVATED

- AS LONG AS HAVE THE KIND OF LABOR MARKET WE HAVE AND INFLATION COMING DOWN, RIGHT THING TO DO IS HOLD RATES.

- WE LIKELY WILL GET TO A PLACE WHERE RATE CUTS APPROPRIATE.

- WE CAN PERHAPS SEE SLOW, CONTINUED COOLING IN THE LABOR MARKET, BUT NOTHING THAT'S TROUBLING.

- IN LOOKING AT FED POLICY PATH PROJECTIONS, FOCUS ON NEAR-TERM. IT'S HARD TO FORECAST LONGER TERM.

- WILL MAKE SMARTER DECISION IF WE WAIT A COUPLE OF MONTHS

- WE EXPECT A MEANINGFUL AMOUNT OF INFLATION IN COMING MONTHS

- SUPPLY AND DEMAND IN LABOR MARKET HAVE KEPT UNEMPLOYMENT RATE IN REASONABLE PLACE

FOMC Market Reaction

After some initial choppiness, markets appear to be settling on a (slight) hawkish interpretation of the Fed festivities. The US dollar is rallying a handful of pips against most of its major rivals, while US indices have fallen back to flat on the day. US bond yields are rising by 1-2bps across the curve.

Fed Chairman Powell’s comments about waiting “a couple of months” to make a “smarter decision” on interest rates ostensibly rules out any chance of an interest rate cut in July, barring an unexpected surprise, and potentially even opens the door for another hold in September if inflation shows signs of picking up this summer.

With Powell and the rest of the Fed seemingly headed to the beach for the summer, traders may quickly shift their focus back to the Israel-Iran conflict and looming trade deal deadlines as near-term catalysts.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX